Global Drugs Of Abuse Doa Testing Market

Market Size in USD Million

CAGR :

%

USD

6,253.25 Million

USD

13,650.06 Million

2022

2030

USD

6,253.25 Million

USD

13,650.06 Million

2022

2030

| 2023 –2030 | |

| USD 6,253.25 Million | |

| USD 13,650.06 Million | |

|

|

|

|

Drugs of Abuse (DOA) Testing Market Analysis and Size

According to the United Nations Office on Drugs and Crime's World Drug Report 2017, the annual prevalence of all illicit drug use is 5.3%, with 255 million users. This will necessitate the need for DOA testing, propelling the market forward. The government's initiatives to raise awareness about DOA and increase organizational compliance for DOA testing will contribute to the overall market's growth. The high demand for products with increased specificity and sensitivity to designer drugs will also contribute to the expansion of the Drug of Abuse (DOA) testing market.

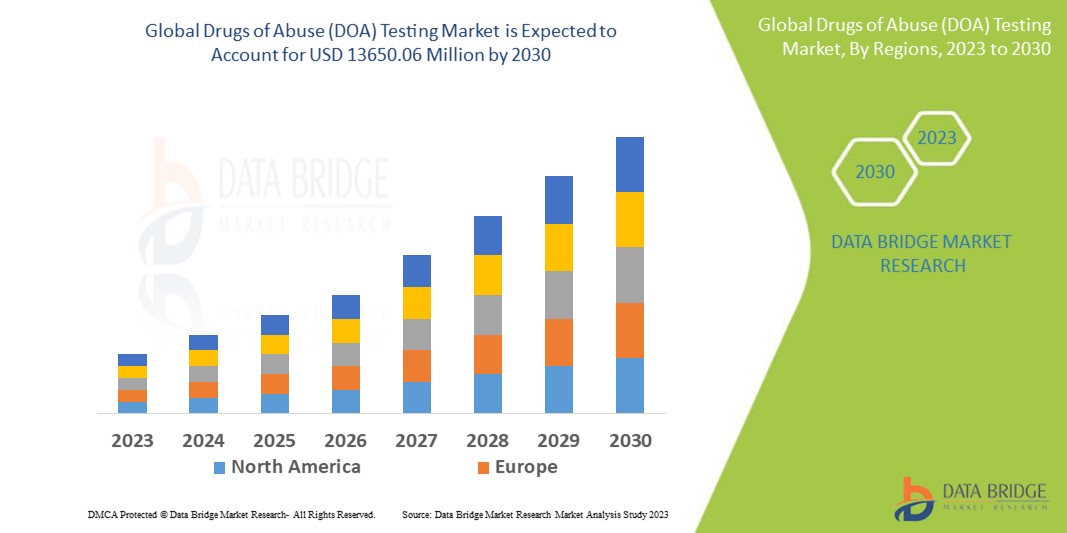

Data Bridge Market Research analyses that the drugs of abuse (DOA) testing market, which is USD 6253.25 million in 2022, is expected to reach USD 13650.06 million by 2030, at a CAGR of 10.25% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Drugs of Abuse (DOA) Testing Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Consumables, Analyzers, Equipment), Sample Type (Urine, Saliva, Hair, Others), Application (Pain Management, Criminal Justice, Workplace Screening), End Users (Hospitals, Laboratories, Workplace, At Home, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Takeda Pharmaceutical Company Limited (Japan), F. Hoffmann-La Roche Ltd (Switzerland), Abbott (U.S.), Medtronic (Ireland), Abbott (U.S.), BD (U.S.), Johnson & Johnson Services, Inc., GSK Plc. (U.K.), Bayer AG (Germany), Zimmer Biomet (U.S.), Stryker Corporation (U.S.), Homology Medicines, Inc (U.S.), Novartis AG (Switzerland), Pfizer Inc.(U.S.), JCR Pharmaceuticals Co., Ltd. (Japan), Sangamo Therapeutics (U.S.), AVROBIO, Inc (U.S.), REGENXBIO Inc (U.S), CANbridge Life Sciences Ltd. (Taiwan), Denali Therapeutics (U.S.), and Jasper Therapeutics, Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Drug of Abuse testing is a clinical screening procedure used to detect one or more illegal substances such as a drug, chemical, or plant product the patient is addicted to. This clinical screening method uses the patient's urine, saliva, blood, hair, or sweat.

Drugs of Abuse (DOA) Testing Market Dynamics

Drivers

- Increase in consumption and trade of illicit drugs

The increased production, consumption, and trade of new and illicit drugs will result in a high demand for DoA testing, driving industry growth. According to the United Nations Office on Drugs and Crime's World Drug Report 2017, the annual prevalence of all illicit drug use is 5.3%, with 255 million users in 2015. This will necessitate the need for DOA testing, propelling the market forward. The government's initiatives to raise awareness about DOA and increase organizational compliance for DOA testing will contribute to the overall market's growth. The high demand for products with increased specificity and sensitivity to designer drugs will also contribute to the industry's growth.

- Technological advancements and product portfolio expansion

To maintain their competency and market share, leading players in the DoA testing market are expanding their product portfolio through product additions and software updates with new substances for DoA testing. For instance, Shimadzu Corporation, released its Smart Forensic Database Ver. 2 in February 2018, with features for analysing forensic toxicological substances involved in DoA in biological samples using Gas Chromatograph-Mass Spectrometry. Similarly, Thermo Fisher Scientific Inc. updated its library for the Thermo Scientific TruNarc handheld narcotics analyzer in November 2017. The update added 45 new substances to the handheld narcotics analyzer, including 14 new forms of fentanyl, and it can now detect Carfentanil.

Opportunities

- Rising ageing population

According to data published by the Organization for Economic Cooperation and Development (OECD) in 2020, nearly one-third of adults in the European Union aged 15-64, or approximately 97 million people, have used illicit drugs at some point in their lives, with men reporting drug use more frequently than women. To maintain their competency and market shares, leading players in the drug abuse testing market are expanding their product portfolios by adding new products and updating software with new substances for drug abuse testing. These are the certain reasons for propelling the market growth.

Restraints/Challenges

- Inability of testing products to detect small amounts of special drugs

The inability of these testing products to detect small amounts of special drugs is expected to hamper the market growth. In the forecast period of 2023-2030, the transformation of laws to legalize the use of recreational drugs/illicit drugs is expected to challenge the drugs of abuse (DOA) testing market.

This drugs of abuse (DOA) testing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the drugs of abuse (DOA) testing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2020, WellCare Health Plans introduced new clinical coverage guidelines and claims payment policy for urine drug testing, including definitive urine drug testing as medically necessary as part of a routine monitoring programme for individuals receiving treatment for chronic pain with prescription opioid or other potentially abused medications, or those undergoing treatment for, or monitoring for relapse of, opioid addiction or substance use disorder.

- In 2022, the Delaware Division of Public Health began including fentanyl strips in Narcan kits for public distribution. The initiative was part of a harm-reduction strategy aimed at preventing accidental fentanyl overdoses.

Global Drugs of Abuse (DOA) Testing Market Scope

The drugs of abuse (DOA) testing market is segmented on the basis of product, sample type, application and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Consumables

- Rapid test kits

- Assay kits

- Reagents

- Others

- Blood

- Breath

- Analyzers

- Equipment

- Immunoassay analyzers

- Chromatography instruments

- Breath analyzers

Sample Type

- Urine

- Saliva

- Hair

- Others

Application

- Pain Management

- Criminal Justice

- Workplace Screening

End Users

- Hospitals

- Laboratories

- Workplace

- At Home

- Others

Drugs of Abuse (DOA) Testing Market Regional Analysis/Insights

The drugs of abuse (DOA) testing market is analyzed and market size insights and trends are provided by country, product, sample type, application and end users as referenced above.

The countries covered in the drugs of abuse (DOA) testing market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the drugs of abuse (DOA) testing market due to the region's high availability of illegal substances, rising drug trafficking, and more workplace monitoring for drug use.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030 due to the region's rising use of illegal substances and rise in organizational adherence to workplace drug testing.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The drugs of abuse (DOA) testing market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for drugs of abuse (DOA) testing market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the drugs of abuse (DOA) testing market. The data is available for historic period 2011-2021.

Competitive Landscape and Drugs of Abuse (DOA) Testing Market Share Analysis

The drugs of abuse (DOA) testing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to drugs of abuse (DOA) testing market.

Some of the major players operating in the drugs of abuse (DOA) testing market are:

- Takeda Pharmaceutical Company Limited (Japan)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Medtronic (Ireland)

- Abbott (U.S.)

- BD (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- GSK Plc. (U.K.)

- Bayer AG (Germany)

- Zimmer Biomet (U.S.)

- Stryker Corporation (U.S.)

- Homology Medicines, Inc (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- JCR Pharmaceuticals Co., Ltd. (Japan)

- Sangamo Therapeutics (U.S.)

- AVROBIO, Inc (U.S.)

- REGENXBIO Inc (U.S)

- CANbridge Life Sciences Ltd. (Taiwan)

- Denali Therapeutics (U.S.)

- Jasper Therapeutics, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL XX SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1 PATENT LANDSCAPE

5.1.2 USPTO NUMBER

5.1.3 PATENT EXPIRY

5.1.4 EPIO NUMBER

5.1.5 PATENT STRENGTH AND QUALITY

5.1.6 PATENT CLAIMS

5.1.7 PATENT CITATIONS

5.1.8 PATENT LITIGATION AND LICENSING

5.1.9 FILE OF PATENT

5.1.10 PATENT RECEIVED CONTRIES

5.1.11 TECHNOLOGY BACKGROUND

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH SPECIALIST

5.8 OTHER KOL SNAPSHOTS

6 EPIDEMIOLOGY

6.1 INCIDENCE OF ALL BY GENDER

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATIENT TREATMENT SUCCESS RATES

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

8.7 OTHERS (PRE-CLINICAL AND RESEARCH)

9 MARKET OVERVIEW

9.1 DRIVERS

9.2 RESTRAINTS

9.3 OPPORTUNITIES

9.4 CHALLENGES

10 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , BY PRODUCT

10.1 OVERVIEW

10.2 EQUIPMENTS

10.2.1 BY TYPE

10.2.1.1. HANDHELD

10.2.1.2. FIXED

10.2.1.3. MOBILES

10.2.2 BY MODALITY

10.2.2.1. AUTOMATED

10.2.2.2. MANUAL

10.2.3 BY PRODUCT

10.2.3.1. ANALYSERS

10.2.3.1.1. IMMUNOASSAY ANALYZERS

10.2.3.1.2. BREATH ANALYZERS

10.2.3.2. CHROMATOGRAPHIC DEVICES

10.2.3.3. RAPID TESTING DEVICES

10.2.3.3.1. URINE TESTING DEVICES

10.2.3.3.2. ORAL FLUID TESTING DEVICES

10.2.3.4. OTHERS

10.3 CONSUMABLES

10.3.1 RAPID TEST KITS

10.3.1.1. STRIPS

10.3.1.1.1. MARKET VALUE (USD MILLION)

10.3.1.1.2. MARKET VOLUME (UNITS)

10.3.1.1.3. AVERAGE SELLING PRICE (USD)

10.3.1.2. CASSETTES

10.3.1.2.1. MARKET VALUE (USD MILLION)

10.3.1.2.2. MARKET VOLUME (UNITS)

10.3.1.2.3. AVERAGE SELLING PRICE (USD)

10.3.1.3. CUPS

10.3.1.3.1. MARKET VALUE (USD MILLION)

10.3.1.3.2. MARKET VOLUME (UNITS)

10.3.1.3.3. AVERAGE SELLING PRICE (USD)

10.3.1.4. OTHERS

10.3.2 ASSAY KITS

10.3.2.1. ENZYME IMMUNOASSAY (EIA) KITS

10.3.2.1.1. MARKET VALUE (USD MILLION)

10.3.2.1.2. MARKET VOLUME (UNITS)

10.3.2.1.3. AVERAGE SELLING PRICE (USD)

10.3.2.2. FLUORESCENCE IMMUNOASSAY (FIA) KITS

10.3.2.2.1. MARKET VALUE (USD MILLION)

10.3.2.2.2. MARKET VOLUME (UNITS)

10.3.2.2.3. AVERAGE SELLING PRICE (USD)

10.3.2.3. CHEMILUMINESCENCE IMMUNOASSAY (CLIA) KITS

10.3.2.3.1. MARKET VALUE (USD MILLION)

10.3.2.3.2. MARKET VOLUME (UNITS)

10.3.2.3.3. AVERAGE SELLING PRICE (USD)

10.3.2.4. RAPID LATERAL FLOW IMMUNOASSAY (LFIA) KITS

10.3.2.4.1. MARKET VALUE (USD MILLION)

10.3.2.4.2. MARKET VOLUME (UNITS)

10.3.2.4.3. AVERAGE SELLING PRICE (USD)

10.3.2.5. RADIOIMMUNOASSAY (RIA) KITS

10.3.2.5.1. MARKET VALUE (USD MILLION)

10.3.2.5.2. MARKET VOLUME (UNITS)

10.3.2.5.3. AVERAGE SELLING PRICE (USD)

10.4 REAGENTS

10.5 OTHERS

11 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , BY SAMPLE TYPE

11.1 OVERVIEW

11.2 URINE

11.3 SALIVA

11.4 HAIR

11.5 BREATH

11.6 OTHERS

12 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , BY MODE

12.1 OVERVIEW

12.2 POINT OF CARE TESTING

12.3 LABORATORY BASED TESTING

13 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , BY APPLICATION

13.1 OVERVIEW

13.2 MEDICAL SCREENING

13.3 PAIN MANAGEMENT

13.4 LAW ENFORCEMENT AND CRIMINAL JUSTICE

13.5 WORKPLACE SCREENING

13.6 SUBSTANCE ABUSE TREATMENT AND REHABILITATION

13.7 DRUG SCREENING IN SCHOOLS AND EDUCATIONAL INSTITUTIONS

13.8 PARENTAL OR HOME DRUG TESTING

13.9 SPORTS AND ATHLETICS TESTINGS

13.1 OTHERS

14 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , BY DRUG TYPE

14.1 OVERVIEW

14.2 ALCOHOL

14.3 COCAINE

14.4 MARIJUANA/ CANNABIS

14.5 LYSERGIC ACID DIETHYLAMIDE

14.6 OPIOIDS

14.7 OTHERS

15 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.3 LABORATORIES

15.4 WORKPLACE

15.5 AT HOME

15.6 OTHERS

16 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDERS

16.3 RETAIL SALES

16.4 ONLINE

16.5 OTHERS

17 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , SWOT AND DBMR ANALYSIS

18 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , BY REGION

19.1 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.2 NORTH AMERICA

19.2.1 U.S.

19.2.2 CANADA

19.2.3 MEXICO

19.3 EUROPE

19.3.1 GERMANY

19.3.2 U.K.

19.3.3 ITALY

19.3.4 FRANCE

19.3.5 SPAIN

19.3.6 RUSSIA

19.3.7 SWITZERLAND

19.3.8 TURKEY

19.3.9 BELGIUM

19.3.10 NETHERLANDS

19.3.11 DENMARK

19.3.12 SWEDEN

19.3.13 POLAND

19.3.14 NORWAY

19.3.15 FINLAND

19.3.16 REST OF EUROPE

19.4 ASIA-PACIFIC

19.4.1 JAPAN

19.4.2 CHINA

19.4.3 SOUTH KOREA

19.4.4 INDIA

19.4.5 SINGAPORE

19.4.6 THAILAND

19.4.7 INDONESIA

19.4.8 MALAYSIA

19.4.9 PHILIPPINES

19.4.10 AUSTRALIA

19.4.11 NEW ZEALAND

19.4.12 VIETNAM

19.4.13 TAIWAN

19.4.14 REST OF ASIA-PACIFIC

19.5 SOUTH AMERICA

19.5.1 BRAZIL

19.5.2 ARGENTINA

19.5.3 REST OF SOUTH AMERICA

19.6 MIDDLE EAST AND AFRICA

19.6.1 SOUTH AFRICA

19.6.2 EGYPT

19.6.3 BAHRAIN

19.6.4 UNITED ARAB EMIRATES

19.6.5 KUWAIT

19.6.6 OMAN

19.6.7 QATAR

19.6.8 SAUDI ARABIA

19.6.9 REST OF MEA

19.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

20 GLOBAL DRUGS OF ABUSE (DOA) TESTING MARKET , COMPANY PROFILE

20.1 EPPENDORF SE

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHIC PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 THERMO FISHER SCIENTIFIC INC.

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHIC PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 BECKMAN COULTER, INC.

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHIC PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 BMG LABTECH

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHIC PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 DRÄGERWERK AG & CO. KGAA

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHIC PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 LIFELOC TECHNOLOGIES, INC

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHIC PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 INTOXIMETERS

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHIC PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPMENTS

20.8 CMI INC.

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHIC PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPMENTS

20.9 ABBOTT

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHIC PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPMENTS

20.1 ALERE.

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHIC PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPMENTS

20.11 BIO-RAD LABORATORIES, INC.

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHIC PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPMENTS

20.12 SIEMENS HEALTHCARE PRIVATE LIMITED

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHIC PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPMENTS

20.13 F. HOFFMANN-LA ROCHE LTD

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHIC PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPMENTS

20.14 AK GLOBALTECH CORPORATION

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHIC PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPMENTS

20.15 C4 DEVELOPMENT LTD

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHIC PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPMENTS

20.16 BACTRACK

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHIC PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPMENTS

20.17 LION LABORATORIES LIMITED

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHIC PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPMENTS

20.18 SECURETEC

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHIC PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPMENTS

20.19 CONTRALCO

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHIC PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPMENTS

20.2 ALCOHOL COUNTERMEASURE SYSTEMS CORP

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHIC PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPMENTS

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.