Global Drum Liner Market

Market Size in USD Billion

CAGR :

%

USD

2.42 Billion

USD

3.55 Billion

2024

2032

USD

2.42 Billion

USD

3.55 Billion

2024

2032

| 2025 –2032 | |

| USD 2.42 Billion | |

| USD 3.55 Billion | |

|

|

|

|

Drum Liners Market Size

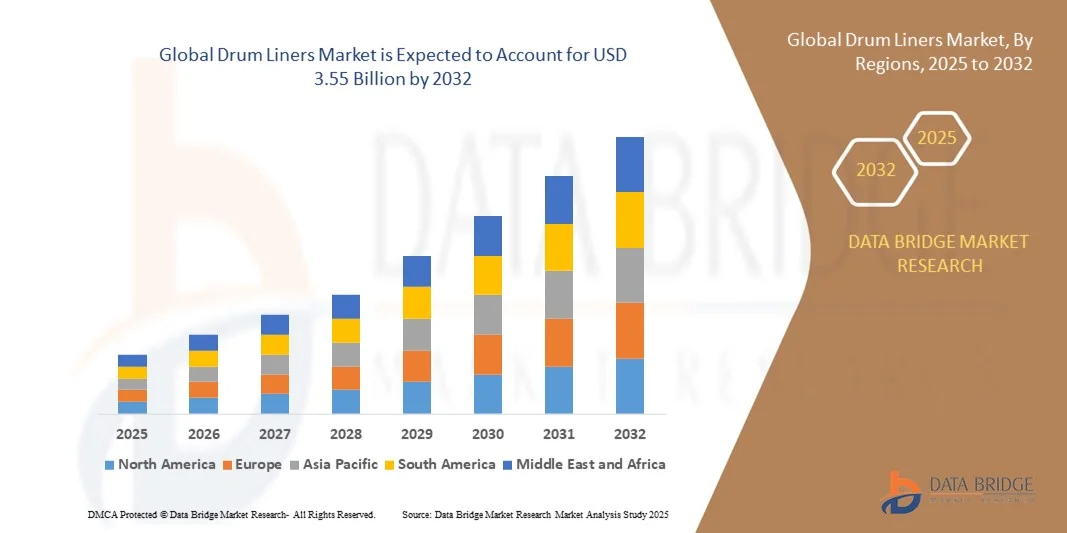

- The global drum liners market size was valued at USD 2.42 billion in 2024 and is expected to reach USD 3.55 billion by 2032, at a CAGR of 3.12% during the forecast period

- The market growth is largely fuelled by the rising demand for safe and efficient material handling solutions across industrial sectors such as chemicals, food processing, and pharmaceuticals

- The increasing emphasis on maintaining product purity, reducing contamination risks, and ensuring easy disposal of hazardous or sensitive materials is driving adoption

Drum Liners Market Analysis

- The drum liners market is witnessing steady growth owing to the expanding industrial packaging sector and the growing need for cost-effective containment solutions

- Manufacturers are focusing on developing liners with enhanced chemical resistance, strength, and compatibility with various drum materials to cater to diverse industrial needs

- North America dominated the drum liners market with the largest revenue share of 38.42% in 2024, driven by strong demand from chemical, food processing, and pharmaceutical industries requiring safe and contamination-free packaging solutions. The region’s well-established industrial infrastructure and emphasis on hygiene and product integrity are major contributors to market growth

- Asia-Pacific region is expected to witness the highest growth rate in the global drum liners market, driven by increasing industrial activities, growing demand for cost-effective packaging solutions, and government initiatives supporting sustainable materials

- The Polyethylene segment held the largest market revenue share in 2024 driven by its wide availability, cost-effectiveness, and excellent chemical resistance, making it suitable for packaging liquids, powders, and semi-solid materials across diverse industries. Its flexibility and durability further enhance performance, ensuring safe handling and minimizing contamination risks during storage and transport

Report Scope and Drum Liners Market Segmentation

|

Attributes |

Drum Liners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drum Liners Market Trends

Rising Focus on Sustainable and Customizable Drum Liners

- The increasing emphasis on sustainability is reshaping the drum liners market, with manufacturers shifting toward eco-friendly materials such as recycled polyethylene and biodegradable polymers. This transition is driven by regulatory pressure and growing environmental awareness among end users in industries such as chemicals, food processing, and pharmaceuticals. Companies are increasingly adopting sustainable liners to reduce plastic waste and align with global circular economy goals, while also enhancing brand image and meeting corporate sustainability commitments through environmentally responsible packaging initiatives

- The demand for customizable drum liners is also gaining traction as end users seek tailored solutions for specific applications. Liners designed for chemical compatibility, anti-static properties, or high-temperature resistance are becoming essential in ensuring product safety and operational efficiency. This customization trend is encouraging manufacturers to offer diverse liner types such as flat bottom, round bottom, and pleated liners to meet industry-specific needs, creating new opportunities for product differentiation and niche market expansion

- In addition, the rise of automation and efficient packaging processes is driving the use of pre-fitted liners that simplify drum handling and filling operations. These solutions minimize contamination risks and enhance productivity, especially in industries requiring strict hygiene standards. The ease of disposal and reduced cleaning requirements further enhance their appeal, while their compatibility with automated filling lines helps reduce downtime and operational costs for large-scale producers

- For instance, in 2023, several beverage manufacturers in Europe adopted food-grade, recyclable drum liners to comply with new EU packaging waste regulations. These liners improved operational hygiene and reduced cleaning time, leading to better process efficiency and sustainability outcomes. The initiative also encouraged other industries to explore similar solutions to meet tightening environmental standards and reduce waste management costs

- While sustainable and customizable drum liners are transforming the market landscape, widespread adoption depends on continued innovation, cost reduction, and global supply chain optimization. Manufacturers must invest in advanced materials and localized production to meet diverse customer requirements and strengthen market competitiveness. The long-term success of this trend will rely on collaboration between producers, recyclers, and regulatory bodies to promote scalable sustainability practices across the packaging industry

Drum Liners Market Dynamics

Driver

Growing Demand for Safe and Efficient Packaging Solutions Across Industries

- The expanding use of drums for storing and transporting liquids, powders, and semi-solids across chemical, food, and pharmaceutical industries is driving demand for drum liners. These liners act as a protective barrier, preventing contamination and ensuring product purity during storage and transit. As industries increasingly prioritize hygiene and safety, drum liners have become essential for maintaining product integrity and compliance with international safety and quality standards

- Rising concerns about material wastage, product residue, and cleaning costs are also encouraging the adoption of disposable liners. Manufacturers are recognizing the cost-saving potential of liners, which eliminate the need for frequent drum cleaning and extend drum lifespan. This trend is especially strong in the food and beverage sector, where strict quality standards necessitate single-use hygienic packaging, ensuring reduced cross-contamination risks and consistent product quality across batches

- The growth of global trade and e-commerce has amplified the need for secure packaging that can withstand long-distance transportation. Drum liners offer an effective solution to avoid leaks, corrosion, and contamination, improving logistics reliability and reducing product losses. As global supply chains expand, the use of liners is becoming a standard practice for exporters dealing with sensitive materials, helping ensure regulatory compliance across multiple jurisdictions

- For instance, in 2022, several chemical producers in North America reported a 20% reduction in material wastage after adopting anti-static and high-barrier drum liners for transporting sensitive compounds, highlighting their efficiency in protecting product quality and reducing operational costs. These success cases are influencing other industrial users to adopt advanced liners for improved performance and reduced waste management expenses

- While demand for efficient packaging solutions continues to rise, consistent material quality, cost competitiveness, and recyclability remain key factors influencing market penetration. Manufacturers must focus on innovation and value-added designs to strengthen their position in the evolving packaging landscape. Long-term growth will depend on balancing performance optimization with sustainable material choices to meet both economic and environmental objectives

Restraint/Challenge

Fluctuating Raw Material Prices and Limited Recycling Infrastructure

- The volatility in raw material prices, particularly polyethylene and polypropylene, poses a major challenge for drum liner manufacturers. As these polymers constitute the primary materials used in production, any fluctuation directly affects profit margins and product pricing, making it difficult for suppliers to maintain price stability in competitive markets. Such volatility also impacts procurement strategies, leading to uncertainties in long-term supply contracts and market forecasts

- Limited recycling infrastructure in developing regions further restricts the adoption of eco-friendly liners. Inadequate waste collection systems and low awareness about liner recyclability contribute to increased plastic waste, undermining sustainability goals and regulatory compliance efforts. This limitation prevents manufacturers from achieving large-scale recycling targets and slows down the shift toward a circular economy in the packaging sector

- The dependency on single-use plastics also raises environmental concerns, compelling manufacturers to invest in R&D for recyclable or compostable alternatives. However, the higher cost of bio-based materials and lack of standardization limit their widespread implementation, particularly among small-scale users. The absence of harmonized recycling policies across countries further complicates market expansion for sustainable drum liner solutions

- For instance, in 2023, several manufacturers in Asia-Pacific reported production slowdowns due to sharp increases in resin prices and supply disruptions, impacting liner availability and delivery timelines for end users. These challenges have prompted companies to explore alternative raw materials, diversify sourcing strategies, and invest in regional production facilities to mitigate supply chain risks

- While the market continues to evolve, addressing material price volatility and strengthening recycling capabilities will be crucial for long-term stability. Industry participants must collaborate with policymakers and recyclers to build sustainable material ecosystems and reduce environmental impact. Encouraging public-private partnerships and expanding recycling programs can create new growth opportunities and enhance industry resilience against raw material fluctuations

Drum Liners Market Scope

The market is segmented on the basis of material, packaging type, product type, and end-user.

- By Material

On the basis of material, the drum liners market is segmented into Polyethylene, High Density Polyethylene (HDPE), Polypropylene, Polyvinylchloride (PVC), Polyester, and Others. The Polyethylene segment held the largest market revenue share in 2024 driven by its wide availability, cost-effectiveness, and excellent chemical resistance, making it suitable for packaging liquids, powders, and semi-solid materials across diverse industries. Its flexibility and durability further enhance performance, ensuring safe handling and minimizing contamination risks during storage and transport.

The High Density Polyethylene (HDPE) segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its superior strength, puncture resistance, and compatibility with hazardous or high-value materials. HDPE liners are increasingly adopted in chemical and industrial sectors where high mechanical protection and temperature tolerance are essential. Their recyclability and alignment with sustainability goals are further boosting demand in global markets.

- By Packaging Type

On the basis of packaging type, the market is segmented into Flexible, Rigid, and Semi-Rigid drum liners. The Flexible segment accounted for the largest market share in 2024 owing to its adaptability, ease of disposal, and lightweight nature, which reduces transportation costs and simplifies installation. Flexible liners are extensively used in food, beverage, and chemical industries for hygienic and contamination-free packaging applications.

The Rigid segment is expected to witness the fastest growth rate from 2025 to 2032 due to its enhanced structural integrity and ability to protect high-density or viscous materials. Rigid liners are favored for their long-lasting performance and compatibility with automated filling systems, making them suitable for high-volume industrial operations requiring reliable containment and safety standards.

- By Product Type

On the basis of product type, the market is segmented into Shrink Liner, Round Bottom Liner, Flat Bottom Liner, Elastic Drum Liners, and Others. The Round Bottom Liner segment held the dominant share in 2024 as it minimizes creasing and ensures complete product evacuation, reducing material waste and cleaning effort. These liners are widely preferred in industries handling liquids and viscous substances where product recovery and hygiene are top priorities.

The Shrink Liner segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its ability to conform tightly to drum surfaces, providing enhanced leak protection and product stability. These liners are gaining popularity in the food and coatings industries, where secure and tamper-evident packaging is essential for maintaining product quality during storage and distribution.

- By End-User

On the basis of end-user, the drum liners market is segmented into Chemicals & Flammables, Adhesives, Inks & Coatings, Food Products, Cosmetic Materials, and Others. The Chemicals & Flammables segment dominated the market in 2024, driven by strict regulatory standards and safety requirements for hazardous material handling. Drum liners in this category help prevent contamination, chemical reactions, and corrosion, ensuring safe storage and transport across industrial supply chains.

The Food Products segment is expected to witness the fastest growth rate from 2025 to 2032 due to the increasing need for hygienic, contamination-free packaging solutions. The use of FDA-compliant, food-grade liners ensures product purity, reduces cleaning time, and extends shelf life. Rising consumption of packaged food and beverage products across emerging economies is expected to further stimulate segment growth.

Drum Liners Market Regional Analysis

- North America dominated the drum liners market with the largest revenue share of 38.42% in 2024, driven by strong demand from chemical, food processing, and pharmaceutical industries requiring safe and contamination-free packaging solutions. The region’s well-established industrial infrastructure and emphasis on hygiene and product integrity are major contributors to market growth

- The growing preference for sustainable and recyclable packaging materials is also supporting the adoption of eco-friendly drum liners. Manufacturers in North America are increasingly focusing on advanced liner designs that enhance operational efficiency, reduce waste, and comply with stringent environmental regulations

- In addition, the presence of key packaging and chemical companies, coupled with ongoing innovations in polymer technology, continues to reinforce North America’s position as a leading market for drum liners

U.S. Drum Liners Market Insight

The U.S. drum liners market captured the largest revenue share in 2024 within North America, driven by the extensive use of drums in the chemical, pharmaceutical, and food industries. The demand for high-performance liners with superior chemical resistance and product safety features continues to rise. Increasing environmental regulations and corporate sustainability initiatives are encouraging manufacturers to adopt biodegradable and recycled materials. Moreover, the rapid adoption of automation and hygienic packaging systems in production facilities is further strengthening the demand for customized and disposable liners across the country.

Europe Drum Liners Market Insight

The Europe drum liners market is expected to witness the fastest growth rate from 2025 to 2032, primarily fuelled by strict packaging waste management regulations and a growing shift toward sustainable materials. The rising need for safe transportation and storage of industrial and food-grade products is boosting liner adoption across the region. European companies are also emphasizing eco-friendly production processes and the use of recyclable polymers to align with EU circular economy objectives. The demand for specialized liners such as anti-static and high-barrier types is expanding, particularly in sectors dealing with sensitive or hazardous materials.

U.K. Drum Liners Market Insight

The U.K. drum liners market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing regulatory focus on sustainable packaging and the growing adoption of reusable drums with disposable liners. The country's robust food and beverage sector, combined with strict hygiene requirements, drives the use of food-grade liners for contamination-free packaging. In addition, the shift toward eco-conscious production and recycling initiatives, along with growing industrial activity, is fostering significant demand for high-quality, compliant drum liners.

Germany Drum Liners Market Insight

The Germany drum liners market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by strong industrial production and a national focus on environmental sustainability. The country’s leadership in chemical and automotive manufacturing creates a steady demand for durable liners capable of safely containing hazardous and sensitive materials. Germany’s emphasis on advanced material engineering and regulatory compliance is encouraging local manufacturers to invest in recyclable and high-barrier liners, aligning with the nation’s environmental protection goals and innovation-driven economy.

Asia-Pacific Drum Liners Market Insight

The Asia-Pacific drum liners market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, expanding manufacturing sectors, and growing export activities in countries such as China, India, and Japan. The rising demand for cost-effective, efficient, and sustainable packaging solutions is propelling market growth. Increasing awareness about contamination prevention and product quality in the food, chemical, and pharmaceutical industries is further stimulating liner adoption. The region’s expanding polymer production capabilities and growing foreign investments in packaging infrastructure are also enhancing market accessibility and affordability.

Japan Drum Liners Market Insight

The Japan drum liners market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s strong manufacturing base, emphasis on product safety, and commitment to environmental sustainability. Japanese industries are rapidly adopting high-performance liners with enhanced chemical resistance and precision-fit designs for efficient operations. The use of recyclable and biodegradable materials is increasing in alignment with Japan’s national waste reduction policies. Moreover, technological advancements and the integration of automated packaging systems are expected to further boost market adoption across multiple industrial sectors.

China Drum Liners Market Insight

The China drum liners market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrial growth, expanding exports, and increasing demand for safe packaging in the chemical and food sectors. The country’s large-scale manufacturing capabilities and access to cost-efficient raw materials provide a competitive edge to domestic producers. Rising environmental awareness and government initiatives promoting sustainable packaging are further encouraging the use of recyclable drum liners. In addition, the growing adoption of high-barrier and anti-static liners in industrial applications is propelling market expansion across the region.

Drum Liners Market Share

The Drum Liners industry is primarily led by well-established companies, including:

• Greif, Inc. (U.S.)

• Berry Global Inc. (U.S.)

• Sealed Air Corporation (U.S.)

• Bemis Company, Inc. (U.S.)

• WINPAK Ltd. (Canada)

• Balmer Lawrie & Co. Ltd. (India)

• International Plastics Inc. (U.S.)

• CDF Corporation (U.S.)

• Welch Fluorocarbon Inc. (U.S.)

• The Cary Company (U.S.)

• Vestil Manufacturing Corp. (U.S.)

• Protective Lining Corp. (U.S.)

• Sri Lakshmi Vishnu Plastics (India)

• Heritage Packaging (U.S.)

• Dana Poly Inc. (U.S.)

• Glasnost India (India)

• Lormac Group (U.K.)

• SPP Poly Pack Pvt. Ltd. (India)

Latest Developments in Global Drum Liners Market

- In February 2024, Berry Global Inc. announced a merger with Glatfelter Corporation valued at USD 3.6 billion. The merger combines Berry’s Health, Hygiene, and Specialties segment with its Global Nonwovens and Films business to form a new publicly traded company, NewCo. This strategic move is aimed at enhancing operational efficiency, expanding product offerings, and strengthening the company’s global presence. The merger is expected to create significant synergies and drive innovation across sustainable packaging and specialty material solutions, positively impacting the global drum liners market

- In April 2023, Greif Inc. completed the acquisition of an additional stake in Centurion Container LLC, increasing its ownership from 9% to 80% for USD 145 million in cash. The acquisition, financed through Greif’s existing credit facility, strengthens its position in the industrial packaging sector. This development enhances Greif’s portfolio in sustainable container solutions and is expected to improve its competitive edge and market reach within the drum liners and industrial packaging industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Drum Liner Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Drum Liner Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Drum Liner Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.