Global Dual Chamber Prefilled Syringes Market

Market Size in USD Million

CAGR :

%

USD

177.69 Million

USD

292.54 Million

2024

2032

USD

177.69 Million

USD

292.54 Million

2024

2032

| 2025 –2032 | |

| USD 177.69 Million | |

| USD 292.54 Million | |

|

|

|

|

Dual Chamber Prefilled Syringes Market Size

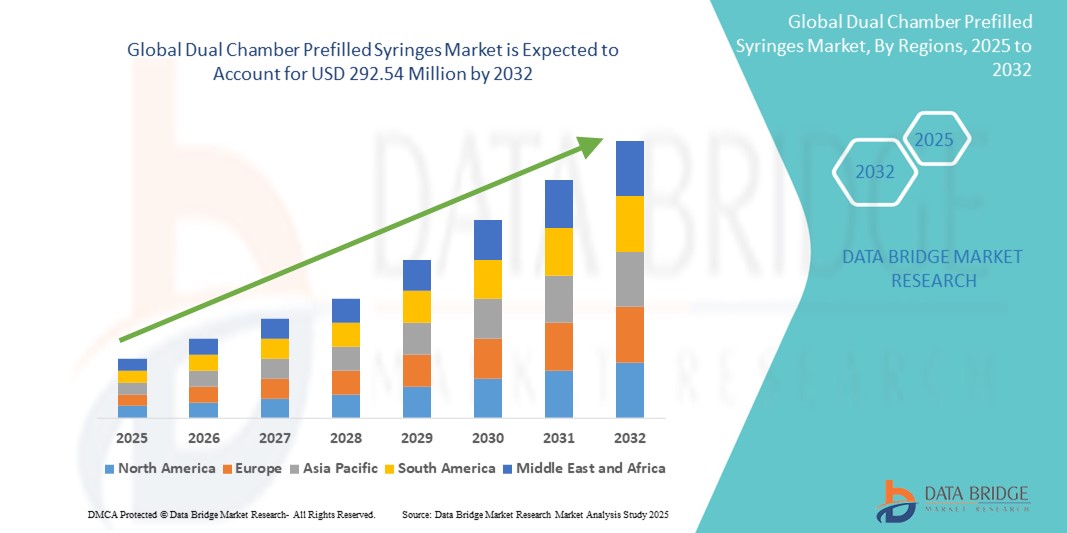

- The global dual chamber prefilled syringes market size was valued at USD 177.69 million in 2024 and is expected to reach USD 292.54 million by 2032, at a CAGR of 6.43% during the forecast period

- The market growth is largely fueled by increasing demand for lyophilized drugs and the growing need for convenient, safe, and accurate drug delivery systems across healthcare settings. This trend is particularly prominent in chronic disease management and emergency care scenarios

- Furthermore, advancements in pharmaceutical packaging technologies, coupled with heightened focus on minimizing drug wastage and ensuring sterility, are reinforcing the adoption of dual chamber prefilled syringes. These dynamics are driving widespread acceptance across biopharmaceutical and vaccine segments, thereby significantly boosting the industry's growth

Dual Chamber Prefilled Syringes Market Analysis

- Dual chamber prefilled syringes, designed to keep drug components separate until the point of administration, are becoming increasingly vital in pharmaceutical and biotechnology applications due to their enhanced drug stability, ease of use, and suitability for lyophilized and sensitive formulations

- The rising demand for dual chamber prefilled syringes is primarily driven by the growing prevalence of chronic diseases, increasing preference for self-administration of injectable therapies, and the pharmaceutical industry's shift toward advanced drug delivery systems

- North America dominated the dual chamber prefilled syringes market with the largest revenue share of 39.1% in 2024, attributed to robust pharmaceutical R&D, strong regulatory frameworks, and early adoption of innovative drug delivery technologies in the United States and Canada, especially for high-value biologics and emergency-use medications

- Asia-Pacific is expected to be the fastest growing region in the dual chamber prefilled syringes market during the forecast period due to rapid expansion of the pharmaceutical sector, rising healthcare awareness, and increasing demand for innovative injectable solutions

- Conventional Prefilled Syringes segment dominated the dual chamber prefilled syringes market with a market share of 63.3% in 2024, driven by its widespread usage, cost-effectiveness, and compatibility with a broad range of lyophilized and liquid drug formulations

Report Scope and Dual Chamber Prefilled Syringes Market Segmentation

|

Attributes |

Dual Chamber Prefilled Syringes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dual Chamber Prefilled Syringes Market Trends

“Surge in Demand for Lyophilized Biologics and Combination Therapies”

- A significant and accelerating trend in the global dual chamber prefilled syringes market is the rising demand for packaging solutions suitable for lyophilized biologics and combination drug therapies. Dual chamber syringes offer a unique advantage by storing liquid and powder components separately, ensuring stability and extending shelf life until the moment of use

- For instance, several biologic drug formulations—particularly monoclonal antibodies and peptide-based therapies—require freeze-drying and reconstitution prior to administration, making dual chamber systems the optimal delivery choice. Companies such as SCHOTT Pharma and Vetter Pharma have launched advanced dual chamber systems to support the pharmaceutical industry's need for patient-centric and stability-enhancing packaging

- These syringes are increasingly used in the treatment of complex chronic conditions such as diabetes, hemophilia, and hormone therapies, where precise mixing and immediate administration are critical

- As combination therapies become more prevalent—especially in oncology and autoimmune disease treatment—dual chamber systems allow for the co-delivery of two drugs or components that must remain separate until the time of injection

- The rising trend toward self-administration is also fueling innovation in user-friendly dual chamber systems, including automatic mixing mechanisms and ergonomic designs, aimed at improving patient compliance and reducing healthcare burdens

- This trend is fundamentally transforming pharmaceutical packaging standards, encouraging manufacturers to invest in dual chamber formats that support stability, efficacy, and ease of use across diverse therapeutic segments

Dual Chamber Prefilled Syringes Market Dynamics

Driver

“Growing Biologic Drug Pipeline and Demand for Safe, Efficient Drug Delivery”

- The expanding pipeline of biologic drugs and lyophilized formulations is a major driver fueling demand for dual chamber prefilled syringes, which allow for stable storage and convenient reconstitution of sensitive compounds at the point of care

- For instance, in February 2024, Gerresheimer AG partnered with a global biopharmaceutical firm to scale up dual chamber syringe production for a new biologic targeting rare autoimmune conditions. This reflects how partnerships are shaping the growth trajectory of advanced injectable packaging solutions

- Dual chamber prefilled syringes offer improved dose accuracy, reduced contamination risk, and better patient compliance, making them increasingly attractive for chronic conditions requiring home-based care, such as hemophilia and diabetes

- In addition, the shift toward self-injection and reduced clinical visits post-pandemic has led to increased demand for delivery systems that combine safety, sterility, and ease of use. The compatibility of dual chamber syringes with autoinjectors and wearable injectors further supports their adoption

- The pharmaceutical industry’s focus on minimizing drug waste and streamlining drug administration workflows also contributes to the rising adoption of dual chamber prefilled syringes

Restraint/Challenge

“High Manufacturing Complexity and Regulatory Compliance Barriers”

- Despite their advantages, dual chamber prefilled syringes pose challenges related to complex manufacturing processes, stringent quality control, and high development costs, which can deter smaller pharmaceutical firms from adoption

- These syringes require precise engineering to maintain sterility and stability across two chambers, along with advanced materials that can withstand freeze-drying and chemical exposure without compromising drug integrity

- Regulatory agencies impose rigorous standards on combination drug-device products, including detailed validation of stability, compatibility, and user safety. Meeting these requirements significantly increases time-to-market and development investment

- In addition, concerns about extractables and leachables, particularly in plastic-based dual chamber systems, add another layer of regulatory and material scrutiny

- Cost also remains a barrier in price-sensitive markets where conventional prefilled syringes or vials may still be favored. While adoption is high in developed regions, emerging markets face slower uptake due to budget constraints and limited healthcare infrastructure

- Overcoming these challenges will require innovation in cost-effective manufacturing, collaborative regulatory strategies, and expanding awareness about the long-term clinical and economic benefits of dual chamber systems

Dual Chamber Prefilled Syringes Market Scope

The market is segmented on the basis of product type, type (volume), material type, indication, application, and distribution channel.

- By Product Type

On the basis of product type, the dual chamber prefilled syringes market is segmented into conventional prefilled syringes and safety prefilled syringes. The conventional prefilled syringes segment dominated the market with the largest market revenue share of 63.3% in 2024, driven by its cost-efficiency, broad compatibility with lyophilized and liquid formulations, and established usage across diverse therapeutic areas. Pharmaceutical manufacturers continue to favor conventional dual chamber systems for their simplicity, scalability, and regulatory familiarity, especially in chronic and emergency therapies.

The safety prefilled syringes segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by rising healthcare regulations aimed at reducing needlestick injuries and improving safety standards in drug delivery. Built-in needle protection mechanisms are increasingly demanded by hospitals and clinics seeking enhanced occupational safety.

- By Type

On the basis of type, the dual chamber prefilled syringes market is segmented into <1 mL, 1–2.5 mL, 2.5–5 mL, and >5 mL. The <1 mL segment dominated the market with the largest market revenue share of 54.1% in 2024, driven by the rising demand for low-volume, high-potency biologic therapies such as insulin, vaccines, and hormone treatments. This volume range is ideal for self-administration and minimizes injection site discomfort.

The 1–2.5 mL segment is expected to witness the fastest CAGR from 2025 to 2032, as combination therapies and long-acting injectables often fall within this volume bracket, making them suitable for chronic disease management.

- By Material Type

On the basis of material type, the dual chamber prefilled syringes market is segmented into glass and plastic. The glass segment held the largest market revenue share of 69.3% in 2024, owing to its superior barrier properties, drug compatibility, and regulatory acceptance. Glass syringes are widely used for storing sensitive biologics, lyophilized drugs, and high-value pharmaceuticals due to their chemical inertness and proven safety.

The plastic segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing demand for lightweight, break-resistant, and patient-friendly devices. Advances in polymer technology, such as cyclic olefin copolymers, are enabling safer and more ergonomic designs suitable for wearable injectors and home use.

- By Indication

On the basis of indication, the dual chamber prefilled syringes market is segmented into hemophilia, schizophrenia, diabetes, erectile dysfunction, endometriosis, and others. The diabetes segment dominated the market with the largest market revenue share of 31.5% in 2024, driven by the increasing global prevalence of diabetes and the growing use of injectable therapies requiring accurate dosing and reconstitution. Dual chamber systems are especially useful for stable delivery of GLP-1 receptor agonists and insulin formulations in home settings.

The hemophilia segment is expected to witness the fastest CAGR from 2025 to 2032, owing to the increasing adoption of dual chamber syringes for clotting factor concentrates, which often require reconstitution prior to administration in emergency scenarios.

- By Application

On the basis of application, the dual chamber prefilled syringes market is segmented into liquid/powder and liquid/liquid. The liquid/powder segment dominated the market with the largest market revenue share of 46.3% in 2024, supported by its critical role in delivering lyophilized drugs, which require mixing immediately before injection to preserve efficacy and stability. This format is preferred for sensitive biologics and vaccines.

The liquid/liquid segment is projected to witness steady growth during forecast period, as dual chamber systems are increasingly employed for co-formulated therapies or delivery of diluents alongside active pharmaceutical ingredients in one device, simplifying administration and improving patient adherence.

- By Distribution Channel

On the basis of distribution channel, the dual chamber prefilled syringes market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market with the largest market revenue share of 41.7% in 2024, driven by the high demand for injectable therapies administered in clinical settings and the need for precise and sterile delivery solutions. Hospitals remain the primary point of care for acute conditions treated with dual chamber systems.

The online pharmacies segment is expected to witness the fastest growth from 2025 to 2032, fueled by the rising trend of home-based care, increasing patient preference for convenience, and the broader acceptance of e-commerce platforms for specialty medications and medical supplies.

Dual Chamber Prefilled Syringes Market Regional Analysis

- North America dominated the dual chamber prefilled syringes market with the largest revenue share of 39.1% in 2024, attributed to robust pharmaceutical R&D, strong regulatory frameworks, and early adoption of innovative drug delivery technologies in the United States and Canada, especially for high-value biologics and emergency-use medications

- The region benefits from a robust healthcare infrastructure, high healthcare expenditure, and a growing emphasis on patient-centric care, supporting the use of convenient and efficient injectable delivery formats

- Furthermore, the presence of leading pharmaceutical manufacturers, favorable regulatory environments, and rising prevalence of chronic diseases contribute to the widespread adoption of dual chamber prefilled syringes across hospital and self-care settings in both the United States and Canada

U.S. Dual Chamber Prefilled Syringes Market Insight

The U.S. dual chamber prefilled syringes market captured the largest revenue share of 81% in 2024 within North America, fueled by the country’s leadership in biologics development, advanced healthcare infrastructure, and growing preference for self-administered injectable therapies. The rising prevalence of chronic diseases such as diabetes and hemophilia, coupled with demand for patient-centric drug delivery solutions, supports the strong adoption of dual chamber formats. Moreover, FDA approvals of lyophilized drugs and combination therapies are accelerating pharmaceutical companies’ investment in dual chamber systems.

Europe Dual Chamber Prefilled Syringes Market Insight

The Europe dual chamber prefilled syringes market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent EU drug safety regulations and the increasing demand for stable, efficient drug delivery formats. The region benefits from a high concentration of pharmaceutical manufacturers and advanced packaging solution providers, particularly in countries such as Germany, Switzerland, and France. The growing use of biologics and lyophilized injectables across hospital and home care settings is fueling adoption in both established and emerging therapeutic areas.

U.K. Dual Chamber Prefilled Syringes Market Insight

The U.K. dual chamber prefilled syringes market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising investments in biopharmaceuticals and increased focus on safe, compliant injectable delivery systems. NHS support for self-injection programs and growing awareness around reducing hospital visits are driving demand for user-friendly dual chamber syringes. In addition, the country’s leadership in clinical trials and specialty drug manufacturing contributes to rising product integration.

Germany Dual Chamber Prefilled Syringes Market Insight

The Germany dual chamber prefilled syringes market is expected to expand at a considerable CAGR during the forecast period, driven by its strong pharmaceutical manufacturing base and focus on innovation in drug delivery technologies. German pharmaceutical and biotech firms are actively adopting dual chamber systems for their lyophilized drug portfolios, aiming to enhance stability and extend product shelf life. Growing demand for combination therapies and self-administration solutions aligns with Germany’s emphasis on healthcare efficiency and patient safety.

Asia-Pacific Dual Chamber Prefilled Syringes Market Insight

The Asia-Pacific dual chamber prefilled syringes market is poised to grow at the fastest CAGR of 24% during 2025 to 2032, supported by rapid expansion of the pharmaceutical sector, urbanization, and increasing awareness of advanced injectable formats. Government support for local biologics production, combined with healthcare infrastructure development in countries such as China, Japan, and India, is creating robust demand. In addition, improved access to high-quality drug packaging solutions is enabling broader use in both hospitals and home-care environments.

Japan Dual Chamber Prefilled Syringes Market Insight

The Japan dual chamber prefilled syringes market is gaining momentum due to the country’s strong focus on healthcare innovation, aging population, and growing preference for precision drug delivery systems. Japanese pharmaceutical companies are leveraging dual chamber syringes to deliver lyophilized biologics and combination therapies efficiently. The demand is further strengthened by the integration of ergonomic, user-friendly features to support elderly patients and promote safe self-administration.

India Dual Chamber Prefilled Syringes Market Insight

The India dual chamber prefilled syringes market accounted for the largest market revenue share in Asia Pacific in 2024, driven by a growing middle class, increased prevalence of chronic diseases, and government-backed pharmaceutical expansion. The country's domestic manufacturers are increasingly adopting dual chamber systems to meet demand for affordable yet sophisticated drug delivery solutions. Furthermore, India’s focus on localizing biopharmaceutical production and expanding access to injectable therapies through hospitals and home care is propelling market growth.

Dual Chamber Prefilled Syringes Market Share

The dual chamber prefilled syringes industry is primarily led by well-established companies, including:

- Arte Corp (South Korea)

- BD (U.S.)

- Haselmeier (Switzerland)

- Gerresheimer AG (Germany)

- SCHOTT AG (Germany)

- MAEDA INDUSTRY Co., Ltd. (Japan)

- Catalent, Inc (U.S.)

- Terumo Europe NV (Belgium)

- Baxter (U.S.)

- Medtronic (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Stevanato Group (Italy)

- Vetter Pharma-Fertigung GmbH & Co. KG (Germany)

- Bayer AG (Germany)

- Elcam Drug Delivery Devices (Israel)

- Dätwyler Holding Inc. (Switzerland)

- Viatris Inc. (U.S.)

- Credence MedSystems, Inc. (U.S.)

- Nipro (Japan)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

What are the Recent Developments in Global Dual Chamber Prefilled Syringes Market?

- In May 2024, Gerresheimer AG expanded its production capacity for dual chamber prefilled syringes at its facility in Bünde, Germany, to meet the increasing demand for lyophilized biologics and combination therapies. This strategic move enables Gerresheimer to support pharmaceutical companies with advanced drug delivery solutions tailored to stability-sensitive formulations, reinforcing its position as a key provider of high-quality primary packaging systems in the global injectable drug market

- In March 2024, SCHOTT Pharma announced the launch of its next-generation syriQ BioPure® dual chamber prefillable syringes designed for biologics requiring reconstitution. These syringes aim to improve drug stability, minimize interaction with container surfaces, and offer better compatibility with automation lines. The development reflects SCHOTT’s focus on innovation and its response to the growing need for safe, reliable, and patient-friendly drug delivery systems

- In February 2024, Vetter Pharma, a global contract development and manufacturing organization (CDMO), revealed the completion of a major expansion at its Ravensburg site, increasing capacity for dual chamber syringe filling. This enhancement allows Vetter to accommodate growing client demand for complex injectable therapies, particularly in the biologics and biosimilar markets. The expansion demonstrates Vetter’s commitment to addressing rising global demand for sophisticated, ready-to-use injection systems

- In January 2024, Credence MedSystems received industry recognition for its Dual Chamber Companion® syringe platform, which facilitates the delivery of combination therapies requiring separation until administration. The system supports automatic mixing, ensuring safety and ease-of-use for self-administration. This recognition underscores Credence’s innovation in developing intuitive drug delivery platforms aligned with evolving pharmaceutical trends toward user-centric designs and combination formulations

- In December 2023, Nipro Corporation announced the advancement of its dual chamber syringe solutions optimized for emergency drug administration. These syringes enable rapid and accurate reconstitution, crucial for time-sensitive medications. The development responds to the increasing global demand for injectable systems that ensure rapid drug deployment and high stability, particularly in critical care and field-based medical scenarios

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.