Global Dual Contaminant Pipe Market

Market Size in USD Billion

CAGR :

%

USD

3.11 Billion

USD

4.71 Billion

2024

2032

USD

3.11 Billion

USD

4.71 Billion

2024

2032

| 2025 –2032 | |

| USD 3.11 Billion | |

| USD 4.71 Billion | |

|

|

|

|

Dual Contaminant Pipe Market Size

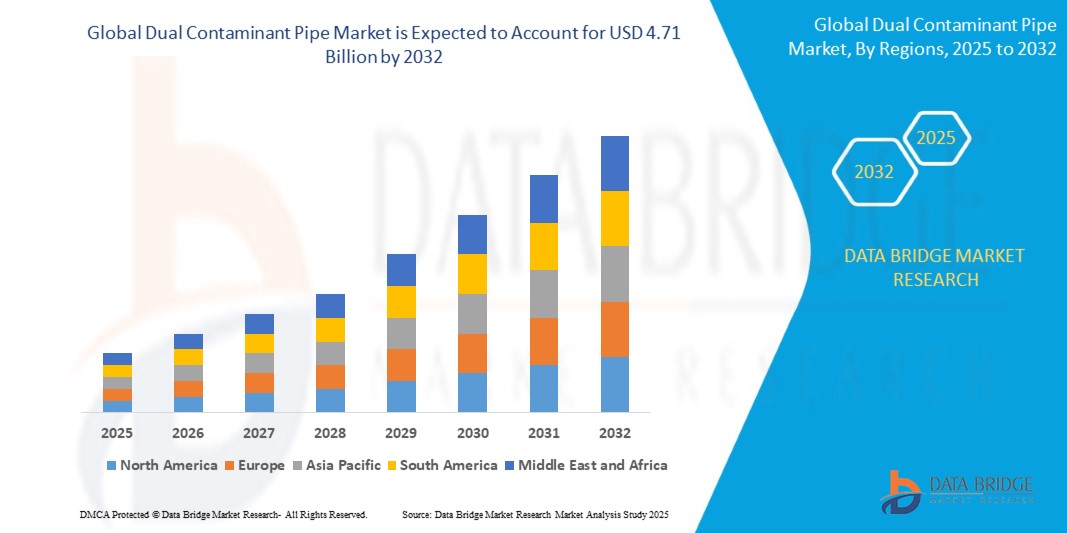

- The global dual contaminant pipe market size was valued at USD 3.11 billion in 2024 and is expected to reach USD 4.71 billion by 2032, at a CAGR of 5.32% during the forecast period

- The market growth is largely fueled by increasing industrialization, urbanization, and stringent safety and environmental regulations, leading to higher adoption of dual containment piping systems in chemical, pharmaceutical, and water treatment industries

- Furthermore, rising demand for advanced, durable, and leak-proof piping solutions that ensure operational safety and compliance with regulatory standards is driving the uptake of dual contaminant pipes, significantly boosting the industry’s growth

Dual Contaminant Pipe Market Analysis

- Dual contaminant pipes are specialized piping systems designed with an inner pipe for primary fluid transport and an outer containment pipe to prevent leaks or spills. These systems are widely used in industries handling hazardous or corrosive substances, ensuring environmental protection and workplace safety

- The escalating demand for dual contaminant pipes is primarily fueled by stringent industrial safety regulations, increasing awareness of environmental protection, and growing investments in industrial and municipal infrastructure requiring reliable leak containment solutions

- North America dominated the dual contaminant pipe market with a share of 39.21% in 2024, due to increasing investments in industrial infrastructure, oil and gas, and water treatment projects

- Europe is expected to be the fastest growing region in the dual contaminant pipe market during the forecast period due to stringent safety regulations and growing demand for environmentally sustainable and efficient containment solutions

- PVC segment dominated the market with a market share of 39% in 2024, due to its cost-effectiveness, chemical resistance, and widespread availability. PVC pipes are widely preferred in industrial and water treatment applications due to their durability, ease of installation, and low maintenance requirements. The market also sees strong demand for PVC types because they are compatible with various fluid transport systems and meet regulatory standards for contaminant containment. The lightweight nature of PVC pipes and their resistance to corrosion further reinforce their adoption in both retrofit and new infrastructure projects

Report Scope and Dual Contaminant Pipe Market Segmentation

|

Attributes |

Dual Contaminant Pipe Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Dual Contaminant Pipe Market Trends

Integration of Smart Monitoring and Leak Detection Systems

- The dual contaminant pipe market is witnessing a growing trend toward the integration of smart monitoring and leak detection technologies to improve pipeline safety and environmental compliance. Real-time sensors and IoT-enabled devices are being embedded within pipes to detect leakage, contamination, and structural integrity issues early

- For instance, Emerson has incorporated advanced leak detection sensors and smart analytics into dual contaminant pipe systems used in chemical and water treatment plants. These solutions enable operators to monitor pipe performance remotely and prevent environmental hazards proactively

- The adoption of digital twins and predictive maintenance models is enhancing the ability to simulate pipe behavior and forecast contamination risks, which reduces downtime and repair costs for industrial operators

- Growing regulatory pressures for environmental protection and spill prevention are driving innovation in pipe systems with embedded monitoring to meet stringent compliance standards

- In addition, enhanced remote monitoring capabilities allow integration of contamination data into centralized control systems, improving responsiveness and safety in critical infrastructure such as oil refineries and municipal water networks

- Development of multiparameter sensor arrays capable of detecting various contaminants simultaneously is expanding application possibilities across industrial sectors requiring robust dual contaminant management

- Emerging materials with embedded sensor capabilities further enable smart pipe constructions that combine high durability with intelligent diagnostics, fostering next-generation pipeline solutions

Dual Contaminant Pipe Market Dynamics

Driver

Advances in Materials Technology

- Advances in pipe material technologies, including composite blends, corrosion-resistant alloys, and polymer linings, are driving the dual contaminant pipe market by improving durability and chemical resistance against aggressive fluids and environmental conditions

- For instance, Saint-Gobain’s development of dual-layer composite pipes featuring corrosion-resistant inner linings and structural outer layers supports long service life even under exposure to harsh chemicals, making them ideal for chemical processing and wastewater applications

- The integration of nanomaterials and anti-fouling coatings enhances pipe performance, reducing clogging and contamination buildup, which is critical for maintaining water quality and industrial fluid purity

- Materials with improved thermal and mechanical properties allow pipes to operate efficiently under extreme temperature and pressure conditions, broadening the scope of applications in power plants, oil & gas, and chemical manufacturing

- The ongoing R&D efforts that reduce maintenance frequency and extend pipe lifespan are strengthening market attractiveness, particularly in sectors with costly downtime and environmental sensitivities

Restraint/Challenge

High Initial Investment Costs

- The significant upfront capital expenditure for advanced dual contaminant pipes and integrated monitoring infrastructure presents a major barrier to wider market adoption. Costs for materials, sensors, control units, and installation can be prohibitive, especially for smaller-scale applications

- For instance, large-scale industrial facilities considering smart pipe systems from companies such as Xylem face cost-benefit analyses where initial investments must be justified by long-term operational savings, delaying widespread deployment in price-sensitive markets

- The complexity of installing integrated systems often requires specialized labor and testing, which adds to installation costs and project timelines, limiting adoption in retrofit or budget-constrained environments

- In addition, limited availability of financing options for infrastructure upgrades in emerging economies restricts access to high-end dual contaminant pipe solutions, curbing market growth potential in those regions

- Variability in regulatory support and incentive programs across regions affects willingness to invest in advanced pipe systems, creating uneven market development and adoption rates globally

Dual Contaminant Pipe Market Scope

The market is segmented on the basis of material type, diameter, sales channel, technology, and end-uses.

• By Material Type

On the basis of material type, the dual contaminant pipe market is segmented into PVC, CPVC, HDPE, PVDF, and Others. The PVC segment dominated the market with the largest revenue share of 39% in 2024, driven by its cost-effectiveness, chemical resistance, and widespread availability. PVC pipes are widely preferred in industrial and water treatment applications due to their durability, ease of installation, and low maintenance requirements. The market also sees strong demand for PVC types because they are compatible with various fluid transport systems and meet regulatory standards for contaminant containment. The lightweight nature of PVC pipes and their resistance to corrosion further reinforce their adoption in both retrofit and new infrastructure projects.

The PVDF segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption in high-purity chemical processing and pharmaceutical industries. PVDF pipes offer superior chemical resistance, thermal stability, and long service life, making them ideal for aggressive or corrosive media. The rising demand for high-performance dual contaminant solutions in sensitive industrial environments is expected to accelerate PVDF adoption, particularly in regions investing in advanced manufacturing and chemical infrastructure.

• By Diameter

On the basis of diameter, the dual contaminant pipe market is segmented into small diameter (<2 inches), medium diameter (2–8 inches), and large diameter (>8 inches). The medium diameter segment dominated the market in 2024, accounting for the largest revenue share, owing to its versatility and compatibility across multiple industrial and municipal applications. Medium-diameter pipes are often preferred for chemical processing, water treatment, and oil & gas operations because they balance flow capacity with ease of handling and installation. The segment also benefits from standardization in industrial piping projects and strong OEM partnerships for medium-size piping systems.

The large-diameter segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in large-scale oil, gas, and water infrastructure projects. Large-diameter dual contaminant pipes provide higher throughput and enhanced safety for transporting hazardous or corrosive fluids over long distances. Investments in expanding municipal water networks and petrochemical plants are further expected to fuel the adoption of large-diameter solutions in emerging economies.

• By Sales Channel

On the basis of sales channel, the market is segmented into direct sales, distributors, and online retailers. The direct sales segment dominated the market in 2024, driven by strong B2B relationships, customized solutions, and bulk order contracts with industrial and municipal clients. Manufacturers increasingly prefer direct sales to maintain quality assurance, provide technical support, and offer installation services for complex dual contaminant pipe systems. This approach also allows better integration with project timelines and engineering specifications, enhancing trust among key industrial end-users.

The online retailers segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing digitalization of procurement processes and the rise of e-commerce platforms for industrial components. Online channels provide convenient access to product catalogs, competitive pricing, and quick delivery options, especially for small and medium enterprises. Increasing adoption of digital procurement and real-time inventory management solutions is likely to boost the uptake of online sales channels in the dual contaminant pipe market.

• By Technology

On the basis of technology, the dual contaminant pipe market is segmented into conventional dual containment pipes, advanced composite dual containment pipes, and smart dual containment pipes with integrated monitoring systems. The conventional dual containment pipes segment dominated the market in 2024 due to its proven reliability, ease of fabrication, and compatibility with a wide range of industrial fluids. These pipes are widely adopted across chemical, oil, and water treatment industries where safety, containment, and regulatory compliance are critical. The segment also benefits from established installation expertise and long-standing industrial trust in conventional systems.

The smart dual containment pipes segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing integration of IoT-based monitoring systems and predictive maintenance capabilities. Smart pipes provide real-time data on pressure, temperature, and leak detection, significantly reducing operational risks and downtime. The rising adoption of Industry 4.0 practices in chemical processing, pharmaceuticals, and oil & gas industries is accelerating demand for intelligent dual containment solutions.

• By End-Uses

On the basis of end-uses, the dual contaminant pipe market is segmented into chemical processing, oil and gas, water treatment, industrial manufacturing, pharmaceutical, and others. The chemical processing segment dominated the market in 2024, holding the largest revenue share due to the critical need for safe handling and containment of corrosive or hazardous chemicals. Chemical plants prioritize dual containment solutions to minimize environmental risks, ensure regulatory compliance, and protect operational assets. Strong demand is driven by ongoing investments in chemical production infrastructure and retrofitting of aging pipelines for safer operations.

The pharmaceutical segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising need for contamination-free fluid transport in drug manufacturing and bioprocessing applications. High-purity dual contaminant pipes reduce risks of chemical interactions, contamination, and compliance violations, making them essential for sensitive pharmaceutical operations. Expanding production capacities in emerging markets and stringent global quality regulations are further driving the adoption of specialized piping solutions in this sector.

Dual Contaminant Pipe Market Regional Analysis

- North America dominated the dual contaminant pipe market with the largest revenue share of 39.21% in 2024, driven by increasing investments in industrial infrastructure, oil and gas, and water treatment projects

- Industries in the region highly prioritize safety, regulatory compliance, and efficient contaminant containment, fueling demand for reliable dual containment pipe solutions

- The widespread adoption is further supported by advanced manufacturing facilities, strong industrial growth, and a technologically inclined workforce, establishing dual contaminant pipes as a preferred choice across chemical, pharmaceutical, and manufacturing sectors

U.S. Dual Contaminant Pipe Market Insight

The U.S. dual contaminant pipe market captured the largest revenue share in 2024 within North America, driven by rapid industrialization and expansion of chemical and water treatment infrastructure. Industries increasingly focus on safety and leak prevention, boosting demand for dual containment solutions. Growing adoption of advanced manufacturing processes and stringent environmental regulations further propels market growth. In addition, the rising integration of smart monitoring systems in dual containment pipes enhances operational efficiency, reliability, and safety, contributing to market expansion.

Asia-Pacific Dual Contaminant Pipe Market Insight

The Asia-Pacific dual contaminant pipe market is poised for significant growth during the forecast period of 2025 to 2032, supported by rapid industrialization, urbanization, and increasing demand for chemical, water, and pharmaceutical infrastructure in countries such as China, India, and Japan. The region’s growing industrial base and investments in oil and gas, water treatment, and manufacturing facilities are driving adoption. In addition, emerging economies in APAC are increasingly integrating advanced composite and smart dual containment pipes to enhance operational safety and compliance.

Japan Dual Contaminant Pipe Market Insight

The Japan dual contaminant pipe market is witnessing steady growth due to high industrial standards, focus on safety, and the adoption of smart containment systems. The demand for reliable dual containment pipes is driven by the chemical, pharmaceutical, and water treatment sectors. Japan’s technologically advanced industrial landscape and emphasis on sustainability further support market expansion.

China Dual Contaminant Pipe Market Insight

The China dual contaminant pipe market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrial growth, urbanization, and high adoption of advanced piping solutions. The chemical, pharmaceutical, and water treatment industries are driving demand for dual containment pipes. Government initiatives for industrial safety, smart manufacturing, and infrastructure development are key factors propelling market growth.

Europe Dual Contaminant Pipe Market Insight

The Europe dual contaminant pipe market is projected to grow at the fastest CAGR during the forecast period, primarily driven by stringent safety regulations and growing demand for environmentally sustainable and efficient containment solutions. The rise in industrial modernization, coupled with increased adoption of advanced composite and smart dual containment technologies, is fostering market growth. European industries prioritize high-quality piping systems for chemical processing, pharmaceutical, and water treatment applications. The expansion of urban and industrial infrastructure, along with increasing awareness of safety and environmental standards, is significantly driving adoption across the region.

U.K. Dual Contaminant Pipe Market Insight

The U.K. dual contaminant pipe market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising industrial safety standards and the need for efficient chemical and pharmaceutical handling systems. The adoption of dual containment solutions is supported by government regulations and industrial modernization initiatives. Increasing investments in water treatment and manufacturing facilities are also contributing to market expansion.

Germany Dual Contaminant Pipe Market Insight

The Germany dual contaminant pipe market is expected to expand at a considerable CAGR during the forecast period, driven by a strong focus on industrial safety, sustainability, and high-performance piping systems. Germany’s advanced industrial infrastructure and adoption of smart monitoring technologies promote dual containment pipe usage across chemical, pharmaceutical, and oil and gas sectors. The preference for eco-conscious and technologically advanced containment solutions is further stimulating market growth.

Dual Contaminant Pipe Market Share

The dual contaminant pipe industry is primarily led by well-established companies, including:

- GF Piping Systems (Switzerland)

- Asahi/America (U.S.)

- Simtech (U.S.)

- Aquatherm (Germany)

- IPEX (Canada)

- Plast-O-Matic Valves, Inc. (U.S.)

- Asahi Kasei Corporation (Japan)

- Entegris (U.S.)

- Rovanco (U.S.)

- Chemline (U.S.)

- Furon (U.S.)

- WGS Plastic Services (U.S.)

- Sangir (U.S.)

Latest Developments in Global Dual Contaminant Pipe Market

- In November 2023, GF Piping Systems announced the acquisition of a 51% majority stake in Corys Piping Systems LLC, based in Dubai, UAE. This partnership aims to become a leading provider of advanced flow solutions in various specialized markets. The new entity combines GF's global experience and innovative solutions with CPS’s deep regional market understanding. This acquisition strengthens GF Piping Systems' global presence in regions with a sizeable and growing market and enhances its capabilities in delivering advanced dual contaminant piping solutions

- In November 2023, GF Piping Systems completed the acquisition of Uponor, a move aimed at accelerating the implementation of GF's Strategy 2025 and benefiting from global megatrends. The integration of Uponor into GF Piping Systems is expected to enhance the company's capabilities in providing sustainable water and flow solutions, positioning it as a global leader in the dual contaminant pipe industry

- In April 2022, IPEX announced the acquisition of Harrington Corporation (Harco), strengthening its position and providing significant growth opportunities in the U.S. market. This acquisition expands IPEX's presence and enhances its ability to serve customers with a broader range of piping solutions, boosting its footprint in chemical, pharmaceutical, and water treatment sectors

- In January 2022, Aquatherm launched a new pipe series in MagiCAD to support designers. MagiCAD 2022 for MEP design included several innovative features, including preconfigured drainage and pipe series specifically for Revit environments. This development streamlines the design process for engineers and enhances the efficiency of MEP design workflows, contributing to faster adoption of dual contaminant piping systems in industrial projects

- In March 2021, Georg Fischer introduced an advanced dual containment pipe system with integrated leak detection, aimed at improving operational safety and reducing environmental risk in chemical and pharmaceutical industries. This innovation positions the company as a leader in smart containment solutions and accelerates market adoption of advanced monitoring technologies

- In August 2020, IPEX launched a high-performance PVDF dual contaminant pipe series designed for aggressive chemical handling and high-temperature applications. This development strengthened IPEX's product portfolio, meeting the growing demand for durable and high-resistance piping systems in industrial and water treatment applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dual Contaminant Pipe Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dual Contaminant Pipe Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dual Contaminant Pipe Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.