Global Dual Gip Glp 1 Receptor Agonists Obesity

Market Size in USD Billion

CAGR :

%

USD

4.75 Billion

USD

17.71 Billion

2024

2032

USD

4.75 Billion

USD

17.71 Billion

2024

2032

| 2025 –2032 | |

| USD 4.75 Billion | |

| USD 17.71 Billion | |

|

|

|

|

Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Size

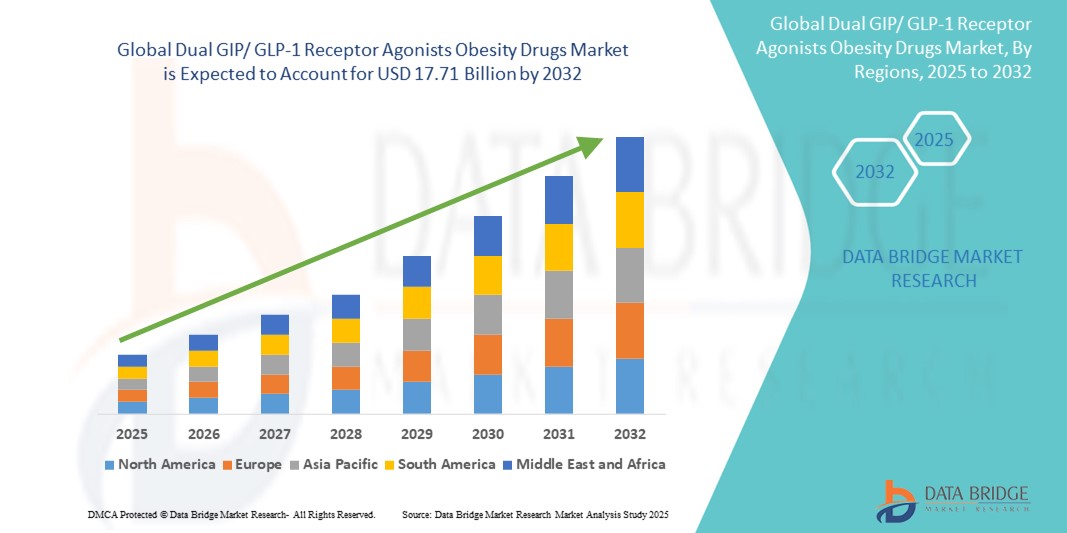

- The global dual GIP/ GLP-1 receptor agonists obesity drugs market size was valued at USD 4.75 billion in 2024 and is expected to reach USD 17.71 billion by 2032, at a CAGR of 17.85% during the forecast period

- The market growth is largely fueled by the increasing prevalence of obesity and related metabolic disorders globally, coupled with the rising demand for more effective, long-acting pharmacological treatments. Dual GIP/GLP-1 receptor agonists are emerging as a promising class of drugs that offer superior weight reduction and glycemic control compared to earlier monotherapy options

- Furthermore, growing investments in clinical research, favourable regulatory pathways, and strategic collaborations between pharmaceutical companies are accelerating the development and commercialization of Dual GIP/GLP-1 receptor agonist therapies. These converging factors are driving widespread adoption and significantly boosting the growth of the Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs market

Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Analysis

- Dual GIP/GLP-1 receptor agonists, a novel class of anti-obesity drugs, are emerging as a transformative solution in managing obesity and related metabolic disorders due to their dual action on glucose regulation and appetite suppression. These therapies have demonstrated superior efficacy and tolerability over conventional monotherapies, driving increased clinical adoption

- The surging demand for Dual GIP/GLP-1 receptor agonists is largely attributed to the global obesity epidemic, with more than 650 million adults classified as obese. Rising healthcare awareness, patient preference for non-surgical interventions, and robust clinical outcomes are further accelerating market penetration, especially in developed regions

- North America dominated the dual GIP/ GLP-1 receptor agonists obesity drugs market with the largest revenue share of 45.6% in 2024, supported by a high prevalence of obesity, advanced healthcare infrastructure, early adoption of innovative treatments, and the presence of major players such as Eli Lilly and Novo Nordisk. The U.S. alone accounted for over 82% of the regional market, fueled by favorable reimbursement policies and increasing use of combination therapies in chronic disease management

- Asia-Pacific is expected to be the fastest growing region in the dual GIP/ GLP-1 receptor agonists obesity drugs market, driven by growing urbanization, increasing disposable incomes, and rising obesity rates in populous nations such as China, India, and Japan.

- The Tirzepatide-based drugs segment dominated the dual GIP/ GLP-1 receptor agonists obesity drugs market with a market share of 47.8% in 2024, owing to strong clinical results from trials such as SURMOUNT and SURPASS, FDA and EMA approvals, and widespread use in managing both obesity and type 2 diabetes. The drug’s ability to deliver >20% weight loss in clinical trials has made it a game-changer in the obesity treatment space

Report Scope and Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Segmentation

|

Attributes |

Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Trends

“Rising Demand for Intelligent and Personalized Obesity Treatment Solutions”

- A significant and accelerating trend in the global dual GIP/ GLP-1 receptor agonists obesity drugs market is the advancement of precision-based and patient-centric treatment approaches driven by evolving clinical insights and patient demand for individualized care. These therapies are offering transformative weight loss outcomes while minimizing adverse effects, reshaping the treatment paradigm for obesity

- For instance, Eli Lilly’s Mounjaro (tirzepatide), a leading dual GIP/GLP-1 receptor agonist, has demonstrated unprecedented efficacy in reducing body weight and improving glycemic control, outperforming many traditional anti-obesity medications. Similarly, pipeline candidates like retatrutide are being designed to address not only obesity but associated metabolic disorders, supporting a more holistic treatment strategy

- The integration of advanced pharmacological design enables these drugs to act on multiple incretin pathways, resulting in enhanced metabolic benefits, reduced appetite, and improved insulin sensitivity. As a result, companies are focusing on optimizing dosing regimens and delivery mechanisms to further improve adherence and clinical outcomes

- These innovations align with the broader healthcare trend of offering therapies that are tailored to patient-specific biological profiles and lifestyle needs. The combination of superior efficacy and improved patient experience is raising the benchmark for what obesity management should look like in the 21st century

- Consequently, key pharmaceutical players such as Novo Nordisk, Amgen, and Sanofi are expanding their obesity treatment pipelines by developing next-generation dual and triple agonists that may further enhance weight loss while maintaining long-term safety and tolerability

- The demand for highly effective, multifunctional, and patient-friendly anti-obesity drugs is growing rapidly across both developed and emerging markets, driven by rising obesity rates and growing public awareness of its health implications. This trend is expected to significantly drive market growth over the next decade

Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Dynamics

Driver

“Growing Need Due to Rising Obesity Rates and Demand for Effective Therapeutics”

- The increasing global prevalence of obesity and obesity-related comorbidities, such as type 2 diabetes, cardiovascular diseases, and metabolic syndrome, is a significant driver for the heightened demand for Dual GIP/GLP-1 Receptor Agonists in the obesity drugs market

- For instance, in June 2023, Eli Lilly and Company announced promising late-stage clinical trial results for retatrutide, a triple agonist including GIP and GLP-1 pathways, showing greater than 24% weight loss in patients. Such breakthroughs are expected to drive the dual GIP/ GLP-1 receptor agonists obesity drugs industry growth over the forecast period

- As patients and healthcare providers seek more effective, long-lasting, and safer alternatives to traditional weight-loss strategies, dual receptor agonists offer superior efficacy in reducing body weight, managing blood glucose levels, and improving overall metabolic health

- Furthermore, the increasing awareness of the health risks associated with obesity, combined with rising public and private healthcare investments in chronic disease management, is making dual GIP/GLP-1 drugs a key component of future obesity care

- The convenience of once-weekly dosing, fewer side effects compared to older pharmacological agents, and greater weight-loss efficacy compared to GLP-1 monotherapy are critical factors propelling the adoption of these drugs in both primary care and specialist obesity clinics. The growing emphasis on preventative healthcare and personalized medicine further contributes to the expanding use of Dual GIP/GLP-1 Receptor Agonists

Restraint/Challenge

“Concerns Regarding Side Effects and High Treatment Costs”

- Concerns surrounding the side effects and high cost of Dual GIP/GLP-1 receptor agonist therapies pose significant challenges to broader market penetration. Despite their effectiveness, these drugs may lead to gastrointestinal side effects such as nausea, vomiting, and diarrhea, which can impact patient adherence and long-term usage

- For instance, while tirzepatide (Mounjaro) has shown remarkable weight-loss results, some patients report tolerability issues during the early phases of treatment, leading to dropouts or dose adjustments

- Addressing these safety concerns through dose titration strategies, patient education, and post-marketing surveillance is crucial for maintaining user confidence. Moreover, the relatively high cost of these advanced therapies compared to older anti-obesity drugs or lifestyle interventions can be a barrier to adoption, especially in low- and middle-income countries

- While insurers in developed regions like the U.S. are increasingly covering anti-obesity medications, reimbursement remains limited or non-existent in several global markets, which hinders widespread adoption

- Overcoming these challenges through broader reimbursement frameworks, development of cost-effective biosimilars, and greater healthcare provider awareness will be vital for ensuring equitable access and sustained growth of the dual GIP/GLP-1 receptor agonists obesity drug Market

Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Scope

The market is segmented on the basis of drug type, route of administration, indication, distribution channel, and end user.

• By Drug Type

On the basis of drug type, the dual GIP/ GLP-1 receptor agonists obesity drugs market is segmented into semaglutide-based, tirzepatide-based, and others. The tirzepatide-based segment dominated the market with a 47.8% revenue share in 2024, owing to its superior weight loss efficacy and growing global adoption.

The semaglutide-based segment is anticipated to witness the fastest growth rate of 22.9% CAGR from 2025 to 2032, driven by strong clinical performance and expanding regulatory approvals.

• By Route of Administration

On the basis of route of administration, the dual GIP/ GLP-1 receptor agonists obesity drugs market is segmented into subcutaneous, oral, and others. The subcutaneous segment held the largest market share at 72.3% in 2024, supported by the current availability of most approved drugs in injectable format.

The oral segment is expected to register the highest CAGR of 24.1% from 2025 to 2032, owing to increasing patient preference and ongoing clinical development.

• By Indication

On the basis of indication, the dual GIP/ GLP-1 receptor agonists obesity drugs market is segmented into obesity, type 2 diabetes, cardiovascular disorders, and others. The obesity segment accounted for the largest revenue share of 61.4% in 2024, driven by a growing patient base and superior clinical outcomes with dual agonists.

The cardiovascular disorders segment is projected to grow at the highest CAGR of 21.3% from 2025 to 2032, as new data support the cardiometabolic benefits of these therapies.

• By Distribution Channel

On the basis of distribution channel, the dual GIP/ GLP-1 receptor agonists obesity drugs market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and others. The hospital pharmacies segment dominated with a 46.7% market share in 2024, due to the clinical nature of therapy initiation and specialist oversight.

The online pharmacies segment is forecasted to grow at the fastest CAGR of 20.8% from 2025 to 2032, fueled by rising digital adoption and convenience for chronic care patients.

• By End User

On the basis of end user, the dual GIP/ GLP-1 receptor agonists obesity drugs market is segmented into hospitals, specialty clinics, homecare settings, and others. The hospitals segment held the highest share of 49.5% in 2024, driven by the need for clinical monitoring and structured treatment initiation.

The homecare settings segment is anticipated to grow at the fastest CAGR of 23.4% from 2025 to 2032, supported by trends in self-administration, patient autonomy, and decentralized healthcare models.

Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Regional Analysis

- North America dominated the dual GIP/ GLP-1 receptor agonists obesity drugs market with the largest revenue share of 45.6% in 2024, driven by a rising obesity burden, strong healthcare infrastructure, and early adoption of innovative metabolic therapies such as tirzepatide and semaglutide

- Consumers and physicians in the region favor advanced, evidence-backed treatments, leading to high uptake of dual incretin therapies supported by widespread insurance coverage and clinical guideline integration

- Strong R&D pipelines, favorable reimbursement scenarios, and increasing prevalence of obesity-related comorbidities continue to drive growth in both the U.S. and Canada

U.S. Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Insight

The U.S. dual GIP/ GLP-1 receptor agonists obesity drugs market captured the largest revenue share of 79% within North America in 2024, owing to early regulatory approvals, high obesity rates, and robust patient access to novel therapies like Mounjaro (tirzepatide) and Wegovy (semaglutide). The U.S. is also a hub for clinical trials, driving early adoption, while the integration of these treatments into electronic health systems and telehealth platforms enhances prescription adherence and monitoring. Expanding awareness campaigns and employer-based health programs further propel market penetration across various population segments

Europe Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Insight

The Europe dual GIP/ GLP-1 receptor agonists obesity drugs market is projected to expand at a substantial CAGR from 2025 to 2032, driven by an increasing incidence of lifestyle-related diseases and growing awareness of obesity’s long-term impact. Reimbursement expansion across Germany, the U.K., France, and Nordic countries is facilitating access to dual agonist therapies. Stringent treatment protocols, aging populations, and public health initiatives are pushing healthcare systems toward more preventive and weight-centric approaches, accelerating adoption.

U.K. Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Insight

The U.K. dual GIP/ GLP-1 receptor agonists obesity drugs market is anticipated to grow at a noteworthy CAGR of 20.7% from 2025 to 2032, fueled by the NHS’s increasing support for pharmacological weight-loss interventions.The growing prevalence of obesity in both adults and adolescents, combined with clinical endorsement of semaglutide under the NICE guidelines, supports rapid growth. Policy-level focus on reducing obesity-related healthcare costs and expanding digital prescriptions further supports market expansion.

Germany Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Insight

The Germany dual GIP/ GLP-1 receptor agonists obesity drugs market is expected to expand at a considerable CAGR from 2025 to 2032, supported by high healthcare spending, a strong regulatory framework, and growing acceptance of dual incretin therapies in metabolic care. With increasing obesity awareness and integration of pharmacotherapy into wellness and prevention programs, Germany is becoming a key driver of regional growth. Hospitals and specialty clinics are embracing dual agonist therapies as part of comprehensive metabolic and cardiovascular treatment strategies.

Asia-Pacific Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Insight

The Asia-Pacific dual GIP/ GLP-1 receptor agonists obesity drugs market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rising urbanization, improved healthcare access, and growing awareness around weight management. Countries such as China, Japan, and India are seeing rapid growth due to increasing obesity prevalence and the expansion of healthcare programs targeting non-communicable diseases. Government initiatives promoting healthier lifestyles and pharmaceutical innovation are supporting regulatory approvals and access to newer anti-obesity therapies.

Japan Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Insight

The Japan dual GIP/ GLP-1 receptor agonists obesity drugs market is gaining momentum with a projected CAGR from 2025 to 2032, propelled by technological innovation, healthcare digitization, and a strong pharmaceutical R&D culture. Japan’s focus on geriatric health, prevention of diabetes-related complications, and preference for efficient, minimally invasive solutions make dual receptor agonists highly appealing. Growing partnerships between domestic pharma and global biotech companies further support therapeutic rollout.

China Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Insight

The China dual GIP/ GLP-1 receptor agonists obesity drugs market accounted for the largest revenue share in Asia-Pacific in 2024, capturing 38.6% of the regional market, driven by a surging middle class, increased urban lifestyle diseases, and rapid regulatory progress in metabolic therapies. Domestic pharmaceutical companies are accelerating clinical development and commercialization of GLP-1/GIP-based therapies, making China one of the most dynamic and competitive markets globally. The government’s push for healthcare modernization and affordability, along with digital health expansion, is expected to further fuel growth.

Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market Share

The dual GIP/ GLP-1 receptor agonists obesity drugs industry is primarily led by well-established companies, including:

- Lilly (U.S.)

- Novo Nordisk A/S (Denmark)

- Pfizer Inc. (U.S.)

- AstraZeneca plc (U.K.)

- Amgen Inc. (U.S.)

- Sanofi S.A. (France)

- Boehringer Ingelheim International GmbH (Germany)

- Hua Medicine (Shanghai) Co., Ltd. (China)

- Innovent (China)

- Hanmi Pharmaceutical Co., Ltd. (South Korea)

- Structure Therapeutics, Inc. (China/U.S.)

- Zealand Pharma (Denmark)

- Altimmune (U.S.)

- Rani Therapeutics (U.S.)

- PegBio Co. Ltd. (China)

Latest Developments in Global Dual GIP/ GLP-1 Receptor Agonists Obesity Drugs Market

- In April 2024, Eli Lilly and Company received expanded FDA approval for its dual GIP/GLP-1 receptor agonist, tirzepatide (marketed as Mounjaro), for chronic weight management in individuals without type 2 diabetes. This landmark approval significantly broadens the therapeutic scope of the drug, reinforcing Lilly’s leadership position in the metabolic disease treatment space and accelerating its global commercialization strategy for dual agonists

- In March 2024, Novo Nordisk A/S announced the initiation of a global Phase 3 trial for its next-generation dual GIP/GLP-1 receptor agonist targeting obesity and cardiovascular risk reduction. This pipeline advancement follows the success of semaglutide and aligns with the company’s ambition to address unmet needs in obesity and cardiometabolic care through innovative incretin-based therapies

- In February 2024, Amgen Inc. disclosed positive interim results from its Phase 2 study of AMG 133, a novel GIPR/GLP-1R dual agonist. The trial demonstrated substantial weight loss and improved glycemic control, with a favorable safety profile. The development positions Amgen as a strong emerging competitor in the dual agonist obesity treatment landscape

- In January 2024, Structure Therapeutics entered a strategic partnership with Huadong Medicine Co., Ltd. to co-develop and commercialize oral GIP/GLP-1 receptor agonists in the Asia-Pacific region. This collaboration aims to accelerate the development of orally administered therapies, addressing the growing demand for convenient, non-injectable solutions in obesity management

- In December 2023, Zealand Pharma announced the successful completion of preclinical studies for its investigational triple agonist (GLP-1, GIP, and glucagon receptor), demonstrating superior weight loss and metabolic effects compared to dual agonists. The company plans to initiate human trials in 2025, signaling a shift toward multi-targeted peptide therapeutics in the obesity space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.