Global Dump Truck Market

Market Size in USD Billion

CAGR :

%

USD

56.26 Billion

USD

90.35 Billion

2025

2033

USD

56.26 Billion

USD

90.35 Billion

2025

2033

| 2026 –2033 | |

| USD 56.26 Billion | |

| USD 90.35 Billion | |

|

|

|

|

What is the Global Dump Truck Market Size and Growth Rate?

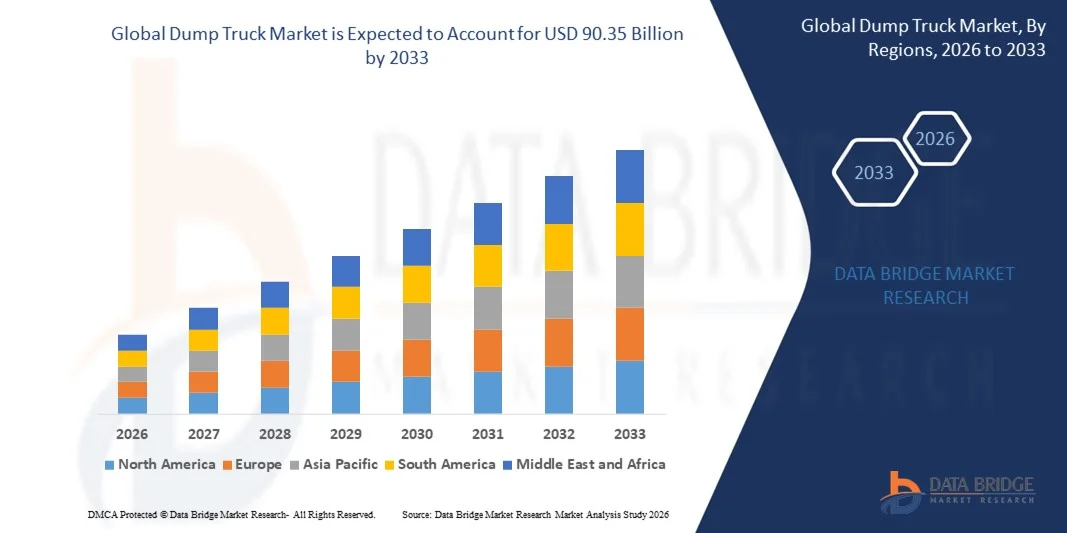

- The global dump truck market size was valued at USD 56.26 billion in 2025 and is expected to reach USD 90.35 billion by 2033, at a CAGR of 6.10% during the forecast period

- The rise in the government funding on substantial infrastructure and technological developments, of the vehicles act as the major factors driving the growth of dump truck market

- The rise in the global mining production due to increased demand for minerals and natural resources and the introduction of energy-efficient vehicles with the purpose of reducing the adverse effects of mining and excavation accelerate the dump truck market growth

What are the Major Takeaways of Dump Truck Market?

- The surge in the Foreign Direct Investment especially in the developing nations, and development of electric dump trucks, that comply with emission regulations, and meet customer requirements further influence the dump truck market

- In addition, rapid urbanization and industrialization, growth of end user industries, research and development activities and surge in investments positively affect the dump truck market

- Furthermore, development of next-generation dump trucks integrating AI and machine learning to enable autonomous operation extend profitable opportunities to the dump truck market players

- Asia-Pacific dominated the dump truck market with the largest revenue share of 32.25% in 2025, driven by rapid infrastructure development, large-scale mining activities, expanding construction projects, and strong industrial growth across China, India, Japan, South Korea, and Southeast Asia

- North America is expected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by modernization of mining operations, rising infrastructure investments, and growing adoption of electric and autonomous dump trucks across the U.S. and Canada

- The Rear Dump Truck segment dominated the market with around 41.6% share in 2025, owing to its widespread use in construction and mining operations for efficient bulk material unloading

Report Scope and Dump Truck Market Segmentation

|

Attributes |

Dump Truck Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Dump Truck Market?

Increasing Shift Toward High-Capacity, Smart, and Digitally Integrated Dump Trucks

- The dump truck market is witnessing strong adoption of high-capacity, fuel-efficient, and technologically advanced dump trucks designed to support mining, construction, and large-scale infrastructure projects

- Manufacturers are increasingly introducing autonomous, electric, and hybrid dump trucks equipped with GPS tracking, telematics, fleet management systems, and real-time performance monitoring to enhance operational efficiency

- Growing demand for cost-efficient, durable, and high-payload vehicles is driving adoption across mining sites, quarrying operations, large construction projects, and infrastructure development activities

- For instance, companies such as Caterpillar, Komatsu, AB Volvo, Liebherr, and BELAZ have launched advanced dump trucks with higher payload capacities, improved fuel efficiency, predictive maintenance systems, and operator-assist technologies

- Increasing need for reduced operational downtime, improved safety, and optimized material handling is accelerating the shift toward digitally enabled and semi-autonomous dump trucks

- As mining and construction operations become more complex and scale-intensive, Dump Trucks will remain critical for high-volume material transportation, productivity optimization, and cost control

What are the Key Drivers of Dump Truck Market?

- Rising demand for large-scale mining, infrastructure development, and urban construction projects is driving the need for high-performance dump trucks worldwide

- For instance, in 2025, leading manufacturers such as Caterpillar, Komatsu, and Liebherr expanded their dump truck portfolios with models offering higher payloads, advanced fuel management, and enhanced safety features

- Growing investments in mining activities, road construction, smart cities, and industrial infrastructure across the U.S., Europe, and Asia-Pacific are boosting market demand

- Advancements in engine efficiency, electric drivetrains, autonomous navigation, and telematics systems have strengthened vehicle performance, reliability, and lifecycle efficiency

- Rising focus on reducing emissions, improving fuel economy, and lowering total cost of ownership is encouraging adoption of electric and hybrid dump trucks

- Supported by sustained investments in construction equipment manufacturing, mining expansion, and infrastructure modernization, the Dump Truck market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Dump Truck Market?

- High acquisition and operating costs associated with heavy-duty dump trucks, including fuel expenses, maintenance, and spare parts, restrict adoption among small contractors and medium-scale mining operators

- For instance, during 2024–2025, fluctuations in steel prices, engine components, tires, and electronic systems increased manufacturing costs, leading to higher vehicle prices across several global dump truck manufacturers

- Stringent emission regulations and compliance requirements increase design complexity and R&D costs, especially for diesel-powered dump trucks, creating challenges for manufacturers in cost-sensitive markets

- Limited infrastructure in emerging economies, including inadequate road networks, charging infrastructure for electric dump trucks, and skilled operators, slows market penetration

- Competition from alternative material-handling equipment, such as conveyors, articulated haulers, and autonomous hauling systems, creates pricing pressure and limits differentiation in certain applications

- To overcome these challenges, manufacturers are focusing on fuel-efficient engines, electrification, modular designs, predictive maintenance technologies, and operator training programs to improve cost efficiency and accelerate global adoption of dump trucks

How is the Dump Truck Market Segmented?

The market is segmented on the basis of type, engine type, engine capacity, and application.

- By Type

On the basis of type, the dump truck market is segmented into Rear Dump Trucks, Side Dump Trucks, Roll-Off Dump Trucks, On-Road Dump Trucks, and Off-Road Dump Trucks. The Rear Dump Truck segment dominated the market with around 41.6% share in 2025, owing to its widespread use in construction and mining operations for efficient bulk material unloading. Rear dump trucks offer high payload capacity, structural simplicity, and lower maintenance costs, making them the preferred choice across infrastructure and quarrying projects.

The Off-Road Dump Truck segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising mining activities, large-scale earthmoving projects, and increasing adoption in high-load, rugged terrains. Growing investments in mining automation and demand for ultra-class haul trucks are further accelerating segment growth.

- By Engine Type

On the basis of engine type, the dump truck market is segmented into Internal Combustion Engine (ICE) and Electric Engine. The Internal Combustion Engine segment dominated the market with nearly 88.2% share in 2025, supported by its high power output, long operating range, and established fueling infrastructure. Diesel-powered dump trucks remain widely used across mining, construction, and infrastructure projects globally.

The Electric Engine segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by stringent emission regulations, rising fuel costs, and increasing adoption of sustainable construction practices. Advancements in battery technology, charging infrastructure, and government incentives are accelerating the deployment of electric dump trucks, particularly in urban construction and mining applications.

- By Engine Capacity

On the basis of engine capacity, the dump truck market is segmented into Below 5L, 5L to 10L, and More Than 10L. The 5L to 10L segment dominated the market with a 46.9% share in 2025, as it balances power, fuel efficiency, and operational flexibility for medium- to heavy-duty construction and infrastructure projects. These engines are widely used in on-road and mid-size off-road dump trucks.

The More Than 10L segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing demand for high-capacity dump trucks in mining, large-scale excavation, and mega infrastructure projects. Rising focus on higher productivity and reduced hauling cycles supports adoption of large-engine dump trucks.

- By Application

On the basis of application, the dump truck market is segmented into Construction, Mining, Infrastructure, Military, Agriculture, and Others. The Construction segment dominated the market with a 38.4% share in 2025, driven by rapid urbanization, road construction, and residential and commercial development worldwide. Dump trucks are essential for transporting sand, gravel, debris, and construction materials efficiently.

The Mining segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for minerals, metals, and energy resources. Expansion of open-pit mining, increased use of autonomous haulage systems, and investments in mining equipment modernization are significantly driving dump truck adoption in this segment.

Which Region Holds the Largest Share of the Dump Truck Market?

- Asia-Pacific dominated the dump truck market with the largest revenue share of 32.25% in 2025, driven by rapid infrastructure development, large-scale mining activities, expanding construction projects, and strong industrial growth across China, India, Japan, South Korea, and Southeast Asia. High demand for dump trucks in road construction, urban development, mining operations, and quarrying continues to support market leadership

- Leading manufacturers in Asia-Pacific are focusing on high-capacity, fuel-efficient, and technologically advanced dump trucks, including electric and autonomous models, to meet rising productivity and sustainability requirements. Strong government spending on infrastructure and mining further accelerates market expansion

- Availability of low-cost manufacturing, skilled labor, and extensive construction activity reinforces the region’s dominance in the global dump truck market

China Dump Truck Market Insight

China is the largest contributor in Asia-Pacific, supported by massive investments in infrastructure, mining, and industrial projects. Strong domestic manufacturing capacity and government-backed development programs drive high demand for both on-road and off-road dump trucks.

India Dump Truck Market Insight

India is witnessing robust growth due to increasing road construction, mining expansion, and smart city initiatives. Rising demand for cost-effective and high-payload dump trucks supports market growth.

North America Dump Truck Market – Fastest Growing Region

North America is expected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by modernization of mining operations, rising infrastructure investments, and growing adoption of electric and autonomous dump trucks across the U.S. and Canada.

U.S. Dump Truck Market Insight

The U.S. leads regional growth with strong demand from mining, construction, and infrastructure rehabilitation projects, supported by advanced fleet management and automation technologies.

Canada Dump Truck Market Insight

Canada contributes steadily due to extensive mining operations, infrastructure upgrades, and rising adoption of high-capacity off-road dump trucks.

Which are the Top Companies in Dump Truck Market?

The dump truck industry is primarily led by well-established companies, including:

- Caterpillar Inc. (U.S.)

- Deere & Company (U.S.)

- AB Volvo (Sweden)

- Komatsu Ltd. (Japan)

- Liebherr Group (Switzerland)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Kubota-Gear (Japan)

- J C Bamford Excavators Ltd. (U.K.)

- Rogers Dump Bodies (U.S.)

- BAS Mining Trucks (Netherlands)

- OJSC BELAZ (Belarus)

- Cummins Inc. (U.S.)

- Komatsu Europe International N.V. (Belgium)

- Terex Equipment P. Ltd. (India)

- Volkswagen (Germany)

- DUX Machinery Corporation (Canada)

- AdvanceQuip (U.S.)

- Navistar, Inc. (U.S.)

- Mack Trucks (U.S.)

- KrAZ (Ukraine)

- Peterbilt (U.S.)

What are the Recent Developments in Global Dump Truck Market?

- In April 2025, SANY India launched India’s first locally manufactured hybrid mining dump truck, the SKT130S, a 100-ton hybrid model, at its Chakan, Pune facility in Maharashtra. Designed to support India’s self-reliance and next-generation mining technology goals, the launch reflects the country’s push toward sustainable and advanced mining equipment adoption

- In February 2025, Komatsu announced the commencement of proof-of-concept testing for its HD785 rigid-frame dump truck powered by a hydrogen combustion engine at its Ibaraki Plant in Japan. As the world’s first large dump truck using hydrogen combustion technology, this milestone underlines Komatsu’s commitment to low-carbon heavy mining solutions

- In August 2024, Vale revealed plans to modernize its mining dump truck fleet in collaboration with Komatsu and Cummins, using a dual-fuel system based on ethanol and diesel. Claimed to be the world’s first 230–290-ton payload truck using ethanol in its fuel mix, the initiative supports Vale’s long-term decarbonization strategy

- In July 2024, Vale partnered with Komatsu and Cummins to develop large mining trucks with payload capacities ranging from 230 to 290 tons, powered by a combination of ethanol and diesel. The Dual Fuel project aligns with Vale’s objective to significantly reduce Scope 1 and Scope 2 carbon emissions across its mining operations

- In June 2024, XCMG Machinery introduced the EHSL552F hydrogen fuel cell dump truck, featuring a high-power battery system and a 120 kW hydrogen fuel cell. This innovation is expected to help mining operators substantially cut daily carbon emissions and advance clean-energy adoption in heavy equipment fleets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.