Global Dunnage Tray Market

Market Size in USD Billion

CAGR :

%

USD

2.16 Billion

USD

3.09 Billion

2025

2033

USD

2.16 Billion

USD

3.09 Billion

2025

2033

| 2026 –2033 | |

| USD 2.16 Billion | |

| USD 3.09 Billion | |

|

|

|

|

What is the Global Dunnage Tray Market Size and Growth Rate?

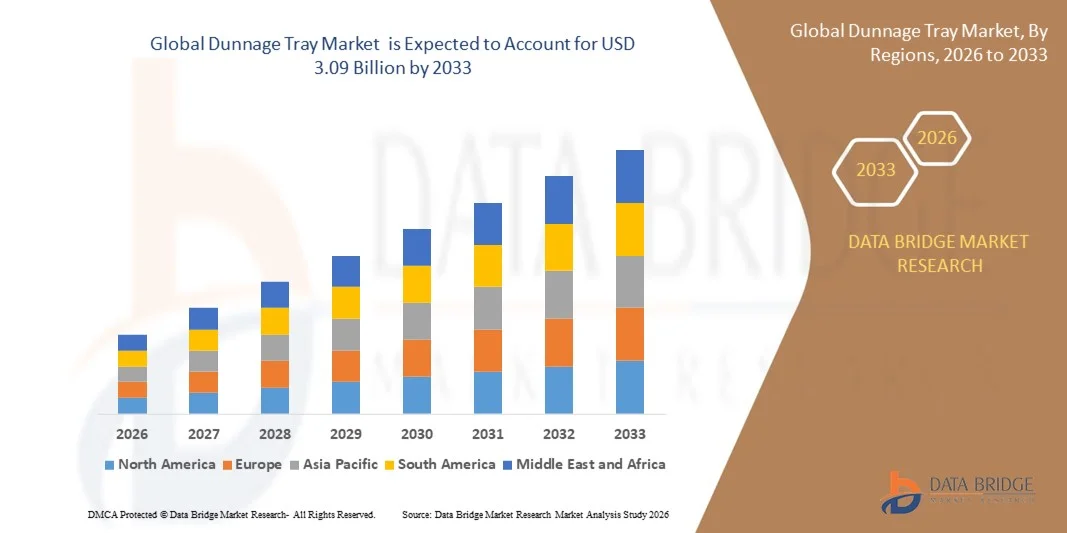

- The global dunnage tray market size was valued at USD 2.16 billion in 2025 and is expected to reach USD 3.09 billion by 2033, at a CAGR of4.56% during the forecast period

- The main use of dunnage tray is to protect the goods from any damage they are expected to receive though moving from factories to warehouses to endpoint consumers. During the transits, goods are loaded onto trucks or sorted, trains, stacked, etc., so there are maximum chances of them getting damaged

- Dunnage trays limit these damages by absorbing the shocks, keeping the goods moisture-free, and ensuring their place intact while transported. The high demand of dunnage trays during transportation is the major factor expected to drive the market growth rate

What are the Major Takeaways of Dunnage Tray Market?

- Dunnage trays are very suitable for automated handling as a matter of fact. The robots mainly use Dunnage in the process. Increasing application of robotic technology in manufacturing industries, especially in the automotive industry has been a dynamic factor for sales of customized dunnage trays, because robots replace the assembly line

- The flourishing demand of electric vehicle (EV) market is expected to contribute substantially to the growth of the dunnage trays market in the forecast period

- North America dominated the dunnage tray market with a 41.02% revenue share in 2025, driven by high adoption of reusable, lightweight, and durable trays across automotive, electronics, healthcare, and industrial supply chains in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.41% from 2026 to 2033, fueled by rising industrial production, expanding automotive and electronics manufacturing, and increasing demand for durable, reusable, and lightweight dunnage trays across China, India, Japan, South Korea, and Southeast Asia

- The Polypropylene (PP) segment dominated the market with an estimated 38–40% share in 2025, owing to its excellent balance of durability, chemical resistance, lightweight nature, and cost-effectiveness

Report Scope and Dunnage Tray Market Segmentation

|

Attributes |

Dunnage Tray Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Dunnage Tray Market?

Increasing Shift Toward Customized, Reusable, and Lightweight Dunnage Tray Solutions

- The dunnage tray market is witnessing strong adoption of custom-designed and application-specific trays to ensure safe handling and transportation of components

- Manufacturers are increasingly offering lightweight, durable, and reusable plastic dunnage trays to reduce logistics costs and improve operational efficiency

- Growing demand for returnable packaging solutions across automotive, electronics, and industrial supply chains is driving widespread adoption

- For instance, companies such as Dunnage Engineering, Great River Plastics, Sohner Plastics, and BMG are expanding customized tray designs with enhanced load-bearing strength and component protection

- Rising focus on automation-compatible trays for robotic handling and warehouse automation is accelerating market growth

- As supply chains become more efficiency-driven and sustainability-focused, dunnage trays remain critical for product protection, cost reduction, and process optimization

What are the Key Drivers of Dunnage Tray Market?

- Rising demand for safe, damage-free transportation of high-value and precision components

- For instance, in 2024–2025, several manufacturers expanded reusable and recyclable dunnage tray portfolios to support automotive and electronics logistics

- Growing adoption of just-in-time manufacturing and lean supply chain practices is boosting demand for standardized dunnage solutions

- Advancements in thermoforming, injection molding, and material engineering have improved tray durability and design flexibility

- Increasing use of dunnage trays in automotive parts, EV components, electronics assemblies, and industrial equipment

- Supported by rising focus on sustainable packaging and cost-efficient logistics, the Dunnage Tray market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Dunnage Tray Market?

- High initial tooling and customization costs associated with tailored dunnage tray designs limit adoption among small manufacturers

- For instance, during 2024–2025, raw material price volatility and polymer supply disruptions increased manufacturing costs

- Design complexity and long development cycles for highly customized trays slow time-to-market

- Limited awareness among SMEs regarding returnable packaging benefits and lifecycle cost savings restricts adoption

- Competition from corrugated packaging, foam inserts, and alternative protective packaging solutions creates pricing pressure

- To address these challenges, companies are focusing on modular tray designs, recyclable materials, and cost-optimized manufacturing processes to increase global adoption of dunnage trays

How is the Dunnage Tray Market Segmented?

The market is segmented on the basis of material, application, and end user.

- By Material

On the basis of material, the dunnage tray market is segmented into Polystyrene, Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polypropylene (PP), High-Density Polyethylene (HDPE), High Molecular Weight Polyethylene (HMWPE), Acrylonitrile Butadiene Styrene (ABS), and Thermoplastic Polyurethanes (TPU). The Polypropylene (PP) segment dominated the market with an estimated 38–40% share in 2025, owing to its excellent balance of durability, chemical resistance, lightweight nature, and cost-effectiveness. PP trays are widely used across automotive, electronics, and industrial supply chains due to their compatibility with automated handling systems and ability to withstand repeated use.

The HMWPE segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for high-strength, impact-resistant trays in heavy-duty applications such as automotive components, precision electronics, and industrial logistics. Increasing adoption of reusable and returnable packaging solutions further accelerates demand for HMWPE trays.

- By Application

On the basis of application, the dunnage tray market is segmented into Shipping Trays, In-Process Trays, Automation Trays, Wash Cycle Trays, Food Sterilization, Assembly Trays, and Others. The Shipping Trays segment held the largest share at approximately 42% in 2025, supported by the need to protect components during transportation, reduce product damage, and enable safe handling across logistics and supply chain operations. These trays are widely adopted in automotive parts, electronics, and industrial machinery shipments.

The Automation Trays segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by the rising integration of robotic handling and automated storage systems in modern warehouses and manufacturing plants. Increasing emphasis on operational efficiency, precision handling, and labor cost reduction is boosting demand for automation-compatible dunnage trays.

- By End User

On the basis of end user, the dunnage tray market is segmented into Automotive Industry, Electronics Industry, Healthcare Industry, Retail, Food and Beverage Industry, Shipping and Logistics Industry, Cosmetics Industry, and Others. The Automotive Industry segment dominated the market with an estimated 36–38% share in 2025, driven by extensive use of dunnage trays for engine components, EV batteries, transmission parts, and precision assemblies. High-volume production, stringent quality requirements, and adoption of reusable trays contribute to strong deployment.

The Electronics Industry segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for component protection, anti-static properties, and automation-compatible trays in PCB manufacturing, semiconductor handling, and assembly lines. Increasing electronics production and global supply chain expansion are key growth drivers for this segment.

Which Region Holds the Largest Share of the Dunnage Tray Market?

- North America dominated the dunnage tray market with a 41.02% revenue share in 2025, driven by high adoption of reusable, lightweight, and durable trays across automotive, electronics, healthcare, and industrial supply chains in the U.S. and Canada. Strong manufacturing infrastructure, advanced logistics systems, and widespread mechanization of warehouses and production lines continue to fuel demand for dunnage trays

- Leading companies in North America are expanding customized, returnable, and automation-compatible dunnage tray portfolios, enhancing operational efficiency and sustainability. Continuous investment in precision manufacturing, supply chain optimization, and sustainable packaging solutions supports long-term regional growth

- Robust distribution networks, high agricultural and industrial output, and strong regulatory standards reinforce North America’s market leadership

U.S. Dunnage Tray Market Insight

The U.S. is the largest contributor in North America, supported by extensive use of dunnage trays in automotive parts, EV components, electronics assemblies, and industrial manufacturing. Strong focus on reusable packaging, labor efficiency, and supply chain cost reduction drives growth.

Canada Dunnage Tray Market Insight

Canada contributes steadily, driven by adoption of reusable trays in automotive and electronics supply chains, and growing industrial automation. Government initiatives supporting modern logistics and manufacturing practices further strengthen adoption.

Asia-Pacific Dunnage Tray Market

Asia-Pacific is projected to register the fastest CAGR of 7.41% from 2026 to 2033, fueled by rising industrial production, expanding automotive and electronics manufacturing, and increasing demand for durable, reusable, and lightweight dunnage trays across China, India, Japan, South Korea, and Southeast Asia. Rapid growth in industrial supply chains, automation adoption, and sustainable packaging initiatives is accelerating market expansion.

China Dunnage Tray Market Insight

China leads the region due to large-scale electronics, automotive, and industrial manufacturing, rising demand for high-strength and reusable trays, and strong government support for modern supply chain practices.

India Dunnage Tray Market Insight

India is emerging as a growth hub, driven by increasing industrial and automotive production, startup-led manufacturing, and government-backed initiatives promoting efficient supply chains.

Japan & South Korea Dunnage Tray Market Insight

Japan and South Korea show steady growth, supported by precision manufacturing, automation integration, and increasing adoption of high-quality, reusable, and durable dunnage trays for industrial and automotive applications.

Which are the Top Companies in Dunnage Tray Market?

The dunnage tray industry is primarily led by well-established companies, including:

- Dunnage Engineering (U.S.)

- BMG (U.S.)

- sohnerplastics (U.S.)

- Great River Plastics, LLC (U.S.)

- Electro-General Plastics Corp (U.S.)

- Innovative Plastech (U.S.)

- Engineered Components & Packaging, LLC (U.S.)

- Waveform Plastics (Canada)

- South-Pak, Inc. (U.S.)

- Bardes Plastics, Inc. (U.S.)

- DS Smith (U.K.)

- Sonoco Products Company (U.S.)

- Menasha Corporation (U.S.)

- Schaefer Systems International Pvt Ltd (India)

- Sinclair & Rush, Inc. (U.S.)

- Rohrer Corporation (U.S.)

- Dordan Manufacturing Company (U.S.)

- PolyFlex Pro (U.S.)

What are the Recent Developments in Global Dunnage Tray Market?

- In March 2024, Allpack declared the launch of innovative dunnage bag solutions with the introduction of the contain-A-Pac brand, which is designed to transform the shipping and logistics industry and expand its cargo protection product range, strengthening the company’s position in protective packaging solutions

- In July 2023, Nefab announced the opening of a new manufacturing facility in Mexico, enhancing its production capabilities and improving service to North American customers while producing wood, plywood crating, thermoformed, and corrugated packaging solutions, ultimately improving operational efficiency and reducing lead times to meet rising market demand

- In May 2023, Orbis Corporation introduced a new heavy-duty BulkPak container measuring 48x45 inches, engineered to improve bulk handling and storage efficiency across multiple industries, offering a durable solution that optimizes space, reduces costs, and strengthens logistics operations

- In February 2023, SSI SCHAEFER Packaging launched a threadless dunnage product line, which saves material and reduces handling costs for customers requiring parts protection, providing a reliable solution especially for automotive products that need high surface protection, thereby enhancing operational efficiency

- In May 2021, ORBIS Corporation expanded its reusable packaging portfolio by adding a new material, PolySilk, to its ORBIShield production line, designed to protect automotive parts during transit, assembly, and storage, further solidifying its expertise in custom protective dunnage solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dunnage Tray Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dunnage Tray Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dunnage Tray Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.