Global Dye Sensitized Solar Cell Dssc Market

Market Size in USD Million

CAGR :

%

USD

128.96 Million

USD

333.95 Million

2024

2032

USD

128.96 Million

USD

333.95 Million

2024

2032

| 2025 –2032 | |

| USD 128.96 Million | |

| USD 333.95 Million | |

|

|

|

|

What is the Global Dye-Sensitized Solar Cell (Dssc) Market Size and Growth Rate?

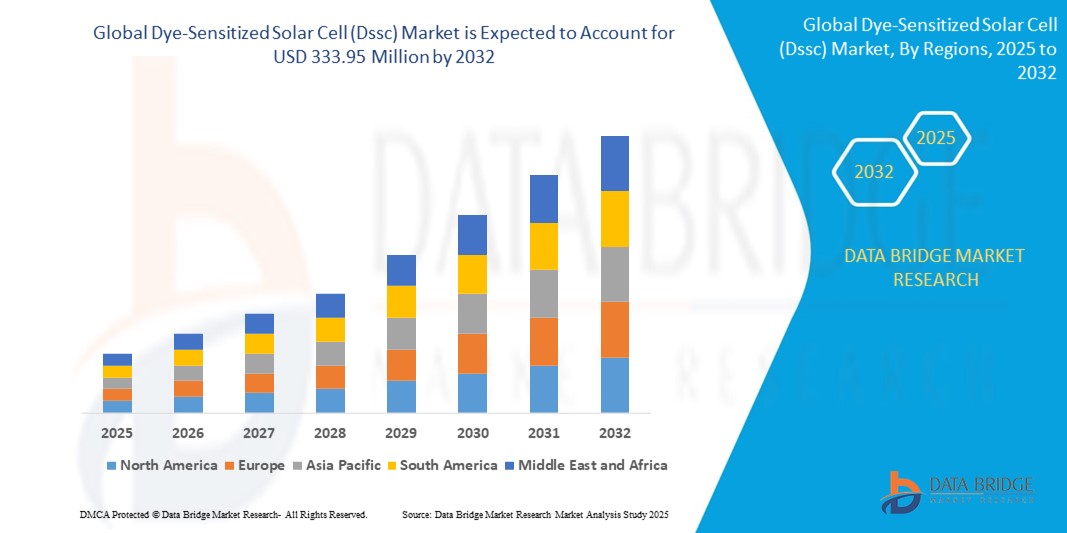

- The global dye-sensitized solar cell (Dssc) market size was valued at USD 128.96 million in 2024 and is expected to reach USD 333.95 million by 2032, at a CAGR of 12.63% during the forecast period

- Dye sensitized solar cells (Dssc) and photovoltaic cells are considered the third generation of solar technologies offering added functionality at lower cost. This technology is being highly deployed throughout the world due to the rise in awareness among consumers regarding adverse environmental impacts of fossil fuels

What are the Major Takeaways of Dye-Sensitized Solar Cell (Dssc) Market?

- The rise in awareness among buyers regarding adverse environmental impacts of non-renewable source-based power acts as one of the major factors driving the dye-sensitized solar cell (Dssc) market. Also, increase in the dependence on unconventional sources of energy has a positive impact on the market

- Europe dominated the dye-sensitized solar cell (DSSC) market with the largest revenue share of 38.4% in 2024, driven by a strong focus on renewable energy policies and advancements in sustainable building technologies

- Asia-Pacific is projected to grow at the fastest CAGR of 14.1% from 2025 to 2032, propelled by rapid urbanization, government support for solar adoption, and expanding electronics and construction industries

- The synthetic dye sensitizers segment held the largest market revenue share of 33.56% in 2024, attributed to their higher photochemical stability, broader light absorption spectrum, and enhanced energy conversion efficiency

Report Scope and Dye-Sensitized Solar Cell (Dssc) Market Segmentation

|

Attributes |

Dye-Sensitized Solar Cell (Dssc) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Dye-Sensitized Solar Cell (Dssc) Market?

“Rising Efficiency and Aesthetic Integration in Building-Integrated Photovoltaics (BIPV)”

- A major trend reshaping the global DSSC market is the growing focus on architectural integration and energy harvesting efficiency, particularly in Building-Integrated Photovoltaics (BIPV) applications. DSSCs are being incorporated into windows, facades, and skylights due to their semi-transparency, tunable color, and flexibility

- For instance, companies such as Exeger and Oxford PV are pushing the boundaries by developing DSSC modules that double as energy-generating surfaces without compromising aesthetics. This is especially appealing for green buildings and urban infrastructure

- The lightweight and low-light operability of DSSCs make them ideal for indoor and shaded environments, which expands their usability beyond traditional solar setups. This includes integration into consumer electronics, wearables, and IoT sensors

- Technological advancements are enabling DSSCs to generate power even in diffused lighting conditions, making them suitable for indoor and off-grid applications. Recent product innovations have demonstrated how DSSCs can maintain decent output in varied lighting environments

- Companies such as 3GSolar and Greatcell Solar are investing in next-generation DSSC modules with improved photoelectrodes and electrolytes to increase conversion efficiency and stability under diverse environmental conditions

- As sustainability becomes a top priority globally, the ability to combine functionality with design is cementing DSSCs’ position in both residential and commercial solar adoption. This trend is expected to dominate the market in coming years as eco-friendly infrastructure gains momentum

What are the Key Drivers of Dye-Sensitized Solar Cell (Dssc) Maret?

- The rising demand for sustainable and aesthetically integrated renewable energy solutions is a major driver for DSSCs. Their unique ability to function under low and indoor light makes them ideal for next-gen energy-harvesting applications

- For instance, in January 2024, Sony Corporation announced it would integrate DSSC modules into its sensor-based IoT devices for energy-autonomous operation, highlighting the growing industrial appeal of this technology

- Growing interest in off-grid and portable solar solutions is pushing DSSC development for consumer electronics, especially wearables, smartwatches, and wireless sensors where size, weight, and power requirements limit traditional solar adoption

- The expanding BIPV segment is boosting DSSC demand in commercial, residential, and public infrastructure projects, where aesthetics, transparency, and energy efficiency intersect. Government incentives and green building certifications further support this growth

- In addition, the shift toward miniaturized energy harvesting for IoT and smart city solutions is opening new market avenues. DSSCs can be seamlessly embedded into urban furniture, transit systems, and low-energy signage to provide self-sufficient power sources

Which Factor is Challenging the Growth of the Dye-Sensitized Solar Cell (Dssc) Market?

- One of the core challenges limiting widespread DSSC adoption is its comparatively lower power conversion efficiency and long-term durability issues under harsh outdoor conditions when compared to silicon-based solar cells

- For instance, several studies have highlighted how electrolyte leakage and photoanode degradation can reduce DSSC performance over time, especially under fluctuating temperature and UV exposure. This raises concerns about product lifespan in large-scale deployments

- High-performance silicon solar cells still dominate due to their cost-effectiveness and proven reliability, making it harder for DSSCs to compete in mainstream energy markets. DSSCs often remain a niche technology unless tailored to specific design or lighting conditions

- In addition, production scalability and commercialization of DSSCs are hampered by the availability of key materials (such as ruthenium-based dyes and iodide electrolytes), which can be expensive or environmentally sensitive

- To overcome these hurdles, manufacturers must focus on developing solid-state DSSCs, adopting non-toxic dyes, and improving sealing techniques to enhance the durability and efficiency of the cells. Efforts to simplify the manufacturing process and reduce costs are also essential

- Addressing these issues through innovative material science and strategic collaborations will be critical to unlocking DSSCs’ full potential in the evolving renewable energy ecosystem

How is the Dye-Sensitized Solar Cell (Dssc) Market Segmented?

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the dye-sensitized solar cell (DSSC) market is segmented into natural dye sensitizers and synthetic dye sensitizers. The synthetic dye sensitizers segment held the largest market revenue share of 33.56% in 2024, attributed to their higher photochemical stability, broader light absorption spectrum, and enhanced energy conversion efficiency. These features make synthetic dyes more suitable for commercial DSSC applications where long-term performance is critical. In addition, their compatibility with modern fabrication techniques supports scalability in mass production.

The natural dye sensitizers segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing interest in eco-friendly, biodegradable alternatives. Derived from plant sources such as anthocyanins and chlorophyll, natural dyes offer a low-cost and sustainable solution, especially in academic research and small-scale solar projects. As sustainability becomes a key focus globally, investments in improving the stability and efficiency of natural dye-based DSSCs are gaining momentum.

• By Application

On the basis of application, the dye-sensitized solar cell (DSSC) market is segmented into portable charging, building-integrated photovoltaics (BIPVs), building-applied photovoltaics (BAPVs), embedded electronics, outdoor advertising, solar chargers, wireless keyboards, emergency power in military, and automotive-integrated photovoltaics (AIPVs). The building-integrated photovoltaics (BIPVs) segment dominated the market in 2024with the largest market share of 38.89% due to DSSCs' unique ability to blend with architectural aesthetics while delivering clean energy. Their semi-transparency and flexibility make them ideal for windows, facades, and skylights in sustainable building projects. Governments promoting net-zero buildings and green infrastructure further accelerate this segment's adoption.

The embedded electronics segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the rising demand for self-powered IoT devices, smart sensors, and portable consumer electronics. DSSCs are increasingly being integrated into compact, low-energy applications such as wireless keyboards, environmental sensors, and wearables due to their excellent indoor and low-light energy harvesting capabilities.

Which Region Holds the Largest Share of the Dye-Sensitized Solar Cell (Dssc) Maret?

- Europe dominated the dye-sensitized solar cell (DSSC) market with the largest revenue share of 38.4% in 2024, driven by a strong focus on renewable energy policies and advancements in sustainable building technologies

- European nations have shown early adoption of innovative photovoltaic technologies, supported by robust government subsidies and environmental regulations promoting clean energy

- The region’s emphasis on building-integrated photovoltaics (BIPVs) and its leadership in green architecture has significantly boosted the deployment of DSSCs. In addition, ongoing R&D investments and collaborations between academia and industry continue to enhance DSSC efficiency, solidifying Europe’s position as the market leader

Germany Dye-Sensitized Solar Cell (DSSC) Market Insight

Germany captured the largest revenue share within Europe in 2024, attributed to its ambitious Energiewende (energy transition) goals and the growing incorporation of solar technologies in residential and commercial buildings. The integration of DSSCs in smart windows, façades, and green buildings is gaining momentum, further supported by government incentives and strong consumer demand for eco-friendly energy solutions.

France Dye-Sensitized Solar Cell (DSSC) Market Insight

The France DSSC market is witnessing strong growth, driven by national commitments to carbon neutrality and the expansion of renewable infrastructure. DSSCs are increasingly being used in urban sustainability projects, such as solar façades and aesthetically integrated systems in public and commercial structures. The market benefits from supportive regulations and strategic public-private partnerships.

Italy Dye-Sensitized Solar Cell (DSSC) Market Insight

Italy's DSSC market is growing steadily due to its favorable solar climate, government incentives for building retrofitting, and consumer interest in energy-efficient design. The use of DSSCs in historical building renovations, where conventional panels are unsuitable, is a key growth driver. The market also benefits from Italy's active role in EU-funded photovoltaic R&D initiatives.

Which Region is the Fastest Growing in the Dye-Sensitized Solar Cell (DSSC) Market?

Asia-Pacific is projected to grow at the fastest CAGR of 14.1% from 2025 to 2032, propelled by rapid urbanization, government support for solar adoption, and expanding electronics and construction industries. The region’s growing middle class and environmental awareness are fueling demand for lightweight, flexible, and aesthetically appealing solar technologies, including DSSCs. The proliferation of smart cities, rising investment in clean energy manufacturing, and integration of DSSCs in consumer electronics and automotive applications further position Asia-Pacific as a major growth hub.

China Dye-Sensitized Solar Cell (DSSC) Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, supported by its vast renewable energy infrastructure, favorable government policies, and local manufacturing capabilities. DSSCs are being deployed across urban housing, advertising panels, and automotive applications, driven by domestic innovation and affordability.

Japan Dye-Sensitized Solar Cell (DSSC) Market Insight

Japan’s DSSC market is expanding due to the nation’s commitment to high-tech innovation, space-efficient renewable solutions, and a preference for low-light photovoltaics suitable for indoor environments. DSSCs are gaining traction in embedded electronics, portable chargers, and urban infrastructure as Japan continues its focus on energy-efficient and user-friendly technologies.

India Dye-Sensitized Solar Cell (DSSC) Market Insight

India is emerging as a promising DSSC market, driven by initiatives such as ‘Make in India’ and national solar energy goals. The growing need for off-grid solar solutions and demand for cost-effective, flexible photovoltaic options make DSSCs ideal for rural electrification and smart device integration. Increasing R&D collaboration and pilot projects are enhancing market visibility.

Which are the Top Companies in Dye-Sensitized Solar Cell (Dssc) Market?

The dye-sensitized solar cell (Dssc) industry is primarily led by well-established companies, including:

- 3GSolar. (Jerusalem)

- Greatcell Solar (Australia)

- Exeger Operations AB (Sweden)

- Fujikura Europe Ltd. (U.K.)

- G24 Power Ltd. (U.K.)

- Konica Minolta Sensing Europe B.V. (Netherlands)

- Merck KGaA (Germany)

- Oxford PV (U.K.)

- Peccell Technologies, Inc. (Japan)

- Sharp Corporation (Japan)

- Solaronix SA (Switzerland)

- Sony Corporation (Japan)

- Ricoh (Japan)

- National Institute for Materials Science (NIMS) (Japan)

What are the Recent Developments in Global Dye-Sensitized Solar Cell (Dssc) Market?

- In November 2024, Coatema Coating Machinery, a renowned provider of manufacturing equipment, launched a new product range tailored for perovskite, flexible organic, and dye-sensitized solar cell technologies, aiming to advance innovation in solar energy manufacturing. This strategic launch reinforces Coatema’s commitment to supporting next-generation photovoltaic solutions

- In October 2024, Jakson Solar Modules and Cells, a division of the Jakson Group, unveiled its Helia NXT R series of n-type bifacial solar modules during the Renewable Energy India (REI) Expo held at India Expo Mart, Greater Noida, Uttar Pradesh. This introduction marks a significant step in expanding Jakson’s high-efficiency solar product portfolio

- In September 2024, Worksport Ltd., a U.S.-based leader in clean and hybrid energy solutions for trucks and consumer goods, announced a major update to its nano-grid system, rebranding it as "SOLIS & COR" to enhance energy accessibility and resilience. This development reflects Worksport’s growing focus on off-grid and mobile power innovations

- In September 2024, EcoFlow introduced the River 3 and River 3 Plus portable power stations, successors to the River 2 series, featuring compact Gallium Nitride technology with a 245Wh capacity, dimensions of 10 x 8.1 x 4.4 inches, and a weight of 7.7 pounds. This launch strengthens EcoFlow’s portfolio of portable, high-efficiency clean energy products

- In September 2023, Exeger entered into an exclusive partnership with a major computer peripherals company, becoming the sole supplier of its Powerfoyle solar cells to improve product sustainability and reliability. This collaboration signifies Exeger’s leadership in integrating advanced solar solutions into everyday electronics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dye Sensitized Solar Cell Dssc Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dye Sensitized Solar Cell Dssc Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dye Sensitized Solar Cell Dssc Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.