Global E Access Metro Ethernet Services Market

Market Size in USD Billion

CAGR :

%

USD

43.20 Billion

USD

120.23 Billion

2024

2032

USD

43.20 Billion

USD

120.23 Billion

2024

2032

| 2025 –2032 | |

| USD 43.20 Billion | |

| USD 120.23 Billion | |

|

|

|

|

E-Access Metro Ethernet Services Market Size

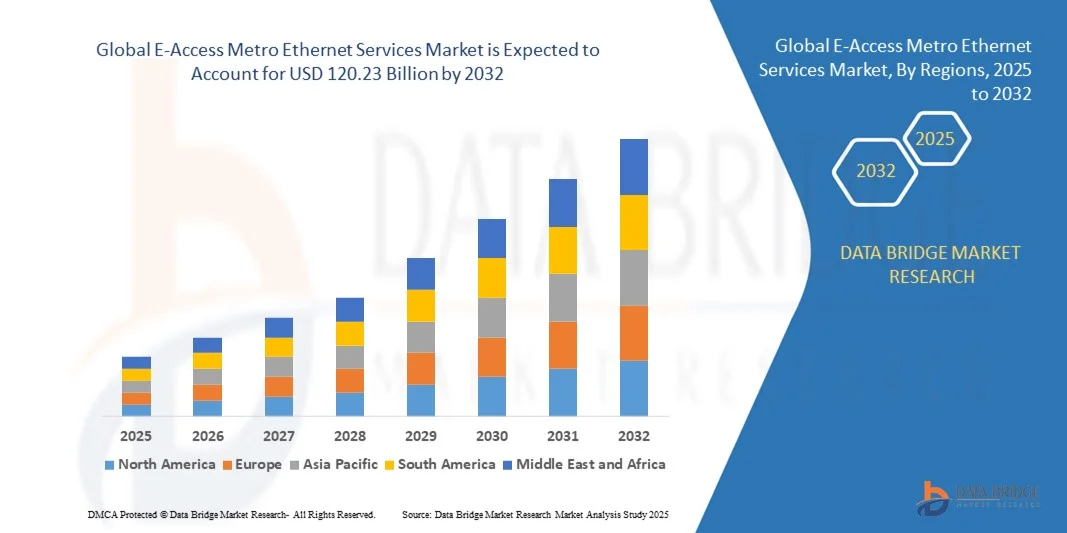

- The global E-access metro ethernet services market size was valued at USD 43.2 billion in 2024 and is expected to reach USD 120.23 billion by 2032, at a CAGR of 4.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-speed connectivity, cloud adoption, and enterprise digital transformation initiatives

- The rising need for secure, scalable, and low-latency network solutions across industries such as IT, BFSI, healthcare, and manufacturing is further supporting market expansion

E-Access Metro Ethernet Services Market Analysis

- The adoption of metro ethernet services is being accelerated by enterprises seeking reliable connectivity, bandwidth scalability, and enhanced network performance

- Service providers are increasingly offering flexible, managed, and dedicated metro ethernet solutions to meet diverse business requirements, improving operational efficiency and reducing network downtime

- North America dominated the E-Access Metro Ethernet Services market with the largest revenue share in 2024, driven by the growing adoption of high-speed enterprise connectivity, cloud computing, and data center interconnectivity

- Asia-Pacific region is expected to witness the highest growth rate in the global E-access metro ethernet services market, driven by rising urbanization, government initiatives for smart cities, and growing demand for high-bandwidth connectivity across industries

- The Retail/Enterprise segment held the largest market revenue share in 2024 driven by the growing adoption of dedicated metro ethernet connections among businesses, data centers, and IT service providers. These services offer reliable, high-speed connectivity with enhanced SLA guarantees, making them a preferred choice for enterprises requiring consistent bandwidth and low-latency connections

Report Scope and E-Access Metro Ethernet Services Market Segmentation

|

Attributes |

E-Access Metro Ethernet Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

E-Access Metro Ethernet Services Market Trends

Increasing Adoption of High-Speed Connectivity Solutions for Enterprises

- The growing demand for high-speed, reliable, and scalable metro ethernet services is transforming enterprise networking by enabling seamless data transfer, cloud access, and business-critical application support. These services allow organizations to optimize bandwidth utilization, improve operational efficiency, and support remote or hybrid work models. Enterprises benefit from improved collaboration, reduced downtime, and better overall network performance

- The rising adoption of cloud computing, virtualization, and data center interconnectivity is accelerating the deployment of metro ethernet solutions. Enterprises benefit from reduced latency, enhanced disaster recovery capabilities, and simplified network management. This trend also supports emerging technologies such as AI, big data analytics, and IoT integration, enabling real-time decision-making

- Service providers are increasingly offering managed and flexible metro ethernet solutions, catering to the dynamic needs of businesses such as bandwidth scalability, secure connections, and dedicated support. This trend is further supported by governments and regulatory initiatives promoting digital infrastructure, smart city deployment, and enterprise-grade security compliance. Enhanced SLA guarantees are boosting customer confidence and adoption

- For instance, in 2023, several multinational corporations in Europe and North America upgraded to high-capacity metro ethernet services to support hybrid work models and cloud adoption, resulting in improved connectivity, operational agility, and optimized IT resource allocation. The move also enabled seamless integration with multi-cloud environments and virtualized applications

- While metro ethernet services are enhancing enterprise network performance and scalability, their impact depends on continued technological innovation, service reliability, and cost-effectiveness. Providers must focus on flexible solutions, end-to-end service management, and geographic coverage to fully capitalize on the growing demand, while maintaining high levels of customer satisfaction and security

E-Access Metro Ethernet Services Market Dynamics

Driver

Increasing Demand for High-Bandwidth and Low-Latency Network Connectivity

- The rise in cloud-based applications, IoT deployments, and real-time data analytics is pushing enterprises to adopt metro ethernet services that offer high-bandwidth and low-latency connections. This leads to improved operational efficiency, enhanced user experience, and business continuity. Businesses can run multiple high-data applications simultaneously without network congestion or downtime

- Businesses are increasingly aware of the advantages of metro ethernet, including scalable bandwidth, secure connectivity, and simplified network management. This awareness is driving adoption across sectors such as IT, BFSI, healthcare, and manufacturing. Enhanced SLA agreements, low packet loss, and high uptime reliability further encourage large-scale deployment

- Government programs and regional initiatives supporting digital transformation and smart city projects are fostering investments in metro ethernet infrastructure. From subsidized broadband initiatives to regulatory support for enterprise connectivity, favorable policies are accelerating deployment. This also facilitates integration with 5G networks, edge computing, and municipal IoT applications

- For instance, in 2022, several North American cities implemented high-capacity metro ethernet networks to enable smart city applications, boosting demand among enterprises and service providers. These deployments improved urban connectivity, optimized traffic management systems, and strengthened public safety communications

- While high-bandwidth requirements and digital transformation initiatives are driving the market, challenges such as infrastructure readiness, network redundancy, and high deployment costs must be addressed for sustainable adoption. Providers must also ensure robust cybersecurity measures, scalable network designs, and comprehensive maintenance support to ensure reliability

Restraint/Challenge

High Implementation Costs and Limited Last-Mile Connectivity

- The capital-intensive nature of metro ethernet infrastructure, including fiber deployment, equipment, and maintenance, limits accessibility for small and medium-sized enterprises. High upfront investments remain a major barrier to widespread adoption, especially in developing regions. Long ROI cycles and complex financing options further restrict market penetration

- Many regions lack last-mile connectivity or face challenges with legacy network infrastructure, reducing the reach and performance of metro ethernet services. This can lead to limited service availability, inconsistent performance, and slower adoption in remote or suburban areas. Providers must navigate regulatory hurdles, right-of-way issues, and local permitting processes to expand coverage

- Service integration and interoperability issues with existing enterprise networks can hinder seamless deployment and performance. Variability in network standards, vendor equipment, and configurations across providers may increase operational complexity and maintenance requirements. Ensuring backward compatibility and multi-vendor support is essential to avoid disruptions

- For instance, in 2023, several SMEs in Southeast Asia reported delays in adopting metro ethernet services due to high costs, limited last-mile connectivity, and infrastructure gaps. These issues forced companies to rely on alternative broadband solutions or hybrid network setups, which increased complexity and operational risk

- While metro ethernet technology continues to evolve, addressing cost, infrastructure limitations, and interoperability challenges is crucial. Providers must focus on modular solutions, extended coverage, simplified deployment, and strategic partnerships with local ISPs to expand adoption and ensure sustainable growth, while also enhancing training, support, and network monitoring capabilities

E-Access Metro Ethernet Services Market Scope

The market is segmented on the basis of category, service type, port speed, and parameter.

- By Category

On the basis of category, the E-access metro ethernet services market is segmented into Retail/Enterprise and Wholesale/Access. The Retail/Enterprise segment held the largest market revenue share in 2024 driven by the growing adoption of dedicated metro ethernet connections among businesses, data centers, and IT service providers. These services offer reliable, high-speed connectivity with enhanced SLA guarantees, making them a preferred choice for enterprises requiring consistent bandwidth and low-latency connections.

The Wholesale/Access segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for large-scale bandwidth provisioning and interconnectivity between service providers. Wholesale metro ethernet solutions are particularly popular for their ability to support multiple clients simultaneously, optimize network utilization, and enable cost-effective deployment across urban and suburban regions, making them critical for network scalability and service expansion.

- By Service Type

On the basis of service type, the market is segmented into Dedicated and Switched. The Dedicated segment accounted for the largest share in 2024 due to its guaranteed bandwidth, low latency, and superior security features, which are highly valued by enterprises for mission-critical applications such as cloud computing and data center interconnectivity.

The Switched segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the flexibility it offers in bandwidth allocation, on-demand scalability, and cost-efficient connectivity for businesses with variable traffic patterns. Switched metro ethernet is particularly preferred for hybrid network deployments, managed services, and dynamic bandwidth management, supporting enterprises in optimizing operational efficiency.

- By Port Speed

On the basis of port speed, the market is segmented into 10 Mbps, 100 Mbps, 1 GigE, and 100Gbps. The 1 GigE segment held the largest market revenue share in 2024 owing to the widespread adoption of gigabit connections for enterprise networking, data centers, and service provider backbones, ensuring reliable performance and high-speed data transfer.

The 100Gbps segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for ultra-high-speed connectivity for large enterprises, cloud service providers, and telecommunication networks. These high-capacity ports are crucial for supporting emerging technologies such as AI, big data analytics, and IoT deployments, enabling real-time processing and seamless data flow.

- By Parameter

On the basis of parameter, the market is segmented into Ethernet Physical Interface Attribute, Traffic Parameters, Performance Parameters, Class of Service Parameters, Service Frame Delivery Attribute, VLAN Tag Support Attribute, Service Multiplexing Attribute, Bundling Attribute, and Security Filters Attribute. The Performance Parameters segment held the largest share in 2024, driven by the critical need to monitor network reliability, latency, jitter, and packet loss to ensure optimal service quality and SLA compliance for enterprise and wholesale users.

The Security Filters Attribute segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing concerns around network security, compliance, and data privacy. Enterprises are prioritizing secure metro ethernet solutions with advanced filtering, access control, and protection against unauthorized traffic, supporting safe and reliable network operations across critical applications and services.

E-Access Metro Ethernet Services Market Regional Analysis

- North America dominated the E-Access Metro Ethernet Services market with the largest revenue share in 2024, driven by the growing adoption of high-speed enterprise connectivity, cloud computing, and data center interconnectivity

- Businesses increasingly prioritize reliable, low-latency networks to support critical applications and hybrid work models

- This widespread adoption is further supported by government initiatives promoting digital infrastructure, robust telecom networks, and a technologically advanced corporate ecosystem

U.S. E-Access Metro Ethernet Services Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by rapid digital transformation, enterprise cloud adoption, and increasing demand for secure, scalable connectivity solutions. Organizations are increasingly deploying metro ethernet services to enhance bandwidth, optimize performance, and enable seamless data transfer. The integration of managed services, AI-driven network monitoring, and flexible service models is further driving market growth across commercial, IT, and financial sectors.

Europe E-Access Metro Ethernet Services Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent data compliance regulations, increasing digitalization, and the expansion of smart city initiatives. Enterprises are adopting metro ethernet services to ensure reliable network performance, reduce latency, and improve connectivity across multiple sites. The market is witnessing strong growth in sectors such as banking, healthcare, and education, with services being incorporated into both new infrastructure and network upgrades.

U.K. E-Access Metro Ethernet Services Market Insight

The U.K. market is projected to see rapid growth from 2025 to 2032, driven by rising cloud adoption, the need for high-bandwidth connections, and demand for secure enterprise networks. Companies are focusing on managed metro ethernet services to support remote work, digital services, and business-critical applications. The presence of robust telecom infrastructure, strong regulatory support, and a high rate of IT adoption is expected to further accelerate market expansion.

Germany E-Access Metro Ethernet Services Market Insight

Germany is expected to witness significant growth from 2025 to 2032, fueled by industrial digitalization, smart manufacturing initiatives, and the demand for high-speed connectivity in commercial and enterprise networks. Metro ethernet services are increasingly deployed to enhance performance, reduce latency, and ensure seamless interconnectivity between business locations. The country’s advanced ICT infrastructure and strong emphasis on network security are key factors supporting market adoption.

Asia-Pacific E-Access Metro Ethernet Services Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urbanization, the expansion of IT and telecom infrastructure, and growing enterprise demand for high-speed network solutions in countries such as China, Japan, and India. The region is also supported by government initiatives promoting digital connectivity, smart city projects, and cloud adoption, which collectively boost the deployment of metro ethernet services.

Japan E-Access Metro Ethernet Services Market Insight

The Japan market is projected to grow rapidly from 2025 to 2032 due to high-tech industrialization, rising adoption of cloud services, and the need for reliable, low-latency enterprise connectivity. Japanese enterprises are leveraging metro ethernet services to enhance operational efficiency, ensure uninterrupted data transfer, and support IoT and digital transformation initiatives. The country’s emphasis on technology adoption and network reliability is further driving market growth.

China E-Access Metro Ethernet Services Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its expanding enterprise sector, rapid urbanization, and high adoption of digital technologies. Companies are increasingly deploying metro ethernet services for cloud connectivity, data center interlinking, and enterprise networking. Strong government support for smart city infrastructure and affordable service options provided by local providers are major factors propelling market growth in China.

E-Access Metro Ethernet Services Market Share

The E-Access Metro Ethernet Services industry is primarily led by well-established companies, including:

- AMDOCS (U.S.)

- Cogent Communications, Inc. (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Fujitsu Network Communications Inc. (U.S.)

- Lumen Technologies (U.S.)

- Ciena Corporation (U.S.)

- Netcracker (U.S.)

- NewWave Communications (U.S.)

- AT&T Intellectual Property (U.S.)

- Charter Communications Inc. (U.S.)

- Comcast Corporation (U.S.)

- Verizon (U.S.)

- Proximus (Belgium)

- Colt Technology Services Group Limited (U.K.)

- Deutsche Telekom AG (Germany)

- euNetworks (U.K.)

- KPN International (Netherlands)

- Swisscom (Switzerland)

- Tata Communications (India)

- Telefónica S.A. (Spain)

- Telia Company (Sweden)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.