Global E Discovery Market

Market Size in USD Billion

CAGR :

%

16.87 USD

39.53 USD

2024

2032

16.87 USD

39.53 USD

2024

2032

| 2025 –2032 | |

| 16.87 USD | |

| 39.53 USD | |

|

|

|

|

E-Discovery Market Size

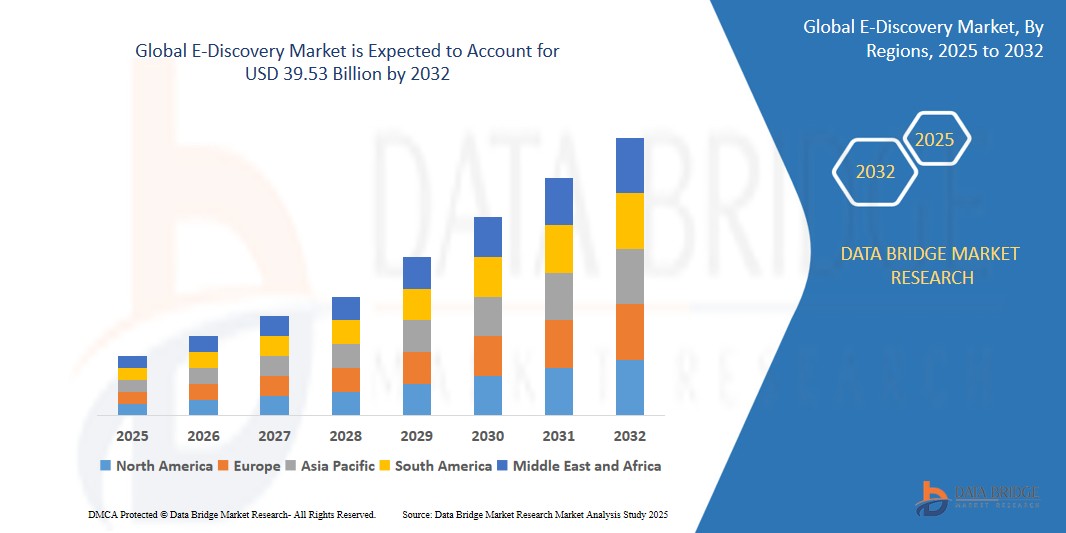

- The Global E-Discovery Market size was valued at USD 16.87 billion in 2024 and is expected to reach USD 39.53 billion by 2032, at a CAGR of 11.23% during the forecast period

- This growth is driven by factors such as the increasing need for organizations to preserve metadata from electronic documents

E-Discovery Market Analysis

- E-discovery refers to the process of identifying, collecting, and producing electronically stored information in response to legal, regulatory, or investigative requests

- The market is expanding due to the adoption of AI, machine learning, and cloud-based e-discovery solutions to manage large-scale data efficiently

- North America dominates the e-discovery market, owing to stringent data protection laws, high litigation rates, and early adoption of advanced legal technologies

- Asia-Pacific is expected to grow at the highest CAGR, fueled by increasing digital transformation, regulatory reforms, and rising corporate legal disputes.

- The services segment is projected to lead the market due to the growing demand for consulting, implementation, and managed e-discovery services to handle complex legal and compliance requirements.

Report Scope and E-Discovery Market Segmentation

|

Attributes |

E-Discovery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

E-Discovery Market Trends

“AI, Machine Learning, and Cloud-Based E-Discovery Transforming Legal Workflows”

- A major trend shaping the global e-discovery market is the integration of AI, machine learning (ML), and cloud computing to automate document review, predictive coding, and legal analytics.

- These technologies enable faster case assessments, reduced manual effort, and improved compliance accuracy, particularly in large-scale litigation and regulatory investigations.

- For instance, In March 2025, Relativity launched an AI-powered Smart Review feature that reduced document review time by 50% in complex litigation cases by prioritizing relevant evidence using natural language processing (NLP

- Cloud-based e-discovery platforms are gaining traction due to scalability, remote accessibility, and cost efficiency, especially for small and mid sized law firms.

- Blockchain for legal evidence integrity is emerging as a niche trend, ensuring tamper proof chain of custody logs in digital forensics.

E-Discovery Market Dynamics

Driver

Rising Regulatory Compliance and Surge in Litigation & Investigations

- Strict data privacy laws (GDPR, CCPA, SEC e-discovery rules) and increasing corporate litigation are driving demand for advanced e-discovery solutions.

- Growing digital data volumes from emails, cloud storage, and collaboration tools (Slack, Teams) necessitate automated legal discovery tools to manage large datasets efficiently.

For instance,

- In 2024, a Fortune 500 company faced a USD 200M penalty for failing to produce compliant e-discovery records in an SEC investigation, accelerating adoption of AI-driven compliance tools.

- Cybersecurity breaches and internal investigations further fuel demand, as companies require forensic e-discovery to trace data leaks and insider threats.

Opportunity

“Expansion of Managed E-Discovery Services and SME Adoption”

- The shift toward outsourced e-discovery services (consulting, managed review, litigation support) presents a key growth opportunity, particularly for SMEs lacking in-house legal tech resources

- Cloud-based e-discovery solutions are increasingly adopted by small law firms and corporate legal departments due to lower upfront costs and pay-as-you-go models

- For instance, in January 2025, Disco announced a 40% year on year growth in SME clients using its cloud e-discovery platform, driven by ease of deployment and AI-assisted legal review.

- Emerging markets (Asia-Pacific, Latin America) offer untapped potential due to rising corporate legal disputes and digital transformation in legal systems.

Restraint/Challenge

High Implementation Costs and Data Privacy Concerns

- High upfront costs of advanced e-discovery software (AI, predictive coding) and integration with legacy legal systems pose challenges, especially for small firms and government agencies.

- Data security risks in cloud based e-discovery platforms raise concerns, particularly in highly regulated industries (healthcare, finance).

- For instance, in 2024, a major e-discovery vendor suffered a ransomware attack, exposing sensitive legal documents and delaying multiple court cases, highlighting cybersecurity vulnerabilities.

- Cross border data compliance (e.g., GDPR vs. U.S. discovery laws) creates legal complexities for multinational corporations, slowing down e-discovery processes.

E-Discovery Market Scope

The market is segmented on the basis component, deployment, type, application, enterprise type, End User.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Model |

|

|

By Organization Size |

|

|

By End User

|

|

In 2025, the services is projected to dominate the market with a largest share in component segment

The services segment is expected to dominate the Global E-Discovery Market in 2025 due to the increasing need for expert guidance, system integration, and support in navigating complex international trade regulations. As businesses expand across borders, they rely heavily on managed services and consulting to ensure compliance, reduce risk, and streamline their trade operations.

The cloud is expected to account for the largest share during the forecast period in deployment model segment

The cloud segment is expected to dominate the Global E-Discovery Market in 2025, driven by its scalability, cost-efficiency, and ease of access across geographically dispersed operations. As global trade becomes more complex and dynamic, enterprises are increasingly shifting to cloud-based platforms to gain real-time visibility, automate compliance tasks, and quickly adapt to regulatory changes.

E-Discovery Market Regional Analysis

“North America Holds the Largest Share in the E-Discovery Market”

- North America leads the global E-Discovery market, driven by the presence of a highly developed logistics sector, advanced IT infrastructure, and strong regulatory frameworks governing international trade and customs compliance.

- The United States dominates the regional market due to the high volume of imports and exports, stringent trade regulations such as the U.S. Export Administration Regulations (EAR), and increasing adoption of automation in trade compliance and supply chain processes.

- Additionally, ongoing investments in digitization, trade finance technologies, and the integration of AI and blockchain in customs and compliance workflows are further supporting the growth of the E-Discovery Market in North America.

“Asia-Pacific is Projected to Register the Highest CAGR in the E-Discovery Market”

- The Asia-Pacific region is expected to witness the fastest growth in the global E-Discovery market, supported by expanding cross-border trade, the rise of e-commerce, and government-led trade facilitation initiatives.

- Major economies such as China, India, Japan, and South Korea are contributing significantly to market growth due to large-scale manufacturing activities and increasing demand for transparent and efficient export-import processes.

- China’s Belt and Road Initiative, along with India’s push toward paperless trade and customs automation under the National Trade Facilitation Action Plan, are creating favorable conditions for the adoption of advanced E-Discovery solutions.

- The region is also witnessing increased participation in free trade agreements (FTAs), prompting businesses to invest in trade compliance tools that ensure alignment with varying international regulations, reduce risk, and optimize global operations.

E-Discovery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Microsoft Corporation (U.S.)

- Open Text Corporation (Canada)

- CloudNine (U.S.)

- IBM Corporation (U.S.)

- Deloitte (U.K.)

- CS DISCO, Inc. (U.S.)

- KLDiscovery Ontrack, LLC (U.S.)

- EPIQ (U.S.)

- Nuix (Australia)

- Conduent, Inc. (U.S.)

Latest Developments in Global E-Discovery Market

- In May 2025, Relativity unveiled Fact Manager an AI-driven e-discovery tool that automates evidence validation in litigation and regulatory investigations. The product uses natural language processing (NLP) to cross-reference documents, detect inconsistencies, and flag critical facts, reducing manual review time by 60%. This launch addresses growing demand for fraud detection and compliance automation, particularly in financial and healthcare sectors

- In April 2025, OpenText strengthened its e-discovery portfolio by acquiring LexFusion, a startup specializing in AI-based contract analysis and litigation analytics. The acquisition integrates LexFusion’s machine learning models into OpenText’s Axcelerate platform, enhancing predictive coding and redaction capabilities. This move positions OpenText to compete with Disco and Everlaw in the cloud e-discovery space

- In March 2025, Microsoft announced a strategic partnership with PwC to develop GDPR and CCPA-compliant e-discovery tools on Azure. The collaboration combines Microsoft’s Purview eDiscovery with PwC’s legal expertise to help multinational corporations navigate cross border data privacy laws. Early adopters include EU-based firms facing stringent regulatory audits

- In February 2025, Nuix launched a blockchain based evidence tracking system to ensure tamper proof legal documentation. The innovation targets corporate investigations and criminal cases, where data integrity is critical. Early pilots reduced evidence disputes by 45% in U.S. federal court cases

- In January 2025, Exterro partnered with Splunk to merge e-discovery with cybersecurity incident response. The integration allows enterprises to automatically collect, preserve, and analyze breach related data for legal and regulatory purposes. A Fortune 500 tech firm reported a 30% faster response time to SEC cyber incident disclosures using the solution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.