Global E Kyc Market

Market Size in

CAGR :

%

800.00

3,353.67

2024

2032

800.00

3,353.67

2024

2032

| 2025 –2032 | |

| USD 800.00 | |

| USD 3,353.67 | |

|

|

|

|

E-KYC market Market Size

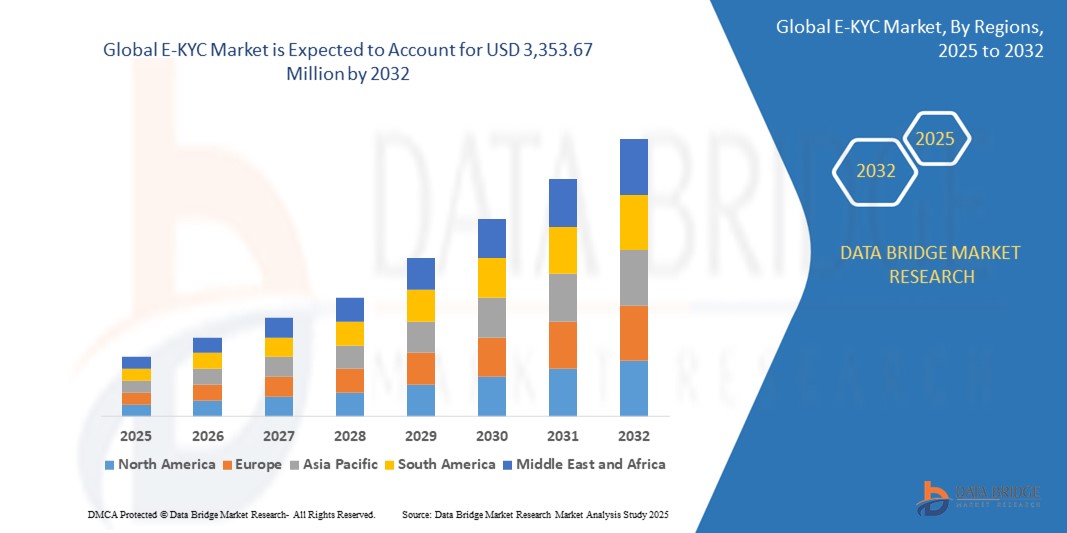

- The global e-KYC market market size was valued at USD 800 million in 2024 and is expected to reach USD 3,353.67 million by 2032, at a CAGR of 19.62% during the forecast period

- The market growth is largely fuelled by the increasing digitization of financial services, rising regulatory compliance requirements, and the growing need for secure and seamless identity verification in remote onboarding processes

- Expanding applications of e-KYC across sectors such as banking, telecommunications, insurance, and e-payments are further accelerating demand, as organizations seek to enhance customer experience while minimizing identity fraud and operational costs

E-KYC market Market Analysis

- The rising adoption of digital payment platforms, online banking, and financial inclusion initiatives across emerging economies is significantly boosting the demand for electronic know-your-customer (e-KYC) systems

- Governments and regulatory bodies are increasingly mandating e-KYC to reduce fraud, ensure customer data accuracy, and improve efficiency in customer onboarding. This regulatory push, combined with the growing penetration of smartphones and internet access, is further accelerating market expansion across regions such as Asia-Pacific, North America, and Europe

- North America dominated the e-KYC market with the largest revenue share in 2024, driven by stringent regulatory mandates, increasing digital banking adoption, and the demand for real-time identity verification solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global e-KYC market market, driven by increasing internet penetration, rising mobile banking adoption, and growing demand for remote customer verification across emerging economies such as India, Indonesia, and the Philippines

- The identity authentication and matching segment dominated the market with the largest market revenue share in 2024, primarily driven by the surge in digital banking and remote onboarding practices. Financial institutions and government agencies are increasingly investing in robust authentication tools to combat identity fraud and ensure regulatory compliance. The demand for seamless user verification while maintaining high security standards has positioned identity authentication as a critical component of e-KYC frameworks

Report Scope and E-KYC market Market Segmentation

|

Attributes |

E-KYC market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• 63 Moons Technologies Limited (India) |

|

Market Opportunities |

• Rising Adoption of Digital Identity Verification Solutions Across Emerging Economies |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

E-KYC market Market Trends

“Growing Integration of Biometric Authentication in E-KYC Platforms”

- Organizations are increasingly incorporating fingerprint, facial recognition, and iris scans into e-KYC systems to enhance identity verification

- Biometric authentication significantly improves accuracy and reduces the risk of identity fraud, especially in digital onboarding

- Financial institutions and fintech companies are leveraging biometric solutions to accelerate customer acquisition and ensure regulatory compliance

- For instance, Indian banks use Aadhaar-enabled biometric e-KYC to reduce fraud and simplify rural banking access

- The widespread availability of smartphones with embedded biometric sensors is making this technology more accessible to both users and service providers

E-KYC market Market Dynamics

Driver

“Stringent Regulatory Mandates and Rise in Digital Transactions”

- Global compliance requirements such as Anti-Money Laundering (AML) and Know Your Customer (KYC) are driving the adoption of e-KYC systems

- Digital transformation in banking, telecom, and insurance sectors has increased the need for efficient and secure identity verification

- e-KYC solutions help reduce manual effort, lower onboarding costs, and speed up customer verification across digital channels

- For instance, Europe’s eIDAS regulation and India’s UIDAI-based KYC framework have compelled companies to deploy e-KYC technologies

- These regulatory developments are pushing businesses to modernize verification processes while ensuring better fraud detection

Restraint/Challenge

“Privacy Concerns and Data Security Risks”

- The collection and storage of sensitive customer data in e-KYC processes have raised serious concerns about data privacy and cybersecurity

- Breaches of personal or biometric data can damage trust, harm brand reputation, and lead to legal and regulatory penalties

- Strict laws such as the General Data Protection Regulation (GDPR) enforce high standards for secure data processing and consent management

- For instance, a 2020 data breach involving a third-party KYC vendor led to scrutiny over digital onboarding processes in Southeast Asia

- Companies must prioritize investment in encryption, secure cloud infrastructure, and compliance training to mitigate privacy risks

E-KYC market Market Scope

The market is segmented on the basis of product, deployment mode, and end user.

- By Product

On the basis of product, the e-KYC market is segmented into identity authentication and matching, video verification, digital ID schemes, and enhanced vs simplified due diligence. The identity authentication and matching segment dominated the market with the largest market revenue share in 2024, primarily driven by the surge in digital banking and remote onboarding practices. Financial institutions and government agencies are increasingly investing in robust authentication tools to combat identity fraud and ensure regulatory compliance. The demand for seamless user verification while maintaining high security standards has positioned identity authentication as a critical component of e-KYC frameworks.

The video verification segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the adoption of remote customer onboarding and real-time verification mandates. It is gaining traction particularly among financial services and telecom companies, as it combines convenience, regulatory alignment, and operational efficiency. The use of AI in live video checks further enhances fraud detection and user authentication accuracy.

- By Deployment Mode

On the basis of deployment mode, the e-KYC market is segmented into cloud-based and on-premises. The cloud-based segment accounted for the largest revenue share in 2024, owing to its scalability, lower upfront costs, and easy integration with digital platforms. Cloud deployment enables real-time updates, automated compliance, and seamless access to KYC services, especially for fintechs and startups with remote operations.

The on-premises segment is expected to witness the fastest growth rate from 2025 to 2032, driven by large financial institutions and government bodies that prioritize data sovereignty and internal control. This model offers higher data security and customization but typically involves longer deployment timelines and higher infrastructure investments.

- By End User

On the basis of end user, the e-KYC market is segmented into banks, financial institutions, e-payment service providers, telecom companies, and insurance companies. The banks segment held the largest share in 2024 due to increasing digitization of financial services and strict regulatory requirements around customer identity verification. Banks are adopting e-KYC solutions to streamline onboarding, reduce manual paperwork, and minimize fraudulent activities.

The e-payment service providers segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising number of digital transactions and mobile wallet users. As e-payment platforms rapidly scale across regions, automated and secure KYC processes have become essential to maintain user trust and comply with evolving financial regulations.

E-KYC market Market Regional Analysis

- North America dominated the e-KYC market with the largest revenue share in 2024, driven by stringent regulatory mandates, increasing digital banking adoption, and the demand for real-time identity verification solutions

- Financial institutions in the region are actively investing in advanced e-KYC technologies to streamline onboarding, reduce fraud, and ensure compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) standards

- The integration of artificial intelligence, machine learning, and biometric authentication across various sectors including banking, insurance, and telecom, further accelerates the adoption of e-KYC solutions across North America

U.S. E-KYC Market Insight

The U.S. e-KYC market accounted for the largest revenue share within North America in 2024, supported by a highly digitized financial services sector and evolving regulatory frameworks. Increasing adoption of remote onboarding tools and growing cybersecurity concerns are driving institutions to deploy robust e-KYC systems. The country’s vibrant fintech ecosystem, along with rising consumer expectations for seamless digital experiences, is further propelling demand for real-time, AI-enabled identity verification technologies.

Europe E-KYC Market Insight

The Europe e-KYC market is expected to witness the fastest growth rate from 2025 to 2032,, driven by increasing compliance obligations and cross-border financial activities. Regulatory initiatives such as eIDAS and GDPR are encouraging enterprises to adopt secure and standardized digital identity verification practices. Countries including Germany, France, and the U.K. are leading the shift toward digital onboarding, with banks and insurance firms investing in scalable e-KYC infrastructure to improve customer experience and operational efficiency.

U.K. E-KYC Market Insight

The U.K. e-KYC market s expected to witness the fastest growth rate from 2025 to 2032, supported by a strong fintech sector and regulatory initiatives focused on secure digital transformation. Demand for quick and secure remote customer onboarding in banking, payments, and telecom services is rising. The government’s emphasis on digital identity trust frameworks and data protection compliance further drives the adoption of AI-based, paperless KYC platforms across both private and public sectors.

Germany E-KYC Market Insight

The Germany e-KYC market s expected to witness the fastest growth rate from 2025 to 2032, bolstered by a tech-savvy population and a financial sector prioritizing secure, compliant customer verification solutions. Increasing digitization across industries such as banking and insurance is prompting investments in biometric authentication, facial recognition, and automated document verification. Germany’s strict data privacy regulations support the development and deployment of GDPR-compliant e-KYC systems, enhancing consumer trust and market expansion.

Asia-Pacific E-KYC Market Insight

The Asia-Pacific e-KYC market s expected to witness the fastest growth rate from 2025 to 2032, supported by government-led digital ID initiatives, rising mobile usage, and rapid financial inclusion. Countries such as India, China, and Indonesia are leading adoption with scalable, cloud-based authentication platforms. The growing demand for contactless onboarding, expansion of fintech services, and regulatory support for digital ecosystems are collectively driving e-KYC implementation across various sectors.

China E-KYC Market Insight

The China e-KYC market holds a substantial share of the Asia-Pacific region in 2024, fueled by rapid digitalization, strong domestic tech capabilities, and a growing preference for AI-enabled identity verification. Chinese financial institutions, mobile payment providers, and e-commerce platforms are increasingly using facial recognition and OCR technologies for KYC compliance. Government initiatives supporting the digital economy and anti-fraud regulations further contribute to the expansion of e-KYC systems across the country.

Japan E-KYC Market Insight

The Japan e-KYC market s expected to witness the fastest growth rate from 2025 to 2032, driven by the nation’s focus on digital transformation, stringent financial regulations, and an aging population that demands simplified, secure verification methods. The Japanese government’s initiatives to promote cashless payments and digitized public services are encouraging banks, insurance companies, and telecom providers to implement advanced e-KYC technologies. Increasing integration of biometric authentication and artificial intelligence into financial and mobile platforms is streamlining customer onboarding while reducing fraud. Moreover, Japan's emphasis on regulatory compliance, data security, and user privacy is reinforcing trust in digital identity verification solutions, further boosting market expansion across sectors.

E-KYC market Market Share

The E-KYC market industry is primarily led by well-established companies, including:

• 63 Moons Technologies Limited (India)

• Acuant Inc. (U.S.)

• Financial Software & Systems Pvt. Ltd. (India)

• GB Group plc (U.K.)

• GIEOM Business Solutions Pvt. Ltd. (India)

• Jumio (U.S.)

• Onfido (U.K.)

• Panamax Inc. (U.S.)

• Tata Consultancy Services Limited (India)

• Trulioo (Canada)

• Trust Stamp (U.S.)

• Wipro Limited (India)

Latest Developments in Global E-KYC market Market

- In January 2025, India Post introduced an Aadhaar-based eKYC system for opening Post Office Savings Accounts. This development enables digital identity verification at Departmental Post Office counters, enhancing the reach of UIDAI's biometric authentication and supporting the country’s broader push toward financial inclusion and digital infrastructure growth

- In November 2024, Brankas integrated ADVANCE.AI’s eKYC technology and API suite into its open banking compliance platform. This move allows banks in Indonesia, particularly those under BI-SNAP regulations, to streamline compliance processes through a unified digital solution, improving efficiency and regulatory adherence

- In September 2024, Finacus Solutions partnered with pi-labs.ai to launch a deepfake-proof eKYC solution. Designed to strengthen identity verification systems, the collaboration addresses rising deepfake-related fraud in the financial sector, ensuring safer and more secure onboarding for financial institutions

- In September 2024, HDB Financial Services became the first organization to implement the eKYC Setu System developed by NPCI and UIDAI. This new system enhances customer onboarding by offering a faster, more secure digital process, marking a significant advancement in India’s digital banking and authentication ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.