Global E Line Metro Ethernet Services Market

Market Size in USD Billion

CAGR :

%

USD

13.42 Billion

USD

22.55 Billion

2024

2032

USD

13.42 Billion

USD

22.55 Billion

2024

2032

| 2025 –2032 | |

| USD 13.42 Billion | |

| USD 22.55 Billion | |

|

|

|

|

E-Line Metro Ethernet Services Market Size

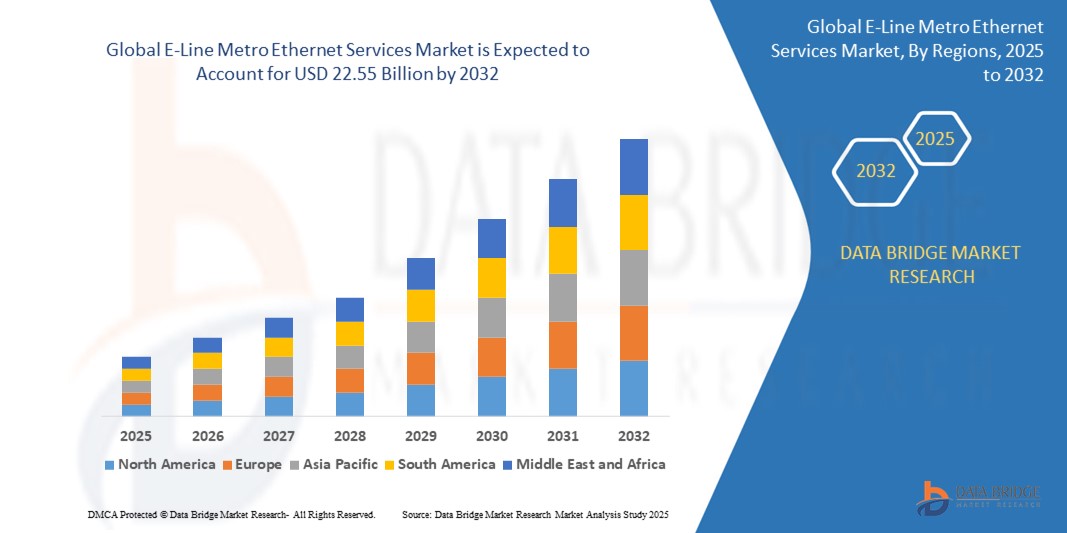

- The global e-line metro ethernet services market size was valued at USD 13.42 billion in 2024 and is expected to reach USD 22.55 billion by 2032, at a CAGR of 6.7% during the forecast period

- The market growth is largely fueled by the rising demand for high-speed, low-latency, and scalable connectivity solutions across industries undergoing digital transformation, such as BFSI, healthcare, manufacturing, and education

- Furthermore, the rapid proliferation of cloud computing, IoT devices, and data-intensive applications is driving enterprises and service providers to adopt dedicated point-to-point Ethernet services for reliable, secure, and high-performance network communication

E-Line Metro Ethernet Services Market Analysis

- E-Line Metro Ethernet services are point-to-point Ethernet virtual connections that provide dedicated bandwidth between two customer locations over a metropolitan area network (MAN). These services support high-speed data transfer, low-latency performance, and enhanced security for enterprise communication and cloud access

- The escalating demand for E-Line services is primarily driven by increasing enterprise bandwidth requirements, the need for secure and private connectivity, and growing investments in fiber infrastructure by telecom operators and managed service providers

- North America dominated the e-line metro ethernet services market with a share of 41.7% in 2024, due to the high penetration of advanced networking infrastructure, increasing demand for high-speed internet services, and the strong presence of telecom and cloud service providers

- Asia-Pacific is expected to be the fastest growing region in the e-line metro ethernet services market during the forecast period due to rapid digital transformation, urbanization, and the proliferation of mobile and broadband subscribers

- Single-mode module segment dominated the market with a market share of 61.9% in 2024, due to its superior performance over long distances and higher bandwidth capabilities. Single-mode fiber is preferred by large enterprises and service providers needing high-speed data transmission across geographically dispersed locations. Its lower attenuation and minimal signal loss make it suitable for metro and long-haul applications, especially in financial institutions and telecom infrastructure where uninterrupted connectivity is critical

Report Scope and E-Line Metro Ethernet Services Market Segmentation

|

Attributes |

E-Line Metro Ethernet Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

E-Line Metro Ethernet Services Market Trends

“Growing Demand for High-Speed Connectivity”

- The E-Line Metro Ethernet services market is expanding rapidly as enterprises and service providers seek high-speed, low-latency connectivity solutions to support growing data consumption, cloud migration, and digital transformation initiatives

- For instance, companies such as Zayo Group have upgraded major metro fiber networks with 400G-enabled wavelength routes to address surging client demand for bandwidth, operational efficiency, and seamless cloud access

- Deployment of advanced Ethernet technologies—including 10G, 100G, and software-defined networking (SDN)—enables scalable, robust connections for mission-critical business applications and real-time digital services

- The proliferation of cloud-based tools, video applications, and remote workforces is increasing the need for reliable, dedicated E-Line links that guarantee secure, high-performance data exchanges across metropolitan areas

- Initiatives such as smart city development and IoT integration are driving further adoption, as urban infrastructure and businesses rely on Metro Ethernet’s dedicated, flexible connections to manage large-scale real-time data

- Growing emphasis on cost efficiency, operational simplicity, and improved network management through automation and virtualization further propels the adoption of E-Line services, providing significant opex savings over legacy private lines

E-Line Metro Ethernet Services Market Dynamics

Driver

“Increasing Bandwidth Demand”

- Massive growth in bandwidth requirements—driven by cloud computing, big data analytics, 5G backhaul, and enterprise digitalization—remains a central catalyst for market expansion, as organizations must support ever-larger volumes of simultaneous data interactions

- For instance, recent upgrades by Zayo Group and similar providers have been implemented specifically to accommodate the exponential rise in enterprise bandwidth needs, including rapid adoption across sectors such as BFSI, healthcare, telecom, and manufacturing

- Scalability and flexibility of E-Line Metro Ethernet allow clients to rapidly adjust bandwidth from 10 Mbps up to 100 Gbps or more, making it suitable for both SMEs and large urban enterprises facing fluctuating capacity demands

- The shift from legacy TDM and MPLS networks to Ethernet-based services is accelerating due to easier provisioning, improved security, and cost savings for multisite connectivity and cloud integration

- Increased penetration of fiber networks in urban and emerging markets broadens the customer base, enabling more organizations to benefit from high-speed, resilient E-Line connections for a wide array of business and digital applications

Restraint/Challenge

“High Deployment Costs”

- High initial investment in fiber optic infrastructure, advanced switching equipment, and network integration continues to pose a barrier for service providers seeking metro-wide E-Line deployments, especially in highly competitive or underdeveloped regions

- For instance, smaller carriers and regional ISPs cite capital expenditures and long ROI horizons as significant hurdles, slowing market penetration and limiting provider diversity, while established players benefit from scale and existing assets

- Regulatory requirements, right-of-way acquisition, and city permitting processes can further elevate costs and delay deployments, particularly in dense metropolitan areas where construction is complex and expensive

- Fluctuating prices of network hardware and ongoing costs for skilled personnel, maintenance, and technology upgrades add further pressure to margins, making affordable solutions challenging for budget-constrained projects

- These high deployment and operational costs may also lead to premium service pricing for end-customers, thereby constraining adoption among price-sensitive SMEs and organizations with limited IT budgets

E-Line Metro Ethernet Services Market Scope

The market is segmented on the basis of fiber mode type, category, and end-user.

- By Fiber Mode Type

On the basis of fiber mode type, the E-Line Metro Ethernet services market is segmented into Single-Mode Module and Multi-Mode Module. The Single-Mode Module segment dominated the largest market revenue share of 61.9% in 2024, attributed to its superior performance over long distances and higher bandwidth capabilities. Single-mode fiber is preferred by large enterprises and service providers needing high-speed data transmission across geographically dispersed locations. Its lower attenuation and minimal signal loss make it suitable for metro and long-haul applications, especially in financial institutions and telecom infrastructure where uninterrupted connectivity is critical.

The Multi-Mode Module segment is anticipated to register the fastest growth from 2025 to 2032, supported by its cost-effectiveness and ease of deployment in short-distance, high-density network environments. It is increasingly used in data centers, educational institutions, and retail networks where rapid intra-building communication is essential. The expanding use of digital tools and localized cloud computing further accelerates demand for multi-mode modules due to their scalability and efficient support for high traffic volumes within confined areas.

- By Category

On the basis of category, the E-Line Metro Ethernet services market is segmented into Retail and Wholesale. The Retail segment accounted for the largest market share in 2024, largely driven by growing demand from SMEs and enterprise customers for dedicated, point-to-point connectivity with guaranteed bandwidth. Retail E-Line services offer customizable solutions with enhanced SLAs, appealing to businesses seeking reliable, high-speed communication for cloud access, video conferencing, and real-time applications. Their flexibility and ease of provisioning have also contributed to rapid adoption across urban enterprise hubs.

The Wholesale segment is projected to experience the highest growth rate during the forecast period, as global and regional telecom operators increasingly rely on wholesale Ethernet circuits to extend their service coverage and reduce infrastructure costs. With rising demand for mobile backhaul, carrier interconnects, and high-capacity transit services, wholesale providers are scaling up their investments in Ethernet-based metro connectivity. This trend is amplified by 5G rollouts and the proliferation of content delivery networks (CDNs), which require robust, low-latency transport solutions.

- By End-User

On the basis of end-user, the market is segmented into Banking, Finance Services and Insurance (BFSI), ISPs and Telecom, Education, Manufacturing and Logistics, Hospitality, Retail, and Healthcare. The BFSI segment held the largest market revenue share in 2024, driven by the sector’s critical need for secure, high-bandwidth connectivity to support real-time transactions, disaster recovery, and remote branch networking. Metro Ethernet’s scalable and private line characteristics make it a preferred solution for financial institutions aiming to meet regulatory compliance and low-latency data access requirements.

The ISPs and Telecom segment is expected to register the fastest growth from 2025 to 2032, propelled by surging bandwidth demands, 5G expansion, and edge computing developments. E-Line services enable ISPs and telecom operators to build flexible, high-speed last-mile and intercity connections that enhance service delivery and network performance. As operators look to upgrade infrastructure to support modern digital applications, the role of Ethernet-based services in ensuring scalable and cost-effective transport solutions becomes increasingly pivotal.

E-Line Metro Ethernet Services Market Regional Analysis

- North America dominated the e-line metro ethernet services market with the largest revenue share of 41.7% in 2024, driven by the high penetration of advanced networking infrastructure, increasing demand for high-speed internet services, and the strong presence of telecom and cloud service providers

- Enterprises across the region are rapidly embracing metro Ethernet solutions to support data-intensive applications, cloud computing, and unified communication systems

- The widespread digital transformation initiatives, coupled with rising bandwidth consumption across industries such as BFSI, IT, and education, are reinforcing the demand for reliable and scalable Ethernet services

U.S. E-Line Metro Ethernet Services Market Insight

The U.S. market accounted for the largest share within North America in 2024, primarily fueled by the country's robust digital ecosystem and growing reliance on low-latency, high-performance network solutions. The increasing deployment of cloud platforms, IoT systems, and video conferencing tools in both public and private sectors is elevating the demand for dedicated Ethernet lines. Additionally, the rapid rollout of 5G and the expansion of edge data centers are prompting service providers to upgrade their metro network capacities with Ethernet-based offerings.

Europe E-Line Metro Ethernet Services Market Insight

The Europe market is projected to grow at a substantial CAGR throughout the forecast period, supported by strong regulatory backing for broadband development and digital infrastructure. The rising need for secure and scalable data transfer across distributed enterprise networks is driving the uptake of E-Line services. Demand is especially strong in verticals such as finance, logistics, and government, where uninterrupted, high-speed communication is vital. The region’s focus on digital sovereignty and cross-border data compliance also accelerates investment in private Ethernet networks.

U.K. E-Line Metro Ethernet Services Market Insight

The U.K. market is expected to grow at a notable CAGR during the forecast period, driven by a sharp rise in demand for enterprise connectivity, cloud computing, and hosted services. Increasing investments in network modernization and FTTP (fiber to the premises) deployment are fostering the adoption of dedicated Ethernet lines. Businesses are prioritizing high-speed, symmetrical connections to support hybrid work environments and latency-sensitive applications, making E-Line services a preferred choice in the enterprise networking landscape.

Germany E-Line Metro Ethernet Services Market Insight

Germany is anticipated to witness considerable growth in the E-Line services market, bolstered by a strong industrial base and increasing digitization of manufacturing, logistics, and financial services. The country’s focus on Industry 4.0 and smart infrastructure is leading to increased deployment of private Ethernet connections. Moreover, Germany’s emphasis on data privacy and localized network management further drives demand for dedicated point-to-point Ethernet services within enterprise and institutional segments.

Asia-Pacific E-Line Metro Ethernet Services Market Insight

The Asia-Pacific region is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rapid digital transformation, urbanization, and the proliferation of mobile and broadband subscribers. Countries such as China, Japan, and India are heavily investing in fiber infrastructure and smart city initiatives, which support the deployment of metro Ethernet services. Rising data consumption, increasing enterprise cloud adoption, and government-backed digital programs are contributing to market expansion across the region.

Japan E-Line Metro Ethernet Services Market Insight

Japan's E-Line services market is gaining momentum due to the country's technologically advanced telecom landscape and high demand for reliable, high-bandwidth communication solutions. Enterprises and public institutions are leveraging Ethernet services to connect distributed branches and ensure secure access to centralized data resources. The emphasis on automation, coupled with aging infrastructure upgrades, is pushing both public and private sectors to adopt robust Ethernet connectivity.

China E-Line Metro Ethernet Services Market Insight

China held the largest market share within Asia-Pacific in 2024, driven by its expansive fiber optic network and the rapid development of smart infrastructure projects. Government policies supporting digital innovation and the presence of major telecom operators are key factors behind the widespread adoption of Ethernet services. Enterprises across e-commerce, finance, and manufacturing sectors are increasingly opting for high-performance E-Line solutions to manage growing data traffic and support scalable, cloud-based operations.

E-Line Metro Ethernet Services Market Share

The e-line metro ethernet services industry is primarily led by well-established companies, including:

- Verizon (U.S.)

- AT&T Intellectual Property (U.S.)

- Zayo Group, LLC (U.S.)

- Consolidated Communications (U.S.)

- Lumen Technologies (U.S.)

- Interoute Communications Ltd (U.K.)

- Comcast (U.S.)

- Colt Technology Services Group Limited (U.K.)

- Windstream Communications (U.S.)

- NTT Communications Corporation (Japan)

- Charter Communications (U.S.)

- NewWave Communications (U.S.)

- Netcracker (U.S.)

- Liberty Global (U.K.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Amdocs (U.S.)

Latest Developments in Global E-Line Metro Ethernet Services Market

- In July 2024, Zayo Group, LLC. expanded its network connectivity offerings, introducing new 400G-enabled wavelength routes. This enhancement involves upgrading Zayo’s extensive 90% fiber network across North America, supporting 400G operations. This will empower users by boosting their network capacity and operational efficiency, enabling smoother data handling, lower latency, and greater bandwidth for cloud services, applications, and business operations, significantly improving the overall network performance

- In May 2022, African Infrastructure Investment Managers (AIIM) successfully completed the acquisition of MetroFibre Networx after gaining approval from the Independent Communications Authority of South Africa. The acquisition strengthens AIIM’s position in the telecommunications infrastructure sector, allowing MetroFibre to continue expanding its fiber network across the country, contributing to greater broadband connectivity and enhanced internet services for both residential and commercial customers

- In April 2022, Synopsys and Juniper Networks launched OpenLight, a groundbreaking firm designed to enable third parties to develop products with integrated on-chip lasers. Utilizing Tower Semiconductor’s manufacturing capabilities, this innovation offers significant advancements in photonic integration, paving the way for enhanced optical communication systems and providing developers with the tools needed to create more efficient and scalable solutions in various tech industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.