Global E Paper Market

Market Size in USD Billion

CAGR :

%

USD

4.50 Billion

USD

13.06 Billion

2024

2032

USD

4.50 Billion

USD

13.06 Billion

2024

2032

| 2025 –2032 | |

| USD 4.50 Billion | |

| USD 13.06 Billion | |

|

|

|

|

E-Paper Market Size

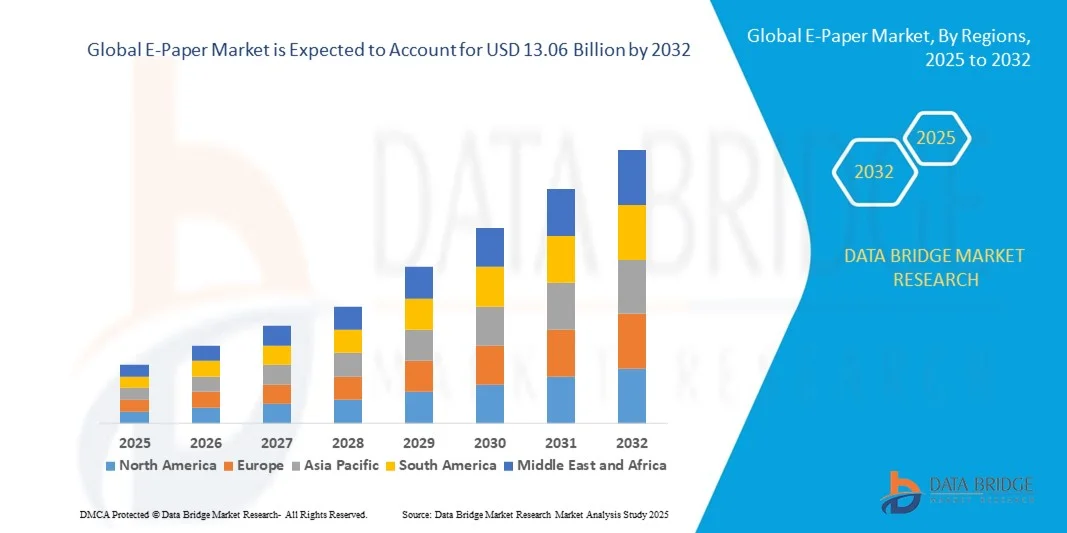

- The global E-paper market size was valued at USD 4.5 billion in 2024 and is expected to reach USD 13.06 billion by 2032, at a CAGR of 14.25% during the forecast period

- The market growth is largely fuelled by the increasing adoption of energy-efficient display technologies in consumer electronics, retail signage, and smart devices

- Rising demand for low-power, high-visibility displays in e-readers, digital signage, and wearable devices is accelerating market expansion

E-Paper Market Analysis

- The market is witnessing rapid innovation in E-paper materials, including electrophoretic, electrowetting, and electrochromic technologies, enhancing display performance and versatility

- Growing applications in retail, transportation, healthcare, and logistics for cost-effective, low-power digital signage and smart labels are expanding the market reach

- North America dominated the e-paper market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of low-power and energy-efficient display solutions across consumer electronics, retail, and transportation sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global E-paper market, driven by rapid urbanization, growing electronics and automotive industries, increasing consumer awareness, and the presence of major E-paper manufacturers in countries such as China, Japan, and South Korea

- The Electrophoretic segment held the largest market revenue share in 2024, driven by its low power consumption, high visibility, and widespread adoption in e-readers, signage, and smart wearable devices. Electrophoretic displays are particularly favored for their ability to retain images without constant power, providing energy-efficient solutions for long-term deployments

Report Scope and E-Paper Market Segmentation

|

Attributes |

E-Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

E-Paper Market Trends

Increasing Adoption of E-Paper Displays Across Various Applications

- The growing shift toward e-paper displays is transforming the digital display landscape by enabling low-power, high-visibility screens for a variety of devices. Their readability in sunlight and energy efficiency make them ideal for applications such as signage, e-readers, and smart wearables, improving user experience and reducing operational costs. In addition, e-paper displays contribute to sustainability by reducing the need for paper-based signage and printed materials. They also offer long battery life, which decreases maintenance cycles and operational interruptions. The adoption of advanced e-paper panels supports businesses in achieving cost-effective, eco-friendly digital transformation initiatives

- The high demand for flexible and sustainable display solutions is accelerating the adoption of color and flexible e-paper technologies. These displays are particularly effective in retail, logistics, and public information systems, helping reduce energy consumption while offering enhanced visual performance. Flexible e-paper allows integration into curved surfaces, wearable devices, and portable electronics, expanding design possibilities. Color e-paper adoption is increasing for dynamic signage, menus, and public displays, creating engaging visual experiences. Furthermore, ongoing R&D is improving refresh rates, brightness, and resolution, enhancing the usability of these displays across more demanding commercial applications

- The affordability and durability of modern e-paper displays are making them attractive for widespread commercial and consumer adoption. Businesses benefit from more frequent updates and dynamic content without incurring high maintenance or energy costs, which ultimately enhances operational efficiency. These displays are resilient to harsh lighting and temperature conditions, making them suitable for both indoor and outdoor environments. E-paper’s low-power requirements allow integration into battery-operated devices, reducing infrastructure dependence. Organizations are increasingly leveraging e-paper to replace conventional LCDs, achieving long-term cost savings and sustainable operations

- For instance, in 2023, several retail chains across Europe adopted e-paper shelf labels for dynamic pricing and promotions, resulting in improved customer engagement and reduced paper waste. This implementation also allowed automated updates and centralized control of pricing across multiple outlets, reducing manual labor. Retailers reported faster deployment of promotional changes and improved inventory visibility. Similar implementations in logistics and warehouses enhanced workflow efficiency and real-time tracking, highlighting e-paper’s operational benefits. These success stories are encouraging broader adoption across commercial sectors globally

- While e-paper technology is gaining traction, its market impact depends on continued innovation, cost reduction, and scalability. Manufacturers must focus on localized product development and strategic deployments to fully capitalize on this growing demand. Partnerships between e-paper technology providers and device manufacturers are fostering tailored solutions for specific industries. Efforts to reduce component costs and expand mass production capacity are critical to improving market accessibility. Moreover, integration with IoT platforms and cloud-based content management systems will enable smarter, scalable deployments across commercial, industrial, and consumer applications

E-Paper Market Dynamics

Driver

Rising Demand for Energy-Efficient and Low-Power Display Solutions

- Increasing emphasis on energy conservation and sustainability is driving the adoption of e-paper displays across various sectors. The technology’s extremely low power consumption makes it ideal for devices that require long battery life and minimal maintenance. Businesses are also leveraging e-paper to achieve sustainability goals, including lower carbon footprints and reduced electricity consumption. Its passive display mode, which retains content without power, makes it a preferred choice for long-term deployments in signage, retail, and industrial monitoring. The technology is being recognized as a reliable alternative to traditional display methods, supporting eco-conscious operations globally

- Enterprises and consumers are increasingly aware of the environmental and operational benefits of e-paper, such as reduced electricity usage and extended device lifespan, which fuels market growth. Governments and NGOs promoting green initiatives are incentivizing organizations to replace conventional displays with low-power alternatives. E-paper’s durability reduces replacement frequency, further minimizing electronic waste. Consumer electronics, especially e-readers and wearable devices, are adopting e-paper to balance functionality and energy efficiency. This awareness is creating a strong pull across both developed and emerging markets

- Government initiatives and private sector programs promoting green technology adoption are further boosting demand. Regulatory incentives for energy-efficient solutions are encouraging manufacturers to integrate e-paper into a wide range of devices. Public infrastructure projects, such as smart cities and intelligent transportation systems, increasingly utilize e-paper displays to reduce energy costs and improve information accessibility. Adoption is further aided by tax incentives and energy efficiency standards in key regions. Collaborative programs between local governments and e-paper suppliers are also accelerating the development of innovative, energy-conscious display solutions

- For instance, in 2022, multiple public transport networks in Asia implemented e-paper ticketing and schedule displays to reduce energy consumption and operational costs, significantly enhancing passenger information management. These deployments improved the reliability and readability of transit schedules under varying lighting conditions. Operational efficiency was enhanced due to lower maintenance needs, fewer battery replacements, and reduced manpower for updates. The success of such implementations is encouraging similar projects across Europe and North America, promoting large-scale adoption

- While energy efficiency drives growth, the market still requires ongoing innovation in color, flexibility, and refresh rate to expand adoption in more demanding applications. Advancements in manufacturing processes are also needed to improve yield, reduce defect rates, and lower overall product cost. Integration with smart devices and cloud-based management systems will be critical to scale adoption in commercial and industrial sectors. As e-paper technologies evolve, they will increasingly compete with low-power LCDs and OLEDs, making innovation key to sustaining market leadership

Restraint/Challenge

High Cost Of Advanced E-Paper Solutions And Limited Manufacturing Capacity

- The high cost of advanced e-paper displays, including color, flexible, and large-format variants, limits adoption in cost-sensitive segments. Price remains a significant barrier for widespread usage, particularly in small businesses and developing regions. Investments in R&D, specialized equipment, and materials contribute to elevated product costs. Reducing production costs and scaling manufacturing are critical to making e-paper viable for broader markets. Premium pricing has also slowed adoption in sectors such as education, small retail, and niche consumer electronics

- Limited manufacturing capabilities and supply chain challenges constrain the availability of specialized e-paper components, delaying production timelines and restricting market penetration. Dependence on a few key suppliers for microcapsule technology, substrates, and conductive inks creates vulnerability. Geopolitical factors, raw material shortages, and logistics issues can further impact production consistency. These supply limitations hinder timely deployment of projects, particularly large-scale signage and public infrastructure initiatives. Strengthening local supply chains and diversifying production sites are essential to meet growing global demand

- Integrating e-paper technology with existing digital platforms can be complex, requiring additional hardware and software support. This increases deployment costs and time-to-market for new devices and applications. Compatibility issues with content management systems, IoT platforms, and enterprise software add to technical challenges. Skilled personnel and specialized training are required for optimal installation and maintenance. These complexities can deter smaller organizations from adopting e-paper despite its long-term operational benefits

- For instance, in 2023, several SMEs in North America reported delays in rolling out e-paper signage solutions due to component shortages and integration challenges, highlighting the need for robust manufacturing and supply strategies. Such delays resulted in missed marketing and operational opportunities, emphasizing the importance of reliable sourcing and logistics. Lessons from these cases are guiding manufacturers to improve supply chain resilience and technical support services

- While the technology continues to advance, addressing cost, supply, and integration challenges remains critical. Stakeholders must focus on scalable production, innovative display designs, and reliable sourcing to unlock long-term market potential. Collaboration between manufacturers, system integrators, and end-users is essential to streamline deployment and maximize adoption. Investment in automated manufacturing, modular designs, and improved logistics will support market expansion and reduce entry barriers for new adopters

E-Paper Market Scope

The market is segmented on the basis of technology and applications.

- By Technology

On the basis of technology, the e-paper market is segmented into Electrophoretic, Electrochromic, Electro Wetting, Cholesteric LCD (CH-LCD), and Others. The Electrophoretic segment held the largest market revenue share in 2024, driven by its low power consumption, high visibility, and widespread adoption in e-readers, signage, and smart wearable devices. Electrophoretic displays are particularly favored for their ability to retain images without constant power, providing energy-efficient solutions for long-term deployments.

The Electrochromic segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its rapid color-changing capability and suitability for dynamic signage, automotive mirrors, and smart windows. Electrochromic e-paper offers improved visual performance and interactive display options, making it increasingly popular across consumer electronics and commercial applications. Its adoption is further supported by ongoing innovations aimed at enhancing response time, color richness, and durability.

- By Applications

On the basis of applications, the e-paper market is segmented into Consumer Electronics, Retail, Medical, Transportation, and Others. The Consumer Electronics segment accounted for the largest share in 2024, driven by the proliferation of e-readers, smart watches, and portable devices requiring low-power, high-contrast displays. These devices benefit from enhanced readability, long battery life, and lightweight designs, making e-paper a preferred display technology.

The Retail segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing adoption of electronic shelf labels, dynamic pricing solutions, and in-store signage. E-paper displays provide retailers with energy-efficient, updateable, and visually appealing solutions to enhance customer engagement. Rising demand for sustainability, reduced operational costs, and seamless integration with digital management systems is further accelerating adoption across retail environments.

E-Paper Market Regional Analysis

- North America dominated the e-paper market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of low-power and energy-efficient display solutions across consumer electronics, retail, and transportation sectors

- Enterprises and consumers in the region highly value the readability, durability, and operational cost savings offered by e-paper displays, making them a preferred choice for dynamic signage, e-readers, and smart wearables

- This widespread adoption is further supported by strong technological infrastructure, high disposable incomes, and favorable government policies promoting energy-efficient devices, establishing e-paper as a key solution for both commercial and consumer applications

U.S. E-Paper Market Insight

The U.S. e-paper market captured the largest revenue share in 2024 within North America, fueled by the increasing deployment of digital signage, smart packaging, and e-readers. Consumers and businesses are increasingly prioritizing low-power, eco-friendly display solutions that reduce operational costs. The growth is further accelerated by rising interest in IoT-enabled devices and interactive retail applications, while integration with mobile and cloud-based platforms enhances functionality and usability, significantly contributing to market expansion.

Europe E-Paper Market Insight

The Europe e-paper market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent environmental regulations and growing demand for energy-efficient display solutions. Urbanization, increasing smart city projects, and adoption of e-paper for public information systems and retail are fostering market growth. European consumers are attracted to the long battery life and low maintenance requirements of e-paper displays. The region is witnessing significant adoption across transportation, retail, and industrial sectors, with e-paper being integrated into both new installations and retrofitting projects.

U.K. E-Paper Market Insight

The U.K. e-paper market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising adoption of smart retail solutions, dynamic pricing displays, and energy-efficient signage. Businesses are increasingly opting for e-paper technology to reduce printing costs and energy consumption. In addition, government initiatives encouraging sustainability and digital transformation in public infrastructure support market growth. The U.K.’s strong retail and logistics sector, coupled with technological advancements in display solutions, is expected to continue stimulating market expansion.

Germany E-Paper Market Insight

The Germany e-paper market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising awareness of energy conservation and eco-friendly technologies. Germany’s emphasis on innovation, smart infrastructure, and sustainability promotes e-paper adoption in transportation, industrial, and retail applications. E-paper displays are increasingly being integrated into public transport information systems, smart labels, and industrial control panels, with a strong preference for long-lasting, low-maintenance solutions aligning with consumer and regulatory expectations.

Asia-Pacific E-Paper Market Insight

The Asia-Pacific e-paper market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and technological advancements in countries such as China, Japan, and India. The region’s growing inclination toward smart cities, digital signage, and sustainable display solutions is driving adoption. Furthermore, as APAC becomes a manufacturing hub for e-paper components and devices, affordability and accessibility are improving, expanding the market to a wider consumer and commercial base.

Japan E-Paper Market Insight

The Japan e-paper market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech culture, demand for energy-efficient displays, and extensive use in public transportation, retail, and consumer electronics. Japanese enterprises prioritize low-power, durable display solutions for signage and smart packaging. Integration with IoT devices and digital platforms is accelerating adoption, while government programs promoting green technologies and smart infrastructure are further supporting market growth.

China E-Paper Market Insight

The China e-paper market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, a growing middle class, and high technological adoption. China is one of the largest markets for e-paper displays, widely used in retail, transportation, and consumer electronics. The push for smart cities, eco-friendly solutions, and the presence of domestic manufacturers producing affordable e-paper devices are key factors propelling market growth. Adoption is further supported by government incentives for energy-efficient technologies and expanding applications across commercial and public sectors.

E-Paper Market Share

The E-Paper industry is primarily led by well-established companies, including:

- GUANGZHOU OED TECHNOLOGIES CO., LTD. (China)

- InkCase Enterprise Pte Ltd (Singapore)

- LG Electronics (South Korea)

- PERVASIVE DISPLAYS, INC. (U.S.)

- Plastic Logic HK Ltd (Hong Kong)

- SAMSUNG (South Korea)

- Displaydata Limited (U.K.)

- DKE CO., LTD. (South Korea)

- Epson America, Inc. (U.S.)

- GDS Holding S.r.l. (Italy)

- Motion Display (U.S.)

- MPicoSys Low Power Innovators (U.S.)

- Omni-ID (U.K.)

- Solomon Systech (Hong Kong)

- Ubiik (South Korea)

- Visionect (Slovenia)

- Cambrios Technologies Corp. (U.S.)

- CLEARink Displays, Inc. (U.S.)

- E Ink Holdings Inc. (Taiwan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global E Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global E Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global E Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.