Global E Sports Betting Market

Market Size in USD Billion

CAGR :

%

USD

2.49 Billion

USD

4.38 Billion

2024

2032

USD

2.49 Billion

USD

4.38 Billion

2024

2032

| 2025 –2032 | |

| USD 2.49 Billion | |

| USD 4.38 Billion | |

|

|

|

|

What is the Global E-Sports Betting Market Size and Growth Rate?

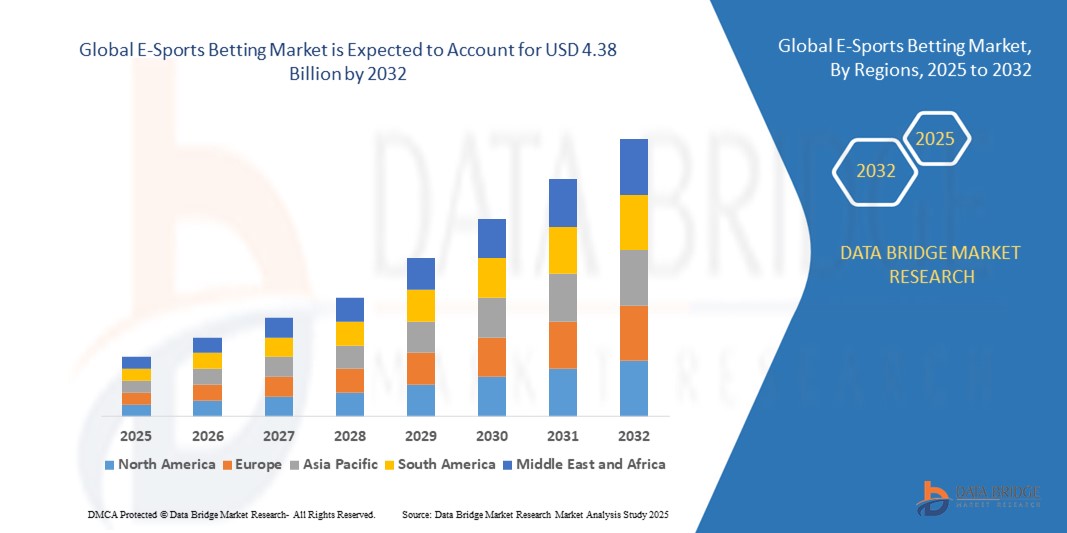

- The global E-Sports betting market size was valued at USD 2.49 billion in 2024 and is expected to reach USD 4.38 billion by 2032, at a CAGR of 7.27% during the forecast period

- E-sports betting, a rapidly growing segment within the broader gambling industry, is witnessing significant traction due to the rising popularity of e-sports tournaments and events worldwide. The global e-sports betting market is poised for robust growth, driven by factors such as increasing internet penetration, widespread adoption of smartphones, and the growing e-sports fan base

What are the Major Takeaways of E-Sports Betting Market?

- The expanding viewership and fanbase of e-sports serve as a significant driver for the global e-sports betting market. As e-sports tournaments and leagues attract a growing number of enthusiasts worldwide, the larger viewer base translates into increased engagement with e-sports betting platforms

- The rising popularity of competitive gaming events across various game genres such as MOBA, FPS, and RTS creates ample opportunities for bettors to participate in wagering on their favorite teams and players. This surge in viewership amplifies the demand for e-sports betting services and fosters a vibrant ecosystem where betting platforms can capitalize on the excitement and passion of e-sports fans to drive market growth and expansion

- North America dominated the E-Sports betting market with the largest revenue share of 37.41% in 2024, driven by the rising popularity of online gaming, increasing legalization of sports betting, and expanding digital payment infrastructure

- Asia-Pacific (APAC) E-Sports Betting market is poised to grow at the fastest CAGR of 7.21% during 2025–2032, driven by increasing internet penetration, rising disposable incomes, and a massive gaming population in countries such as China, Japan, and India

- The Real Money Betting segment dominated the E-Sports Betting market with the largest market revenue share of 61.4% in 2024, driven by increasing legalization of online betting platforms, rising participation of professional tournaments, and higher monetary rewards

Report Scope and E-Sports Betting Market Segmentation

|

Attributes |

E-Sports Betting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the E-Sports Betting Market?

Enhanced Convenience Through AI and Voice Integration

- A major and accelerating trend in the global E-Sports Betting market is the integration of artificial intelligence (AI) and voice-enabled assistants such as Amazon Alexa, Google Assistant, and Apple Siri, which are enhancing user experiences and betting convenience

- For instance, platforms are enabling hands-free bet placements and AI-driven odds suggestions, where AI analyzes past betting patterns and esports statistics to offer smarter recommendations

- Voice commands allow users to place wagers or check live odds instantly, creating seamless engagement during live esports events. This intuitive system is reshaping user expectations by blending betting with everyday digital interactions

- The integration of E-Sports Betting with broader digital ecosystems facilitates centralized entertainment management, where betting, streaming, and in-game stats can be accessed from one interface

- Companies such as Pinnacle and Bet365 are experimenting with AI-powered personalization, offering predictive betting options and real-time recommendations through digital assistants

- This trend is fundamentally reshaping how users interact with betting platforms, driving demand for intelligent, convenient, and interconnected solutions

What are the Key Drivers of E-Sports Betting Market?

- The rising popularity of esports tournaments such as League of Legends World Championship and The International is fueling betting engagement on a global scale

- In March 2024, Betway announced sponsorship of multiple esports events, strengthening its footprint and driving user acquisition through integrated betting promotions

- Growing digitalization and smartphone penetration are enabling real-time betting experiences, making esports betting accessible worldwide

- The demand for innovative engagement tools such as live-stream betting, micro-betting, and social betting communities is increasing

- Features such as instant digital payments, remote betting access, and AI-based odds analytics are further boosting adoption among both casual and professional bettors

- The rising acceptance of legalized online betting markets in regions such as the U.S., U.K., and parts of Asia is acting as a strong growth catalyst

Which Factor is Challenging the Growth of the E-Sports Betting Market?

- Cybersecurity concerns remain a significant challenge, with threats of hacking, fraudulent activities, and illegal betting platforms creating mistrust among potential users

- For instance, reports of match-fixing in esports events and fraudulent betting sites have raised alarms in 2023–24, making regulatory compliance a pressing need

- High-profile incidents of data breaches and underage gambling have also led to stricter oversight from regulators, impacting market expansion

- Addressing these risks requires robust encryption, transparent regulatory frameworks, and anti-fraud systems to protect users and platforms alike

- In addition, the lack of uniform regulation across regions poses hurdles, as betting is legal in some markets but restricted in others, limiting global scalability

- Overcoming these challenges with stronger cybersecurity, fair-play measures, and responsible gambling practices will be critical for building consumer trust and driving sustainable growth in the E-Sports Betting market

How is the E-Sports Betting Market Segmented?

The market is segmented on the basis of betting type, game type, platform, and device.

- By Betting Type

On the basis of betting type, the E-Sports Betting market is segmented into Real Money Betting, Skin Betting, and Challenge Tokens Betting. The Real Money Betting segment dominated the E-Sports Betting market with the largest market revenue share of 61.4% in 2024, driven by increasing legalization of online betting platforms, rising participation of professional tournaments, and higher monetary rewards. Real money betting is widely preferred due to its direct financial incentives and established regulatory frameworks across various countries.

The Skin Betting segment is anticipated to witness the fastest CAGR of 22.6% from 2025 to 2032, fueled by its popularity among younger demographics and its integration with in-game items that enhance the gaming experience.

- By Game Type

On the basis of game type, the E-Sports Betting market is segmented into Multiplayer Online Battle Arena (MOBA), First Person Shooter (FPS), Real-Time Strategy (RTS), Sports Simulation, Fighting, and Others. The MOBA segment held the largest market revenue share of 37.8% in 2024, driven by the dominance of global tournaments such as League of Legends World Championship and Dota 2’s The International, which attract massive audiences and high-value betting activities.

The First-Person Shooter (FPS) segment is projected to record the fastest growth of 20.9% CAGR from 2025 to 2032, supported by the rising popularity of titles such as Counter-Strike 2, Call of Duty, and Valorant in competitive betting events.

- By Platform

On the basis of platform, the E-Sports Betting market is segmented into Online Betting and Offline Betting. The Online Betting segment dominated the market with a 78.5% revenue share in 2024, attributed to the rapid digitalization of betting platforms, availability of mobile applications, and ease of access for global users. Online platforms also enable real-time odds updates, live streaming, and digital payment options, enhancing user engagement.

The Offline Betting segment is expected to grow at the fastest CAGR of 17.2% from 2025 to 2032, primarily driven by the resurgence of physical betting shops, esports arenas, and live viewing venues that promote community-driven betting experiences.

- By Device

On the basis of device, the E-Sports Betting market is segmented into Mobile and Desktop. The Mobile segment held the largest market revenue share of 64.1% in 2024, supported by the increasing penetration of smartphones, mobile betting apps, and on-the-go convenience for users. Mobile platforms also benefit from enhanced security features, push notifications, and personalized user experiences.

The Desktop segment is anticipated to witness the fastest CAGR of 18.6% from 2025 to 2032, driven by its popularity among professional bettors and heavy users who prefer larger screens, multiple betting tabs, and more detailed data analytics.

Which Region Holds the Largest Share of the E-Sports Betting Market?

- North America dominated the E-Sports betting market with the largest revenue share of 37.41% in 2024, driven by the rising popularity of online gaming, increasing legalization of sports betting, and expanding digital payment infrastructure

- Consumers in the region highly value secure platforms, fast payouts, and seamless integration with streaming services such as Twitch and YouTube Gaming

- This growth is further supported by a tech-savvy youth population, strong presence of betting operators, and favorable regulations in certain states, positioning E-Sports Betting as a mainstream entertainment option

U.S. E-Sports Betting Market Insight

U.S. E-Sports Betting market captured the largest revenue share of 81% in 2024 within North America, fueled by the rising popularity of e-sports tournaments such as League of Legends Worlds and Call of Duty League. Widespread adoption of mobile betting apps, combined with supportive state regulations, is driving growth. Moreover, the integration of betting with live-streaming platforms and the surge in sponsorship deals by top betting operators are further expanding the industry’s reach.

Europe E-Sports Betting Market Insight

Europe E-Sports Betting market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strict gambling regulations, growing e-sports fanbase, and wider acceptance of digital betting platforms. The region is seeing high adoption in countries such as Germany, the U.K., and Sweden. Consumers are drawn to secure transactions, live in-play betting, and data-driven odds, making e-sports betting a rapidly evolving sector.

U.K. E-Sports Betting Market Insight

U.K. E-Sports Betting market is anticipated to grow at a noteworthy CAGR, driven by the country’s well-established gambling infrastructure and rising e-sports tournament viewership. Concerns regarding gambling safety and regulatory compliance are encouraging operators to adopt responsible gambling practices. The U.K.’s strong online betting culture and advanced digital payment systems are expected to continue fueling growth.

Germany E-Sports Betting Market Insight

Germany E-Sports Betting market is expected to expand at a considerable CAGR, fueled by increasing awareness of e-sports as a competitive industry, growing online viewership, and stricter data protection measures. Germany’s regulatory framework emphasizes consumer safety and transparency, encouraging legal platforms over unregulated operators. Rising demand for live-stream betting and mobile-friendly applications is further accelerating adoption.

Which Region is the Fastest Growing Region in the E-Sports Betting Market?

Asia-Pacific (APAC) E-Sports Betting market is poised to grow at the fastest CAGR of 7.21% during 2025–2032, driven by increasing internet penetration, rising disposable incomes, and a massive gaming population in countries such as China, Japan, and India. Government-led initiatives promoting digital ecosystems and the region’s dominance in e-sports tournaments are boosting adoption. Moreover, affordable betting platforms, strong local operators, and cross-platform integrations are enabling wider market accessibility.

Japan E-Sports Betting Market Insight

Japan E-Sports Betting market is gaining traction due to the country’s tech-driven culture, growing e-sports viewership, and emphasis on cashless payment systems. Demand is rising for platforms that integrate with mobile wallets and e-sports live-streams. In addition, Japan’s aging population and preference for digital entertainment are fostering adoption across both casual and competitive betting audiences.

China E-Sports Betting Market Insight

China E-Sports Betting market accounted for the largest revenue share in APAC in 2024, attributed to the world’s biggest gaming community, rapid urbanization, and strong domestic platforms. The government’s smart city initiatives and high smartphone penetration are further propelling demand. China’s hosting of major e-sports tournaments and presence of leading global players and local startups ensure the country remains a dominant hub for e-sports betting expansion.

Which are the Top Companies in E-Sports Betting Market?

The E-Sports betting industry is primarily led by well-established companies, including:

- Bet365 (U.K.)

- Betway (Malta)

- Pinnacle (Curacao)

- William Hill (U.K.)

- 888 Holdings PLC (Gibraltar)

- Betsson AB (Sweden)

- Betfred (U.K.)

- Bet-at-home.com (Austria)

- GG.Bet (Curacao)

- Rivalry (Canada)

- Unikrn (U.S.)

- Luckbox (Isle of Man)

- Esports Entertainment Group (U.S.)

- Vulkanbet (Malta)

- EGB.com (Curacao)

- Pixel.bet (Malta)

- Vie.gg (Malta)

- Thunderpick (Curacao)

- Buff.bet (Cyprus)

- Cyber.bet (Curacao)

- Loot.bet (Cyprus)

- GGBook (Isle of Man)

What are the Recent Developments in Global E-Sports Betting Market?

- In December 2023, Unikrn, a leading e-sports betting platform based in the U.S., introduced its latest mobile application, designed to enhance user accessibility and deliver a seamless betting experience. The app offers real-time betting, live streaming of e-sports matches, and personalized recommendations tailored to user preferences. This launch underscores the platform’s commitment to meeting the rising demand for mobile betting solutions

- In October 2023, Rivalry, a Canadian e-sports betting platform, entered into a strategic partnership with prominent e-sports organizations to sponsor major tournaments and events. This collaboration strengthens Rivalry’s brand visibility, attracts new users, and supports the broader growth of the e-sports betting ecosystem. The move highlights the increasing synergy between betting platforms and e-sports communities

- In April 2023, VideoVerse, a video editing SaaS provider, completed the acquisition of Reely.ai, an AI-powered content creation company, to strengthen its capabilities in delivering advanced AI-driven solutions. This acquisition enhances VideoVerse’s ability to cater to the evolving content needs of its global customers. The deal marks a significant step in expanding the company’s technological footprint

- In April 2023, NODWIN Gaming acquired a 51% stake in Branded, a Singapore-based live media company, aiming to broaden its gaming and e-sports ecosystem across global markets and sponsors. This acquisition enables NODWIN to expand its international network and strengthen its influence in the gaming industry. The move reflects the company’s ambition to scale operations globally

- In February 2023, Nvidia and Microsoft announced a collaboration to integrate Xbox PC games into NVIDIA’s GeForce Now cloud gaming platform, expanding the accessibility of titles, including those from Activision Blizzard. This partnership significantly boosts the presence of Xbox games in the cloud ecosystem. The initiative reinforces both companies’ strategies to strengthen their positions in the cloud gaming market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.