Global E Tailing Solutions Market

Market Size in USD Billion

CAGR :

%

USD

4.79 Billion

USD

12.22 Billion

2025

2033

USD

4.79 Billion

USD

12.22 Billion

2025

2033

| 2026 –2033 | |

| USD 4.79 Billion | |

| USD 12.22 Billion | |

|

|

|

|

What is the Global E-Tailing Solutions Market Size and Growth Rate?

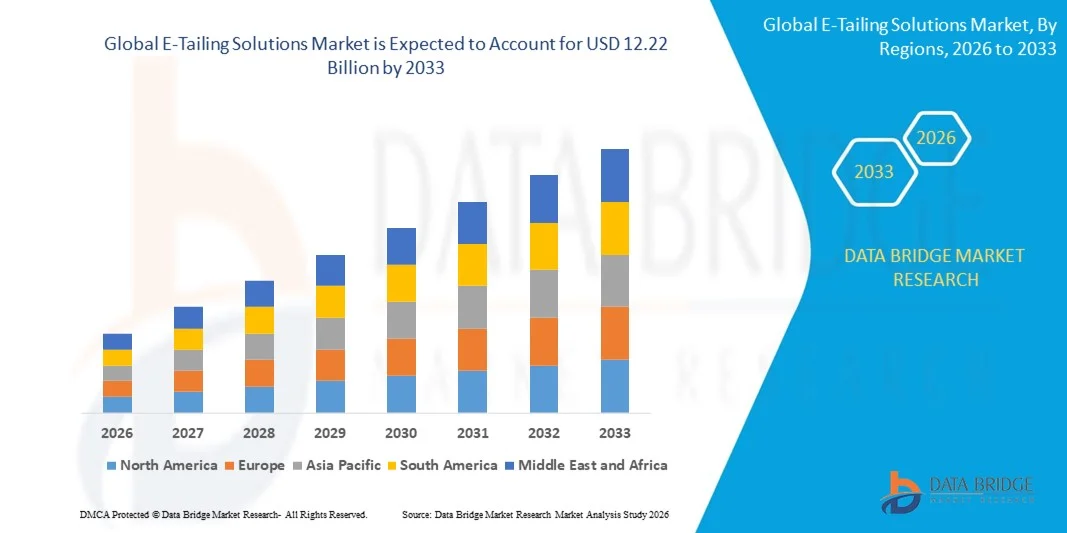

- The global e-tailing solutions market size was valued at USD 4.79 billion in 2025 and is expected to reach USD 12.22 billion by 2033, at a CAGR of12.40% during the forecast period

- The rapid internet proliferation across the globe has been directly influencing the growth of e-tailing solutions market

- Also, the constant advancements and developments of e-commerce platforms integrated with technologies such as artificial intelligence, machine learning and analytics are also flourishing the growth of thee-tailing solutions market

What are the Major Takeaways of E-Tailing Solutions Market?

- The rising preference for online shopping by consumers is also positively impacting the growth of the market

- Furthermore, the ever-increasing consumer spending over internet to purchase the products or services is also acting as an active growth driver towards the growth of thee-tailing solutions market

- Moreover, due to the rising importance of e-tailing, many brick and mortar retailer’s preferring e-tailing platform to capture online sales is creating a huge demand for e-tailing solutions as well as lifting the growth of the e-tailing solutions market

- North America dominated the e-tailing solutions market with a 35.35% revenue share in 2025, driven by the strong presence of leading e-commerce platforms, advanced digital infrastructure, high internet penetration, and widespread adoption of online shopping across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rapid growth in online retail, expanding middle-class population, increasing smartphone usage, and widespread adoption of digital payments across China, Japan, India, South Korea, and Southeast Asia

- The Solutions segment dominated the market with a 68.4% revenue share in 2025, driven by rising demand for high-density racks, cable-optimized structures, tool-less designs, PDUs, and mounting accessories essential for modern data centre buildouts

Report Scope and E-Tailing Solutions Market Segmentation

|

Attributes |

E-Tailing Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the E-Tailing Solutions Market?

Rapid Shift Toward Omnichannel, AI-Driven, and Cloud-Based E-Tailing Solutions

- The E-Tailing Solutions market is witnessing strong adoption of cloud-native, scalable, and mobile-optimized platforms that support seamless online shopping, order management, and digital payments

- Vendors are integrating AI, machine learning, and analytics to enable personalized recommendations, dynamic pricing, customer behavior tracking, and demand forecasting

- Growing preference for headless commerce, API-based integrations, and SaaS models is allowing retailers to deploy flexible and faster go-to-market e-commerce solutions

- For instance, companies such as Shopify, Salesforce, Adobe, SAP, and Oracle are enhancing their e-tailing platforms with AI-powered personalization, omnichannel fulfillment, and real-time analytics

- Increasing focus on mobile commerce, social commerce, and cross-border e-commerce is accelerating adoption among SMEs and large enterprises

- As digital retail becomes more experience-driven and data-centric, E-Tailing Solutions will remain critical for scalability, customer engagement, and revenue optimization

What are the Key Drivers of E-Tailing Solutions Market?

- Rapid growth in online shopping, mobile payments, and digital consumer engagement is driving adoption of advanced e-tailing platforms

- For instance, in 2024–2025, leading providers such as Amazon, Shopify, and Salesforce expanded AI-based recommendation engines and omnichannel capabilities

- Rising penetration of smartphones, high-speed internet, and digital wallets across the U.S., Europe, and Asia-Pacific is boosting e-commerce activity

- Increasing demand for cost-effective, scalable, and cloud-based retail solutions supports adoption among SMEs

- Growth of cross-border trade, D2C brands, and subscription-based commerce models further fuels market demand

- Supported by continuous innovation in cloud computing, AI, and digital payments, the E-Tailing Solutions market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the E-Tailing Solutions Market?

- High implementation and integration costs of advanced e-tailing platforms limit adoption among small retailers

- For instance, during 2024–2025, rising cloud service costs and cybersecurity investments increased operational expenses for e-commerce providers

- Data privacy regulations, cybersecurity risks, and payment fraud pose significant operational challenges

- Intense competition among platform providers leads to pricing pressure and reduced differentiation

- Complexity in integrating legacy systems with modern omnichannel platforms slows digital transformation

- To overcome these challenges, vendors are focusing on modular platforms, enhanced security features, AI-driven automation, and flexible pricing models to expand global adoption of E-Tailing Solutions

How is the E-Tailing Solutions Market Segmented?

The market is segmented on the basis of solution, business model, and end user.

- By Solution

On the basis of solution, the e-tailing solutions market is segmented into E-Commerce Platform, E-Commerce APIs, and Services. The E-Commerce Platform segment dominated the market with an estimated 46.3% share in 2025, as it serves as the core infrastructure for online storefronts, order management, inventory control, and payment processing. These platforms are widely adopted by retailers due to their scalability, user-friendly interfaces, integrated analytics, and support for omnichannel commerce. Growing adoption among SMEs and large enterprises, along with SaaS-based deployment models, further strengthens this segment’s dominance.

The E-Commerce APIs segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for headless commerce, modular architecture, and seamless integration with third-party applications such as CRM, ERP, logistics, and digital payment systems. Increasing customization requirements and rapid innovation cycles are accelerating API adoption.

- By Business Models

On the basis of business model, the market is segmented into B2B, B2C, C2B, and C2C E-Tailing Solutions. The Business-to-Consumer (B2C) segment dominated the market with a 52.7% share in 2025, supported by rapid growth in online retail, mobile commerce, digital payments, and direct-to-consumer (D2C) brands. High consumer preference for convenience, wide product availability, and personalized shopping experiences drives strong adoption of B2C platforms globally. Major online retailers and marketplaces continue to invest heavily in AI-driven personalization, logistics optimization, and customer engagement tools.

The Business-to-Business (B2B) segment is projected to register the fastest CAGR from 2026 to 2033, driven by digital transformation of wholesale trade, rising adoption of e-procurement platforms, and increasing use of online channels for bulk purchasing, supplier management, and cross-border trade.

- By End User

On the basis of end user, the e-tailing solutions market is segmented into Food and Beverages, Fashion and Apparel, Health and Beauty, Electronics, Automotive, Home and Furniture, and Others. The Fashion and Apparel segment dominated the market with a 34.9% share in 2025, driven by high online purchase frequency, strong influence of social commerce, and widespread adoption of mobile shopping applications. Features such as virtual try-ons, personalized recommendations, flexible returns, and influencer-driven marketing significantly support growth in this segment.

The Food and Beverages segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rapid expansion of online grocery platforms, quick commerce models, subscription-based deliveries, and increasing consumer preference for home delivery and contactless shopping. Rising urbanization and digital payment adoption further accelerate segment growth.

Which Region Holds the Largest Share of the E-Tailing Solutions Market?

- North America dominated the e-tailing solutions market with a 35.35% revenue share in 2025, driven by the strong presence of leading e-commerce platforms, advanced digital infrastructure, high internet penetration, and widespread adoption of online shopping across the U.S. and Canada. High consumer spending power, mature logistics networks, digital payment adoption, and omnichannel retail strategies continue to fuel demand for E-Tailing Solutions across retail, electronics, fashion, grocery, and consumer goods sectors

- Leading companies in North America are investing heavily in AI-driven personalization, cloud-based commerce platforms, data analytics, and automation tools, strengthening the region’s technological leadership. Continuous innovation in customer experience, fulfillment optimization, and cybersecurity supports long-term market growth

- A strong startup ecosystem, skilled workforce, and sustained investment in digital commerce technologies further reinforce North America’s market dominance

U.S. E-Tailing Solutions Market Insight

The U.S. is the largest contributor in North America, supported by a highly developed e-commerce ecosystem, rapid adoption of mobile commerce, and strong presence of global online retailers and marketplaces. Increasing use of AI, machine learning, voice commerce, and same-day delivery services is accelerating demand for advanced E-Tailing Solutions. Strong consumer trust in digital payments and subscription-based shopping models further drives market expansion.

Canada E-Tailing Solutions Market Insight

Canada contributes significantly to regional growth, driven by rising online retail penetration, cross-border e-commerce activity, and growing adoption of cloud-based commerce platforms. Retailers increasingly leverage E-Tailing Solutions to enhance customer engagement, streamline logistics, and support omnichannel strategies, supported by favorable digital policies and infrastructure.

Asia-Pacific E-Tailing Solutions Market

Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rapid growth in online retail, expanding middle-class population, increasing smartphone usage, and widespread adoption of digital payments across China, Japan, India, South Korea, and Southeast Asia. High growth in fashion, electronics, grocery, and social commerce is significantly boosting demand for scalable E-Tailing Solutions.

China E-Tailing Solutions Market Insight

China is the largest contributor to Asia-Pacific due to its massive e-commerce user base, strong domestic platforms, and advanced digital payment ecosystems. Continuous innovation in live commerce, AI-driven recommendations, and logistics automation drives strong adoption of advanced E-Tailing Solutions.

Japan E-Tailing Solutions Market Insight

Japan shows steady growth supported by high internet penetration, strong consumer trust, and advanced logistics infrastructure. Demand for secure, reliable, and high-quality E-Tailing Solutions remains strong, particularly across electronics, fashion, and specialty retail segments.

India E-Tailing Solutions Market Insight

India is emerging as a major growth hub, driven by rapid smartphone adoption, expanding internet access, and government-led digital initiatives. Growth in online marketplaces, quick commerce, and D2C brands is accelerating adoption of flexible and scalable E-Tailing Solutions.

South Korea E-Tailing Solutions Market Insight

South Korea contributes significantly due to high digital literacy, advanced mobile commerce adoption, and strong demand for fast delivery services. Innovation in AI, data analytics, and customer engagement tools continues to support sustained growth of the E-Tailing Solutions market.

Which are the Top Companies in E-Tailing Solutions Market?

The e-tailing solutions industry is primarily led by well-established companies, including:

- Shopify (Canada)

- Salesforce (U.S.)

- Oracle (U.S.)

- Digital River, Inc. (U.S.)

- BigCommerce Pty. Ltd. (Australia)

- Adobe (U.S.)

- eComchain (U.S.)

- Elastic Path Software Inc. (Canada)

- VTEX (U.K.)

- Sitecore (U.S.)

- Skava (U.S.)

- Kentico Software (Czech Republic)

- SAP SE (Germany)

- Wix (Israel)

- Amazon (U.S.)

- eBay Inc. (U.S.)

- Dell Inc. (U.S.)

- Walmart Inc. (U.S.)

- ZDNET (U.S.)

- Staples, Inc. (U.S.)

What are the Recent Developments in Global E-Tailing Solutions Market?

- In August 2025, AutoZone implemented artificial intelligence across its customer service and inventory management operations to enhance service efficiency and streamline stock management, a move aimed at strengthening its competitive position in the automotive aftermarket sector and supporting long-term operational scalability

- In June 2024, Oracle and Shopify expanded their collaboration to deliver data-driven, integrated commerce solutions that enable real-time personalized shopping experiences and AI-powered recommendations, a partnership designed to boost customer engagement and improve conversion rates for joint customers

- In June 2023, BigCommerce enhanced its multi-storefront capabilities to help merchants seamlessly sell across regions, languages, and currencies, an upgrade aimed at supporting global expansion and improving omnichannel commerce efficiency

- In March 2023, Shopify Inc. introduced Shopify Payments to provide improved point-of-sale and payment processing tools for e-commerce businesses, reinforcing its platform ecosystem and simplifying transaction management for merchants worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global E Tailing Solutions Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global E Tailing Solutions Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global E Tailing Solutions Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.