Global E Tree Metro Ethernet Services Market

Market Size in USD Billion

CAGR :

%

USD

6.43 Billion

USD

9.73 Billion

2024

2032

USD

6.43 Billion

USD

9.73 Billion

2024

2032

| 2025 –2032 | |

| USD 6.43 Billion | |

| USD 9.73 Billion | |

|

|

|

|

E-Tree Metro Ethernet Services Market Size

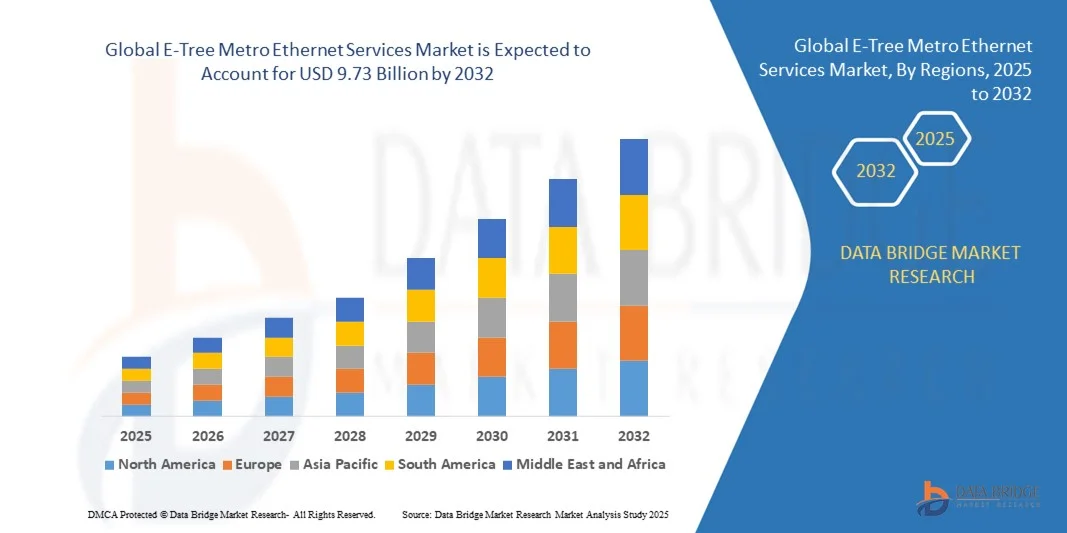

- The global e-tree metro ethernet services market size was valued at USD 6.43 billion in 2024 and is expected to reach USD 9.73 billion by 2032, at a CAGR of 5.32% during the forecast period

- The market growth is largely fueled by the increasing adoption of high-speed, low-latency connectivity solutions by enterprises and service providers, driven by digital transformation, cloud migration, and the need for reliable multi-site networking. The technological advancement in Ethernet services, including enhanced bandwidth scalability and SLA-backed performance, is accelerating deployment across commercial, industrial, and wholesale segments

- Furthermore, rising demand for secure, flexible, and cost-efficient Ethernet connectivity is establishing E-Tree services as the preferred choice for enterprise and telecom networks. Organizations increasingly prioritize predictable performance, easy scalability, and integration with managed IT services, which, combined with expanding data center and cloud infrastructure, is significantly boosting market growth

E-Tree Metro Ethernet Services Market Analysis

- E-Tree Metro Ethernet services, offering dedicated and switched point-to-point or point-to-multipoint connectivity, are becoming critical for enterprises seeking reliable communication between branches, data centers, and cloud platforms. The market is being driven by enterprises’ requirements for high-performance, low-latency networking solutions, growing reliance on digital applications, and the expansion of smart city and IoT initiatives

- The escalating demand is primarily fueled by the proliferation of cloud computing, IoT adoption, and the need for robust, secure connectivity in sectors such as BFSI, healthcare, IT, and manufacturing. Service providers’ continuous investment in next-generation network infrastructure and Ethernet service enhancements is further propelling the adoption of E-Tree Metro Ethernet services

- North America dominated the e-tree metro ethernet services market with a share of 41.7% in 2024, due to strong enterprise digital transformation initiatives and increasing demand for high-speed, reliable connectivity

- Asia-Pacific is expected to be the fastest growing region in the e-tree metro ethernet services market during the forecast period due to rising digitalization, expanding enterprise networks, and increasing investment in telecom infrastructure in countries such as China, Japan, and India

- Retail/enterprise segment dominated the market with a market share of 68% in 2024, due to the growing demand from SMEs and large organizations for reliable, high-speed connectivity to support cloud applications, unified communications, and digital transformation initiatives. Enterprises increasingly prefer E-Tree services for dedicated bandwidth, predictable performance, and easy scalability, which are critical for mission-critical operations. The segment also benefits from rising adoption of hybrid work models, requiring robust connectivity across multiple locations

Report Scope and E-Tree Metro Ethernet Services Market Segmentation

|

Attributes |

E-Tree Metro Ethernet Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

E-Tree Metro Ethernet Services Market Trends

Adoption of Cloud-Based Multi-Site Networking

- The E-Tree Metro Ethernet services market is expanding as enterprises increasingly adopt cloud-based multi-site networking to enhance operational flexibility, reduce latency, and improve centralized data management. E-Tree architectures support point-to-multipoint connectivity, allowing seamless communication between a central office and multiple branch locations through a unified, high-speed network

- For instance, Verizon Business has implemented E-Tree Metro Ethernet solutions integrated with cloud connectivity, enabling enterprises to link distributed offices and data centers under a single network management framework. Similarly, Orange Business Services offers E-Tree network designs that simplify centralized data exchange for clients managing widespread digital infrastructures

- Enterprises adopting hybrid and multi-cloud strategies find E-Tree services critical for securely connecting central data centers with multiple remote nodes. This setup supports efficient cloud workload management, enhanced traffic segregation, and improved reliability for mission-critical applications operating across geographically dispersed locations

- The rapid shift toward digital transformation and IoT integration within enterprise settings is amplifying demand for cloud-compatible E-Tree networks. These networks facilitate dynamic resource allocation, bandwidth optimization, and real-time monitoring through centralized control points, ensuring consistent performance across all endpoints

- Advancements in network virtualization and software-defined networking (SDN) are further enabling enterprises to modernize their E-Tree architectures. These technologies reduce operational complexities while increasing network agility, supporting remote access and scalable connectivity essential for evolving IT environments

- The growing adoption of cloud-based multi-site networking underscores E-Tree’s strategic importance in connecting decentralized infrastructures. As enterprises pursue higher mobility, data security, and efficiency, E-Tree Metro Ethernet services are emerging as a vital component for next-generation network transformation initiatives

E-Tree Metro Ethernet Services Market Dynamics

Driver

Rising Demand for High-Speed, Secure Connectivity

- The increasing need for reliable and secure high-speed connectivity across distributed enterprise networks is driving demand for E-Tree Metro Ethernet services. Organizations seek to connect central repositories with multiple remote offices while maintaining strong performance, security, and ease of management

- For instance, AT&T offers E-Tree network solutions that provide enterprises with scalable and secure connections between a hub site and various branch offices. This allows businesses to centralize access to critical data and applications while maintaining isolation and encryption across traffic flows

- E-Tree services enable high-speed data transmission over metropolitan area networks, supporting bandwidth-intensive activities such as enterprise cloud integration, data backup, and video collaboration. Their symmetric upload and download capabilities ensure efficient resource sharing without performance degradation across user sites

- The rising need to maintain regulatory compliance and safeguard sensitive enterprise data has increased the preference for private Metro Ethernet solutions. E-Tree’s inherent traffic separation between sites improves network security while allowing centralized IT policy enforcement

- With enterprises demanding predictable performance and low-latency access to centralized applications, E-Tree networks are becoming an integral part of corporate IT infrastructure. Their scalability and robust architecture ensure they remain a critical enabler for secure, high-throughput communications across widely distributed business ecosystems

Restraint/Challenge

High Infrastructure Costs and Complex Deployments

- High infrastructure development costs and the complexity of deploying large-scale E-Tree architectures present significant challenges to market growth. Establishing high-speed point-to-multipoint metro connections requires substantial investment in fiber networks, network equipment, and configuration resources

- For instance, service providers such as Lumen Technologies and British Telecom face substantial capital expenditures while expanding their E-Tree service capabilities due to construction costs, hardware upgrades, and adherence to metropolitan cabling regulations. These costs can limit market expansion into mid-sized business segments with constrained budgets

- Complexity arises in configuring E-Tree topologies that maintain optimal traffic segregation between client endpoints while ensuring consistent quality of service. Achieving network redundancy and fault tolerance requires advanced design expertise, increasing operational overhead for service providers

- Geographical constraints and diverse regional regulations can delay deployment, especially in areas lacking reliable fiber infrastructure or where municipal access permits are restrictive. This adds layers of logistical, financial, and administrative complexity to implementation timelines

- To mitigate these challenges, operators are focusing on adopting virtualization, shared infrastructure approaches, and automation tools to reduce deployment costs and improve manageability. Successful adoption of these strategies will be key to extending E-Tree Metro Ethernet services to a broader range of enterprise customers while maintaining economic sustainability

E-Tree Metro Ethernet Services Market Scope

The market is segmented on the basis of category, service type, port speed, and parameter.

- By Category

On the basis of category, the E-Tree Metro Ethernet Services market is segmented into Retail/Enterprise and Wholesale/Access. The Retail/Enterprise segment dominated the market with the largest revenue share of 68% in 2024, driven by the growing demand from SMEs and large organizations for reliable, high-speed connectivity to support cloud applications, unified communications, and digital transformation initiatives. Enterprises increasingly prefer E-Tree services for dedicated bandwidth, predictable performance, and easy scalability, which are critical for mission-critical operations. The segment also benefits from rising adoption of hybrid work models, requiring robust connectivity across multiple locations.

The Wholesale/Access segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by telecom operators and service providers expanding their network infrastructure to offer managed Ethernet solutions to multiple clients. The growing need for cost-efficient bandwidth provisioning and the ability to aggregate services for multiple end-users is driving adoption. Wholesale/Access services also provide operators with the flexibility to customize bandwidth and service levels according to customer requirements, further propelling market growth.

- By Service Type

On the basis of service type, the market is segmented into Dedicated and Switched services. The Dedicated segment held the largest market revenue share in 2024, owing to its guaranteed bandwidth and predictable performance, which are essential for latency-sensitive applications such as video conferencing, enterprise data transfer, and financial transactions. Dedicated services are preferred by enterprises seeking secure, point-to-point connectivity with consistent quality of service and minimal downtime. The reliability and ease of SLA management further enhance the adoption of dedicated E-Tree Ethernet services.

The Switched segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its flexibility, scalability, and cost-efficiency for organizations that do not require constant maximum bandwidth. Switched services enable dynamic bandwidth allocation based on traffic demand, allowing service providers and end-users to optimize network resources. The growing adoption of cloud-based applications and multi-tenant setups is contributing to the rising popularity of switched Ethernet solutions.

- By Port Speed

On the basis of port speed, the market is segmented into 10 Mbps, 100 Mbps, 1 GigE, and 100 Gbps. The 1 GigE segment dominated the market with the largest revenue share in 2024, driven by its balance of high performance and cost-effectiveness for enterprise connectivity. Gigabit speeds are widely adopted for applications such as enterprise networking, data centers, and video streaming, where reliable throughput and low latency are critical. Service providers increasingly offer 1 GigE ports as a standard for retail and enterprise customers, ensuring compatibility with existing network equipment and growing digital workloads.

The 100 Gbps segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the surge in data-intensive applications, cloud migration, and large-scale enterprise networks. As organizations adopt high-bandwidth services for AI, big data analytics, and hyperscale cloud infrastructure, demand for ultra-high-speed Ethernet ports is increasing. Service providers are investing in next-generation infrastructure to accommodate these high-speed requirements, driving market expansion.

- By Parameter

On the basis of parameter, the market is segmented into Ethernet Physical Interface Attribute, Traffic Parameters, Performance Parameters, Class of Service Parameters, Service Frame Delivery Attribute, VLAN Tag Support Attribute, Service Multiplexing Attribute, Bundling Attribute, and Security Filters Attribute. The Performance Parameters segment dominated the market with the largest revenue share in 2024, driven by enterprises’ focus on predictable latency, packet loss minimization, and end-to-end service reliability. High-performance E-Tree services are critical for mission-critical applications, financial services, and cloud-based operations that rely on stringent SLA compliance.

The Security Filters Attribute segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising need for secure connectivity amid increasing cyber threats and data privacy regulations. Service providers are enhancing E-Tree services with advanced security features such as traffic filtering, VLAN segregation, and access control mechanisms to protect enterprise networks. The growing awareness of network security and regulatory compliance requirements is driving accelerated adoption of security-focused Ethernet services.

E-Tree Metro Ethernet Services Market Regional Analysis

- North America dominated the e-tree metro ethernet services market with the largest revenue share of 41.7% in 2024, driven by strong enterprise digital transformation initiatives and increasing demand for high-speed, reliable connectivity

- Businesses and service providers in the region are adopting E-Tree services to support cloud applications, unified communications, and multi-site networking

- The widespread deployment is further supported by advanced telecom infrastructure, high technology adoption rates, and strong IT budgets, establishing E-Tree services as a preferred solution for both enterprise and wholesale connectivity needs

U.S. E-Tree Metro Ethernet Services Market Insight

The U.S. captured the largest market revenue share in North America in 2024, fueled by growing cloud adoption, data center expansions, and enterprise networking requirements. Organizations are increasingly prioritizing reliable, scalable, and low-latency Ethernet services for mission-critical applications. The trend of hybrid workplaces and the rising demand for secure point-to-point and multipoint connectivity further bolster market growth. Service providers are enhancing offerings with performance guarantees, SLA-backed services, and integration with managed IT solutions, accelerating the adoption of E-Tree services.

Europe E-Tree Metro Ethernet Services Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory requirements for secure and reliable connectivity and the growing need for high-performance networking in enterprises. Increasing urbanization, coupled with cloud migration and digital transformation initiatives, is fostering the adoption of E-Tree services. Enterprises in Europe are also seeking flexible bandwidth provisioning, predictable performance, and cost-efficient networking solutions, driving growth in both retail and wholesale segments.

U.K. E-Tree Metro Ethernet Services Market Insight

The U.K. market is expected to grow at a noteworthy CAGR during the forecast period, driven by the adoption of advanced networking solutions in enterprises, telecom expansions, and demand for secure, scalable connectivity. The strong presence of financial services, IT companies, and e-commerce businesses necessitates reliable Ethernet services. The U.K.’s focus on digital infrastructure upgrades, 5G backhaul integration, and cloud adoption continues to stimulate market expansion.

Germany E-Tree Metro Ethernet Services Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by industrial digitization, IoT adoption, and increasing reliance on high-speed, low-latency networks. Germany’s well-developed infrastructure and emphasis on Industry 4.0 and smart manufacturing promote the adoption of E-Tree Metro Ethernet services. Enterprises are increasingly deploying dedicated and high-speed switched services to enhance operational efficiency and network performance.

Asia-Pacific E-Tree Metro Ethernet Services Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2025–2032, driven by rising digitalization, expanding enterprise networks, and increasing investment in telecom infrastructure in countries such as China, Japan, and India. The region’s growing cloud adoption, enterprise modernization initiatives, and government-backed smart city programs are accelerating the adoption of E-Tree services. The presence of cost-competitive service providers and rapid urbanization are also contributing to widespread deployment across retail and wholesale segments.

Japan E-Tree Metro Ethernet Services Market Insight

The Japan market is gaining momentum due to the country’s advanced IT infrastructure, strong enterprise connectivity requirements, and adoption of digital transformation initiatives. Japanese organizations are increasingly leveraging high-speed Ethernet services for cloud, IoT, and industrial automation applications. The trend of integrating Ethernet services with managed IT solutions and network optimization tools is fueling market growth, especially among manufacturing and technology sectors.

China E-Tree Metro Ethernet Services Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding data centers, and growing enterprise networking demands. The country’s push for smart cities, cloud adoption, and high-speed connectivity across commercial and industrial sectors is boosting E-Tree service deployment. Local service providers offering scalable, cost-effective solutions, combined with rising digital enterprise initiatives, are key factors propelling market growth in China.

E-Tree Metro Ethernet Services Market Share

The e-tree metro ethernet services industry is primarily led by well-established companies, including:

- Amdocs (U.S.)

- Cogent Communications, Inc. (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Fujitsu Network Communications Inc. (U.S.)

- Lumen Technologies (U.S.)

- Ciena Corporation (U.S.)

- Netcracker Technology (U.S.)

- NewWave Communications (U.S.)

- AT&T Intellectual Property (U.S.)

- Charter Communications Inc. (U.S.)

- Comcast Corporation (U.S.)

- Verizon Communications Inc. (U.S.)

- Proximus (Belgium)

- Colt Technology Services Group Limited (U.K.)

- Deutsche Telekom AG (Germany)

- euNetworks (U.K.)

- KPN International (Netherlands)

- Swisscom (Switzerland)

- Tata Communications (India)

- Telefónica S.A. (Spain)

- Telia Company (Sweden)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.