Global Ear Tube Devices Market

Market Size in USD Million

CAGR :

%

USD

90.50 Million

USD

110.26 Million

2025

2033

USD

90.50 Million

USD

110.26 Million

2025

2033

| 2026 –2033 | |

| USD 90.50 Million | |

| USD 110.26 Million | |

|

|

|

|

Ear Tube Devices Market Size

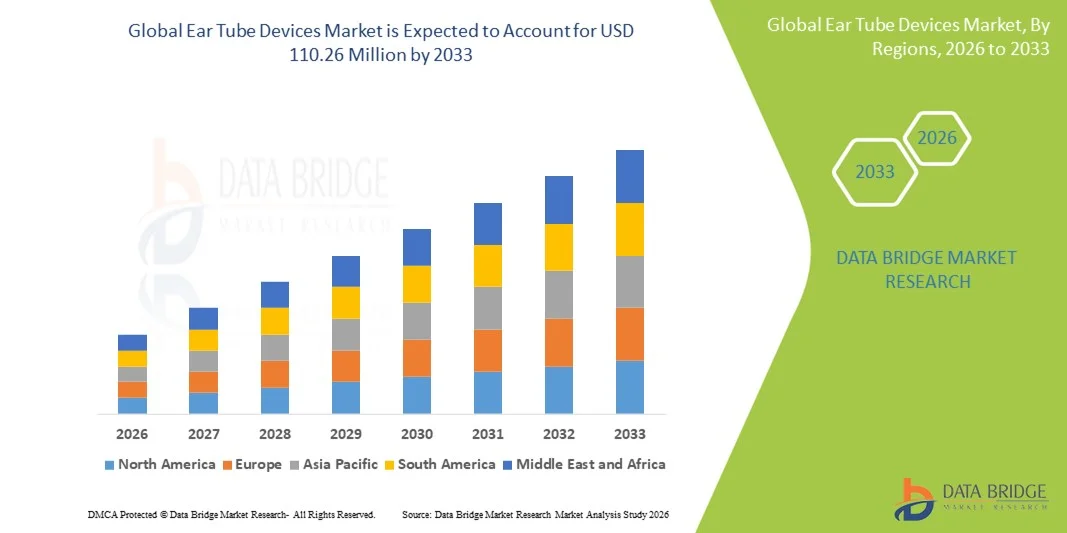

- The global Ear tube devices market size was valued at USD 90.50 Million in 2025 and is expected to reach USD 110.26 Million by 2033, at a CAGR of 2.50% during the forecast period

- The market growth is largely fueled by the rising prevalence of otitis media, recurrent ear infections, and hearing-related disorders, particularly among pediatric and geriatric populations, along with increasing awareness regarding early diagnosis and timely surgical intervention, leading to higher adoption of ear tube placement procedures across hospitals and specialty clinics

- Furthermore, growing advancements in minimally invasive ENT procedures, improvements in ear tube materials and designs, and expanding access to specialized otolaryngology care in both developed and emerging regions are accelerating the uptake of Ear Tube Devices solutions, thereby significantly boosting the industry’s growth

Ear Tube Devices Market Analysis

- Ear tube devices, used primarily in the treatment of recurrent otitis media and chronic middle-ear effusion, are increasingly vital components of modern otolaryngology care across pediatric and adult populations due to their effectiveness in improving ventilation of the middle ear and preventing hearing loss

- The escalating demand for ear tube devices is primarily fueled by the rising prevalence of ear infections among children, growing awareness of early ENT interventions, advancements in minimally invasive surgical techniques, and increasing access to specialized ENT services globally

- North America dominated the ear tube devices market with the largest revenue share of 38.6% in 2025, supported by a high diagnosis rate of otitis media, strong healthcare infrastructure, favorable reimbursement policies, and widespread adoption of advanced ENT surgical procedures, with the U.S. accounting for the majority of regional demand

- Asia-Pacific is expected to be the fastest-growing region in the ear tube devices market during the forecast period, registering a projected CAGR of 7.9%, driven by a large pediatric population, improving healthcare access, increasing awareness of hearing health, and rising healthcare expenditure across countries such as China and India

- The Silicon segment dominated the largest market revenue share of 38.6% in 2025, driven by its excellent biocompatibility, flexibility, and long-standing clinical acceptance in otolaryngology procedures

Report Scope and Ear Tube Devices Market Segmentation

|

Attributes |

Ear Tube Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Medtronic (Ireland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Ear Tube Devices Market Trends

Rising Adoption of Minimally Invasive ENT Procedures

- A significant and accelerating trend in the global ear tube devices market is the growing preference for minimally invasive otolaryngology (ENT) procedures, particularly for the treatment of chronic otitis media and recurrent ear infections in pediatric and geriatric populations. Advances in device design have improved procedural safety, reduced recovery time, and enhanced patient comfort

- For instance, in March 2024, Olympus Corporation introduced advanced tympanostomy tube placement tools designed to support minimally invasive ear procedures, enabling ENT specialists to perform faster and more precise interventions in outpatient settings. Such developments are reinforcing the shift toward minimally invasive ear tube insertion techniques

- Technological improvements in ear tube materials, including biocompatible silicone and fluoroplastic polymers, are reducing complications such as tube blockage and premature extrusion. These material innovations improve long-term outcomes and reduce the need for repeat procedures

- The growing use of office-based and ambulatory surgical centers for ear tube insertion is further supporting this trend. Minimally invasive techniques allow procedures to be completed without general anesthesia in selected patient groups, lowering overall treatment costs

- Increased awareness among parents and caregivers regarding early intervention for middle ear infections is driving higher procedural volumes. Physicians increasingly recommend early tympanostomy to prevent hearing loss and speech development delays in children

- As a result, manufacturers are focusing on developing next-generation ear tube devices that support precision placement, improved durability, and reduced post-operative complications, strengthening long-term market growth

Ear Tube Devices Market Dynamics

Driver

High Prevalence of Otitis Media and Pediatric Hearing Disorders

- The rising incidence of otitis media, particularly among children under five years of age, is a major driver fueling demand for ear tube devices globally. Recurrent middle ear infections and persistent fluid buildup often necessitate tympanostomy tube placement to restore hearing and prevent long-term complications

- For instance, according to data published by the Centers for Disease Control and Prevention (CDC) in 2024, nearly 80% of children in the U.S. experience at least one episode of otitis media by the age of three, significantly increasing the clinical demand for ear tube insertion procedures. This high disease burden directly supports market expansion

- Pediatric populations represent the largest patient group undergoing ear tube procedures, driven by increased diagnosis rates and routine hearing screening programs. Early detection initiatives are accelerating treatment adoption

- In addition, aging populations are contributing to market growth, as elderly patients are more prone to ear infections, Eustachian tube dysfunction, and hearing impairment requiring surgical intervention

- Improvements in healthcare infrastructure, especially in emerging economies, are expanding access to ENT specialists and surgical care, further driving procedure volumes

- Increased insurance coverage and reimbursement for ear tube placement procedures in developed markets are also supporting higher adoption rates, strengthening overall market demand

Restraint/Challenge

Risk of Post-Procedure Complications and Cost Sensitivity

- Despite strong demand, the Ear Tube Devices market faces challenges related to potential post-procedure complications such as otorrhea, tympanic membrane scarring, and tube extrusion, which can affect patient outcomes and caregiver confidence

- For instance, clinical studies published in 2023 highlighted that approximately 10–15% of pediatric patients experience post-tympanostomy ear discharge, leading to follow-up treatments and increased healthcare costs. Such outcomes can restrain adoption in cost-sensitive populations

- Concerns regarding repeat procedures due to tube blockage or early extrusion increase the financial burden on healthcare systems and families, particularly in regions with limited insurance coverage

- In low- and middle-income countries, limited access to specialized ENT care and surgical facilities restricts the widespread adoption of ear tube devices

- In addition, cost sensitivity remains a key challenge, as advanced ear tube devices made from premium materials may be unaffordable for certain healthcare providers and patients

- Overcoming these challenges will require continued innovation in device design, improved patient education, better post-operative care protocols, and the development of cost-effective ear tube solutions to ensure sustained market growth

Ear Tube Devices Market Scope

The Global Ear Tube Devices market is segmented on the basis of material and end users.

- By Material

On the basis of material, the Global Ear Tube Devices market is segmented into Fluoroplastics, Phosphorylcholine (PC), Silicon, Polyethylene, Titanium, Ultrasil, Stainless Steel, and Micron. The Silicon segment dominated the largest market revenue share of 38.6% in 2025, driven by its excellent biocompatibility, flexibility, and long-standing clinical acceptance in otolaryngology procedures. Silicon ear tubes are widely preferred by surgeons due to their soft texture, reduced risk of tissue irritation, and lower incidence of post-operative complications. These tubes offer optimal balance between durability and patient comfort, making them suitable for both pediatric and adult patients. Their cost-effectiveness compared to advanced coated or metallic alternatives further supports widespread adoption, especially in high-volume procedures. Additionally, silicon tubes demonstrate reliable performance across varying patient anatomies and clinical settings. Strong availability, regulatory approvals, and extensive clinical data reinforce physician confidence. As a result, silicon remains the material of choice across hospitals and ENT clinics globally, sustaining its leadership position in the market.

The Phosphorylcholine (PC) segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, driven by increasing demand for advanced, infection-resistant ear tube materials. PC-coated ear tubes are designed to mimic natural cell membranes, significantly reducing bacterial adhesion and biofilm formation. This makes them particularly attractive in patients with recurrent otitis media and higher risk of post-surgical infections. Growing awareness among ENT specialists regarding improved long-term outcomes is accelerating adoption. Technological advancements and rising R&D investments by medical device manufacturers further support growth. Although PC-based tubes are priced higher than conventional materials, their clinical benefits justify the premium. Increasing preference for premium ENT solutions in developed markets is expected to fuel rapid expansion of this segment globally.

- By End Users

On the basis of end users, the Global Ear Tube Devices market is segmented into Hospitals, Ambulatory Surgical Centres, ENT Clinics, and Home Usage. The Hospitals segment accounted for the largest market revenue share of 46.3% in 2025, primarily due to the high volume of ear tube insertion procedures performed in hospital settings. Hospitals offer advanced surgical infrastructure, access to trained ENT specialists, and comprehensive post-operative care, making them the preferred choice for complex and pediatric cases. The presence of anesthesia support and emergency facilities further strengthens hospital dominance. Additionally, favorable reimbursement policies in many countries support hospital-based ENT procedures. Hospitals also tend to adopt technologically advanced and premium ear tube devices, contributing to higher revenue generation. Rising hospital admissions for chronic ear infections and increasing pediatric population further fuel demand. These factors collectively position hospitals as the leading end-user segment in the global market.

The Ambulatory Surgical Centres segment is projected to register the fastest CAGR of 9.4% from 2026 to 2033, driven by the global shift toward outpatient and minimally invasive procedures. ASCs offer cost-effective treatment, reduced hospital stays, and faster patient turnaround, making them increasingly attractive for routine ear tube insertions. Technological advancements have enabled safe and efficient ENT procedures in ambulatory settings. Patients and payers alike favor ASCs due to lower procedural costs and shorter recovery times. Increasing establishment of specialized ENT-focused ASCs further supports growth. Moreover, growing healthcare infrastructure in emerging economies is accelerating ASC adoption. These advantages are expected to significantly boost demand for ear tube devices in ambulatory surgical centers worldwide.

Ear Tube Devices Market Regional Analysis

- North America dominated the ear tube devices market with the largest revenue share of 38.6% in 2025, supported by a high diagnosis rate of otitis media, a strong healthcare infrastructure, favorable reimbursement frameworks, and widespread adoption of advanced ENT surgical procedures

- The region benefits from early disease detection, high awareness among parents regarding pediatric ear infections, and ready access to specialized otolaryngology services across hospitals and ambulatory surgical centers

- This dominance is further reinforced by high healthcare spending, availability of technologically advanced ear tube devices, and continuous product innovation, establishing North America as a key revenue-generating region for both pediatric and adult ear tube procedures

U.S. Ear Tube Devices Market Insight

The U.S. ear tube devices market captured the largest revenue share within North America in 2025, driven by the high prevalence of recurrent otitis media, especially among children, and strong adoption of tympanostomy procedures. The presence of advanced healthcare facilities, skilled ENT surgeons, and favorable insurance coverage for ear tube insertion procedures continues to support market growth. Additionally, rising awareness of early hearing loss prevention and increasing outpatient surgical volumes are further propelling demand for ear tube devices in the U.S.

Europe Ear Tube Devices Market Insight

The Europe ear tube devices market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing incidence of middle ear infections, growing pediatric population in select countries, and well-established public healthcare systems. Countries across Europe are witnessing rising demand for minimally invasive ENT procedures, supported by improved diagnostic capabilities and standardized clinical guidelines for otitis media management. The region also benefits from strong regulatory oversight ensuring high product quality and patient safety.

U.K. Ear Tube Devices Market Insight

The U.K. ear tube devices market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing referrals for ENT procedures through the National Health Service (NHS). Rising awareness of hearing impairment in children, coupled with government initiatives focused on early diagnosis and treatment, is contributing to higher adoption of ear tube insertion procedures. The expansion of outpatient surgical services and reduced waiting times are further aiding market growth in the country.

Germany Ear Tube Devices Market Insight

The Germany ear tube devices market is expected to expand at a considerable CAGR during the forecast period, driven by a strong healthcare infrastructure, high standards of medical care, and widespread access to ENT specialists. Germany’s emphasis on early intervention for hearing disorders and its well-developed hospital network support consistent demand for ear tube devices. Additionally, increasing adoption of advanced and biocompatible materials in ENT devices aligns with the country’s focus on patient safety and clinical efficiency.

Asia-Pacific Ear Tube Devices Market Insight

The Asia-Pacific ear tube devices market is expected to grow at the fastest CAGR of 7.9% during the forecast period, driven by a large pediatric population, rising incidence of ear infections, and improving access to healthcare services across emerging economies. Increasing healthcare expenditure, expanding hospital infrastructure, and growing awareness about hearing health are accelerating the adoption of ear tube procedures. Government initiatives aimed at strengthening pediatric care services further support regional market expansion.

Japan Ear Tube Devices Market Insight

The Japan ear tube devices market is gaining momentum due to the country’s advanced medical infrastructure, high awareness of hearing health, and increasing focus on early diagnosis of ENT disorders. Japan’s aging population also contributes to demand for ear tube devices, as middle ear conditions are prevalent among elderly patients. The widespread availability of advanced ENT surgical technologies and minimally invasive procedures supports sustained market growth.

China Ear Tube Devices Market Insight

The China ear tube devices market accounted for the largest revenue share in Asia Pacific in 2025, attributed to its large pediatric population, rising healthcare expenditure, and expanding hospital network. Increasing awareness of childhood hearing disorders and improving access to specialized ENT care are driving procedure volumes. Additionally, the presence of domestic manufacturers offering cost-effective ear tube devices, along with government investments in healthcare infrastructure, is significantly propelling market growth in China.

Ear Tube Devices Market Share

The Ear Tube Devices industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Olympus Corporation (Japan)

• Smith & Nephew plc (U.K.)

• Grace Medical Inc. (U.S.)

• Anthony Products, Inc. (U.S.)

• Heinz Kurz GmbH Medizintechnik (Germany)

• Spiggle & Theis Medizintechnik GmbH (Germany)

• Preceptis Medical, Inc. (U.S.)

• Summit Medical, LLC (U.S.)

• KARL STORZ SE & Co. KG (Germany)

• Cook Medical (U.S.)

• B. Braun Melsungen AG (Germany)

• Teleflex Incorporated (U.S.)

• Atos Medical AB (Sweden)

• Medasil Surgical Ltd. (U.K.)

Latest Developments in Global Ear Tube Devices Market

- In June 2021, Preceptis Medical launched the Hummingbird® Tympanostomy Tube System (TTS) for office-based pediatric ear tube procedures, enabling placement of ear tubes in children aged six months and older using a single-pass device outside the traditional operating room setting

- In August 2022, Preceptis Medical received expanded U.S. FDA clearance for the Hummingbird Tympanostomy Tube System (TTS), allowing broader use in office-based pediatric ear tube procedures beyond the original age indication and enhancing access to less invasive tympanostomy options

- In August 2023, Medtronic launched a next-generation tympanostomy tube system featuring enhanced, minimally invasive design improvements to reduce tissue damage and promote quicker healing, adopted widely by pediatric care centers

- In August 2024, AventaMed, a KARL STORZ company, gained U.S. FDA 510(k) clearance for the Solo+ Ear-Tube Placement Device, an all-in-one tympanostomy tube delivery system designed to streamline office-based ear tube placement with reduced need for general anesthesia

- In January 2025, a new CMS add-on G code (G0561) for pediatric tympanostomy procedures was finalized by the Centers for Medicare & Medicaid Services, helping reimburse in-office ear tube procedures performed with delivery devices such as Preceptis Medical’s Hummingbird® TTS and improving access to care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.