Global Edge Data Center Market

Market Size in USD Billion

CAGR :

%

USD

12.93 Billion

USD

70.15 Billion

2024

2032

USD

12.93 Billion

USD

70.15 Billion

2024

2032

| 2025 –2032 | |

| USD 12.93 Billion | |

| USD 70.15 Billion | |

|

|

|

|

Edge Data Center Market Size

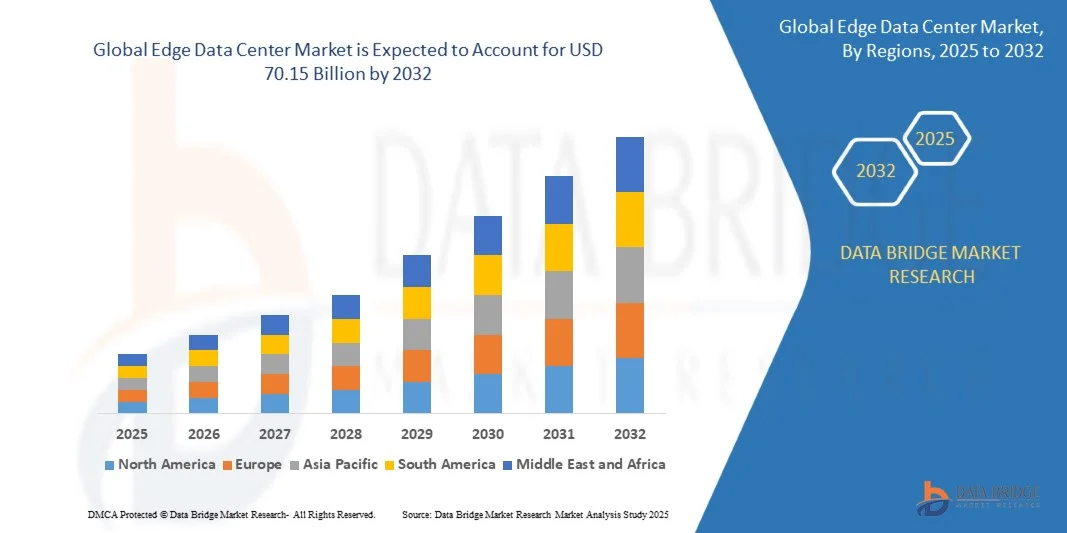

- The global edge data center market size was valued at USD 12.93 billion in 2024 and is expected to reach USD 70.15 billion by 2032, at a CAGR of 23.54% during the forecast period

- The market growth is largely fueled by the rapid adoption of edge computing and technological advancements in AI, IoT, and 5G networks, which are driving the need for low-latency, high-performance data processing closer to end users

- Furthermore, increasing enterprise demand for real-time analytics, enhanced network efficiency, and scalable hybrid cloud solutions is establishing edge data centers as a critical component of modern IT infrastructure. These factors are accelerating the deployment of edge facilities, thereby significantly boosting market growth

Edge Data Center Market Analysis

- Edge data centers are decentralized facilities that bring computation, storage, and networking closer to data sources and end users, reducing latency and improving application performance. They support critical workloads across industries such as IT, telecom, manufacturing, healthcare, and retail, enabling faster data processing and improved user experiences

- The escalating demand for edge data centers is primarily driven by the proliferation of connected devices, increasing data traffic, and the need for secure, reliable, and energy-efficient computing solutions. Growing investments from hyperscalers, telecom operators, and cloud providers are further reinforcing the market’s expansion across global regions

- North America dominated the edge data center market with a share of 34.9% in 2024, due to the strong presence of hyperscale data center operators and rapid 5G network expansion

- Asia-Pacific is expected to be the fastest growing region in the edge data center market during the forecast period due to accelerating digitalization, growing internet penetration, and government initiatives supporting smart city projects

- Solution segment dominated the market with a market share of 87.8% in 2024, due to the growing deployment of edge computing infrastructure across telecom, manufacturing, and cloud service providers. Organizations are increasingly investing in edge servers, storage, and networking equipment to handle real-time data processing closer to end users. The rising demand for low-latency computing, supported by 5G expansion and IoT proliferation, has accelerated solution adoption. Furthermore, the integration of AI-powered analytics and virtualization capabilities within edge infrastructure continues to strengthen the dominance of this segment

Report Scope and Edge Data Center Market Segmentation

|

Attributes |

Edge Data Center Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Edge Data Center Market Trends

“Rising Adoption of AI and IoT at the Edge”

- The edge data center market is experiencing strong growth fueled by the increasing adoption of artificial intelligence (AI) and the Internet of Things (IoT) across industries requiring faster data processing and localized computing. As organizations shift toward digital transformation, edge infrastructure is becoming essential for managing the exponential rise in connected devices and real-time analytics applications

- For instance, Schneider Electric and Vertiv have introduced modular edge data center solutions optimized for AI-driven workloads and IoT networks in smart manufacturing and autonomous vehicle ecosystems. Similarly, Dell Technologies and Hewlett Packard Enterprise are deploying edge platforms that bring cloud capabilities closer to data sources, significantly improving response times and system efficiency

- By processing AI and IoT data closer to where it is generated, edge data centers reduce latency and bandwidth use while ensuring faster decision-making. This approach supports use cases such as predictive maintenance in industrial automation, smart traffic management, and energy optimization in connected buildings, all of which require instant, localized data insights

- In addition, the growth of remote operations and 5G-powered environments is accelerating the need for distributed micro data centers. These compact yet powerful infrastructures enable decentralized data processing while ensuring seamless integration with central cloud frameworks for scalable management and analytics

- Edge data centers are also becoming critical for sectors such as healthcare, retail, and agriculture, where real-time insights from IoT sensors aid in improving service delivery, supply chain performance, and environmental monitoring. The ability to combine AI-based analytics with edge computing is thus redefining operational efficiency across these data-intensive domains

- As industries embrace intelligent automation and connected ecosystems, the convergence of AI, IoT, and edge computing will remain a defining factor for the evolution of digital infrastructure. This trend reinforces the transition from centralized processing models toward distributed, performance-optimized architectures designed for future data-driven economies

Edge Data Center Market Dynamics

Driver

“Demand for Low-Latency, Real-Time Data Processing”

- The growing requirement for real-time data processing and ultra-low latency communication is a key driver for the global edge data center market. Businesses dependent on immediate analytics and decision-making, such as manufacturing, telecommunications, and autonomous systems, are increasingly adopting edge architecture to reduce transmission delays and network congestion

- For instance, Equinix and EdgeConneX have expanded their networks of localized edge data centers to enable near-instant content delivery and cloud access for customers in remote regions. Their edge facilities allow processing and storage closer to end-users, ensuring rapid data transfer and high service reliability for mission-critical applications

- Edge data centers deliver a significant advantage by eliminating the inefficiencies of centralized networks. They facilitate quick responses for workloads such as autonomous driving, video analytics, and AI-enabled monitoring where delays of even milliseconds can impact operational outcomes or safety performance

- In addition, the proliferation of 5G networks is amplifying the importance of distributed computing models. Real-time processing of massive data volumes at the edge ensures optimal network utilization and supports seamless connectivity for emerging industrial IoT systems and immersive digital experiences

- As organizations accelerate their shift toward latency-sensitive computing environments, the strategic deployment of edge data centers will be vital in achieving faster, smarter, and more efficient data management. Their growing role in real-time digital infrastructure underscores their importance for future-ready enterprises and connected ecosystems worldwide

Restraint/Challenge

“High Costs and Complexity of Edge Deployment”

- The implementation of edge data centers involves high capital expenditure and operational complexity, posing a major challenge for market expansion. Establishing distributed facilities requires substantial investments in infrastructure, site management, cooling systems, and power continuity—all of which significantly increase project costs compared to centralized data centers

- For instance, companies such as Vapor IO and Compass Datacenters face elevated deployment costs due to the need for specialized modular designs, redundant power systems, and advanced security monitoring suitable for decentralized operations. The necessity of managing numerous micro data centers also adds logistical challenges in maintenance and resource allocation

- Integration with existing IT and cloud frameworks can further complicate deployment, requiring significant expertise in network orchestration, automation, and cybersecurity. Organizations often encounter difficulties in ensuring interoperability across hybrid environments consisting of multiple edge nodes, cloud platforms, and IoT devices

- In addition, operational scalability demands reliable connectivity and consistent energy supply in remote or urban areas, both of which can be constrained by local infrastructure limitations. This results in extended deployment timelines and higher operational risks for service providers entering new regions

- While ongoing innovation in modular, prefabricated, and containerized edge centers is improving cost efficiency, economic feasibility and management complexity remain prominent issues. Addressing these challenges through automation, strategic partnerships, and standardized design frameworks will be essential to ensure global scalability and sustainable adoption of edge computing infrastructure

Edge Data Center Market Scope

The market is segmented on the basis of component, facility size, and end-use industry.

• By Component

On the basis of component, the edge data center market is segmented into solution and services. The solution segment dominated the market revenue share of 87.8% in 2024, driven by the growing deployment of edge computing infrastructure across telecom, manufacturing, and cloud service providers. Organizations are increasingly investing in edge servers, storage, and networking equipment to handle real-time data processing closer to end users. The rising demand for low-latency computing, supported by 5G expansion and IoT proliferation, has accelerated solution adoption. Furthermore, the integration of AI-powered analytics and virtualization capabilities within edge infrastructure continues to strengthen the dominance of this segment.

The services segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising need for system integration, managed monitoring, and maintenance of distributed edge networks. Businesses increasingly rely on managed service providers to ensure continuous uptime, energy efficiency, and cybersecurity across decentralized facilities. The complexity of hybrid IT environments and multi-edge deployments further amplifies the demand for professional services, including design, consulting, and lifecycle management. As edge networks scale, service offerings tailored to predictive maintenance and remote management are expected to grow substantially.

• By Facility Size

On the basis of facility size, the market is bifurcated into large facility and small & medium-sized facility. The large facility segment held the largest revenue share of 79.5% in 2024, supported by strong adoption from hyperscalers, telecom operators, and colocation providers. These facilities typically host extensive workloads requiring high-density computing, scalable cooling systems, and robust network interconnectivity. The continued investment by large enterprises in expanding regional edge hubs to support AI, cloud gaming, and content delivery networks further drives segment growth. The presence of well-established infrastructure and significant capital expenditure capabilities positions large facilities as key contributors to market dominance.

The small and medium-sized facility segment is projected to grow at the fastest rate from 2025 to 2032, propelled by the surge in localized data processing needs among enterprises and smart city projects. SMEs and regional data operators are increasingly deploying compact edge centers to reduce latency for critical applications, including retail analytics, industrial automation, and healthcare monitoring. The segment benefits from lower setup costs, flexible scalability, and easier integration with distributed cloud environments. As demand for real-time insights and localized computing intensifies, small and medium-sized edge facilities are expected to become a cornerstone of the decentralized data infrastructure landscape.

• By End-use Industry

Based on end-use industry, the market is segmented into IT and telecom, BFSI, healthcare and lifesciences, manufacturing & automotive, government, gaming and entertainment, retail and e-commerce, and others. The IT and telecom segment dominated the edge data center market in 2024, primarily due to the rapid rollout of 5G networks and the growing need for decentralized computing to support data-heavy applications. Telecom operators are deploying edge data centers to enhance network efficiency, minimize backhaul traffic, and deliver ultra-low latency services. The segment’s leadership is further strengthened by ongoing partnerships between telecom companies and cloud providers aimed at building integrated edge ecosystems to support next-generation digital infrastructure.

The gaming and entertainment segment is projected to register the fastest growth rate from 2025 to 2032, fueled by the rising popularity of cloud gaming, AR/VR content, and real-time streaming platforms. Edge data centers enable faster content delivery and reduce lag, enhancing user experiences across online gaming and immersive media. As major gaming providers focus on latency-sensitive workloads and expanding user bases in developing regions, investments in edge-enabled distribution networks are increasing. This growing dependence on real-time data transmission positions the gaming and entertainment industry as the most dynamic contributor to future market expansion.

Edge Data Center Market Regional Analysis

- North America dominated the edge data center market with the largest revenue share of 34.9% in 2024, driven by the strong presence of hyperscale data center operators and rapid 5G network expansion

- The growing need for low-latency data processing to support IoT, AI, and autonomous systems has encouraged large-scale deployment of edge facilities across the region

- The rising adoption of cloud-based applications, coupled with the expansion of smart cities and industrial automation, is strengthening regional growth. The region’s well-established digital infrastructure, high investment capacity, and presence of major technology companies are further solidifying its market dominance

U.S. Edge Data Center Market Insight

The U.S. edge data center market captured the largest share in 2024 within North America, attributed to surging demand for decentralized computing from telecom, manufacturing, and IT sectors. The proliferation of connected devices, coupled with rapid deployment of 5G and private networks, is boosting local edge data infrastructure. Enterprises are increasingly adopting edge facilities to support real-time analytics and content delivery closer to end users. Strategic collaborations among cloud service providers, colocation operators, and telecom companies are further enhancing scalability and reliability, reinforcing the U.S. as the leading market in the region.

Europe Edge Data Center Market Insight

The Europe edge data center market is projected to grow at a significant CAGR over the forecast period, driven by data sovereignty regulations, digital transformation initiatives, and the expansion of renewable-powered data centers. Increasing adoption of IoT and smart infrastructure across manufacturing and government sectors is accelerating demand for localized data processing. The region is also witnessing rising investments in modular and prefabricated edge facilities to support latency-sensitive applications. The focus on energy efficiency, sustainability, and compliance with the EU’s data protection policies continues to shape market development across the continent.

U.K. Edge Data Center Market Insight

The U.K. edge data center market is anticipated to grow at a robust CAGR during the forecast period, supported by the country’s expanding digital economy and rising adoption of edge computing across financial services, retail, and telecom sectors. The growing demand for faster content delivery and real-time analytics among enterprises is boosting localized edge deployments. Furthermore, the U.K.’s commitment to achieving carbon-neutral data operations and the increasing focus on hybrid cloud infrastructure are fostering market expansion.

Germany Edge Data Center Market Insight

The Germany edge data center market is expected to expand steadily throughout the forecast period, backed by strong industrial automation and digital manufacturing initiatives. The country’s Industry 4.0 strategy emphasizes low-latency connectivity and localized computing, fueling demand for edge facilities. Germany’s emphasis on sustainability and renewable energy integration within data infrastructure further drives growth. Moreover, the presence of advanced logistics and automotive industries creates substantial opportunities for edge computing adoption in mission-critical operations.

Asia-Pacific Edge Data Center Market Insight

The Asia-Pacific edge data center market is poised to record the fastest CAGR from 2025 to 2032, driven by accelerating digitalization, growing internet penetration, and government initiatives supporting smart city projects. Countries such as China, Japan, and India are witnessing a rapid surge in cloud adoption and mobile data traffic, prompting large-scale edge infrastructure development. The region’s strong manufacturing ecosystem and expanding telecom networks are creating a favorable environment for edge data deployments. Increasing investments from global and regional players are further enhancing capacity and connectivity across emerging markets.

China Edge Data Center Market Insight

China accounted for the largest revenue share in the Asia-Pacific region in 2024, propelled by widespread adoption of 5G, IoT, and AI-driven applications. The nation’s focus on developing smart cities and industrial digitalization is driving substantial investments in edge computing infrastructure. Local technology giants are leading extensive rollouts of edge facilities to support real-time processing and data localization. Strong government support and domestic manufacturing capabilities continue to enhance China’s leadership in the regional edge data center landscape.

Japan Edge Data Center Market Insight

Japan’s edge data center market is witnessing rapid expansion due to the country’s advanced telecommunications framework and growing demand for low-latency computing in manufacturing, gaming, and financial services. The increasing integration of edge systems with AI and robotics to support automation and digital twins is stimulating market demand. Furthermore, Japan’s focus on resilience, energy efficiency, and compact modular infrastructure makes it a key player in the regional growth of edge computing.

Edge Data Center Market Share

The edge data center industry is primarily led by well-established companies, including:

- 365 Data Centers (U.S.)

- Amazon Web Services (AWS) (U.S.)

- American Tower Corporation (U.S.)

- AtlasEdge Data Centres (U.K.)

- Cisco Systems (U.S.)

- DartPoints (U.S.)

- Dell Inc. (U.S.)

- Digital Realty Trust (U.S.)

- EdgeConneX Inc. (U.S.)

- Equinix, Inc. (U.S.)

- Flexential Corporation (U.S.)

- Fujitsu Limited (Japan)

- Google LLC (U.S.)

- Hewlett Packard Enterprise Company (U.S.)

- Vapor IO, Inc. (U.S.)

Latest Developments in Edge Data Center Market

- In August 2025, EdgeConneX announced a partnership with Lambda to build over 30 MW of AI-optimized data center infrastructure across Chicago and Atlanta. This collaboration focuses on high-density AI and cloud workloads, utilizing hybrid cooling systems to handle intensive computing tasks efficiently. It strengthens EdgeConneX’s position in the AI edge market by enabling scalable and energy-efficient deployments in key metro areas. This initiative is expected to boost demand for edge-specific hardware, enhance data processing efficiency, and drive competition in the U.S. edge data center landscape

- In July 2025, 365 Data Centers and Megaport expanded their strategic partnership by adding new Points-of-Presence in six 365 Data Center facilities to enhance edge-to-cloud connectivity. This expansion facilitates direct and low-latency connections from edge sites to major public clouds such as AWS, Azure, and Google Cloud. The initiative enhances network performance for enterprise edge workloads and encourages the adoption of hybrid cloud architectures. It is expected to attract more enterprises seeking reliable and flexible connectivity solutions, further strengthening the edge ecosystem

- In May 2025, Dell unveiled its AI Factory and expanded its PowerEdge and PowerScale hardware lineup to support AI workloads at both core and edge locations. The company also entered partnerships with Google Gemini for on-prem AI deployment and Cohere for secure AI integration, emphasizing decentralized edge computing and sustainability. This development highlights Dell’s strategic focus on empowering AI-driven operations at the edge, reinforcing innovation and scalability across hybrid infrastructures

- In February 2025, Veea and Vapor IO launched a strategic collaboration to deliver turnkey AI-as-a-Service and federated learning solutions leveraging Vapor IO’s Zero Gap AI platform and private 5G infrastructure. The initiative is designed to support smart manufacturing, municipal projects, and multi-site enterprises through distributed AI processing. This collaboration is expected to accelerate the integration of intelligent edge computing, enabling faster decision-making and optimized resource utilization across industries

- In October 2023, Vapor IO introduced the “Monetize the AI Edge” partner program, offering deal registration margins and renewal incentives to ISVs, MSPs, VARs, and GSIs. This initiative aims to tap into the growing $100–180 billion edge AI opportunity across 36 U.S. markets. By expanding its partner ecosystem, Vapor IO is strengthening its market presence and encouraging broader adoption of edge computing solutions, thereby driving long-term industry growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.