Global Edible Cosmetics Market

Market Size in USD Million

CAGR :

%

USD

218.63 Million

USD

475.52 Million

2024

2032

USD

218.63 Million

USD

475.52 Million

2024

2032

| 2025 –2032 | |

| USD 218.63 Million | |

| USD 475.52 Million | |

|

|

|

|

Edible Cosmetics Market Size

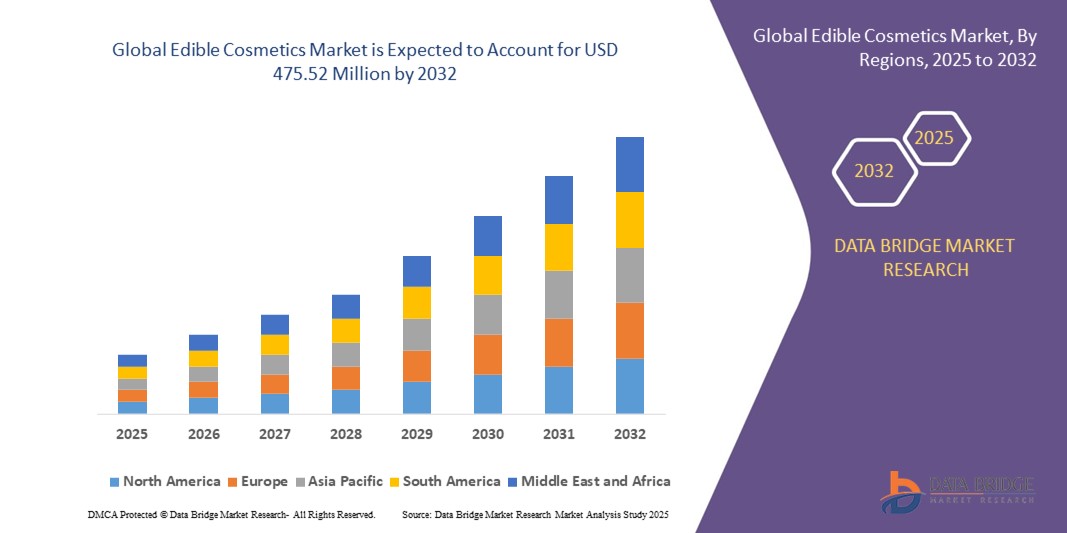

- The global edible cosmetics market size was valued at USD 218.63 million in 2024 and is expected to reach USD 475.52 million by 2032, at a CAGR of 10.2% during the forecast period

- The market growth is largely fueled by the rising consumer inclination toward clean-label, natural, and wellness-focused beauty solutions, which are driving the demand for edible cosmetics as safer alternatives to conventional chemical-based products

- Furthermore, increasing awareness of the “beauty-from-within” trend, coupled with growing consumer expenditure on preventive skincare, haircare, and holistic wellness, is establishing edible cosmetics as a preferred choice. These converging factors are accelerating product adoption, thereby significantly boosting the market’s expansion

Edible Cosmetics Market Analysis

- Edible cosmetics are ingestible formulations designed to improve skin, hair, and overall beauty by delivering nutrients such as collagen, biotin, antioxidants, and herbal extracts from within the body. These products are commonly available in formats such as powders, gummies, capsules, and functional beverages, catering to both skincare and haircare needs

- The escalating demand for edible cosmetics is primarily driven by growing health-conscious consumer lifestyles, the convergence of nutraceuticals with cosmetics, and the rising popularity of natural and organic solutions that promise both beauty enhancement and wellness benefits

- North America dominated edible cosmetics market with a share of 27.30% in 2024, due to rising consumer interest in clean-label beauty products and wellness-oriented lifestyles

- Asia-Pacific is expected to be the fastest growing region in the edible cosmetics market during the forecast period due to rising disposable incomes, rapid urbanization, and a strong cultural focus on beauty and wellness

- Edible skincare segment dominated the market with a market share of 40.78% in 2024, due to rising consumer preference for natural and safe beauty solutions that nourish the skin from within. Skincare remains the most widely adopted category as consumers increasingly prioritize health-oriented beauty routines, functional ingredients, and prevention of chemical-induced side effects. The popularity of edible skincare is further driven by its multifunctional benefits, such as hydration, anti-aging, and overall skin wellness, which appeal to both men and women. The availability of diverse product ranges, including gummies, powders, and capsules, has strengthened consumer adoption across retail and e-commerce platforms

Report Scope and Edible Cosmetics Market Segmentation

|

Attributes |

Edible Cosmetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Edible Cosmetics Market Trends

Growing Popularity of Sustainable and Ethical Products

- The edible cosmetics market is witnessing a sharp upward trajectory as consumers increasingly favor products derived from natural, sustainable, and food-grade ingredients. Ethical production and eco-friendly supply chains are redefining consumer expectations in beauty and wellness industries

- For instance, Lush Cosmetics has expanded its product lines incorporating food-based materials such as oats, cocoa, and honey, designed to deliver both topical benefits and safe-to-ingest formulations. Similar innovations by brands such as Bite Beauty highlight demand growth trajectories

- Social media and wellness influencers are actively promoting edible beauty trends, showcasing food-based cosmetic products as both safe and effective. This digital amplification is shaping consumer perceptions and accelerating adoption within younger and health-aware demographics

- Customization trends are also contributing to growth as brands develop edible products tailored to individual requirements, such as skin type, diet compatibility, or ethical considerations. Such personalized products enhance customer loyalty and boost repeat purchasing patterns

- Clean-label demand is reinforcing the market’s evolution, with consumers increasingly rejecting synthetic chemicals. Transparency around sourcing and food-grade certifications are now critical dimensions of marketing, influencing company positioning and overall product adoption decisions globally

- Global beauty and wellness convergence is driving edible cosmetics beyond niche segments, integrating them into holistic health solutions. Firms are marketing these products as part of daily nutrition and self-care routines, increasing their mainstream commercial viability

Edible Cosmetics Market Dynamics

Driver

Rising Health and Wellness Awareness

- The health and wellness movement has emerged as a significant driver, as consumers prioritize natural solutions to complement holistic lifestyles. Rising concerns around harmful chemicals in personal care are fueling edible cosmetics adoption

- For instance, Nourishe Organic Skincare has incorporated fruit-based and botanical formulations ensuring toxin-free, food-safe ingredients. Such initiatives align seamlessly with modern wellness preferences and strengthen consumer trust through both safety and nutritional branding contexts

- Increasing consumer focus on beauty-from-within solutions is motivating purchases of edible lip balms, skin treatments, and supplements. These hybrid products deliver both aesthetic and nutritional benefits, thus reinforcing long-term consumption habits among health-conscious buyers

- Retailers and e-commerce platforms are expanding visibility for edible products through wellness-specific categories and targeted marketing strategies. This accessibility is widening awareness and significantly driving market penetration in both developed and emerging consumption regions globally

- The growing overlap between functional food and cosmetics is enhancing adoption. As consumers embrace collagen drinks, antioxidant beauty gummies, and edible oils, crossover demand is providing consistent momentum for this emerging market segment

Restraint/Challenge

Competition from Traditional Cosmetics

- Competition from entrenched conventional cosmetic products remains a major restraint for edible cosmetics adoption. Established global beauty companies offer strong branding, competitive pricing, and entrenched loyalty, making it challenging for new entrants to capture market share

- For instance, legacy players such as L’Oréal continue to invest heavily in advanced synthetic formulations and aggressive marketing campaigns. This scale advantage allows traditional brands to compete strongly against smaller edible-focused businesses with limited budgets

- Consumer skepticism regarding efficacy of edible products compared with traditional cosmetics is slowing immediate adoption. Lack of clear awareness about tangible benefits creates hesitancy among mainstream consumers, particularly in developing regions with strong traditional beauty markets

- Regulatory uncertainties across markets amplify challenges for edible cosmetics producers. Differing regulations on claims, certifications, and product positioning create barriers to commercialization and international expansion, forcing companies to navigate complex compliance landscapes

- Higher pricing of edible cosmetics compared with conventional alternatives restricts mass adoption. Consumers in price-sensitive segments weigh affordability over health benefits, causing slower penetration and positioning edible products as premium niche offerings rather than everyday essentials

Edible Cosmetics Market Scope

The market is segmented on the basis of product type, ingredient type, end-user, and application.

- By Product Type

On the basis of product type, the edible cosmetic market is segmented into edible skincare, edible haircare, edible makeup, and edible nail care. The edible skincare segment dominated the largest market revenue share of 40.78% in 2024, supported by rising consumer preference for natural and safe beauty solutions that nourish the skin from within. Skincare remains the most widely adopted category as consumers increasingly prioritize health-oriented beauty routines, functional ingredients, and prevention of chemical-induced side effects. The popularity of edible skincare is further driven by its multifunctional benefits, such as hydration, anti-aging, and overall skin wellness, which appeal to both men and women. The availability of diverse product ranges, including gummies, powders, and capsules, has strengthened consumer adoption across retail and e-commerce platforms.

The edible haircare segment is projected to witness the fastest growth rate from 2025 to 2032, driven by heightened demand for solutions addressing hair thinning, scalp health, and damage repair. Increasing concerns about pollution, stress, and nutrient deficiencies are encouraging consumers to adopt edible hair supplements for long-term nourishment. The segment also benefits from growing marketing campaigns that emphasize visible results, such as stronger and shinier hair, making them attractive to younger demographics. Expanding innovation in collagen, biotin, and keratin-based formulations tailored for hair wellness further accelerates this growth. The shift toward holistic hair health is fueling wider acceptance of edible haircare as a daily routine product.

- By Ingredient Type

On the basis of ingredient type, the market is segmented into natural and synthetic. The natural ingredient segment held the largest market revenue share in 2024, propelled by strong consumer trust in plant-based and organic formulations that align with the clean beauty trend. Growing health awareness and skepticism toward chemical additives have significantly boosted the adoption of natural edible cosmetics. Consumers are increasingly associating natural ingredients with safety, long-term benefits, and minimal risk of side effects. Brands are leveraging botanicals, superfoods, and herbal extracts to differentiate their offerings, creating a strong premiumization trend in the natural segment.

The synthetic ingredient segment is expected to grow at the fastest CAGR from 2025 to 2032, owing to advancements in food-grade formulations and cost-effectiveness in mass production. Synthetic edible cosmetics offer controlled efficacy, longer shelf life, and customization of nutritional profiles, making them attractive for large-scale commercial use. This segment is particularly appealing in emerging markets where affordability plays a crucial role in purchase decisions. Growing R&D in bio-identical synthetic actives also strengthens their acceptance as safe and effective alternatives. As consumer demand for accessible and affordable edible cosmetics expands, synthetic ingredients are gaining traction in mainstream product lines.

- By End-User

On the basis of end-user, the edible cosmetic market is segmented into adults, teenagers, and children. The adults segment dominated the largest market revenue share in 2024, supported by strong demand for anti-aging, skin-brightening, and hair wellness solutions. Adults are the primary target group for premium edible cosmetics, as they possess higher purchasing power and stronger inclination toward wellness-focused lifestyles. The segment benefits from the rising adoption of preventive beauty routines and the willingness of adults to invest in holistic products that enhance both appearance and health. High awareness levels and availability of targeted products further strengthen the dominance of this category.

The teenagers segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising beauty consciousness among younger consumers and the influence of social media. Teenagers are increasingly drawn to safe, edible beauty products as alternatives to chemical cosmetics, particularly for acne management and general skincare. The growth of influencer-led marketing and youth-centric product launches has played a significant role in fueling demand in this category. In addition, affordability and availability of entry-level edible cosmetic products designed specifically for younger skin and hair needs are accelerating segment growth.

- By Application

On the basis of application, the market is segmented into daily care and special treatments. The daily care segment accounted for the largest market revenue share in 2024, driven by the rising integration of edible cosmetics into routine health and beauty regimens. Consumers are increasingly adopting daily-use supplements for skin hydration, hair strength, and overall beauty maintenance. The growing popularity of multifunctional products that combine nutrition and cosmetic benefits has further enhanced the role of daily care solutions. Wide availability of products through supermarkets, specialty stores, and e-commerce platforms also supports its market strength.

The special treatments segment is forecasted to record the fastest growth from 2025 to 2032, fueled by rising demand for targeted solutions addressing specific concerns such as anti-aging, pigmentation, hair loss, and brittle nails. Consumers are willing to pay a premium for specialized edible cosmetics that deliver visible and result-oriented outcomes. This segment is gaining momentum particularly in developed markets where advanced formulations and clinical-backed claims are highly valued. Expansion of niche brands focusing on treatment-based solutions and personalized products is further boosting this segment. The growing alignment with professional beauty services also enhances its long-term growth trajectory.

Edible Cosmetics Market Regional Analysis

- North America dominated the edible cosmetics market with the largest revenue share of 27.30% in 2024, driven by rising consumer interest in clean-label beauty products and wellness-oriented lifestyles

- Consumers in the region highly value safe, natural, and multifunctional products that combine health benefits with beauty enhancement

- This strong adoption is supported by high disposable incomes, a well-established nutraceuticals industry, and a growing demand for alternatives to chemical-based cosmetics. Increasing retail penetration and e-commerce distribution channels are also reinforcing the region’s market leadership

U.S. Edible Cosmetics Market Insight

The U.S. edible cosmetics market captured the largest revenue share in 2024 within North America, fueled by the rising preference for natural skincare, haircare, and wellness solutions that support holistic beauty. Consumers are increasingly investing in products such as collagen supplements, gummies, and functional powders to address anti-aging and overall beauty maintenance. The strong influence of celebrity endorsements, social media marketing, and product innovation in beauty-from-within categories further drives adoption. Moreover, the country’s advanced regulatory frameworks and availability of premium product ranges strengthen its market dominance.

Europe Edible Cosmetics Market Insight

The Europe edible cosmetics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by a growing shift toward natural and organic beauty solutions. Rising awareness of sustainable and eco-friendly products is boosting consumer interest in edible beauty supplements across the region. The increasing popularity of functional foods, coupled with strong regulatory support for clean-label formulations, is fostering rapid adoption. The market is witnessing notable demand in skincare and haircare categories, especially in urbanized areas where consumers seek preventive wellness and long-term benefits.

U.K. Edible Cosmetics Market Insight

The U.K. edible cosmetics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a rising emphasis on health-conscious beauty and growing demand for anti-aging solutions. The increasing prevalence of lifestyle-related skin and hair issues is encouraging consumers to adopt beauty-from-within products. A thriving e-commerce industry and the strong influence of digital marketing are also fueling market expansion. With high consumer awareness and demand for premium products, the U.K. is emerging as a key growth market in Europe.

Germany Edible Cosmetics Market Insight

The Germany edible cosmetics market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s preference for scientifically backed, high-quality formulations. German consumers place strong emphasis on safety, efficacy, and sustainability, which is fostering demand for natural edible cosmetics. The nation’s advanced healthcare and wellness infrastructure is also playing a pivotal role in market growth. Increasing collaboration between cosmetic brands and nutraceutical companies further strengthens adoption across skincare and haircare categories.

Asia-Pacific Edible Cosmetics Market Insight

The Asia-Pacific edible cosmetics market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising disposable incomes, rapid urbanization, and a strong cultural focus on beauty and wellness. Growing demand for natural and herbal supplements in countries such as China, Japan, and India is a major growth factor. Government support for nutraceutical industries and expanding online distribution channels are also boosting accessibility. The region’s role as a manufacturing hub for dietary supplements and beauty products is further accelerating adoption.

Japan Edible Cosmetics Market Insight

The Japan edible cosmetics market is gaining momentum due to its highly advanced beauty industry and consumer preference for holistic wellness. Japanese consumers value innovation, functionality, and safety, leading to strong uptake of collagen drinks, edible skincare supplements, and anti-aging solutions. Rapid urbanization and the aging population are reinforcing the demand for convenient, science-backed edible beauty products. Integration of edible cosmetics with traditional wellness practices such as herbal extracts is further fueling the market.

China Edible Cosmetics Market Insight

The China edible cosmetics market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to its growing middle class, rapid urbanization, and high adoption of beauty supplements. China is one of the largest markets for functional foods and nutraceuticals, which directly supports the edible cosmetics category. The push toward beauty-from-within solutions, coupled with strong local manufacturing capabilities and affordability of products, is propelling demand. Expanding e-commerce platforms and influencer-led marketing are significantly accelerating the popularity of edible cosmetics among younger consumers.

Edible Cosmetics Market Share

The edible cosmetics industry is primarily led by well-established companies, including:

- Lush Retail Ltd. (U.K.)

- Kendo Holdings (Canada)

- Burt's Bees (U.S.)

- Tarte Inc (U.S.)

- Eminence organic skin care (Hungary)

- Kiehl’s (U.S.)

- Dr. Dennis Gross Skincare LLC. (U.S.)

- L'Oréal Paris (France)

- Herbivore Botanicals, LLC. (U.S.)

- Sappho New Paradigm Cosmetics Inc. (U.S.)

- Tata Harper Skincare (U.S.)

- Juice Beauty (U.S.)

- zoobop me works pvt ltd. (Australia)

- Fenty Beauty by Rihanna (U.S.)

- 100% PURE (U.S.)

Latest Developments in Global Edible Cosmetics Market

- In June 2024, Skin Gourmet introduced its pioneering cocoa-based beauty and wellness products at the Cocoa Food Fair 2024 in Ghana, underscoring the versatility of cocoa in edible cosmetics. Presented during Orange Week, an initiative by the Netherlands Embassy, the showcase positioned cocoa as a functional ingredient with growing demand in both local and international markets. This move is expected to strengthen Skin Gourmet’s brand visibility while advancing the role of cocoa in the edible cosmetics sector, encouraging innovation and diversification of natural ingredient-based products

- In November 2022, Live Verdure Ltd finalized the acquisition of Edible Beauty Australia Pty Ltd, a strategic step aimed at consolidating its footprint in the skincare and wellness industry. By integrating Edible Beauty’s product portfolio, Live Verdure broadened its edible cosmetics offerings and also gained access to an established consumer base. The acquisition is projected to enhance revenue streams and streamline operations through cost synergies, thereby positioning the company for sustained growth in the competitive beauty-from-within market

- In March 2022, Nestlé Health Science announced a strategic partnership with Orgain to co-develop edible beauty and nutrition solutions, marking an expansion into functional food-based cosmetics. This collaboration enhanced Nestlé’s access to plant-based expertise while aligning with consumer demand for clean-label, scientifically backed edible beauty products. The partnership is expected to accelerate innovation pipelines and expand market penetration across multiple geographies

- In August 2021, Amway launched its Nutrilite Collagen Peptide supplements across Asia-Pacific, targeting the rapidly growing demand for edible skincare solutions. With a focus on anti-aging and skin elasticity, the launch addressed rising consumer interest in preventive beauty routines. This expansion strengthened Amway’s position in the edible cosmetics sector and reinforced the growing convergence of dietary supplements with beauty care

- In May 2021, Shiseido introduced its “Inner Beauty” product line under the INRYU brand in Japan, offering ingestible beauty supplements that enhance skin health from within. The launch highlighted Shiseido’s pivot toward holistic wellness and its intent to capture a larger share of the beauty-from-within trend. By leveraging its strong brand equity and research-driven innovation, Shiseido set the stage for significant growth in the edible cosmetics space, particularly in the Asia-Pacific region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.