Global Edible Protein Packaging Market

Market Size in USD Billion

CAGR :

%

USD

4.89 Billion

USD

9.67 Billion

2025

2033

USD

4.89 Billion

USD

9.67 Billion

2025

2033

| 2026 –2033 | |

| USD 4.89 Billion | |

| USD 9.67 Billion | |

|

|

|

|

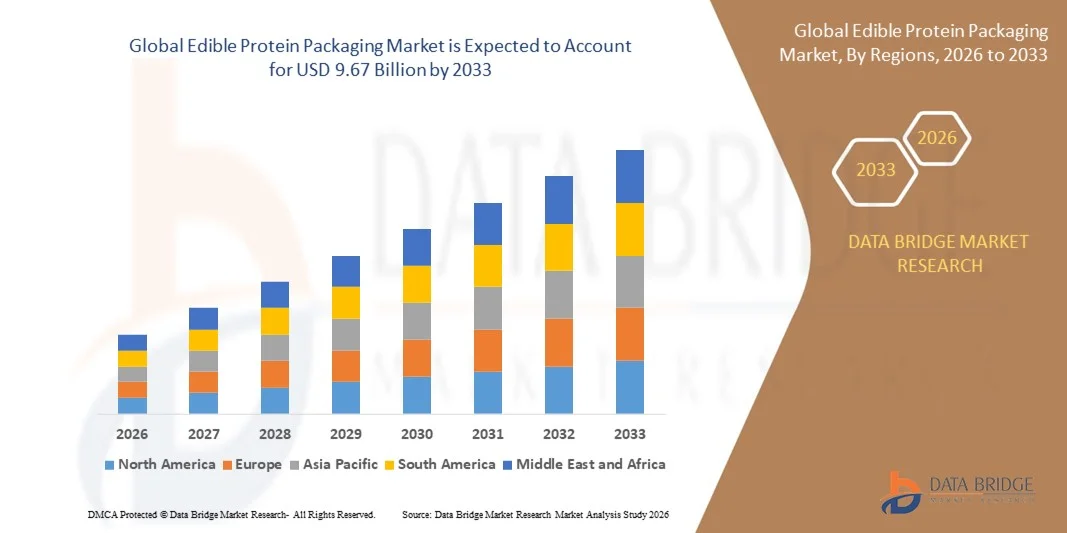

What is the Global Edible Protein Packaging Market Size and Growth Rate?

- The global edible protein packaging market size was valued at USD 4.89 billion in 2025 and is expected to reach USD 9.67 billion by 2033, at a CAGR of8.90% during the forecast period

- The major growing factor towards edible protein packaging market is the rapid increase in the demand for biodegradable packaging across the globe

- Furthermore, the increase in processed food markets and rapid innovation in food packaging are also expected to heighten the overall demand for edible protein packaging market

What are the Major Takeaways of Edible Protein Packaging Market?

- Rapid change in the lifestyle along with high demand for instant and fast food are also expected to serve as foremost drivers for the edible protein packaging market at a global level. In addition, the increase in awareness regarding hygiene, health, food safety and quality and high adoption of edible packaging in different industries is also lifting the growth of the edible protein packaging market

- However, the low tensile strength when compared to traditional plastic and secondary packaging requirement are projected to act as a restraint towards the growth of edible protein packaging market, whereas the higher tolerability of water-soluble and biodegradable packaging can challenge the growth of the edible protein packaging market

- North America dominated the edible protein packaging market with a 37.25% revenue share in 2025, driven by strong demand for sustainable food packaging, high consumer awareness of plastic reduction, and rapid adoption of biodegradable and edible materials across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.24% from 2026 to 2033, driven by rapid urbanization, rising packaged food consumption, expanding foodservice industries, and increasing awareness of sustainable packaging across China, Japan, India, South Korea, and Southeast Asia

- The Plant-Based Proteins segment dominated the market with a 62.4% share in 2025, driven by increasing consumer preference for vegan, clean-label, and environmentally sustainable packaging solutions

Report Scope and Edible Protein Packaging Market Segmentation

|

Attributes |

Edible Protein Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Edible Protein Packaging Market?

Rising Adoption of Sustainable, Biodegradable, and Protein-Based Packaging Solutions

- The edible protein packaging market is witnessing growing adoption of plant- and animal-based protein films derived from whey, gelatin, soy, pea, and collagen to reduce plastic waste

- Manufacturers are developing high-barrier, flexible, and transparent edible films with improved moisture resistance, oxygen control, and mechanical strength

- Increasing demand for single-serve, lightweight, and zero-waste packaging is accelerating usage across food, beverage, and nutraceutical applications

- For instance, companies such as TIPA, Lactips, Notpla, Tate & Lyle, and Ingredion are advancing protein-based materials to enhance compostability and food safety

- Growing focus on clean-label packaging, natural ingredients, and reduced carbon footprint is strengthening adoption among sustainable food brands

- As regulatory pressure on plastic packaging intensifies, Edible Protein Packaging solutions are expected to gain long-term commercial traction

What are the Key Drivers of Edible Protein Packaging Market?

- Rising demand for eco-friendly, plastic-free, and biodegradable packaging in foodservice, FMCG, and ready-to-eat food segments

- For instance, during 2024–2025, companies such as Ingredion, Tate & Lyle, and Lactips expanded investments in protein-based and bio-polymer packaging materials

- Growing consumer awareness regarding environmental sustainability, food safety, and waste reduction is boosting adoption across U.S., Europe, and Asia-Pacific

- Advancements in protein processing, film-forming technologies, and coating techniques are improving shelf life and functional performance

- Increasing use of edible coatings for fruits, confectionery, and meat products is driving demand for protein-based packaging alternatives

- Supported by sustainability mandates and innovation in bio-materials, the Edible Protein Packaging market is expected to grow steadily

Which Factor is Challenging the Growth of the Edible Protein Packaging Market?

- Higher production costs compared to conventional plastic packaging limit large-scale adoption, especially in price-sensitive markets

- For instance, during 2024–2025, fluctuations in raw material prices such as whey protein, gelatin, and plant proteins impacted manufacturing economics

- Limited moisture resistance and shorter shelf life of some protein-based films restrict use in high-humidity and liquid-heavy applications

- Lack of standardized regulations and large-scale industrial infrastructure slows commercialization in emerging economies

- Competition from paper-based, compostable plastics, and bio-polymer alternatives creates pricing and performance challenges

- To overcome these barriers, companies are focusing on material blending, functional coatings, and scalable production technologies to expand market adoption

How is the Edible Protein Packaging Market Segmented?

The market is segmented on the basis of source, packaging process, and end user.

- By Source

On the basis of source, the edible protein packaging market is segmented into Plant-Based Proteins and Animal-Based Proteins. The Plant-Based Proteins segment dominated the market with a 62.4% share in 2025, driven by increasing consumer preference for vegan, clean-label, and environmentally sustainable packaging solutions. Proteins derived from soy, pea, wheat, corn, and other plant sources are widely used due to their strong film-forming properties, scalability, lower allergen risks, and compatibility with biodegradable packaging requirements. Food manufacturers increasingly adopt plant-based edible films and coatings for snacks, confectionery, bakery products, and fresh produce packaging.

The Animal-Based Proteins segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising use of gelatin, whey, and collagen-based materials that offer superior mechanical strength, elasticity, and barrier performance. Increasing applications in premium food packaging and pharmaceutical coatings further support segment growth.

- By Packaging Process

On the basis of packaging process, the market is segmented into Antimicrobial, Nanotechnology, Electrohydrodynamic, Coatings, and Microorganisms-based processes. The Coatings segment dominated the market with a 38.9% share in 2025, owing to widespread use of protein-based edible coatings for fruits, vegetables, meat, and dairy products. These coatings help reduce moisture loss, delay oxidation, inhibit microbial growth, and extend shelf life while remaining invisible to consumers.

The Nanotechnology segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by advancements in nano-encapsulation, enhanced barrier properties, and controlled release of antimicrobial agents. Nanotechnology-enabled edible packaging improves functional performance and food safety, making it increasingly attractive for high-value and export-oriented food applications. Continuous innovation in processing techniques is accelerating adoption across global food supply chains.

- By End User

Based on end user, the edible protein packaging market is segmented into Food, Beverages, and Pharmaceuticals. The Food segment dominated the market with a 57.6% share in 2025, supported by high consumption of packaged foods, growing demand for sustainable packaging, and increasing regulatory pressure to reduce plastic waste. Edible protein packaging is widely used for snacks, confectionery, bakery items, ready-to-eat meals, and fresh produce to enhance shelf life and reduce packaging waste.

The Pharmaceuticals segment is expected to register the fastest CAGR from 2026 to 2033, driven by rising use of edible and biodegradable coatings for capsules, tablets, and nutraceutical products. Growing emphasis on clean excipients, patient-friendly drug delivery, and sustainable pharmaceutical packaging is accelerating adoption across global healthcare markets.

Which Region Holds the Largest Share of the Edible Protein Packaging Market?

- North America dominated the edible protein packaging market with a 37.25% revenue share in 2025, driven by strong demand for sustainable food packaging, high consumer awareness of plastic reduction, and rapid adoption of biodegradable and edible materials across the U.S. and Canada

- Rising consumption of packaged foods, ready-to-eat meals, and single-serve products is accelerating the use of protein-based edible films and coatings across food & beverage and foodservice sectors

- Leading regional players are investing in advanced protein processing, scalable film-forming technologies, and compostable packaging innovations to meet regulatory and sustainability goals

- Strong presence of food innovation hubs, well-established cold chain infrastructure, and continuous investment in bio-based material R&D further reinforce North America’s market leadership

U.S. Edible Protein Packaging Market Insight

The U.S. is the largest contributor in North America, supported by high adoption of sustainable packaging solutions across FMCG, foodservice, and retail sectors. Growing regulatory pressure on single-use plastics, rising consumer preference for clean-label packaging, and strong presence of food innovation startups drive demand for edible protein packaging. Applications in snacks, confectionery, bakery, and fresh produce are expanding rapidly. Investments by major ingredient suppliers and packaging innovators, along with strong collaboration between food brands and material science companies, continue to accelerate market growth.

Canada Edible Protein Packaging Market Insight

Canada contributes significantly to regional growth, driven by increasing focus on environmental sustainability, food waste reduction, and biodegradable packaging alternatives. Rising adoption of edible coatings for fresh fruits, vegetables, and dairy products supports market expansion. Government-backed sustainability programs, growing food exports, and increasing investment in bio-based materials strengthen adoption of edible protein packaging across the country.

Asia-Pacific Edible Protein Packaging Market

Asia-Pacific is projected to register the fastest CAGR of 9.24% from 2026 to 2033, driven by rapid urbanization, rising packaged food consumption, expanding foodservice industries, and increasing awareness of sustainable packaging across China, Japan, India, South Korea, and Southeast Asia. Strong growth in processed foods, takeaway packaging, and e-commerce grocery delivery is accelerating demand for lightweight, biodegradable, and edible packaging solutions. Regional governments are introducing stricter regulations on plastic waste, further supporting market adoption.

China Edible Protein Packaging Market Insight

China is the largest contributor to Asia-Pacific, supported by massive food processing capacity, growing middle-class consumption, and government initiatives promoting biodegradable packaging. Increasing use of edible films for confectionery, snacks, and fresh produce packaging drives strong demand. Domestic manufacturing capabilities and cost-efficient production enhance large-scale adoption.

Japan Edible Protein Packaging Market Insight

Japan shows steady growth due to strong emphasis on food safety, premium packaging quality, and minimal-waste solutions. High adoption of edible coatings for fresh food preservation and portion-controlled packaging supports market expansion, especially in convenience foods and retail sectors.

India Edible Protein Packaging Market Insight

India is emerging as a high-growth market, driven by expanding packaged food consumption, rapid growth of quick-service restaurants, and rising sustainability awareness. Government initiatives to reduce plastic waste and growing investments in food processing infrastructure accelerate adoption of edible protein packaging.

South Korea Edible Protein Packaging Market Insight

South Korea contributes significantly due to high demand for innovative, eco-friendly food packaging and strong focus on premium food presentation. Growth in ready-to-eat meals, smart retail, and sustainable packaging innovation supports long-term market expansion.

Which are the Top Companies in Edible Protein Packaging Market?

The edible protein packaging industry is primarily led by well-established companies, including:

- Nagase America LLC (U.S.)

- Devro (U.K.)

- Monosol, LLC (U.S.)

- JRF Technology, LLC (U.S.)

- Webpac (U.K.)

- Notpla Limited (U.K.)

- TIPA LTD. (Israel)

- Avani Eco (Indonesia)

- Incredible Foods, Inc. (U.S.)

- Ecoactive (U.K.)

- Mantrose UK Ltd. (U.K.)

- CuanTec (U.K.)

- Lactips (France)

- Tri-Mach Group Inc. (Canada)

- Tate & Lyle (U.K.)

- Ingredion (U.S.)

- Bluwrap (U.S.)

- Pace International LLC (U.S.)

- Watson Inc. (U.S.)

- Coveris (Austria)

What are the Recent Developments in Global Edible Protein Packaging Market?

- In September 2023, Xampla announced the launch of its consumer brand Morro, focused on developing bio-based and edible packaging solutions capable of competing with plastics, enabling food brands to transition away from single-use plastic through the company’s breakthrough material, thereby accelerating adoption of plastic-free packaging alternatives

- In August 2022, Nippon Paint China partnered with BASF to introduce eco-friendly edible packaging solutions integrated into the Nippon Paint dry-mixed mortar product series, supporting sustainable material innovation across industrial applications, thereby reinforcing the shift toward environmentally responsible packaging solutions

- In September 2021, Pace International LLC introduced PrimaFresh® 60 Organic, a premium plant-based edible coating designed to enhance the freshness and visual appeal of stone fruits by effectively managing dehydration, thereby improving shelf life and reducing food waste

- In October 2020, London-based startup Notpla launched innovative edible seaweed-based packaging as a viable alternative to conventional plastic packaging, addressing growing concerns around plastic pollution, thereby advancing sustainable single-use packaging solutions

- In January 2020, New York-based company Loliware announced the launch of algae- and seaweed-based edible straws made by blending seaweed with minerals, color, and water, offering a plastic-free alternative for beverages, thereby supporting zero-waste consumption trends

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Edible Protein Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Edible Protein Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Edible Protein Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.