Global Eds Wds Ebsd Micro Xrf Instruments Market

Market Size in USD Billion

CAGR :

%

USD

2.52 Billion

USD

3.74 Billion

2025

2033

USD

2.52 Billion

USD

3.74 Billion

2025

2033

| 2026 –2033 | |

| USD 2.52 Billion | |

| USD 3.74 Billion | |

|

|

|

|

Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Market Size

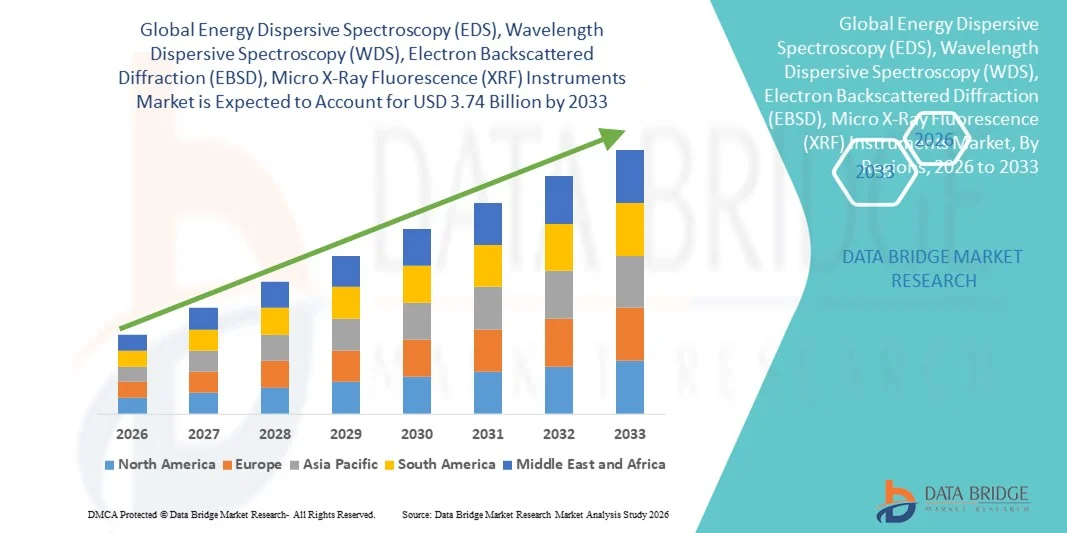

- The global Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) instruments market size was valued at USD 2.52 billion in 2025 and is expected to reach USD 3.74 billion by 2033, at a CAGR of 5.08% during the forecast period

- The market growth is largely driven by the increasing demand for advanced materials characterization and quality control across industries such as aerospace, automotive, electronics, and metallurgy, coupled with ongoing technological innovations in spectroscopic and diffraction instrumentation

- Furthermore, rising emphasis on research and development, along with the need for precise elemental and microstructural analysis in both industrial and academic laboratories, is establishing these instruments as essential tools for material analysis. These converging factors are accelerating the adoption of EDS, WDS, EBSD, and Micro XRF solutions, thereby significantly boosting the industry's growth

Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Market Analysis

- EDS, WDS, EBSD, and Micro XRF instruments, offering high-precision elemental and microstructural analysis, are increasingly critical across industries such as pharmaceuticals, oil, forensics, and clinical research due to their accuracy, speed, and compatibility with modern laboratory workflows

- The growing adoption of these instruments is primarily driven by increasing R&D activities, stringent quality control requirements, and rising demand for advanced analytical techniques in both industrial and academic laboratories

- North America dominated the market with the largest revenue share of 38.9% in 2025, supported by a high concentration of research institutes, leading instrument manufacturers, and early adoption of advanced analytical technologies, with the U.S. experiencing substantial growth in laboratory installations driven by innovations in high-resolution detectors and software-enhanced data analytics

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period due to expanding industrialization, increasing R&D investments, and rising focus on material characterization in emerging economies such as China, India, and South Korea

- Energy Dispersive Spectroscopy (EDS) segment dominated the market with a share of 41.5% in 2025, driven by its versatility, cost-effectiveness, and ability to provide rapid qualitative and quantitative elemental analysis, making it the preferred choice for research institutes and industrial laboratories

Report Scope and Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Market Segmentation

|

Attributes |

Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Market Trends

Advancement in Integrated Analytical Platforms

- A significant and accelerating trend in the global EDS, WDS, EBSD, and Micro XRF instruments market is the development of integrated analytical platforms that combine multiple techniques in a single system, enhancing laboratory efficiency and versatility

- For instance, Thermo Scientific’s Quanta SEM with integrated EDS and EBSD allows simultaneous microstructural and compositional analysis, reducing sample handling time and improving data consistency

- Software advancements with AI and machine learning capabilities are enabling automated data interpretation, pattern recognition, and predictive analysis, allowing laboratories to obtain faster and more accurate insights from complex material samples

- The trend towards more intelligent, user-friendly, and multi-functional instrument platforms is fundamentally reshaping laboratory workflows, with companies such as JEOL developing systems that allow seamless switching between EDS, WDS, and EBSD modes for comprehensive materials characterization

- The demand for versatile, high-throughput instruments that minimize manual intervention and integrate multiple analytical methods is growing rapidly across research institutes, pharmaceutical companies, and industrial laboratories

- Miniaturization and portability of EDS and Micro XRF systems are gaining traction, enabling on-site analysis and field applications without the need for centralized laboratory setups

- For instance, Bruker’s handheld Micro XRF analyzers allow elemental composition testing directly in mining, forensics, and oil industry sites, enhancing real-time decision-making and reducing sample transport time

Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Market Dynamics

Driver

Rising Demand for Advanced Materials Analysis and Research

- The increasing requirement for precise elemental and microstructural analysis across industries such as pharmaceuticals, oil, metallurgy, and forensics is a key driver for the adoption of EDS, WDS, EBSD, and Micro XRF instruments

- For instance, in March 2025, Bruker announced enhanced benchtop Micro XRF systems for rapid material screening, aimed at accelerating research workflows and improving quality control in industrial laboratories

- The need for high-throughput, accurate, and reproducible measurements in both academic and industrial R&D environments is driving laboratories to invest in multi-technique instruments for comprehensive material characterization

- For instance, Thermo Scientific launched an automated EDS-EBSD workflow solution enabling researchers to perform simultaneous elemental and crystallographic analysis with minimal operator intervention

- Growing emphasis on innovation, regulatory compliance, and product quality is making these analytical instruments indispensable for research institutes, clinical laboratories, and pharmaceutical companies, further boosting market adoption

- Increasing collaborations between instrument manufacturers and academic institutions are facilitating tailored solutions and customized training programs, enhancing adoption in research-intensive environments

- For instance, Oxford Instruments partnered with leading universities to provide specialized EBSD and WDS training modules, helping students and researchers gain practical expertise while promoting product usage

Restraint/Challenge

High Costs and Technical Complexity

- The relatively high capital investment required for advanced EDS, WDS, EBSD, and Micro XRF systems poses a significant challenge for small laboratories and developing markets, limiting widespread adoption

- For instance, state-of-the-art EBSD systems from Oxford Instruments can cost several hundred thousand dollars, making them inaccessible for smaller research facilities or budget-conscious industrial labs

- The technical expertise required to operate multi-technique instruments, interpret complex datasets, and maintain equipment can also hinder adoption, particularly in regions with limited skilled personnel

- Overcoming these challenges through modular, user-friendly instruments, portable benchtop systems, and enhanced training programs will be critical to expanding market penetration and enabling smaller laboratories to leverage advanced analytical capabilities

- Maintenance and calibration requirements for high-precision instruments add to operational costs, which may deter smaller labs from long-term adoption

- For instance, periodic recalibration of WDS detectors and EBSD cameras is essential for accurate measurements, leading to recurring costs and potential downtime that may impact lab efficiency

- Regulatory and compliance constraints in certain industries, such as pharmaceuticals and clinical laboratories, can slow adoption due to the need for validated workflows and certified instrument performance

- For instance, Micro XRF and EDS systems used in pharmaceutical quality control must comply with strict FDA or ISO standards, adding complexity and time to deployment in regulated environments

Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the market is segmented into Electron Backscatter Diffraction (EBSD), Micro X-Ray Fluorescence (XRF), Energy Dispersive Spectroscopy (EDS), and Wavelength Dispersive Spectroscopy (WDS). The Energy Dispersive Spectroscopy (EDS) segment dominated the market with the largest revenue share of 41.5% in 2025, driven by its versatility, cost-effectiveness, and ability to provide rapid qualitative and quantitative elemental analysis. EDS is widely adopted in research institutes and industrial laboratories for routine materials characterization, failure analysis, and quality control. Its compatibility with scanning electron microscopes (SEM) and relatively low operational costs make it accessible to a broad range of users. The increasing need for high-throughput analysis in pharmaceuticals, metallurgy, and forensics further supports its dominance. In addition, EDS systems are often integrated into multi-technique platforms, increasing their appeal for laboratories seeking comprehensive material analysis capabilities.

The Micro X-Ray Fluorescence (XRF) segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for non-destructive, rapid elemental analysis across industries. Micro XRF instruments are increasingly used in on-site applications, such as mining, environmental testing, and oil analysis, due to their portability and ease of use. Their capability to analyze small sample areas with high spatial resolution makes them suitable for detailed compositional mapping. Advances in benchtop and handheld Micro XRF devices are expanding their adoption in both research and industrial laboratories. The growing need for precise quality control in the pharmaceutical and manufacturing sectors also drives market expansion. Furthermore, the integration of Micro XRF with AI-driven software for automated analysis is enhancing its usability and accelerating growth in emerging economies.

- By Application

On the basis of application, the market is segmented into oil industry, pharmaceutical companies, research institutes, forensic laboratories, and clinical laboratories. The Research Institutes segment dominated the market in 2025 due to extensive usage of EDS, WDS, EBSD, and Micro XRF instruments for advanced materials research, academic studies, and product development. Research institutions prioritize high-resolution, multi-technique instruments to support innovation, reproducibility, and detailed material characterization. The growing emphasis on nanomaterials, alloys, and semiconductor research further boosts instrument adoption in these settings. In addition, funding support and collaborative projects with instrument manufacturers enable research institutes to acquire state-of-the-art equipment. Continuous technological upgrades, including AI-assisted data interpretation and integrated analytical platforms, also contribute to the dominance of research institutes as key end users.

The Oil Industry segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for accurate, rapid, and non-destructive elemental and microstructural analysis for exploration, drilling, and refining applications. Instruments such as Micro XRF and EDS are employed to analyze oil samples, detect impurities, and monitor equipment wear in pipelines and refineries. Portable and benchtop systems allow on-site testing, reducing downtime and improving operational efficiency. The adoption of these instruments is further accelerated by stricter environmental regulations and quality control requirements in the oil sector. In addition, the need to optimize extraction processes and ensure material durability in harsh environments is creating new opportunities for instrument deployment.

Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Market Regional Analysis

- North America dominated the market with the largest revenue share of 38.9% in 2025, supported by a high concentration of research institutes, leading instrument manufacturers, and early adoption of advanced analytical technologies

- Laboratories and industrial facilities in the region highly value the precision, speed, and multi-technique capabilities offered by these instruments for applications in pharmaceuticals, metallurgy, electronics, and forensics

- This widespread adoption is further supported by significant government and private funding for scientific research, early technology adoption, and the presence of leading instrument manufacturers offering integrated analytical solutions, establishing North America as a key hub for materials characterization and advanced laboratory analysis

The U.S. EDS, WDS, EBSD, and Micro X-Ray Fluorescence (XRF) Instruments Market Insight

The U.S. market captured the largest revenue share of 42% in North America in 2025, fueled by the high concentration of research institutes, advanced manufacturing industries, and R&D-driven organizations. Laboratories are increasingly prioritizing high-precision elemental and microstructural analysis for applications in pharmaceuticals, metallurgy, electronics, and forensics. The growing demand for multi-technique instruments that integrate EDS, WDS, EBSD, and Micro XRF capabilities is further propelling market growth. In addition, U.S. adoption is supported by early technology uptake, strong government and private funding for research, and advanced training programs that enhance instrument utilization. The presence of major global instrument manufacturers in the U.S., offering localized support and service, also strengthens market expansion. Furthermore, high awareness of quality control and compliance standards drives laboratories to invest in cutting-edge analytical instrumentation.

Europe EDS, WDS, EBSD, and Micro XRF Instruments Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent industrial and academic quality standards and the increasing need for precise materials characterization. Rising urbanization and growing industrialization in Germany, France, and Italy are fostering the adoption of advanced analytical instruments. European laboratories favor non-destructive, high-resolution techniques for research and quality assurance, contributing to market growth. In addition, the emphasis on sustainable and eco-friendly processes promotes the integration of advanced instruments in manufacturing and R&D workflows. Government initiatives supporting scientific research and innovation further encourage adoption across research institutes and industrial labs. Strong collaboration between instrument manufacturers and academic institutions also facilitates tailored solutions, enhancing market penetration.

U.K. EDS, WDS, EBSD, and Micro XRF Instruments Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the growing demand for advanced analytical solutions in research, forensics, and industrial laboratories. Laboratories in the U.K. are increasingly adopting integrated instruments for multi-technique elemental and structural analysis. Concerns over compliance, product quality, and accurate material characterization are motivating research institutions and industrial labs to upgrade to high-precision systems. In addition, the country’s robust R&D ecosystem, coupled with strong private and government funding, supports the deployment of EDS, WDS, EBSD, and Micro XRF instruments. Availability of skilled personnel and localized technical support from manufacturers further accelerates market growth. Increasing applications in pharmaceuticals, electronics, and materials research are reinforcing the demand for these analytical solutions.

Germany EDS, WDS, EBSD, and Micro XRF Instruments Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s advanced manufacturing sector, emphasis on R&D, and strong focus on quality control in industries such as automotive, aerospace, and metallurgy. German laboratories are adopting high-resolution and integrated analytical instruments for precise elemental and crystallographic analysis. The trend toward automation, data-driven research, and digitalization in labs is further supporting instrument adoption. In addition, stringent regulatory standards in industrial and academic research necessitate the use of validated analytical systems. Manufacturers offering customizable solutions and advanced software integration are gaining traction. Germany’s emphasis on sustainability and innovation also encourages the integration of energy-efficient and multi-technique analytical platforms in laboratories.

Asia-Pacific EDS, WDS, EBSD, and Micro XRF Instruments Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 23% during 2026–2033, driven by rapid industrialization, expanding R&D infrastructure, and growing adoption of advanced analytical instruments in countries such as China, Japan, and India. The region is witnessing increased investment in research institutes, academic laboratories, and industrial facilities requiring precise materials characterization. In addition, government initiatives promoting digitalization, quality control, and scientific research are accelerating market growth. The availability of cost-effective and portable EDS and Micro XRF systems is improving accessibility for emerging laboratories. Furthermore, Asia-Pacific’s rising focus on pharmaceuticals, electronics, and automotive manufacturing is fueling demand for multi-technique and high-throughput analytical instruments. Collaboration between global instrument manufacturers and local distributors is enhancing market penetration and customer support.

Japan EDS, WDS, EBSD, and Micro XRF Instruments Market Insight

The Japan market is gaining momentum due to the country’s high-tech industrial ecosystem, strong emphasis on R&D, and demand for advanced materials characterization. Laboratories in Japan prioritize high-resolution EDS, WDS, EBSD, and Micro XRF instruments for applications in electronics, automotive, and materials research. The integration of these instruments with AI-driven software and automated workflows is increasing efficiency and reducing operator dependency. In addition, Japan’s aging population is driving the adoption of user-friendly and automated instruments in research and clinical laboratories. Government and private funding support, combined with early adoption of innovative analytical technologies, contributes to market expansion. Collaboration between universities, industrial labs, and instrument manufacturers further enhances localized solutions and training programs, boosting adoption rates.

India EDS, WDS, EBSD, and Micro XRF Instruments Market Insight

The India market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid industrialization, expanding R&D facilities, and rising demand for advanced analytical instruments across research institutes, pharmaceutical companies, and industrial laboratories. India’s push toward smart manufacturing and quality control standards is encouraging the adoption of EDS, WDS, EBSD, and Micro XRF systems. In addition, cost-effective instrument models and growing availability of local support and training programs are increasing accessibility for smaller laboratories. The country’s focus on scientific research, coupled with increasing collaboration with global instrument manufacturers, is driving market growth. Furthermore, applications in pharmaceuticals, metallurgy, and forensics are expanding, reinforcing India’s position as a key growth market in the Asia-Pacific region.

Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Market Share

The Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Bruker Corporation (U.S.)

- AMETEK, Inc. (U.S.)

- JEOL Ltd. (Japan)

- HORIBA, Ltd. (Japan)

- IXRF Systems Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Oxford Instruments plc (U.K.)

- Rigaku Corporation (Japan)

- Nanoscientific (U.K.)

- CAMECA (France)

- Gatan, Inc. (U.S.)

- SPECS GmbH (Germany)

- Kratos Analytical Ltd. (U.K.)

- PIK Instruments (France)

- AYO Technologies Inc. (U.S.)

- EDEN Instruments SAS (France)

- ZEISS (Germany)

- Hitachi High Technologies Corporation (Japan)

- Malvern Panalytical Ltd. (U.K.)

What are the Recent Developments in Global Energy Dispersive Spectroscopy (EDS), Wavelength Dispersive Spectroscopy (WDS), Electron Backscattered Diffraction (EBSD), Micro X-Ray Fluorescence (XRF) Instruments Market?

- In August 2025, Gatan (AMETEK) launched the EDAX Orbis II Micro‑XRF system, a next‑generation micro X‑ray fluorescence analyzer designed to deliver faster data acquisition, enhanced spatial accuracy, and high‑intensity detection with improved optics and software for more reliable elemental analysis of both small particles and larger, complex samples expanding micro‑XRF capabilities for research and industrial laboratories

- In May 2025, Bruker introduced the S8 TIGER™ Series 3 high‑performance WDXRF spectrometer, offering enhanced speed, precision, and detector innovation for wavelength dispersive X‑ray fluorescence (WDXRF) analysis in industry and research, with improved light element detection and cloud‑and‑AI‑enabled sample handling

- In March 2025, Bruker launched the eWARP a pioneering new Electron Backscatter Diffraction (EBSD) detector, introducing a hybrid pixel sensor and direct electron detection for dramatically faster and more signal‑efficient EBSD data acquisition in scanning electron microscopes. This next‑generation detector pushes the boundaries of EBSD speed (up to 14,400 patterns per second) and spatial resolution, enabling enhanced microstructural analysis for research and industrial applications

- In October 2024, Gatan (AMETEK) launched the EDAX Elite T Ultra advanced EDS system, designed to deliver significantly improved detection efficiency across a wide range of elements and accelerate compositional mapping performance in STEM (Scanning Transmission Electron Microscopy) applications. This new system enhances elemental analysis sensitivity and broadens the usability of EDS in thin‑sample research workflows

- In January 2023, AMETEK EDAX introduced the Velocity™ Ultra EBSD camera at its time one of the fastest EBSD cameras available offering high‑speed mapping (thousands of indexed points per second) with improved pattern quality and indexing performance, significantly enhancing EBSD throughput for routine materials characterization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.