Global Education Personal Computer Pc Market

Market Size in USD Billion

CAGR :

%

USD

46.35 Billion

USD

119.78 Billion

2025

2033

USD

46.35 Billion

USD

119.78 Billion

2025

2033

| 2026 –2033 | |

| USD 46.35 Billion | |

| USD 119.78 Billion | |

|

|

|

|

Education Personal Computer (PC) Market Size

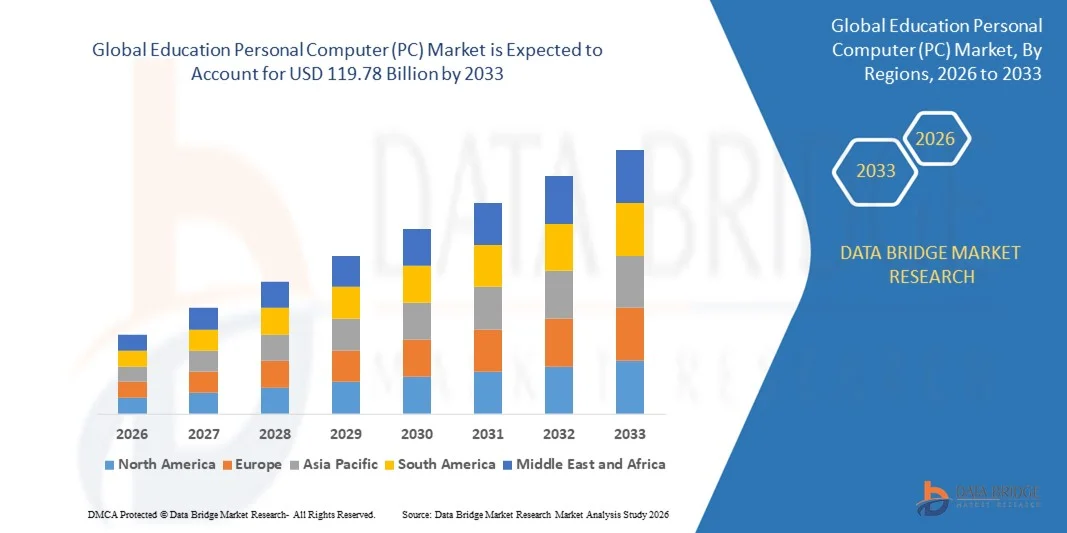

- The global education personal computer (PC) market size was valued at USD 46.35 billion in 2025 and is expected to reach USD 119.78 billion by 2033, at a CAGR of 12.60% during the forecast period

- The market growth is largely fuelled by the increasing adoption of digital learning tools, e-learning platforms, and smart classroom initiatives in schools, colleges, and universities

- Rising government investments in educational technology, coupled with the need for personalized learning solutions and remote learning capabilities, are further supporting market expansion

Education Personal Computer (PC) Market Analysis

- The market is witnessing robust growth due to the integration of technology into curricula, increasing reliance on digital content, and rising adoption of cloud-based educational solutions

- Enhanced connectivity, government funding, and private sector collaborations are enabling broader deployment of PCs in educational institutions, promoting interactive and hybrid learning environments

- North America dominated the education personal computer (PC) market with the largest revenue share of 38.75% in 2025, driven by increasing adoption of digital learning tools, government initiatives supporting smart classrooms, and rising awareness of the benefits of PCs in enhancing student engagement and learning outcomes

- Asia-Pacific region is expected to witness the highest growth rate in the global education personal computer (PC) market, driven by rapid urbanization, increasing digital literacy, rising student population, and government initiatives promoting technology-enabled learning across schools and universities

- The Laptop segment held the largest market revenue share in 2025, driven by its portability, ease of use, and suitability for both classroom and remote learning environments. Laptops offer flexibility for students and educators to access digital content, virtual classrooms, and e-learning platforms, making them a preferred choice for educational institutions.

Report Scope and Education Personal Computer (PC) Market Segmentation

|

Attributes |

Education Personal Computer (PC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• IBM (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Education Personal Computer (PC) Market Trends

Rise of Digital and Hybrid Learning in Education

• The growing shift toward digital and hybrid learning is transforming the education landscape by enabling real-time, interactive, and personalized learning experiences. The use of PCs allows students and educators to access digital content, virtual classrooms, and online assessments, improving learning outcomes and engagement. This trend also encourages collaborative learning, facilitates teacher-student interaction, and supports adaptive learning techniques tailored to individual student needs

• The high demand for remote and blended learning solutions in under-resourced regions is accelerating the adoption of affordable personal computers and connected devices. These tools are particularly effective where access to physical classrooms is limited, helping reduce learning gaps and ensure continuity of education. The integration of low-cost laptops, tablets, and cloud-based educational platforms further enables scalable deployment across rural and urban schools

• The affordability, portability, and user-friendly features of modern PCs are making them attractive for both schools and higher education institutions, enabling frequent use for assignments, collaborative projects, and research. This ultimately enhances overall educational efficiency and digital literacy. Students benefit from instant access to interactive tools, educational apps, and online resources, fostering self-paced learning and skill development

• For instance, in 2023, several universities in Southeast Asia reported improved student performance and participation after integrating laptops and desktop PCs into their blended learning programs. The deployment allowed seamless access to digital resources, interactive lessons, and real-time feedback. Faculty members also reported enhanced teaching efficiency and better engagement metrics, highlighting the positive impact of technology integration

• While digital PCs are accelerating adoption of modern learning methods, their impact depends on ongoing software updates, teacher training, and reliable infrastructure. Education stakeholders must focus on localized content, cloud integration, and IT support to fully capitalize on the growing demand. Continuous professional development and technical support for educators are essential to ensure effective utilization of PC-based learning tools

Education Personal Computer (PC) Market Dynamics

Driver

Increasing Adoption of Digital Learning Tools and E-Learning Platforms

• The rise in adoption of digital learning tools and e-learning platforms is pushing schools, colleges, and universities to prioritize personal computers as essential learning devices. Integration of multimedia content, virtual labs, and assessment software is driving demand for high-performance PCs. This is further supported by growing investments in EdTech solutions, digital curriculum development, and interactive learning platforms

• Educational institutions and parents are increasingly aware of the benefits of PCs in enhancing student engagement, facilitating collaborative learning, and supporting curriculum delivery. This awareness is encouraging broader deployment of personal computers across classrooms. Schools are also leveraging analytics and tracking tools to monitor student progress, adapt content, and improve overall learning outcomes

• Government initiatives and private sector investments in smart classrooms, digital education programs, and IT infrastructure are strengthening market growth. Funding schemes, grants, and partnerships are enabling wider access to PCs in both urban and rural regions. Policymakers are promoting national digital literacy programs, integrating PCs into education standards, and incentivizing schools to adopt modern teaching technology

• For instance, in 2022, several European countries launched nationwide digital classroom initiatives, boosting demand for affordable laptops, desktops, and interactive devices in schools and universities. These programs facilitated access to high-quality digital content, improved classroom interactivity, and enabled hybrid learning models, contributing to better academic outcomes and skill development

• While technology adoption is driving the market, challenges remain in ensuring affordability, digital infrastructure, and teacher training to sustain long-term utilization. Bridging the gap between urban and rural schools, providing low-cost devices, and maintaining ongoing software and hardware support are critical for continued growth

Restraint/Challenge

High Cost of Advanced PCs and Limited Access in Under-Resourced Regions

• The high price of advanced personal computers, including high-performance laptops and desktop PCs, limits adoption among budget-constrained schools and students in developing regions. Cost remains a major barrier for widespread deployment. In addition, frequent upgrades, licensing fees for software, and maintenance expenses further increase the financial burden on institutions

• Many under-resourced areas lack adequate IT infrastructure, including stable internet connectivity, power supply, and technical support. This limits the effective use of PCs for learning and reduces the overall impact of digital education initiatives. Schools face challenges in establishing reliable networks, maintaining hardware, and ensuring uninterrupted access for students and teachers

• Market penetration is further restricted by the need for regular maintenance, software updates, and cybersecurity measures, which require trained personnel and additional investments. The lack of skilled IT staff in many regions exacerbates these challenges, limiting the scalability and effectiveness of PC-based learning programs

• For instance, in 2023, education agencies in Sub-Saharan Africa reported that over 65% of schools had limited access to functional PCs, citing infrastructure gaps and high costs as primary barriers. This hindered the implementation of blended learning models, reduced access to digital educational resources, and impacted overall student performance metrics

• While technology continues to evolve with more affordable and efficient devices, addressing cost, infrastructure, and training challenges remains essential to unlock the full potential of the global education PC market. Public-private partnerships, subsidies, and scalable IT support programs are crucial to bridging the digital divide and promoting inclusive, technology-driven education

Education Personal Computer (PC) Market Scope

The market is segmented on the basis of product and end-user.

- By Product

On the basis of product, the education personal computer (PC) market is segmented into Desktop, Laptop, and Tablets. The Laptop segment held the largest market revenue share in 2025, driven by its portability, ease of use, and suitability for both classroom and remote learning environments. Laptops offer flexibility for students and educators to access digital content, virtual classrooms, and e-learning platforms, making them a preferred choice for educational institutions.

The Tablet segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its lightweight design, interactive touch capabilities, and compatibility with educational apps and cloud-based learning platforms. Tablets are increasingly adopted for personalized learning, collaborative projects, and digital assessments, especially in primary and secondary education settings.

- By End-User

On the basis of end-user, the education personal computer (PC) market is segmented into Primary Education, Secondary Education, Higher Education, and Others. The Higher Education segment held the largest market revenue share in 2025, fueled by the increasing use of PCs for online lectures, research, virtual labs, and academic collaboration. Universities and colleges are investing heavily in high-performance PCs to support digital learning initiatives and advanced coursework.

The Primary Education segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising adoption of interactive learning tools, digital curricula, and government programs promoting technology integration in early education. Schools are implementing PCs to improve digital literacy, enhance engagement, and support hybrid learning models.

Education Personal Computer (PC) Market Regional Analysis

- North America dominated the education personal computer (PC) market with the largest revenue share of 38.75% in 2025, driven by increasing adoption of digital learning tools, government initiatives supporting smart classrooms, and rising awareness of the benefits of PCs in enhancing student engagement and learning outcomes

- Educational institutions and parents in the region highly value the convenience, interactivity, and access to digital content provided by personal computers, which support blended and remote learning models across schools and universities

- This widespread adoption is further supported by high disposable incomes, robust IT infrastructure, and the growing integration of PCs with cloud-based learning platforms, establishing personal computers as essential devices for both primary, secondary, and higher education

U.S. Education PC Market Insight

The U.S. education personal computer market captured the largest revenue share in 2025 within North America, fueled by widespread digital learning adoption and investment in e-learning platforms. Schools and universities are increasingly prioritizing high-performance PCs for virtual classrooms, online assessments, and collaborative projects. The growing preference for BYOD (Bring Your Own Device) initiatives, interactive learning software, and integration with cloud-based educational tools further propels the market. Moreover, government grants and private sector funding supporting digital education infrastructure are significantly contributing to the market's expansion.

Europe Education PC Market Insight

The Europe education personal computer market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the digitalization of schools and universities and the rising demand for connected devices in classrooms. Increasing urbanization, government-funded digital education programs, and the adoption of e-learning platforms are fostering PC deployment. Educational institutions are investing in desktops, laptops, and tablets to enhance interactive learning, improve student engagement, and support hybrid teaching models.

U.K. Education PC Market Insight

The U.K. education personal computer market is expected to witness the fastest growth rate from 2026 to 2033, driven by government initiatives to promote digital learning, increased funding for smart classrooms, and a growing focus on IT literacy among students. Schools and universities are adopting high-performance PCs and tablets to enable interactive learning, digital assessments, and remote education. The region’s strong e-learning infrastructure, combined with robust internet penetration, is expected to continue supporting market growth.

Germany Education PC Market Insight

The Germany education personal computer market is expected to witness the fastest growth rate from 2026 to 2033, fueled by government programs promoting digital classrooms, increasing awareness of the benefits of PC-based learning, and demand for energy-efficient and technologically advanced devices. German educational institutions are investing in high-performance laptops, desktops, and tablets to support virtual labs, online research, and collaborative learning. Integration with cloud-based tools and digital curricula is becoming increasingly prevalent, aligning with local educational standard.

Asia-Pacific Education PC Market Insight

The Asia-Pacific education personal computer market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising digital learning adoption, increasing government investment in IT infrastructure, and growing disposable incomes in countries such as China, Japan, and India. The region's emphasis on smart classrooms and online education, coupled with initiatives to provide affordable PCs to students, is accelerating market expansion. Furthermore, as APAC emerges as a manufacturing hub for PC components, the affordability and accessibility of devices are improving across educational institutions.

Japan Education PC Market Insight

The Japan education personal computer market is expected to witness the fastest growth rate from 2026 to 2033 due to high-tech culture, early adoption of digital education, and the demand for convenience in learning. Schools and universities are increasingly deploying laptops, desktops, and tablets to enable interactive classrooms, e-learning platforms, and research activities. Japan's aging population is also driving the demand for user-friendly and accessible devices to support lifelong learning in both educational institutions and community learning centers.

China Education PC Market Insight

The China education personal computer market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, high digital literacy, and strong government initiatives promoting digital education. Personal computers are increasingly adopted in schools, colleges, and universities to support online learning, blended classrooms, and collaborative projects. The push for smart classrooms, increasing e-learning content availability, and affordability of devices are key factors propelling the market in China.

Education Personal Computer (PC) Market Share

The Education Personal Computer (PC) industry is primarily led by well-established companies, including:

• IBM (U.S.)

• Smart Technologies (Canada)

• AT&T Technologies Inc (U.S.)

• Blackboard Inc. (U.S.)

• Dell (U.S.)

• Apple Inc. (U.S.)

• Microsoft (U.S.)

• HP Development Company, L.P (U.S.)

• Lenovo (China)

• Panasonic India (India)

• SAMSUNG (South Korea)

• Alphabetics Computer Services Pvt. Ltd. (India)

• LG Electronics (South Korea)

• SONY INDIA (India)

• ASUSTeK Computer Inc. (Taiwan)

• HCL Technologies (India)

• NEC Corp (Japan)

Latest Developments in Global Education Personal Computer (PC) Market

- In August 2025, Microsoft (U.S.) announced a strategic partnership with multiple educational institutions to deploy its AI-driven learning platform. This initiative aims to personalize student learning experiences, improve engagement, and support educators with tailored teaching tools. The move is expected to strengthen Microsoft’s position in the education sector, enhance adoption of AI-based educational solutions, and influence the broader market toward interactive, technology-enabled learning

- In September 2025, Lenovo (China) launched a new line of Chromebooks designed for K-12 education, featuring enhanced durability and extended battery life. This development is intended to provide affordable, high-quality devices for schools, enabling students to access digital learning resources effectively. Lenovo’s focus on the K-12 segment is expected to expand its market share, strengthen brand presence in educational technology, and meet the growing demand for cost-effective learning devices

- In October 2025, Apple (U.S.) introduced an initiative to provide discounted iPads and educational software to underprivileged schools. This program is designed to promote equitable access to technology, enhance digital learning opportunities, and support underserved communities. The initiative is likely to reinforce Apple’s reputation for social responsibility, increase adoption of its devices in schools, and boost its influence in the global education technology market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.