Global Egg Packaging Market

Market Size in USD Billion

CAGR :

%

USD

7.21 Billion

USD

11.75 Billion

2024

2032

USD

7.21 Billion

USD

11.75 Billion

2024

2032

| 2025 –2032 | |

| USD 7.21 Billion | |

| USD 11.75 Billion | |

|

|

|

|

Egg Packaging Market Size

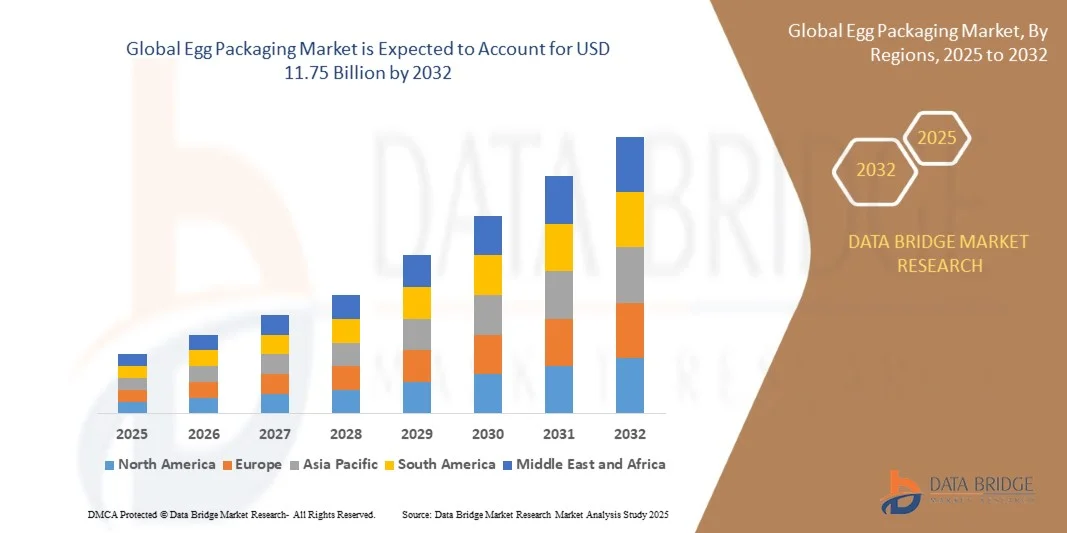

- The global egg packaging market size was valued at USD 7.21 billion in 2024 and is expected to reach USD 11.75 billion by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by increasing consumer awareness regarding food safety, hygiene, and egg quality, leading to higher demand for protective and sustainable packaging solutions

- Furthermore, rising adoption of eco-friendly materials such as paperboard, molded pulp, and biodegradable plastics is establishing advanced egg packaging as the preferred choice for both retailers and consumers. These converging factors are accelerating the uptake of sustainable and durable packaging solutions, thereby significantly boosting the industry's growth

Egg Packaging Market Analysis

- Egg packaging solutions, including cartons, trays, and molded cups, are increasingly vital components of the poultry and retail supply chain due to their ability to minimize breakage, maintain freshness, and ensure safe transportation

- The escalating demand for packaged eggs is primarily fueled by the growth of organized retail, e-commerce grocery delivery, and cold chain logistics, which support the distribution of eggs in modern retail and commercial channels

- Asia-Pacific dominated the egg packaging market in 2024, due to rising demand for safe and sustainable packaging solutions, increasing organized retail penetration, and growing consumer awareness regarding egg quality and hygiene

- North America is expected to be the fastest growing region in the egg packaging market during the forecast period due to increasing demand for safe, durable, and environmentally friendly egg packaging solutions

- Cartons segment dominated the market with a market share of 45.5% in 2024, due to its widespread use in retail environments and ease of handling for consumers. Cartons provide reliable protection for eggs while being lightweight and stackable, making them highly suitable for both home use and large-scale distribution. The segment benefits from ongoing innovations in design, such as inserts and reinforced compartments, which enhance egg safety during transport. Manufacturers also leverage cartons as a medium for branding, nutritional labeling, and marketing, increasing their adoption in modern retail settings

Report Scope and Egg Packaging Market Segmentation

|

Attributes |

Egg Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Egg Packaging Market Trends

“Growing Use of Sustainable and Biodegradable Egg Packaging”

- The global egg packaging market is undergoing a notable transformation with the rising adoption of sustainable and biodegradable materials driven by environmental concerns and regulatory initiatives promoting eco-friendly packaging. Manufacturers are increasingly focusing on materials such as molded fiber, recycled paper, and bioplastics to replace conventional plastic trays and cartons, aligning the industry with circular economy objectives

- For instance, companies such as Huhtamäki Oyj and Hartmann Packaging have expanded their biodegradable molded fiber packaging portfolios to cater to global demand for recyclable and compostable egg containers. These developments reflect growing consumer preference for sustainability-oriented packaging solutions that ensure protection, freshness, and environmental compliance

- The adoption of biodegradable packaging materials helps reduce the carbon footprint while maintaining properties such as cushioning strength, ventilation, and light protection necessary to preserve egg quality. Eco-packaging designs are now emphasizing renewable raw materials and optimized stackability to reduce logistics and storage costs

- Regulatory pressures, particularly in the European Union and North America, are encouraging producers to phase out single-use plastics from egg packaging. This regulatory support is driving material innovation across renewable cellulose-based and PLA-derived solutions that meet environmental standards without compromising functionality

- Emerging economies are witnessing growing implementation of sustainable egg packaging across retail supply chains as modern trade expands. With supermarkets and e-commerce platforms emphasizing brand differentiation, sustainability labeling, and recyclable materials, eco-friendly packaging is becoming a key marketing and compliance differentiator

- As global food industries pivot toward sustainable solutions, biodegradable egg packaging is set to play an essential role in balancing food protection, waste reduction, and environmental safety. The trend reflects the continuing shift from traditional plastics toward recyclable and renewable materials supporting sustainable food distribution

Egg Packaging Market Dynamics

Driver

“Rising Consumer Focus on Food Safety and Hygiene”

- Heightened consumer awareness about food safety, contamination prevention, and quality preservation is driving demand for robust egg packaging. The packaging acts as a crucial barrier against breakage, bacterial contamination, and temperature fluctuations, ensuring product integrity throughout distribution and retail handling

- For instance, Dispak Industries and Tekni-Plex have developed advanced egg packaging designs with improved cushioning and tamper-evident features that enhance safety during storage and transportation. These innovations cater to retail chains and online grocery platforms seeking to deliver uncompromised freshness to end consumers

- The post-pandemic increase in health-conscious consumption behaviors and stricter hygiene standards across the food supply chain have further amplified the importance of sealed, durable packaging. Perforated fiber and paper-based trays offer balanced ventilation and mechanical protection, ensuring product safety without plastic dependency

- Technological advancements in packaging manufacturing—such as automated molding, printing, and labeling—support standardization and contamination-free packaging environments. These improvements contribute to better regulatory compliance and supply chain reliability for perishable products such as eggs

- As food quality and safety become top priorities globally, the demand for protective, hygienic, and traceable egg packaging solutions is poised to continue rising. Manufacturers focusing on innovative safety features and certified sustainable solutions will remain key drivers shaping this growing market

Restraint/Challenge

“High Costs of Eco-Friendly Packaging Materials”

- The production of sustainable and biodegradable egg packaging materials poses cost challenges relative to conventional plastic packaging. The use of renewable fibers, bioplastics, and energy-intensive molding processes increases overall manufacturing expenses, limiting large-scale adoption—particularly in price-sensitive regions

- For instance, Hartmann and Huhtamäki have reported higher input costs related to pulp processing, renewable resin sourcing, and water-intensive recycling operations. These added costs are often passed to consumers, impacting affordability and slowing penetration in developing markets where price competition remains fierce

- Limited availability and supply chain constraints for bio-based raw materials contribute to price volatility. Seasonal fluctuations in paper pulp or sugarcane-derived biopolymer costs can further hinder consistent production economics for sustainable packaging producers

- The need for specialized machinery, customized molds, and higher operational energy use adds to the total cost structure. Manufacturers focusing on small-batch production for premium retail brands often face scale limitations that prevent achieving cost parity with plastic alternatives

- Overcoming these challenges will require investments in scalable green technologies, material innovation, and efficient recycling infrastructure. As technological maturity improves and economies of scale expand, cost barriers are expected to decline—enabling broader adoption of sustainable egg packaging across global markets

Egg Packaging Market Scope

The market is segmented on the basis of material, product type, and application.

• By Material

On the basis of material, the egg packaging market is segmented into paper, paperboard, recycled paper, molded cup, plastic, polyethylene terephthalate (PET), and polystyrene. The paperboard segment dominated the market with the largest market revenue share in 2024, driven by its sustainable profile, lightweight nature, and cost-effectiveness. Consumers and retailers often prefer paperboard packaging for its ability to protect eggs from impact while being easy to stack and transport. The growing emphasis on eco-friendly and biodegradable packaging solutions has further strengthened the adoption of paperboard in both retail and commercial sectors. Manufacturers are also investing in innovative coatings and treatments to enhance moisture resistance and durability of paperboard packaging, increasing its market appeal.

The molded cup segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in organized retail and food service sectors. Molded cup packaging offers superior cushioning, reducing breakage during transportation, and can be designed in ergonomic and space-saving formats. Its compatibility with automated packing lines and ability to display branding or nutritional information contribute to its growing popularity among large-scale egg producers and retailers. Moreover, the increasing preference for portion-controlled packaging for consumer convenience is accelerating the uptake of molded cup solutions.

• By Product Type

On the basis of product type, the egg packaging market is segmented into cartons, trays, containers, and others. The cartons segment dominated the market with the largest market revenue share of 45.5% in 2024, driven by its widespread use in retail environments and ease of handling for consumers. Cartons provide reliable protection for eggs while being lightweight and stackable, making them highly suitable for both home use and large-scale distribution. The segment benefits from ongoing innovations in design, such as inserts and reinforced compartments, which enhance egg safety during transport. Manufacturers also leverage cartons as a medium for branding, nutritional labeling, and marketing, increasing their adoption in modern retail settings.

The trays segment is expected to witness the fastest growth rate from 2025 to 2032, driven by demand from commercial farms and food processing units requiring bulk packaging solutions. Trays allow for efficient organization of multiple eggs while minimizing breakage, making them ideal for transportation and large-scale storage. Their compatibility with automated filling and handling systems enhances operational efficiency and reduces labor costs. In addition, the trays segment is seeing innovation in biodegradable and recycled materials, responding to sustainability initiatives and increasing consumer awareness.

• By Application

On the basis of application, the egg packaging market is segmented into retailing, transportation, and others. The retailing segment dominated the market with the largest market revenue share in 2024, driven by the high demand for packaged eggs in supermarkets, grocery stores, and online channels. Retailers prioritize packaging that ensures product safety, visibility, and convenience for end consumers, which boosts the adoption of structured cartons and trays. Packaging innovations such as easy-open designs, portion control, and branding have further enhanced the appeal of retail-oriented egg packaging. The segment also benefits from increasing urbanization and rising disposable incomes, which fuel organized retail sales.

The transportation segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the expanding cold chain logistics and e-commerce distribution channels for eggs. Efficient transportation packaging reduces breakage during long-distance shipping, preserves product quality, and ensures compliance with food safety standards. Materials and designs that offer shock absorption, stackability, and temperature resistance are increasingly favored by logistics providers. The growth of egg exports and intercity supply chains is further accelerating the adoption of advanced transportation packaging solutions.

Egg Packaging Market Regional Analysis

- Asia-Pacific dominated the egg packaging market with the largest revenue share in 2024, driven by rising demand for safe and sustainable packaging solutions, increasing organized retail penetration, and growing consumer awareness regarding egg quality and hygiene

- The region’s adoption of eco-friendly materials, technological advancements in automated packaging, and expansion of cold chain logistics are accelerating market development

- The availability of cost-effective raw materials, favorable government regulations promoting biodegradable packaging, and increasing e-commerce distribution channels are contributing to higher consumption of advanced egg packaging solutions

China Egg Packaging Market Insight

China held the largest share in the Asia-Pacific egg packaging market in 2024, owing to its strong poultry industry, high egg production, and rapid modernization of retail supply chains. The country’s focus on sustainable and innovative packaging solutions, supported by government initiatives on food safety and environmental protection, is a major growth driver. Demand is further enhanced by increasing exports of packaged eggs and processed egg products to international markets, along with widespread adoption of paperboard and molded cup packaging in urban retail segments.

India Egg Packaging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising egg production, increasing organized retail expansion, and growing consumer preference for hygienic and sustainable packaging. Government programs promoting food safety standards and investments in cold chain infrastructure are strengthening the demand for advanced egg packaging. In addition, the growing e-commerce penetration for groceries, urbanization, and rising disposable incomes are contributing to robust market expansion across both retail and institutional channels.

Europe Egg Packaging Market Insight

The Europe egg packaging market is expanding steadily, supported by strict food safety regulations, high demand for sustainable and recyclable packaging materials, and increasing adoption of automation in packaging processes. The region places strong emphasis on quality, traceability, and environmental compliance, particularly in retail and transportation applications. Innovations in molded pulp, biodegradable trays, and portion-controlled packaging are further enhancing market growth in both mature and emerging European economies.

Germany Egg Packaging Market Insight

Germany’s egg packaging market is driven by its strong poultry industry, advanced food processing infrastructure, and emphasis on sustainable packaging solutions. The country has well-established R&D and manufacturing networks that foster innovation in protective and eco-friendly packaging materials. Demand is particularly strong for paperboard cartons and molded trays used in retail and logistics, supported by consumer awareness of food safety and environmental concerns.

U.K. Egg Packaging Market Insight

The U.K. market is supported by a mature retail sector, increasing demand for sustainable packaging, and government initiatives promoting biodegradable materials. Rising focus on packaging traceability, innovation in portion-controlled solutions, and growth of e-commerce grocery delivery are enhancing market expansion. The country continues to play a significant role in high-value egg packaging markets, particularly for retail-ready and premium egg products.

North America Egg Packaging Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand for safe, durable, and environmentally friendly egg packaging solutions. Strong adoption of automated packaging systems, expansion of cold chain logistics, and growing organized retail channels are boosting demand. In addition, rising consumer preference for convenience-oriented and portion-controlled packaging is supporting market expansion in both the U.S. and Canada.

U.S. Egg Packaging Market Insight

The U.S. accounted for the largest share in the North America egg packaging market in 2024, underpinned by its large-scale poultry production, advanced packaging infrastructure, and high consumer awareness regarding food safety. The country’s focus on sustainable materials, regulatory compliance, and technological innovations in protective and convenient packaging is driving the adoption of cartons, trays, and molded solutions. Presence of key packaging manufacturers and a mature distribution network further solidify the U.S.'s leading position in the region.

Egg Packaging Market Share

The egg packaging industry is primarily led by well-established companies, including:

- Brødrene Hartmann (Denmark)

- Huhtamäki Oyj (Finland)

- Celluloses de La Loire (France)

- Placon (U.S.)

- Cascades Inc. (Canada)

- Reynolds (U.S.)

- BWAY Corporation (U.S.)

- CKF Inc. (Canada)

- mypak.cn (China)

- Sonoco Products Company (U.S.)

- Tekni-Plex (U.S.)

- DFM Packaging Solutions (U.S.)

- SANOVO TECHNOLOGY GROUP (Denmark)

- Ovotherm International Handels GmbH (Germany)

- Dispak (Germany)

- UFP Technologies, Inc. (U.S.)

- Pactiv LLC (U.S.)

Latest Developments in Global Egg Packaging Market

- In June 2024, Cascades Inc. introduced its innovative egg packaging solution, Fresh GUARD EnVision, featuring a molded pulp base combined with a coated recycled board sleeve. This design significantly enhances rigidity, stacking strength, and shock absorption, ensuring eggs are well-protected during transportation and storage. Being made from 100% recycled fibers and widely recyclable, it aligns with the rising consumer demand for sustainable packaging and stricter environmental regulations in North America and Europe. The product strengthens Cascades’ position in the market for eco-friendly and compostable packaging solutions and encourages other manufacturers to adopt sustainable practices

- In November 2023, Huhtamaki North America launched fiber-based egg cartons constructed entirely from recycled materials, providing an eco-conscious alternative to traditional polystyrene foam cartons. These cartons address environmental concerns and regulatory restrictions on single-use plastics, especially in the U.S., while promoting recyclable and renewable packaging adoption. The launch positions Huhtamaki as a market leader in sustainability, enhancing brand reputation among retailers and consumers who increasingly prefer environmentally responsible packaging options

- In September 2023, Pacific Pulp Molding, LLC unveiled 3D modeling technology for creating customized molded pulp solutions for eggs. This innovation allows for precise packaging designs that perfectly fit different egg sizes and shapes, improving protection while reducing material usage and production waste. The technology also streamlines the development process, enabling faster prototyping and efficient production. This development is particularly impactful for commercial egg producers and large retail chains seeking optimized, cost-effective, and sustainable packaging solutions

- In June 2023, Huhtamaki Oyj introduced a sustainable molded fiber egg carton solution, emphasizing recyclability and the use of renewable materials. This initiative supports the global push toward biodegradable packaging and responds to growing consumer and regulatory demand for eco-friendly alternatives. By offering an easily recyclable and durable product, Huhtamaki strengthened its footprint in the global sustainable egg packaging market and encouraged wider adoption of molded fiber solutions

- In November 2022, Smurfit Kappa Group launched an innovative 100% recycled egg tray with advanced moisture-resistant properties to maintain egg freshness and reduce breakage during transportation and storage. This development highlights the company’s commitment to environmental stewardship and addresses industry challenges in preserving product quality while minimizing environmental impact. The product has enhanced Smurfit Kappa’s competitive edge in the sustainable packaging segment and demonstrated the potential of recycled materials in high-performance applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Egg Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Egg Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Egg Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.