Global Ehs Market

Market Size in USD Billion

CAGR :

%

USD

58.33 Billion

USD

104.19 Billion

2024

2032

USD

58.33 Billion

USD

104.19 Billion

2024

2032

| 2025 –2032 | |

| USD 58.33 Billion | |

| USD 104.19 Billion | |

|

|

|

|

Environment, Health and Safety (EHS) Market Size

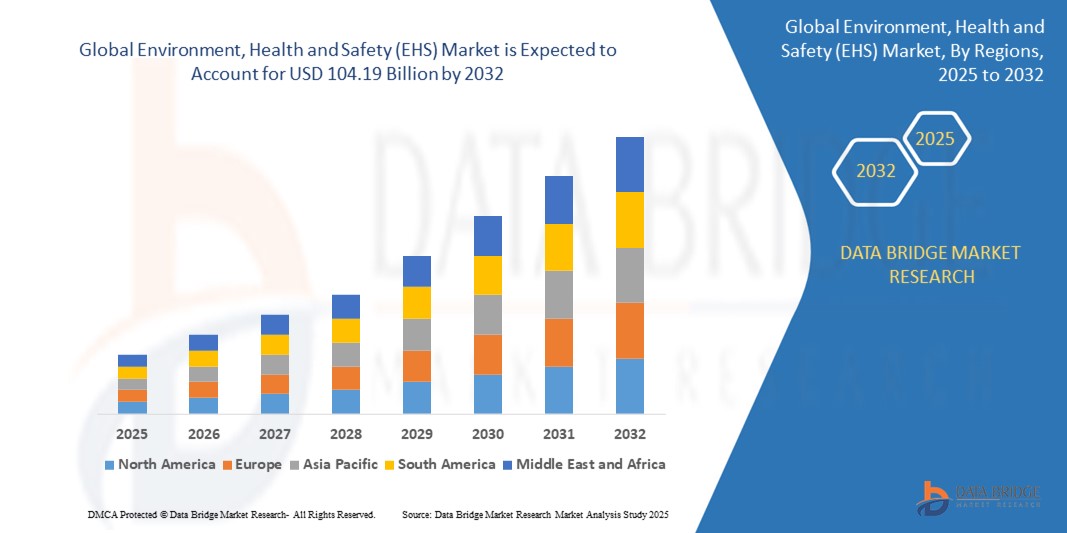

- The Global Environment, Health and Safety (EHS) Market size was valued at USD 58.33 billion in 2024 and is expected to reach USD 104.19 billion by 2032, at a CAGR of 7.52% during the forecast period

- The market expansion is primarily driven by the increasing regulatory compliance requirements across industries, particularly in sectors such as oil & gas, chemicals, construction, and manufacturing. Organizations are increasingly investing in robust EHS solutions to ensure safety, minimize risks, and avoid legal liabilities.

- Additionally, the integration of advanced technologies such as artificial intelligence (AI), big data analytics, Internet of Things (IoT), and cloud computing is revolutionizing the EHS landscape. These innovations are enabling real-time monitoring, predictive analysis, and automated reporting, significantly improving organizational safety and operational efficiency.

Environment, Health and Safety (EHS) Market Analysis

- The Global EHS Market is gaining momentum due to rising regulatory pressures, increased workplace safety awareness, and growing environmental concerns. Organizations across industries are adopting EHS solutions to ensure compliance, minimize risks, and promote sustainable operations.

- The integration of digital technologies such as IoT, AI, and cloud computing is further enhancing real-time monitoring, incident management, and decision-making capabilities. As companies focus more on ESG goals and operational efficiency, the demand for robust and scalable EHS systems continues to grow worldwide.

- North America dominates the Environment, Health and Safety (EHS) Market with the largest revenue share of 34.11% in 2024, driven by stringent regulatory compliance, increasing adoption of safety software, and a growing focus on environmental sustainability.

- Asia-Pacific is the fastest-growing region in the Environment, Health and Safety (EHS) Market, projected to register a CAGR of 8.5% during the forecast period of 2025 to 2032. The growth is driven by rapid industrialization, increasing worker safety awareness, and regulatory reforms across emerging economies such as China, India, and Southeast Asian countries.

- The solution segment held the largest market revenue share in 2024, driven by increasing adoption of integrated platforms for risk assessment, environmental compliance, and energy management. Enterprises are increasingly leveraging digital EHS solutions for real-time monitoring, regulatory reporting, and cost control, particularly in sectors such as energy, chemicals, and manufacturing.

Report Scope and Environment, Health and Safety (EHS) Market Segmentation

|

Attributes |

Environment, Health and Safety (EHS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Environment, Health and Safety (EHS) Market Trends

“Strict Regulatory Compliance and ESG Mandates Driving EHS Adoption”

- The increasing stringency of environmental and occupational safety regulations globally is a major driver for the adoption of EHS solutions. Governments are mandating industries to comply with sustainability, emissions control, and workplace safety norms.

- For instance, in 2023, the U.S. Environmental Protection Agency (EPA) introduced updates to its Risk Management Program (RMP), enhancing safety obligations for chemical facilities. Such regulatory changes are driving demand for EHS platforms to ensure compliance.

- Additionally, companies are under pressure to align with ESG (Environmental, Social, Governance) frameworks, which often include safety, environmental impact, and ethical operations, further fueling EHS system adoption.

Environment, Health and Safety (EHS) Market Dynamics

Driver

“Digital Transformation Enhancing Risk Management Capabilities”

- The integration of digital technologies like IoT, AI, and big data analytics into EHS solutions is revolutionizing risk detection, compliance tracking, and safety management.

- For instance, in February 2024, Cority launched an AI-driven EHS risk platform that provides real-time safety monitoring and predictive analytics for industrial sites. This significantly enhances hazard identification and incident prevention.

- Digital platforms allow organizations to monitor compliance, automate reporting, and respond quickly to incidents — thereby improving operational efficiency and regulatory readiness.

- The ability to integrate EHS systems with existing ERP and asset management systems is also promoting broader adoption among large enterprises.

Restraint/Challenge

“High Cost of Implementation and Integration Complexity”

- A major restraint for the EHS market is the high cost of initial implementation and integration with legacy IT systems.

- Many companies, particularly in emerging markets or low-margin industries, struggle with the upfront investment and workforce training required to deploy advanced EHS platforms.

- Additionally, integrating EHS solutions with older operational systems can be technically complex, leading to extended deployment timelines and increased costs, which can deter adoption.

Environment, Health and Safety (EHS) Market Scope

The market is segmented on the basis of component, verticals, and application.

- By Component

On the basis of component, the Environment, Health and Safety (EHS) Market is segmented into solution and services. The solution segment held the largest market revenue share in 2024, driven by increasing adoption of integrated platforms for risk assessment, environmental compliance, and energy management. Enterprises are increasingly leveraging digital EHS solutions for real-time monitoring, regulatory reporting, and cost control, particularly in sectors such as energy, chemicals, and manufacturing. Within solutions, quality and risk assessment and environmental compliance contributed significantly due to rising industry-specific risks and strict global environmental regulations.

The services segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand for consulting, training, and auditing services as organizations seek expert guidance to navigate complex safety protocols and meet regulatory standards. Sub-segments such as implementation and training are gaining momentum, especially among SMEs seeking to build internal capabilities and maintain compliance.

- By Verticals

On the basis of verticals, the Environment, Health and Safety (EHS) Market is segmented into energy and utilities, chemicals and materials, healthcare, construction and engineering, food and beverage, government and defense, and others. The energy and utilities segment accounted for the largest revenue share in 2024, owing to high regulatory scrutiny, hazardous operations, and the critical need for environmental and worker safety compliance in this sector. Companies are adopting EHS solutions for incident tracking, emissions reporting, and real-time risk mitigation.

The healthcare segment is anticipated to register the fastest growth rate during the forecast period due to increasing focus on infection control, hazardous waste disposal, and worker safety in medical environments. This is further driven by global health concerns and pandemic preparedness efforts.

- By Application

On the basis of application, the Environment, Health and Safety (EHS) Market is segmented into wastewater management, medical and pharmaceutical waste management, industrial waste management, and others. The industrial waste management segment held the largest market share in 2024, driven by the need for safe disposal practices and adherence to environmental regulations across heavy industries, particularly in chemicals, mining, and manufacturing. Automation in waste handling and tracking further boosts this segment's growth.

The medical and pharmaceutical waste management segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by stringent biomedical waste disposal laws and increasing waste volumes from hospitals and laboratories.

Environment, Health and Safety (EHS) Market Regional Analysis

- North America dominates the Environment, Health and Safety (EHS) Market with the largest revenue share of 34.11% in 2024, driven by stringent regulatory compliance, increasing adoption of safety software, and a growing focus on environmental sustainability.

- Companies in the region are investing heavily in automation, digital safety systems, and training programs to reduce workplace incidents and ensure compliance with OSHA and EPA regulations.

- The market is further supported by advanced industrial infrastructure, robust IT capabilities, and strong presence of major EHS service providers.

U.S. Environment, Health and Safety (EHS) Market Insight

The U.S. Environment, Health and Safety (EHS) Market captured the largest revenue share of 76.77% in 2024 within North America, propelled by strict regulatory enforcement, corporate sustainability initiatives, and integration of EHS software across industries like oil & gas, manufacturing, and healthcare. The growing focus on ESG reporting and risk mitigation continues to accelerate market growth.

Europe Environment, Health and Safety (EHS) Market Insight

Europe holds siginificant share of the Environment, Health and Safety (EHS) Market, accounting for 24.67% of global revenue in 2024, fueled by the European Union’s stringent environmental laws and workplace safety mandates. The region is witnessing increased implementation of digital EHS solutions across sectors such as chemicals, automotive, and construction. Technological integration, data analytics for compliance, and eco-friendly industrial practices are shaping the European market.

U.K. Environment, Health and Safety (EHS) Market Insight

The U.K. Environment, Health and Safety (EHS) Market is expected to grow at a robust CAGR during the forecast period due to a rising focus on industrial safety audits, health risk management, and environmental monitoring in line with updated post-Brexit regulations.

Germany Environment, Health and Safety (EHS) Market Insight

The Germany Environment, Health and Safety (EHS) Market is expanding steadily due to strong federal regulations, emphasis on sustainable development, and growing demand for integrated EHS software in its engineering and automotive sectors.

Asia-Pacific Environment, Health and Safety (EHS) Market Insight

Asia-Pacific is the fastest-growing region in the Environment, Health and Safety (EHS) Market, projected to register a CAGR of 8.5% during the forecast period of 2025 to 2032. The growth is driven by rapid industrialization, increasing worker safety awareness, and regulatory reforms across emerging economies such as China, India, and Southeast Asian countries. Additionally, rising investments in infrastructure and environment-focused government policies are boosting demand for EHS solutions.

Japan Environment, Health and Safety (EHS) Market Insight

The Japan Environment, Health and Safety (EHS) Market is gaining traction as corporations prioritize disaster preparedness, aging workforce safety, and compliance with energy-efficient building regulations. Integration of EHS with IoT and robotics is also supporting market growth.

China Environment, Health and Safety (EHS) Market Insight

The China Environment, Health and Safety (EHS) Market accounted for the largest revenue share in Asia-Pacific in 2024, driven by government-led industrial safety reforms, rising pollution control efforts, and growing adoption of digital EHS platforms in manufacturing and mining sectors.

Environment, Health and Safety (EHS) Market Share

The Environment, Health and Safety (EHS) industry is primarily led by well-established companies, including:

- SAP (Germany)

- Enablon France SAS (France)

- VelocityEHS (United States)

- Intelex Technologies (Canada)

- Gensuite (United States)

- Cority (Canada)

- Quentic (Germany)

- Sphera (United States)

- ETQ (United States)

- UL LLC (United States)

- DNV AS (Norway)

- SAI Global Pty Limited (Australia)

- Verisk 3E (United States)

- Dakota Software Corporation (United States)

- ProcessMAP (United States)

- ISOMETRIX (South Africa)

- IBM (United States)

- SafetyCulture (Australia)

- ProntoForms Corporation (Canada)

- Enhesa (Belgium)

Latest Developments in Global Environment, Health and Safety (EHS) Market

- In May 2024, Cority, a leading provider of EHS and sustainability software, launched its next-generation AI-powered CorityOne™ platform aimed at improving predictive analytics and proactive risk management. The platform integrates environment, safety, health, and sustainability data into a unified system to support real-time decision-making. This launch reinforces Cority’s leadership in delivering advanced, AI-integrated EHS solutions that drive better compliance and business performance globally.

- In April 2024, VelocityEHS announced the release of its Accelerate® Platform updates, introducing enhanced chemical management and ESG reporting features. These upgrades are designed to simplify regulatory compliance and streamline sustainability reporting, helping companies align with global frameworks such as GRI and TCFD. The development underscores VelocityEHS’s commitment to driving digital transformation and proactive risk mitigation within EHS operations.

- In March 2024, Intelex Technologies introduced a mobile-first EHSQ solution aimed at frontline workers, enabling real-time safety reporting and hazard identification from any location. This mobile enhancement empowers employees in manufacturing, construction, and field services with intuitive, on-the-go access to EHS systems, thus improving response times and engagement in safety practices across industries.

- In February 2024, Sphera launched its next-gen Sustainability Reporting Software, which integrates seamlessly with EHS systems to provide organizations with real-time environmental impact data. This tool helps companies meet increasing regulatory demands and stakeholder expectations related to ESG performance. The development reflects Sphera’s vision of merging environmental intelligence with EHS compliance for holistic corporate governance.

- In January 2024, Enablon (a Wolters Kluwer company) partnered with Microsoft Azure to expand the scalability and security of its cloud-based EHS and operational risk management solutions. The collaboration aims to enable faster deployment and more secure data handling for large enterprises operating globally. This strategic move highlights Enablon’s effort to enhance cloud capabilities and meet the growing digital demand in the EHS market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.