Global Elderly And Disabled Assistive Devices Market

Market Size in USD Billion

CAGR :

%

USD

25.73 Billion

USD

45.55 Billion

2024

2032

USD

25.73 Billion

USD

45.55 Billion

2024

2032

| 2025 –2032 | |

| USD 25.73 Billion | |

| USD 45.55 Billion | |

|

|

|

|

Elderly and Disabled Assistive Devices Market Size

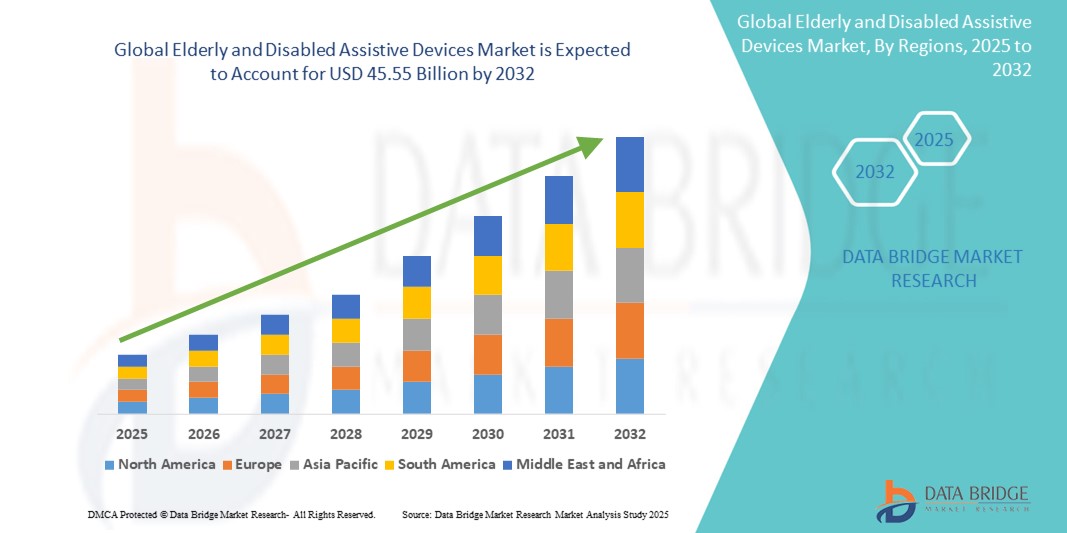

- The global elderly and disabled assistive devices market size was valued at USD 25.73 billion in 2024 and is expected to reach USD 45.55 billion by 2032, at a CAGR of 9.60% during the forecast period

- This growth is driven by factors such as the aging population, increasing prevalence of chronic disease, and advancements in technology

Elderly and Disabled Assistive Devices Market Analysis

- Elderly and disabled assistive devices are crucial tools used to aid individuals with mobility, vision, hearing, and other physical challenges, allowing them to live independently and improve their quality of life. These devices include mobility aids (wheelchairs, walkers, canes), hearing aids, vision aids, and other daily living assistive technologies

- The demand for these devices is significantly driven by the increasing global elderly population, the rising prevalence of chronic conditions such as arthritis, dementia, and sensory impairments (vision and hearing loss), as well as advancements in assistive technology (for instance, smart devices, robotic aids)

- North America is expected to dominate the elderly and disabled assistive devices market due to its advanced healthcare infrastructure, high awareness levels, and strong demand for high-quality assistive devices. In addition, government initiatives, insurance coverage, and a higher percentage of elderly individuals in the population contribute to the region's dominance

- Asia-Pacific is expected to be the fastest-growing region in the elderly and disabled assistive devices market during the forecast period, driven by rising healthcare investments, increasing awareness about elderly care, and a growing elderly population. Countries such as China and India are experiencing rapid urbanization, which is leading to greater access to healthcare solutions and assistive devices, especially in urban areas

- The mobility aid segment is expected to dominate the Elderly and Disabled Assistive Devices market with the largest share of 40.3% in 2025 due to demand for these devices is driven by the growing elderly population, chronic conditions affecting mobility, and technological advancements that enhance comfort, usability, and customization.

Report Scope and Elderly and Disabled Assistive Devices Market Segmentation

|

Attributes |

Elderly and Disabled Assistive Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Elderly and Disabled Assistive Devices Market Trends

“Increasing Integration Of Smart Technologies and IoT Capabilities”

- One prominent trend in the evolution of elderly and disabled assistive devices is the increasing integration of smart technologies and IoT capabilities. These innovations are revolutionizing traditional assistive devices by enhancing their functionality and enabling real-time data monitoring, personalized care, and remote assistance

- These advancements improve user experience and safety by offering real-time tracking, fall detection, and health monitoring features. For instance, smart wheelchairs with GPS navigation and collision avoidance systems, or wearable health sensors that monitor vital signs, are becoming more common. This increases independence for users and provides caregivers with more efficient tools to monitor and assist the elderly or disabled

- For instance, smart hearing aids equipped with Bluetooth connectivity allow users to customize sound settings based on their environment, while AI-powered mobility aids can help those with limited mobility navigate through different terrains more easily. In addition, fall detection systems integrated into mobility aids and smart home devices are becoming more advanced, providing immediate alerts to caregivers or emergency services if an incident occurs

- These advancements are transforming the elderly and disabled assistive devices market by improving user autonomy, enhancing quality of life, and significantly reducing caregiver burden. As a result, there is growing demand for next-generation assistive devices with cutting-edge features such as AI integration, remote monitoring, and voice-activated technology, which are expected to drive market growth in the coming years

Elderly and Disabled Assistive Devices Market Dynamics

Driver

“Growing Need Due to Aging Population and Chronic Health Conditions”

- The rising prevalence of age-related chronic conditions, such as arthritis, Parkinson's disease, dementia, and mobility impairments, is significantly contributing to the increased demand for elderly and disabled assistive devices

- As the global population continues to age, older adults are more such asly to experience conditions that impair their ability to perform daily activities independently, leading to a higher need for mobility aids, hearing aids, vision aids, and other assistive technologies

- With the demand for these devices growing, there is an increasing focus on improving quality of life, enhancing mobility, and supporting independent living among elderly and disabled individuals

For instance,

- In a 2021 report by the World Health Organization (WHO), it was highlighted that by 2050, the global population aged 60 years and older is expected to reach 2.1 billion, significantly increasing the need for assistive devices to support the aging population

- As a result of these demographic changes, the demand for devices that support mobility, communication, and daily living is rising, contributing to the expansion of the elderly and disabled assistive devices market

Opportunity

“Technological Advancements in Smart and Connected Assistive Devices”

- AI-powered and IoT-enabled assistive devices are transforming the way elderly and disabled individuals manage their health and mobility. These devices offer features such as real-time monitoring, predictive health analytics, and automated assistance, enabling users to live more independently

- For instance , smart hearing aids that adjust automatically to different environments, or AI-powered wheelchairs that navigate obstacles autonomously, are becoming increasingly popular

- The integration of telemedicine and remote monitoring within assistive devices allows caregivers and healthcare professionals to track patient progress and intervene proactively

For instance,

- In January 2025, a report published in the Journal of Geriatric Care discussed how AI-powered mobility aids can provide real-time health data to caregivers, reducing the risk of falls or accidents and improving emergency response times. These systems can analyze data from wearable sensors to alert caregivers or healthcare professionals to potential health issues before they become critical

- The integration of such technologies offers significant growth opportunities for the market, enhancing the convenience and safety of elderly and disabled individuals while improving health outcomes

Restraint/Challenge

“High Costs and Affordability Issues”

- The high cost of advanced assistive devices remains a significant challenge, particularly in low-income regions or among elderly individuals with limited financial resources. Devices such as power wheelchairs, hearing aids, and specialized mobility aids can range from hundreds to thousands of dollars, making them inaccessible to some individuals

- In addition, while insurance coverage for assistive devices is expanding, there are still many areas where coverage is insufficient or non-existent, especially in emerging markets. This financial barrier can delay or prevent individuals from purchasing the necessary devices

For instance,

- According to a 2023 study by the National Council on Aging (NCOA), nearly 50% of elderly individuals in the U.S. reported difficulty affording mobility aids, leading to prolonged health issues and reduced quality of life. This economic hurdle prevents many individuals from accessing the devices they need, ultimately limiting market penetration and growth in underserved regions

- As a result, affordability remains a major challenge that could hinder the overall adoption of assistive devices, especially in developing nations, affecting the market's overall growth potential

Elderly and Disabled Assistive Devices Market Scope

The market is segmented on the basis product type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Device Type |

|

|

By Distribution Channel |

|

|

By End User |

|

In 2025, the mobility aid is projected to dominate the market with a largest share in device type segment

The mobility aid segment is expected to dominate the elderly and disabled assistive devices market with the largest share of 40.3% in 2025 due to demand for these devices is driven by the growing elderly population, chronic conditions affecting mobility, and technological advancements that enhance comfort, usability, and customization.

The hospital Segment is expected to account for the largest share during the forecast period in end user market

In 2025, the hospital segment is expected to dominate the market with the largest market share of 51.31% as they are Hospitals are primary centres for treating various disorders such as cerebral palsy and paralysis, which often require the use of assistive devices. The rise in the number of car accidents and hospital readmissions for the treatment of these disorders is a primary driver of the market.

Elderly and Disabled Assistive Devices Market Regional Analysis

“North America Holds the Largest Share in the Elderly and Disabled Assistive Devices Market”

- North America dominates the elderly and disabled assistive devices market, driven by its advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and the strong presence of key market players

- U.S. holds a significant share due to increased demand for assistive devices related to mobility, hearing, and vision. The rising prevalence of conditions such as arthritis, Parkinson’s disease, and age-related macular degeneration, along with continuous advancements in assistive technology, are fueling market growth

- The availability of well-established reimbursement policies and growing investments in research & development by leading medical device companies further strengthen the market

- In addition, home-based care solutions and the preference for aging in place have further accelerated the adoption of assistive devices, contributing to market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Elderly and Disabled Assistive Devices Market”

- Asia-Pacific is expected to witness the highest growth rate in the elderly and disabled assistive devices market, driven by rapid expansion in healthcare infrastructure, increasing awareness about elderly care, and rising surgical and assistive device volumes

- Countries such as China, India, and Japan are emerging as key markets due to the growing elderly population, which is more susceptible to mobility impairments, chronic diseases, and sensory loss, increasing the demand for assistive devices

- Japan, with its advanced healthcare system and aging population, is a crucial market for assistive devices. The country is adopting high-quality and specialized equipment for elderly care, ensuring improved mobility, communication, and overall quality of life for its senior citizens

- China and India, with large populations and rising cases of chronic diseases and disabilities, are witnessing increased government initiatives and private sector investments in assistive device technologies. The expanding presence of global medical device manufacturers and improving accessibility to healthcare further contribute to market growth in these countries

Elderly and Disabled Assistive Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medical Depot, Inc. (U.S.)

- Invacare Holdings Corporation (U.S.)

- Hill-Rom Holdings, Inc. (U.S.)

- Ottobock (Germany)

- Karma Medical Products Co., LTD. (Taiwan)

- Sunrise Medical (U.K.)

- Messe Düsseldorf GmbH (Germany)

- Medline Industries, Inc. (U.S.)

- Ameda (U.S.)

- Permobil (Sweden)

- Bristol-Myers Squibb Company (U.S.)

- GF Health Products, Inc. (U.S.)

- Linus Health (Ireland)

- Lifeway Mobility (U.S.)

- Alimed Inc. (U.S.)

Latest Developments in Global Elderly and Disabled Assistive Devices Market

- In January 2025, Apple’s AirPods Pro 2, with the new iOS 18.2 software, now offer features suitable for individuals with mild to moderate hearing loss. Users can take a hearing test, generate an audiogram, and adjust the AirPods to improve their hearing of both media and environmental sounds. While not a full-time alternative to traditional hearing aids due to battery life limitations, these features offer significant aid and have various functionalities such as Sound Recognition, Conversation Boost, Live Listen, and Loud Sound Reduction. This innovation represents a shift towards integrating assistive technology into everyday consumer devices, making hearing support more accessible

- In December 2024, Platinum Equity LLC, a U.S.-based private equity investment firm, acquired Sunrise Medical Limited, a manufacturer of assistive devices for the elderly and disabled. This acquisition aligns with Platinum Equity's strategy of investing in companies that need operational support to reach their full potential. Such strategic acquisitions enable companies to expand their product offerings and enhance their market presence, catering to the growing demand for assistive devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.