Global Electric Axle Drive And Wheel Drive Market

Market Size in USD Billion

CAGR :

%

USD

15.38 Billion

USD

37.54 Billion

2024

2032

USD

15.38 Billion

USD

37.54 Billion

2024

2032

| 2025 –2032 | |

| USD 15.38 Billion | |

| USD 37.54 Billion | |

|

|

|

|

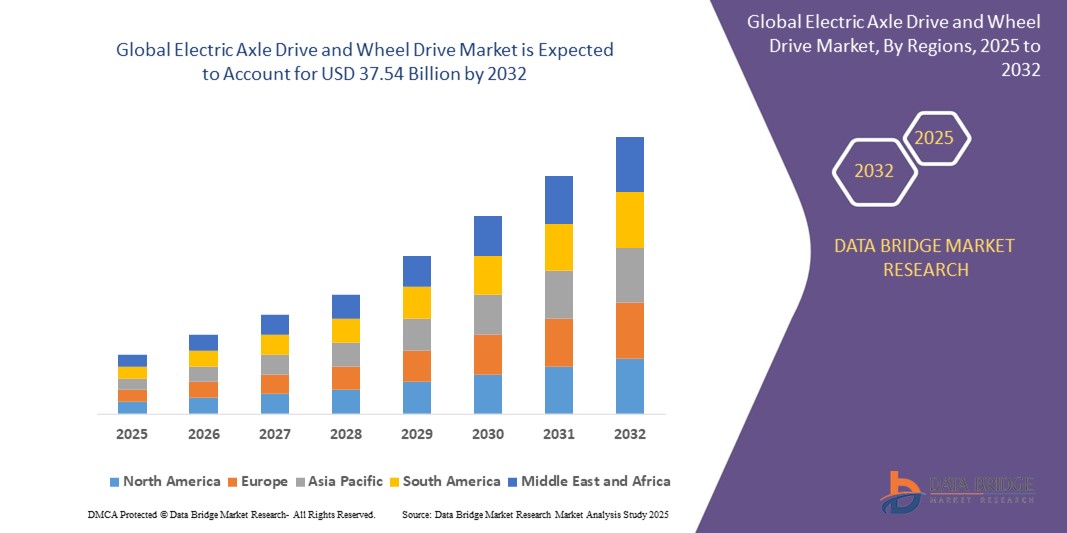

What is the Global Electric Axle Drive and Wheel Drive Market Size and Growth Rate?

- The global electric axle drive and wheel drive market size was valued at USD 15.38 billion in 2024 and is expected to reach USD 37.54 billion by 2032, at a CAGR of 11.80% during the forecast period

- The market for electric axle drives and wheel drives is experiencing significant growth, driven by the increasing demand for electric and hybrid vehicles. As automotive manufacturers shift towards electrification to meet stringent emission regulations and consumer demand for eco-friendly vehicles, the adoption of electric axle and wheel drive systems is becoming more prevalent

- These systems offer advantages such as improved vehicle efficiency, reduced weight, and enhanced space utilization, which are crucial for the design of modern electric vehicles (EVs)

What are the Major Takeaways of Electric Axle Drive and Wheel Drive Market?

- The growing focus on optimizing vehicle performance and maximizing interior space is further fueling the demand for these technologies. In addition, the trend towards all-wheel-drive electric vehicles, particularly in the premium and off-road segments, is boosting the adoption of electric wheel drive systems

- However, challenges such as high development costs and the complexity of integrating these systems into existing vehicle architectures could restrain market growth

- North America dominated the electric axle drive and wheel drive market with the largest revenue share of 39.4% in 2024, driven by strong EV sales, robust automotive infrastructure, and aggressive investments in electrified powertrain system

- Asia-Pacific electric axle drive and wheel drive market is projected to register the fastest CAGR of 24.0% from 2025 to 2032, driven by rapid electrification, expanding EV infrastructure, and favorable government initiatives

- The Permanent Magnet AC Motor segment dominated the market with the largest revenue share of 48.5% in 2024, driven by its high power density, efficiency, and compact size

Report Scope and Electric Axle Drive and Wheel Drive Market Segmentation

|

Attributes |

Electric Axle Drive and Wheel Drive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electric Axle Drive and Wheel Drive Market?

“Integration of Compact High-Torque Motors and Power Electronics”

- A key emerging trend in the electric axle drive and wheel drive market is the integration of high-torque electric motors with power electronics into a compact drive unit, optimizing space and enhancing energy efficiency. These systems combine motors, inverters, and gearboxes into a single housing, improving overall vehicle performance while reducing drivetrain complexity

- For instance, ZF Friedrichshafen AG introduced its latest eAxle with integrated SiC-based power electronics in 2024, offering enhanced efficiency and range capabilities for electric vehicles (EVs). Similarly, Bosch continues to innovate with modular electric axle systems suited for various passenger and light commercial vehicles

- These integrated systems help automakers reduce vehicle weight and increase efficiency, contributing to longer driving ranges and lower carbon footprints—key concerns in the growing EV market. The trend is also enabling quicker adoption by Original Equipment Manufacturers (OEMs) due to easier vehicle design integration

- The market is also witnessing growing demand for 800V electric drive architectures, supporting fast-charging and improved power delivery. This is especially vital for performance EVs and next-generation battery platforms

- Consequently, this trend is accelerating the development of next-gen electric powertrains that offer compact design, better energy efficiency, and seamless integration, supporting global electrification targets. The industry is shifting toward scalable, platform-based designs that meet the needs of a variety of EV segments, from passenger cars to heavy-duty trucks

What are the Key Drivers of Electric Axle Drive and Wheel Drive Maret?

- One of the most prominent drivers of the market is the rapid global shift towards vehicle electrification, spurred by stringent emissions regulations, fuel economy standards, and government incentives supporting EV production and adoption

- For instance, in March 2024, Dana Incorporated announced its expansion of the e-Propulsion product line with high-efficiency electric axle drives tailored for commercial trucks and buses, emphasizing sustainability and high torque density

- The increasing demand for cost-effective, lightweight, and power-dense drivetrain solutions is pushing automakers to adopt integrated axle and wheel drive systems that combine performance with affordability. These systems enable optimized packaging, faster assembly, and simplified vehicle architecture

- Rising consumer awareness about green transportation alternatives, coupled with improvements in battery technologies and fast-charging infrastructure, is further accelerating the uptake of EVs, thereby expanding the demand for electric axle and wheel drives

- In addition, partnerships between OEMs and Tier 1 suppliers are facilitating innovations in modular e-drive platforms, offering scalable solutions that reduce development time and costs across multiple vehicle models

Which Factor is challenging the Growth of the Electric Axle Drive and Wheel Drive Market?

- Despite growing demand, one of the significant challenges facing the market is the high development and integration cost of electric axle and wheel drive systems, particularly for entry-level and budget EVs. Advanced systems with integrated inverters and high-efficiency motors often carry a premium price, posing cost concerns for mass-market adoption

- For instance, many smaller OEMs and new EV startups face financial and engineering hurdles in sourcing and customizing integrated e-drive solutions, delaying production timelines or leading to reliance on less-advanced alternatives

- Another challenge is the thermal management of compact, high-power systems. As electric axles house motors, inverters, and gearboxes in a confined space, managing heat generation becomes critical for maintaining performance and lifespan. This necessitates advanced cooling solutions, which may increase the complexity and cost of the system

- In addition, the lack of standardized e-drive architectures can create compatibility issues across different vehicle platforms, increasing development time and limiting scalability. OEMs must often invest in platform-specific designs, which can slow down widespread adoption

- Overcoming these challenges requires cost optimization, better heat dissipation techniques, and standardization of components, enabling broader accessibility and faster time-to-market for automakers globally

How is the Electric Axle Drive and Wheel Drive Market Segmented?

The market is segmented on the basis of motor type, drive type, vehicle type, component type, and end user.

• By Motor Type

On the basis of motor type, the electric axle drive and wheel drive market is segmented into Permanent Magnet AC Motor, Brushless DC Motor, and Others. The Permanent Magnet AC Motor segment dominated the market with the largest revenue share of 48.5% in 2024, driven by its high power density, efficiency, and compact size. These motors are widely used in electric vehicle drivetrains due to their ability to deliver high torque at low speeds and maintain performance across various driving conditions. Advancements in magnet materials and thermal management are further boosting adoption.

The Brushless DC Motor segment is expected to witness the fastest growth rate from 2025 to 2032, favored for its low maintenance, smooth operation, and improved lifespan. These motors are gaining traction in compact electric vehicles and urban mobility solutions where space efficiency and cost-effectiveness are crucial.

• By Drive Type

On the basis of drive type, the market is segmented into Fully Electric, Hybrid, and Others. The Fully Electric segment held the largest market revenue share of 55.1% in 2024, supported by rising EV adoption, zero-emission goals, and growing investments in battery-powered vehicle platforms. These drives are central to BEVs (Battery Electric Vehicles) and benefit from regulatory support and improved battery technologies that enhance range and performance.

The Hybrid segment is projected to record the fastest CAGR from 2025 to 2032 due to increasing demand for transitional powertrains that combine the benefits of internal combustion and electric propulsion. Automakers are focusing on plug-in hybrid models that offer flexibility, fuel efficiency, and compliance with evolving emission norms.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into Pure Electric Vehicle, Hybrid Electric Vehicle, and Plug-In Hybrid Electric Vehicle. The Pure Electric Vehicle segment led with the highest market share of 49.8% in 2024, fueled by global EV incentives, increasing fuel prices, and public awareness of environmental concerns. These vehicles heavily rely on integrated e-axle systems for efficient and lightweight propulsion.

The Plug-In Hybrid Electric Vehicle segment is expected to grow at the fastest pace from 2025 to 2032, driven by consumer demand for extended range and flexible charging options. OEMs are focusing on launching new PHEV models to cater to markets with limited charging infrastructure while still offering electrified driving benefits.

• By Component Type

On the basis of component type, the market is segmented into Combination Motor, Power Electronics, Transmission, and Others. The Combination Motor segment held the dominant revenue share of 41.6% in 2024, driven by the integration of motor and transmission systems into compact, modular designs. These units reduce weight, enhance system efficiency, and simplify assembly, making them ideal for mass EV production.

The Power Electronics segment is anticipated to register the highest CAGR from 2025 to 2032 due to its critical role in managing energy flow, improving drive efficiency, and enabling fast response in modern EV systems. With the growing shift toward 800V platforms, power electronics are evolving rapidly to support high-voltage applications.

• By End User

On the basis of end user, the electric axle drive and wheel drive market is segmented into Passenger Vehicles, Commercial Vehicles, and Other Vehicles. The Passenger Vehicles segment held the largest market share of 62.3% in 2024, propelled by growing EV sales, government subsidies, and demand for advanced drivetrains that offer superior ride quality, reduced maintenance, and lower emissions.

The Commercial Vehicles segment is projected to expand at the fastest CAGR from 2025 to 2032, supported by increasing electrification of delivery vans, buses, and heavy trucks. Fleets are investing in electric drivetrains for operational savings, emission compliance, and improved urban mobility.

Which Region Holds the Largest Share of the Electric Axle Drive and Wheel Drive Maret?

- North America dominated the electric axle drive and wheel drive market with the largest revenue share of 39.4% in 2024, driven by strong EV sales, robust automotive infrastructure, and aggressive investments in electrified powertrain systems

- The presence of key electric vehicle manufacturers and technology innovators across the U.S. and Canada fuels rapid adoption of integrated e-axle systems

- Government incentives such as federal tax credits and clean energy programs are encouraging both OEMs and consumers to transition to electric mobility

- The region’s focus on reducing carbon emissions, along with improved charging infrastructure, supports the large-scale integration of electric axle drives in passenger and commercial vehicles

U.S. Electric Axle Drive and Wheel Drive Market Insight

The U.S. led the North American market with the largest revenue share of 33.8% in 2024, backed by the rise of EV giants such as Tesla, Rivian, and GM. Widespread adoption of electric pickups, SUVs, and crossovers has increased demand for high-performance e-axle and wheel drive systems that offer better efficiency, weight distribution, and torque handling.

Canada Electric Axle Drive and Wheel Drive Market Insight

Canada’s market is expanding steadily, supported by nationwide EV adoption strategies, green transportation funding, and the development of local EV supply chains. Provincial subsidies and investments in electrification are further boosting the need for electric drivetrain components across the country.

Mexico Electric Axle Drive and Wheel Drive Market Insight

Mexico plays a critical role in the North American automotive supply chain. With increasing foreign investment in EV assembly and component manufacturing, the country is witnessing growing demand for electric axle systems as OEMs set up production hubs for exports and domestic use.

Which Region is the Fastest Growing in the Electric Axle Drive and Wheel Drive Market?

Asia-Pacific electric axle drive and wheel drive market is projected to register the fastest CAGR of 24.0% from 2025 to 2032, driven by rapid electrification, expanding EV infrastructure, and favorable government initiatives. Countries such as China, India, and Japan are making large-scale investments in clean mobility and building out EV ecosystems to meet climate targets. Asia-Pacific is emerging as a global production hub for e-axles due to low manufacturing costs, growing demand for electric two-wheelers, and widespread adoption of compact urban EVs. Technological advancements and localization of key components are further accelerating market growth across the region.

China Electric Axle Drive and Wheel Drive Market Insight

China accounted for the largest share in Asia-Pacific in 2024, driven by aggressive NEV (New Energy Vehicle) targets, subsidies, and a robust domestic EV industry. Local automakers are at the forefront of developing cost-effective e-axle solutions tailored for both urban and long-range vehicles.

India Electric Axle Drive and Wheel Drive Market Insight

India is rapidly growing due to rising fuel prices, government-led programs such as FAME-II, and increasing focus on electrification of public and commercial transportation. Local startups and manufacturers are investing in scalable, low-cost e-axle solutions for electric two-, three-, and four-wheelers.

Japan Electric Axle Drive and Wheel Drive Market Insight

Japan’s mature automotive industry and leadership in hybrid technologies are fostering steady adoption of electric axle drives. OEMs are investing in R&D for compact, efficient e-axles to meet consumer demands for performance, energy efficiency, and design flexibility.

Which are the Top Companies in Electric Axle Drive and Wheel Drive Market?

The electric axle drive and wheel drive industry is primarily led by well-established companies, including:

- ZF Friedrichshafen AG (Germany)

- ZIEHL-ABEGG SE (Germany)

- Robert Bosch GmbH (Germany)

- Magna International Inc. (Canada)

- GKN Automotive Limited (U.K.)

- Continental AG (Germany)

- Dana Limited (U.S.)

- American Axle & Manufacturing, Inc. (U.S.)

- Schaeffler AG (Germany)

- BorgWarner Inc. (U.S.)

- Bonfiglioli Transmissions Private Limited (India)

What are the Recent Developments in Global Electric Axle Drive and Wheel Drive Market?

- In June 2022, Schaeffler AG introduced its most advanced 4in1 electric axle drive system, which integrates the electric motor, power electronics, and transmission into a single compact unit, along with a thermal management system. This innovation marked a significant leap forward in e-axle technology, enhancing energy efficiency and system compactness. This launch further solidified Schaeffler’s position as a frontrunner in integrated electric drive solutions for next-gen EV platforms

- In May 2022, Nidec Corporation held a formal signing ceremony to establish its flagship e-axle production plant in Pinghu, Zhejiang, China. The factory is expected to reach a production capacity of 7 million units annually by 2025, with a targeted sales volume of 3.6 million units. This investment underlines Nidec’s aggressive expansion strategy in the booming Asian EV drivetrain market

- In October 2022, GKN Automotive entered into a collaboration with Ariel to design and manufacture an electric powertrain for the Ariel HIPERCAR, a high-performance electric sports car. The agreement focuses on leveraging GKN’s e-drive capabilities to power hypercar-level performance. This partnership reflects GKN’s commitment to advancing electric mobility in performance vehicle segments

- In September 2021, Dana Limited commenced the production of e-axles for Freightliner Custom Chassis Corporation (FCCC)'s zero-emission delivery vehicles. Dana’s eS9000r e-axle, featuring an integrated gearbox and motor within a Spicer S130 rear-drive axle, delivers up to 240 kW and supports a range of up to 170 miles. This development highlights Dana’s leadership in delivering robust electrified drivetrain solutions for last-mile delivery fleets

- In September 2021, Linamar Corporation launched its eLIN Product Solution Group to tap into electrification opportunities across industrial and mobility sectors. The group focuses on power generation, propulsion systems, energy storage, and chassis systems, including the development of high-efficiency e-axles. This strategic move enhances Linamar’s ability to cater to the evolving needs of electric vehicle manufacturers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.