Global Electric Commercial Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

60.98 Billion

USD

415.29 Billion

2024

2032

USD

60.98 Billion

USD

415.29 Billion

2024

2032

| 2025 –2032 | |

| USD 60.98 Billion | |

| USD 415.29 Billion | |

|

|

|

|

Electric Commercial Vehicle Market Size

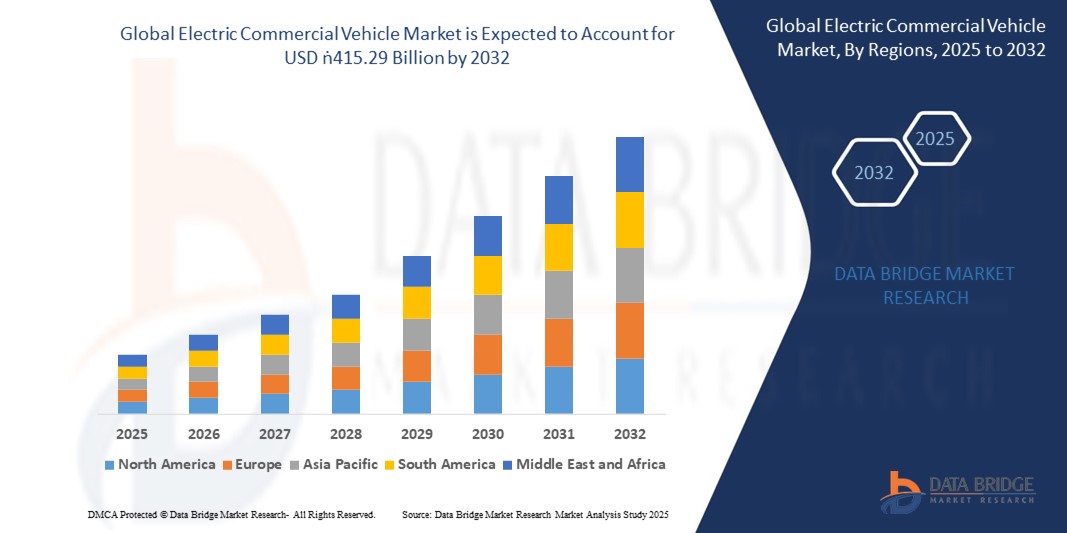

- The global electric commercial vehicle market size was valued at USD 60.98 billion in 2024 and is expected to reach USD 415.29 billion by 2032, at a CAGR of 27.1% during the forecast period

- The market growth is primarily driven by increasing government regulations and incentives aimed at reducing carbon emissions and promoting sustainable transportation. Many regions and countries are setting targets for phasing out gasoline and diesel vehicles, offering subsidies, tax breaks, and other incentives for businesses to transition their commercial fleets to electric vehicles. This regulatory push is a significant factor compelling companies to invest in electric commercial vehicles

- Furthermore, the decreasing total cost of ownership of electric commercial vehicles compared to traditional diesel or gasoline vehicles is a major driver. While the initial purchase price might be higher, electric vehicles typically have lower fuel and maintenance costs, which can lead to significant savings over the vehicle's lifespan. Growing environmental consciousness among businesses and consumers also plays a role, as companies seek to improve their sustainability profile and appeal to environmentally aware customers

Electric Commercial Vehicle Market Analysis

- The Electric Commercial Vehicle (ECV) market encompasses the production, sales, and adoption of battery-powered or otherwise electrified vehicles intended for commercial use, such as vans, trucks, buses, and other vehicles used for transporting goods or passengers in a business context. These vehicles utilize electric powertrains instead of traditional internal combustion engines, offering benefits such as reduced emissions and lower operating costs

- The dynamics of the electric commercial vehicle market are significantly shaped by increasing government regulations promoting zero-emission transportation, growing environmental awareness among businesses and consumers, and advancements in electric vehicle technology, including battery range and charging infrastructure. The market also sees a rising demand due to the potential for lower total cost of ownership and the increasing availability of various electric commercial vehicle models across different vehicle segments

- North America dominates the electric commercial vehicle market due to increasing awareness of environmental concerns and the economic benefits of electric vehicles

- Asia-Pacific is expected to be the fastest growing region in the electric commercial vehicle market during the forecast period due to increasing urbanization and government initiatives to promote electric vehicle adoption to combat air pollution

- Bus segment dominated the market with a market share of 65.7% in 2024 due to government initiatives to electrify public transit and reduce urban emissions

Report Scope and Electric Commercial Vehicle Market Segmentation

|

Attributes |

Electric Commercial Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Electric Commercial Vehicle Market Trends

“Rising Fuel Costs”

- A significant and accelerating trend in the global electric commercial vehicle market is the rising fuel costs, which is driving accelerated adoption of electric propulsion technologies as companies seek to reduce dependency on volatile fossil fuel prices. This trend is prompting manufacturers and fleet operators to increase investments in electric and hydrogen-powered commercial vehicles to achieve cost savings and enhance sustainability

- For instance, major companies such as Tesla and BYD are expanding their electric commercial vehicle portfolios, offering a range of electric trucks and buses designed to provide lower operational costs and reduce fuel expenses. Similarly, Nikola Corporation is focusing on hydrogen fuel cell trucks as a viable alternative to traditional diesel-powered commercial vehicles, targeting long-haul applications with fuel cost efficiency

- The increasing fuel prices are fueled by geopolitical tensions, supply chain disruptions, and regulatory pressures to phase out fossil fuels, making electric commercial vehicles an economically attractive option. Fleet operators are becoming more aware of total cost of ownership benefits, including reduced fuel and maintenance costs, driving the shift toward electrification and alternative fuel solutions

- This trend is not limited to large fleets; small and medium-sized logistics companies are also transitioning to electric commercial vehicles to mitigate fuel cost volatility and meet tightening emissions regulations. In addition, governments worldwide are incentivizing electric vehicle adoption through subsidies and tax benefits, further accelerating this shift

- Consequently, companies such as Volvo Trucks and Daimler Truck are investing heavily in electric and hydrogen vehicle development, offering advanced electric trucks and fuel cell solutions with improved range and performance tailored for commercial use. Similarly, Proterra is focusing on electric buses with high energy efficiency and low operating costs to serve public transit authorities globally

- The rising fuel cost trend is fundamentally reshaping the electric commercial vehicle market, encouraging innovation in battery technology, fuel cell development, and vehicle efficiency, while supporting broader adoption of zero-emission commercial transport solutions across multiple sectors

Electric Commercial Vehicle Market Dynamics

Driver

“Increasing Focus on Sustainability and Environmental Responsibility”

- The increasing focus on sustainability and environmental responsibility across urban and semi-urban regions is a significant driver for the growing demand in the electric commercial vehicle market, as fleet operators and end-users prioritize cleaner, zero-emission transportation solutions

- For instance, major players such as Tesla and BYD continue to expand their electric commercial vehicle offerings, launching new models of electric trucks and buses designed to meet diverse operational needs. Similarly, companies such as Daimler Truck and Volvo Trucks are investing in advanced electric and hybrid vehicle technologies to cater to rising customer demand for eco-friendly commercial transport

- As consumers and businesses increasingly seek sustainable and cost-efficient mobility options, there is a notable shift toward electric vehicles equipped with longer range batteries and enhanced charging capabilities. This shift is also supported by the rising adoption of electric vans and trucks for last-mile delivery and urban logistics

- Furthermore, growing awareness through government policies, social media, and sustainability campaigns is encouraging younger demographics and corporate fleets to adopt electric commercial vehicles, accelerating the transition away from conventional diesel-powered vehicles in emerging and developed markets alike

- The demand for reliable, high-performance, and environmentally friendly commercial vehicles is rising steadily as both fleet operators and vehicle manufacturers embrace a greener and technology-driven future. This trend is transforming the electric commercial vehicle market, driving innovation in battery technology, charging infrastructure, and vehicle design

Restraint/Challenge

“Insufficient EV Charging Infrastructure”

- Insufficient EV charging infrastructure poses a significant challenge to the electric commercial vehicle market, as limited availability of fast and reliable charging stations restricts operational efficiency and route planning for fleet operators, slowing down the adoption of electric commercial vehicles

- For instance, major companies such as Tesla have invested heavily in expanding their Supercharger network to support long-distance travel, while others such as ChargePoint and ABB focus on developing commercial-grade fast chargers to cater specifically to electric buses and trucks. However, many regions still face gaps in accessible and high-capacity charging infrastructure, especially along major freight corridors

- Addressing this challenge requires collaboration between vehicle manufacturers, governments, and infrastructure providers to accelerate the deployment of robust and widespread charging networks, including ultra-fast chargers and hydrogen refueling stations for fuel cell vehicles. Despite these efforts, high installation costs and grid capacity constraints remain key hurdles

- Furthermore, the lack of standardized charging protocols and interoperability issues among different charging networks complicate fleet management and vehicle compatibility, deterring some potential electric commercial vehicle buyers from transitioning from diesel-powered fleets

- The challenge of insufficient charging infrastructure underscores the critical need for integrated solutions and coordinated investment, as the electric commercial vehicle market’s growth heavily depends on reliable and accessible charging to support large-scale commercial operations and achieve broader electrification goals

Electric Commercial Vehicle Market Scope

The market is segmented on the basis of propulsion, vehicle, range, and component.

- By Propulsion

On the basis of propulsion, the electric commercial vehicle market is segmented into Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, and Fuel Cell Electric Vehicle. The Battery Electric Vehicle segment held the largest market revenue share in 2024, attributed to growing environmental regulations, expanding charging infrastructure, and increasing fleet electrification efforts. Its widespread adoption in urban delivery and public transportation supports its dominant position.

The Fuel Cell Electric Vehicle segment is projected to register the fastest growth rate from 2025 to 2032, fueled by technological advancements in hydrogen fuel cells and rising demand for long-range commercial vehicles.

- By Vehicle

On the basis of vehicle type, the market is categorized into Bus, Trucks, Pick-up Trucks, and Van. The Bus segment dominated the market with the largest revenue share of 65.7% in 2024, driven by government initiatives to electrify public transit and reduce urban emissions.

The Trucks segment is expected to witness the fastest CAGR from 2025 to 2032, supported by increasing demand for electric freight and last-mile delivery vehicles.

- By Range

On the basis of range, the market is segmented into 0-150 Miles, 151-250 Miles, 251-500 Miles, and 500 Miles and Above. The 0-150 Miles segment accounted for the largest revenue share in 2024, favored for its efficiency in short-distance urban logistics.

The 251-500 Miles segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by advances in battery technology enabling longer routes and broader adoption in regional transport.

- By Component

On the basis of component, the market is segmented into Electric Motor, EV Battery, and Hydrogen Fuel Cell. The EV Battery segment dominated the market revenue in 2024 due to its central role in vehicle performance and range optimization.

The Hydrogen Fuel Cell segment is projected to witness the fastest CAGR from 2025 to 2032, supported by increased investments in hydrogen infrastructure and rising adoption in heavy-duty commercial vehicles

Electric Commercial Vehicle Market Regional Analysis

- North America dominated the electric commercial vehicle market with the largest revenue share in 2024, driven by increasing awareness of environmental concerns and the economic benefits of electric vehicles

- The region benefits from government incentives and growing investments in charging infrastructure, which encourage the adoption of electric commercial vehicles across various applications

U.S. Electric Commercial Vehicle Market Insight

The U.S. market is a key driver in the North American electric commercial vehicle sector, supported by a strong focus on reducing emissions and dependence on fossil fuels. Growing interest in sustainable transportation among businesses and fleet operators, along with increasing availability of electric commercial vehicle models, is fostering market expansion.

Europe Electric Commercial Vehicle Market Insight

The European electric commercial vehicle market is showing substantial growth, driven by stringent environmental regulations and ambitious targets for carbon neutrality. Many European countries offer incentives and subsidies to promote the adoption of electric vehicles in the commercial sector. There is also a strong emphasis on developing charging infrastructure to support the transition.

U.K. Electric Commercial Vehicle Market Insight

The U.K. market demonstrates a growing demand for electric commercial vehicles, aligned with the government's commitment to phasing out gasoline and diesel vehicles. Increasing awareness of air quality issues in urban areas and the availability of financial incentives are encouraging businesses to transition their fleets to electric.

Germany Electric Commercial Vehicle Market Insight

The German electric commercial vehicle market is expanding, fueled by the country's strong automotive industry and focus on technological innovation in electric mobility. Growing environmental consciousness and government support for electric vehicle adoption are key factors driving the market.

Asia-Pacific Electric Commercial Vehicle Market Insight

The Asia-Pacific electric commercial vehicle market is poised for rapid growth, driven by increasing urbanization and government initiatives to promote electric vehicle adoption to combat air pollution. Countries such as China are at the forefront of this transition, with significant investments in electric vehicle manufacturing and infrastructure.

Japan Electric Commercial Vehicle Market Insight

The Japanese electric commercial vehicle market is experiencing growth, driven by a focus on technological advancements in battery technology and the introduction of more affordable and practical electric models. Partnerships and collaborations among key players are also contributing to the development and adoption of electric commercial vehicles.

China Electric Commercial Vehicle Market Insight

The Chinese electric commercial vehicle market stands as a major and rapidly evolving segment, driven by the country's strong government support for new energy vehicles and a significant push towards electrification to address environmental concerns. The market benefits from a large domestic manufacturing base and strong investments in charging infrastructure, making it a global leader in this sector.

Electric Commercial Vehicle Market Share

The electric commercial vehicle industry is primarily led by well-established companies, including:

- Ford Motor Company (U.S.)

- General Motors (U.S.)

- AUDI AG (Germany)

- Kia Motors Corporation (South Korea)

- Groupe Renault (France)

- Groupe PSA (France)

- SAIC Motor Corporation Limited (China)

- Tesla (U.S.)

- Daimler AG (Germany)

- BMW AG (Germany)

- Hyundai Motor Company (South Korea)

- BYD Company Ltd. (China)

- Continental AG (Germany)

- TOYOTA MOTOR CORPORATION (Japan)

- Nissan Motor Co., LTD. (Japan)

- Volkswagen AG (Germany)

- AB Volvo (Sweden)

- Honda Motor Co., Ltd. (Japan)

Latest Developments in Global Electric Commercial Vehicle Market

- In June 2023, Volkswagen Commercial Vehicles commences autonomous driving tests using the all-electric Volkswagen ID. The program, initiated in Texas, USA, extends to European centers. The objective is to bolster commercially available transport services and expand the mobility portfolio of the Volkswagen Group

- In December 2022, Mercedes-Benz Vans, in collaboration with the Polish government and partners, unveiled plans for a new van production plant in Jawor, Poland. This facility, the first fully electric plant for Mercedes-Benz vans, aims to revolutionize electric vehicle manufacturing

- In December 2022, Mercedes-Benz and Rivian sign an MOU for a strategic partnership to jointly produce electric vans. The collaboration entails establishing a new joint venture manufacturing company in Central/Eastern Europe, leveraging an existing Mercedes-Benz site, to manufacture large electric vans for both brands

- In January 2022, AB Volvo launched an upgraded version of the Volvo VNR Electric. With an 85% increased range and quicker charging capabilities, this version exemplifies Volvo's commitment to advancing electric vehicle technology and sustainability in transportation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.