Global Electric Coolant Pump Market

Market Size in USD Billion

CAGR :

%

USD

2.72 Billion

USD

5.49 Billion

2024

2032

USD

2.72 Billion

USD

5.49 Billion

2024

2032

| 2025 –2032 | |

| USD 2.72 Billion | |

| USD 5.49 Billion | |

|

|

|

|

What is the Global Electric Coolant Pump Market Size and Growth Rate?

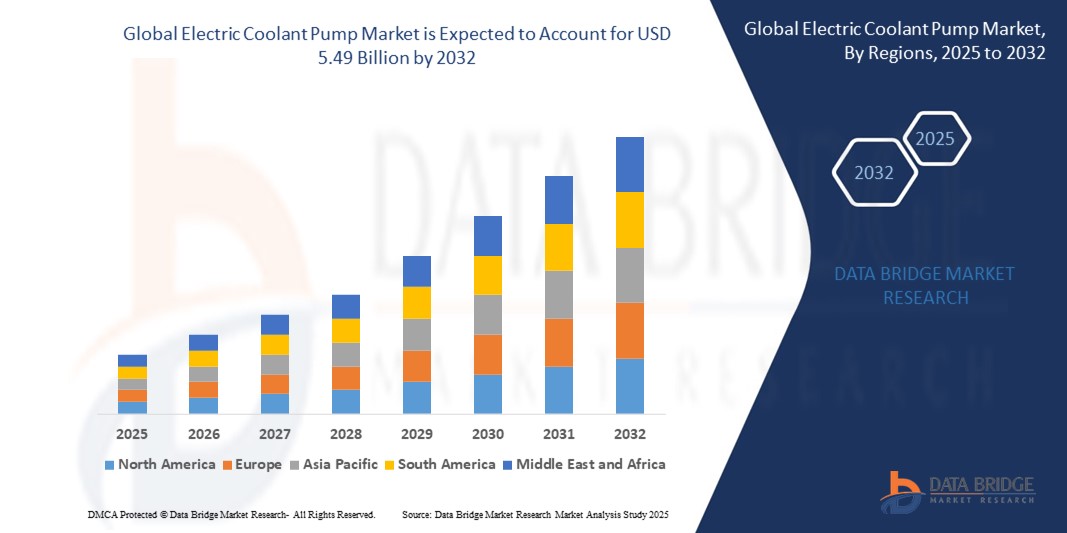

- The global electric coolant pump market size was valued at USD 2.72 billion in 2024 and is expected to reach USD 5.49 billion by 2032, at a CAGR of 9.20% during the forecast period

- Growth is primarily driven by the rapid electrification of vehicles, stringent emission regulations, and the increasing demand for efficient thermal management systems in electric and hybrid vehicles

- Advancements in EV architectures, integration of 48V systems, and increased Use of electronic control modules are further accelerating market adoption and expanding the scope of electric coolant pump applications

What are the Major Takeaways of Electric Coolant Pump Market?

- Electric Coolant Pumps play a crucial role in thermal management, supporting battery, engine, and turbocharger cooling especially in electric and hybrid vehicles that require optimized heat dissipation and energy efficiency

- Their popularity is surging due to benefits such as precise flow control, compact size, and compatibility with modern automotive electronics and CAN/PWM interfaces

- Market momentum is further fueled by the growth of BEVs and PHEVs, government incentives for EV adoption, and the automotive industry’s transition toward sustainable and high-efficiency vehicle platforms

- Asia-Pacific dominated the electric coolant pump market with the largest revenue share of 42.3% in 2024, driven by robust electric vehicle (EV) production, favorable government policies, and the presence of key automotive OEMs across China, Japan, South Korea, and India

- North America is projected to grow at the fastest CAGR of 11.4% during 2025 to 2032, fueled by a surge in EV sales, strong presence of premium automakers, and growing investment in clean mobility and electrification technologies

- The sealed segment dominated the market with the largest revenue share of 55.4% in 2024, owing to its widespread Use in conventional and hybrid vehicles, offering reliable performance and easier integration into existing cooling systems

Report Scope and Electric Coolant Pump Market Segmentation

|

Attributes |

Electric Coolant Pump Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electric Coolant Pump Market?

“Advanced Integration with EV Platforms and Thermal Management Systems”

- A key trend shaping the global electric coolant pump market is the integration of pumps with advanced EV platforms and smart thermal management systems to optimize battery and power electronics performance. Automakers are leveraging electric coolant pumps to enhance energy efficiency, improve range, and manage component temperatures in real-time

- For instance, the integration of electric coolant pumps in Tesla’s Model 3 and Hyundai’s IONIQ 5 enables precise thermal control of battery packs and motors, directly contributing to longer lifespan and enhanced vehicle performance

- Manufacturers are also embedding control interfaces such as CAN, LIN, and PWM to ensure seamless communication with electronic control units (ECU.S.) in EVs and hybrids. This integration allows variable-speed control for different thermal zones and intelligent power Usage, reducing energy waste

- As OEMs increasingly design their vehicles around electrified and connected architecture, electric coolant pumps are evolving into smart thermal control units rather than standalone components. These systems dynamically respond to driving conditions, climate, and load, ensuring efficient operation

- Leading companies such as Rheinmetall Automotive and MAHLE are developing next-gen electric coolant pumps that support high-voltage EVs, smart diagnostics, and modular vehicle platforms, cementing their role in EV thermal innovation

- This shift toward intelligent, energy-efficient, and EV-integrated thermal management solutions is redefining the electric coolant pump landscape, with growing demand across both passenger and commercial electric vehicles

What are the Key Drivers of Electric Coolant Pump Market?

- The surging production of electric and hybrid vehicles globally, coupled with stricter emissions and fuel efficiency regulations, is a primary driver for the adoption of electric coolant pumps

- For instance, in February 2024, Bosch launched an advanced high-performance coolant pump system designed specifically for 48V mild hybrid and BEV platforms, signaling increasing OEM demand for thermal innovation

- As EVs rely heavily on precise thermal regulation of battery packs, motors, and power electronics, electric coolant pumps offer compact, lightweight, and energy-efficient alternatives to traditional belt-driven pumps

- Growing adoption of 48V systems in mild hybrids and increased demand for modular and scalable thermal management solutions are pushing suppliers to innovate pump designs compatible with multiple voltage platforms

- Consumer focus. on performance, safety, and range in electric vehicles is further driving automakers to invest in intelligent cooling systems that adapt to dynamic load conditions, boosting electric coolant pump Usage across various. vehicle classes

- Overall, the transition to electrified mobility, alongside increased EV model launches and government incentives, is creating a robU.S.t foundation for long-term market expansion

Which Factor is challenging the Growth of the Electric Coolant Pump Market?

- The high cost and complex integration requirements of advanced electric coolant pump systems pose a significant barrier to adoption, particularly for entry-level EVs and budget-conscious. manufacturers

- For instance, small-scale OEMs and EV startups often face cost constraints in incorporating advanced thermal systems, opting instead for simpler or mechanical alternatives in early models

- Another major challenge is the thermal management complexity in EVs, which varies greatly depending on battery architecture, vehicle size, and powertrain design requiring customized pump configurations that can delay deployment and increase R&D expenditure

- The limited availability of standardized pump systems across vehicle platforms can complicate supply chains and raise costs, particularly for emerging markets or smaller volume players

- Furthermore, the maintenance of electric coolant pumps in harsh environments and the lack of universal diagnostic tools in aftermarket service centers can affect long-term reliability and serviceability

- Addressing these challenges through modular designs, cost-optimized manufacturing, and platform based integration strategies will be essential for suppliers aiming to scale adoption across broader EV categories

How is the Electric Coolant Pump Market Segmented?

The market is segmented on the basis of type, power output, voltage type, communication interface, application, and vehicle type.

- By Type

On the basis of type, the electric coolant pump market is segmented into sealed and sealless pumps. The sealed segment dominated the market with the largest revenue share of 55.4% in 2024, owing to its widespread Use in conventional and hybrid vehicles, offering reliable performance and easier integration into existing cooling systems. Sealed pumps are cost-effective and known for their compact design and durability, making them a preferred choice across multiple vehicle platforms.

The sealless segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its superior efficiency, lower maintenance, and increasing demand in electric vehicles (EVs), particularly for battery and inverter cooling.

- By Power Output

On the basis of power output, the market is segmented into <150 W, 150–200 W, and >250 W. The <150 W segment held the largest market share of 48.6% in 2024, as it is widely U.S.ed in light-duty applications such as cabin and auxiliary system cooling. These low-power pumps are commonly deployed in compact EVs and hybrids for minimal energy consumption.

The >250 W segment is projected to grow at the fastest CAGR during the forecast period, driven by the rising adoption of high-performance electric vehicles and commercial EVs requiring robU.S.t thermal management.

- By Voltage Type

On the basis of voltage, the electric coolant pump market is divided into 12 V and 48 V. The 12 V segment dominated the market with 60.1% share in 2024, primarily due to its extensive Use in traditional internal combustion engine (ICE) vehicles and mild hybrids.

The 48 V segment is expected to grow at the fastest rate from 2025 to 2032, owing to the increasing implementation of 48V systems in next-gen EV platforms for greater energy efficiency and system performance.

- By Communication Interface

On the basis of communication interface, the market is segmented into interface into Local Interconnect Network (LIN), Controller Area Network (CAN), and Pulse‑Width Modulation (PWM). The CAN segment led with a 39.8% revenue share in 2024, as it is widely Used for real-time communication between the pump and vehicle ECU’s, offering high reliability and integration flexibility.

The PWM segment is anticipated to witness the highest CAGR during the forecast period, due to its simplicity, cost-effectiveness, and growing Use in speed-controlled EV applications.

- By Application

On the basis of application, the market is segmented into Battery & Power Electronics Cooling, Engine Cooling, Turbocharger Cooling, and Other Applications. The Battery & Power Electronics Cooling segment dominated with 46.5% share in 2024, driven by the rising demand for precise temperature regulation in EV batteries and electronic components.

The Turbocharger Cooling segment is expected to grow rapidly from 2025 to 2032, especially in high-performance hybrids and ICE vehicles, where managing turbo heat is critical to performance and longevity.

- By Vehicle Type

On the basis of vehicle type, the electric coolant pump market is categorized into Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV). The BEV segment held the largest market share of 61.3% in 2024, propelled by the surge in global BEV production, increased battery capacities, and greater thermal management needs.

The PHEV segment is forecasted to witness the fastest CAGR, supported by growing hybrid vehicle adoption, favorable tax incentives, and the need for dual-system cooling solutions in combustion and electric components.

Which Region Holds the Largest Share of the Electric Coolant Pump Market?

- Asia-Pacific dominated the electric coolant pump market with the largest revenue share of 42.3% in 2024, driven by robU.S.t electric vehicle (EV) production, favorable government policies, and the presence of key automotive OEMs across China, Japan, South Korea, and India

- The region’s leadership in EV adoption, combined with aggressive investments in EV infrastructure and battery technology, is accelerating the demand for efficient thermal management solutions such as electric coolant pumps

- Furthermore, Asia-Pacific benefits from a strong manufacturing base, cost-effective labor, and rising R&D activities, positioning it as the global hub for electric coolant pump innovation and large-scale deployment in both passenger and commercial vehicles

China Electric Coolant Pump Market Insight

China accounted for the largest market share in Asia-Pacific in 2024 due to its strong EV ecosystem, rapid urbanization, and dominance in lithium-ion battery production. Government incentives, growing exports of electric vehicles, and the presence of domestic leaders such as BYD and NIO are fueling the demand for advanced electric coolant pumps tailored for localized applications

Japan Electric Coolant Pump Market Insight

Japan’s electric coolant pump market is expanding steadily, supported by the country’s precision automotive engineering and rising hybrid vehicle production. Japanese automakers are emphasizing compact and energy-efficient pump designs compatible with evolving hybrid and plug-in systems, while local consumers seek high-performance, sustainable mobility solutions

India Electric Coolant Pump Market Insight

India is emerging as a promising market, driven by its growing EV policy initiatives such as FAME II, expanding EV startup ecosystem, and focus. on localized manufacturing. Increased demand for electric two-wheelers and compact EVs is promoting the need for cost-effective, reliable electric coolant pumps in the domestic market

Which Region is the Fastest Growing Region in the Electric Coolant Pump Market?

North America is projected to grow at the fastest CAGR of 11.4% during 2025 to 2032, fueled by a surge in EV sales, strong presence of premium automakers, and growing investment in clean mobility and electrification technologies. High consumer demand for long-range electric vehicles, supported by federal tax incentives and infrastructure development plans, is propelling electric coolant pump adoption across both OEM and aftermarket segments Furthermore, partnerships between pump manufacturers and U.S.-based EV brands, alongside increased R&D in thermal systems, are accelerating regional market expansion

U.S. Electric Coolant Pump Market Insight

The U.S. leads the North American market with over 80% share in 2024, supported by significant EV model launches, advanced automotive supply chains, and the rise of EV giants such as Tesla and Rivian. The shift toward 48V systems and power-dense battery platforms is driving demand for high-efficiency electric coolant pumps capable of integrated thermal control

Canada Electric Coolant Pump Market Insight

Canada is witnessing gradual growth in electric coolant pump adoption, driven by environmental policies, rising EV penetration, and a shift toward sustainable automotive manufacturing. Collaborations between global OEMs and Canadian battery developers are reinforcing the country’s role in thermal management innovation

Mexico Electric Coolant Pump Market Insight

Mexico’s market is gaining traction due to its growing role in EV component manufacturing and proximity to major U.S. automotive OEMs. Increased EV exports and investments in localized supply chains are creating new opportunities for electric coolant pump suppliers targeting mid-range EV platforms.

Which are the Top Companies in Electric Coolant Pump Market?

The electric coolant pump industry is primarily led by well-established companies, including:

- Rheinmetall Automotive AG (Germany)

- Robert Bosch GmbH (Germany)

- Audi AG(Germany)

- Continental AG (Germany)

- MAHLE GmbH (Germany)

- Schaeffler (Germany)

- Buhler Motor GmbH (Germany)

- Aisin Seiki Co., Ltd (Japan)

- Avid Technology Limited (U.K.)

- Grason Thermal Systems (U.K.)

- Concentric AB (Sweden)

- IndU.S.trie Saleri Italo S.p.A. (Italy)

- Hitachi Automotive Systems Americas, Inc. (U.S.)

- JTEKT Corporation (Japan)

- GMB Corporation (Japan)

- DENSO CORPORATION (Japan)

- Johnson Electric Holdings Limited (Hong Kong)

- Hanon Systems (South Korea)

- VOVYO Technology Co., Ltd. (China)

What are the Recent Developments in Global Electric Coolant Pump Market?

- In February 2024, the Automotive Aftermarket division of Schaeffler AG expanded its INA brand product portfolio by introducing high-quality auxiliary electric water pumps that meet OEM standards. This aftermarket innovation supports a wide variety of combustion engine, hybrid, and electric vehicles, ensuring compatibility with over 50 million units from renowned manufacturers. This launch strengthens Schaeffler's position in the global electric coolant pump aftermarket

- In September 2023, DENSO Corporation introduced the "Everycool" advanced cooling system designed to operate when commercial vehicle engines are idle. Aimed at improving driver comfort during hot weather while reducing fuel consumption, "Everycool" contributes to environmental sustainability by enhancing energy efficiency. This development highlights DENSO’s commitment to comfort and eco-conscious innovation in commercial vehicle technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.