Global Electric Glider Market

Market Size in USD Billion

CAGR :

%

USD

2.06 Billion

USD

4.30 Billion

2025

2033

USD

2.06 Billion

USD

4.30 Billion

2025

2033

| 2026 –2033 | |

| USD 2.06 Billion | |

| USD 4.30 Billion | |

|

|

|

|

Global Electric Glider Market Size

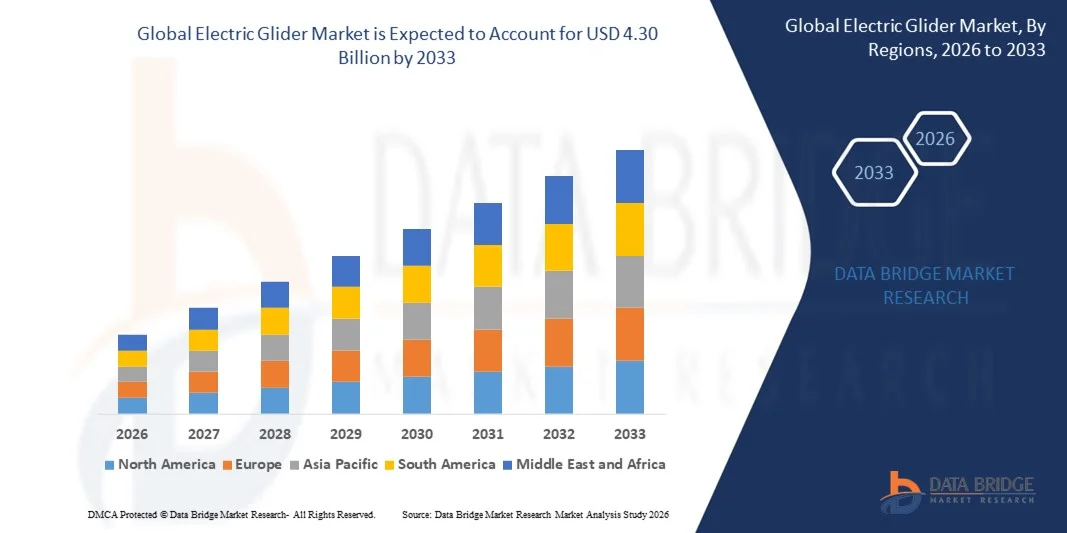

- The global Electric Glider Market size was valued at USD 2.06 billion in 2025 and is expected to reach USD 4.30 billion by 2033, at a CAGR of 9.64% during the forecast period.

- The market growth is primarily driven by the increasing adoption of eco-friendly aviation solutions and advancements in lightweight materials and battery technologies, enhancing the performance and efficiency of electric gliders.

- Additionally, rising interest in sustainable recreational aviation and urban air mobility, coupled with government initiatives supporting low-emission aircraft, is positioning electric gliders as a preferred choice among hobbyists and commercial operators alike. These factors are collectively accelerating market penetration, thereby significantly propelling the industry’s growth.

Global Electric Glider Market Analysis

- Electric gliders, offering sustainable and efficient flight solutions for recreational and commercial use, are increasingly important in modern aviation due to their zero-emission operation, reduced noise levels, and advanced battery and aerodynamic technologies.

- The rising demand for electric gliders is primarily fueled by the growing focus on eco-friendly aviation, increased interest in recreational flying, and government incentives promoting low-emission aircraft.

- North America dominated the Global Electric Glider Market with the largest revenue share of 34.4% in 2025, driven by early adoption of electric aviation technologies, high disposable incomes, and a strong presence of leading manufacturers, with the U.S. witnessing significant growth in electric glider production and usage, particularly in recreational clubs and urban air mobility initiatives, supported by innovations from both established aerospace companies and startups.

- Asia-Pacific is expected to be the fastest-growing region in the Global Electric Glider Market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing investments in sustainable aviation infrastructure.

- The manned segment dominated the market with the largest revenue share of 57.4% in 2025, driven by increasing recreational aviation, pilot training programs, and urban air mobility initiatives requiring human-operated gliders.

Report Scope and Global Electric Glider Market Segmentation

|

Attributes |

Electric Glider Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Pipistrel (Slovenia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Electric Glider Market Trends

Enhanced Convenience Through AI and Autonomous Flight Integration

- A significant and accelerating trend in the Global Electric Glider Market is the increasing integration of artificial intelligence (AI) and autonomous flight systems, enabling smarter navigation, optimized flight performance, and enhanced user convenience for both recreational and commercial applications.

- For instance, Pipistrel electric gliders incorporate advanced flight computers that assist pilots with optimal glide paths and energy management, while some Lilium and Joby Aviation prototypes leverage AI-driven autopilot systems for semi-autonomous operation.

- AI integration in electric gliders enables features such as adaptive flight path optimization, predictive maintenance alerts, and automated collision avoidance. For example, Volocopter’s air taxi designs utilize AI to continuously monitor flight conditions and adjust rotor performance for stability, while Ascendance Flight Technologies integrates intelligent flight planning to maximize range and efficiency.

- The seamless integration of AI with onboard sensors, navigation systems, and digital control interfaces allows pilots or operators to manage flight parameters more intuitively, reducing workload and increasing safety. Through centralized flight management platforms, users can monitor energy usage, track routes, and receive predictive notifications for maintenance or environmental conditions.

- This trend towards more intelligent, automated, and interconnected electric glider systems is fundamentally transforming user expectations for recreational and urban air mobility. Consequently, companies such as Bye Aerospace and Eviation Aircraft are developing AI-enabled electric gliders with autonomous takeoff/landing capabilities, adaptive flight controls, and smart battery management systems.

- The demand for electric gliders with advanced AI and autonomous flight capabilities is rapidly growing across recreational, training, and commercial aviation sectors, as users increasingly prioritize convenience, efficiency, and safer flight experiences.

Global Electric Glider Market Dynamics

Driver

Growing Demand Driven by Environmental Awareness and Recreational Aviation Trends

- The increasing focus on eco-friendly aviation and the rising popularity of recreational and urban air mobility solutions are significant drivers of the heightened demand for electric gliders.

- For instance, in 2025, Pipistrel announced advancements in battery-electric glider technology, highlighting longer flight ranges and improved energy efficiency. Such innovations by key manufacturers are expected to accelerate growth in the electric glider market during the forecast period.

- As consumers and aviation enthusiasts become more conscious of carbon emissions and environmental sustainability, electric gliders offer a clean and quiet alternative to traditional motorized aircraft, providing a compelling choice for recreational flying, pilot training, and short-distance urban air travel.

- Furthermore, the growing interest in interconnected aviation solutions, including AI-assisted flight and autonomous features, is positioning electric gliders as a central component of modern, smart aviation ecosystems.

- The convenience of lower operational costs, reduced maintenance compared to conventional aircraft, and increasingly user-friendly interfaces for both hobbyists and commercial operators are key factors propelling the adoption of electric gliders across various regions. The trend toward electric recreational aviation clubs, flight schools, and urban air mobility pilots further contributes to market growth.

Restraint/Challenge

Concerns Regarding Battery Limitations and High Initial Costs

- Limitations in current battery technology, including flight duration, charging time, and energy density, pose a significant challenge to broader market adoption. As electric gliders rely heavily on battery performance, concerns about range anxiety and operational reliability may restrain growth.

- For instance, high-profile reviews of early electric glider models have highlighted range and charging challenges, making some potential buyers hesitant to invest in these aircraft.

- Addressing these challenges through advancements in battery technology, lightweight materials, and hybrid power solutions is crucial for building consumer confidence. Companies such as Lilium and Bye Aerospace are actively working on high-capacity batteries and energy-efficient propulsion systems to enhance flight range and performance. Additionally, the relatively high initial cost of electric gliders compared to conventional gliders or small aircraft can be a barrier for price-sensitive recreational pilots and commercial operators. While some entry-level models are becoming more affordable, premium features such as autonomous flight capabilities, AI integration, and advanced safety systems often come with a higher price tag.

- While costs are gradually decreasing with technological improvements and economies of scale, the perceived premium for electric aviation technology can still hinder widespread adoption, particularly in developing regions or among individual hobbyists.

- Overcoming these challenges through improved battery performance, cost reductions, operator training programs, and increased awareness of long-term operational savings will be vital for sustained market growth.

Global Electric Glider Market Scope

The electric glider market is segmented on the basis of type, platform, source and end users.

- By Type

On the basis of type, the Global Electric Glider Market is segmented into manned and unmanned. The manned segment dominated the market with the largest revenue share of 57.4% in 2025, driven by increasing recreational aviation, pilot training programs, and urban air mobility initiatives requiring human-operated gliders. Manned electric gliders are preferred for training and leisure flying due to regulatory approvals and the established infrastructure for pilot-operated aircraft.

The unmanned segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, fueled by growing applications in surveillance, aerial mapping, and cargo delivery. Technological advancements in autonomous navigation, AI integration, and remote monitoring systems are enhancing the operational capabilities of unmanned gliders, making them highly suitable for military and commercial use cases, while reducing risks associated with human operation. The increasing adoption of drones for various civilian and defense purposes is further boosting the unmanned segment.

- By Platform

On the basis of platform, the Global Electric Glider Market is segmented into rotary wing electric gliders and fixed wing electric gliders. The fixed wing segment dominated the market with a revenue share of 61.2% in 2025, driven by its superior efficiency, longer flight range, and suitability for both recreational and commercial aviation applications. Fixed wing electric gliders are widely used in training, sport aviation, and environmental monitoring due to their stable flight characteristics and cost-effectiveness.

The rotary wing segment is expected to witness the fastest CAGR of 23.5% from 2026 to 2033, propelled by rising interest in urban air mobility, short-distance aerial transportation, and vertical takeoff and landing (VTOL) operations. Advances in lightweight rotors, improved battery efficiency, and autonomous flight control systems are making rotary wing electric gliders increasingly viable for commercial and military use, supporting faster adoption globally.

- By Source

On the basis of source, the Global Electric Glider Market is segmented into battery, solar cells, fuel cells, ultra-capacitors, and others. The battery-powered segment dominated the market with a revenue share of 68.9% in 2025, owing to the widespread availability of lithium-ion and high-capacity batteries that ensure reliable, long-duration flight. Battery-powered gliders are highly favored for recreational, commercial, and training purposes due to their ease of use, predictable performance, and integration with existing charging infrastructure.

The solar cells segment is expected to witness the fastest CAGR of 25.2% from 2026 to 2033, driven by increasing investments in renewable energy solutions, rising environmental awareness, and technological advancements in photovoltaic efficiency. Solar-powered gliders are gaining traction for sustainable aviation applications, including environmental monitoring, long-endurance flights, and experimental urban air mobility projects.

- By End Users

On the basis of end users, the Global Electric Glider Market is segmented into commercial and military. The commercial segment dominated the market with a revenue share of 59.6% in 2025, driven by recreational aviation clubs, pilot training schools, and emerging urban air mobility services. Commercial operators prioritize safety, ease of maintenance, and operational efficiency, which electric gliders increasingly provide through advanced battery systems and AI-assisted controls.

The military segment is expected to witness the fastest CAGR of 24.7% from 2026 to 2033, propelled by growing applications in surveillance, reconnaissance, training, and tactical operations. Military adoption is further supported by the development of unmanned gliders, AI-enabled navigation systems, and lightweight designs that enhance operational flexibility and reduce risks associated with human pilots in combat or remote missions.

Global Electric Glider Market Regional Analysis

- North America dominated the Global Electric Glider Market with the largest revenue share of 34.4% in 2025, driven by rising demand for recreational aviation, urban air mobility initiatives, and pilot training programs.

- Consumers and operators in the region highly value advanced electric glider technologies, including AI-assisted navigation, autonomous flight features, and efficient battery systems that enhance performance, safety, and operational convenience.

- This widespread adoption is further supported by high disposable incomes, a strong recreational aviation culture, and government initiatives promoting sustainable and low-emission aircraft, positioning electric gliders as a preferred choice for both recreational and commercial aviation applications.

U.S. Electric Glider Market Insight

The U.S. electric glider market captured the largest revenue share of 81% in 2025 within North America, fueled by increasing interest in recreational aviation, pilot training programs, and emerging urban air mobility initiatives. Consumers and operators are prioritizing eco-friendly aviation solutions and advanced electric glider technologies, such as AI-assisted navigation, autonomous flight features, and high-efficiency battery systems. The growing adoption of drone and unmanned aerial technologies, combined with supportive government regulations and subsidies for low-emission aircraft, further propels market growth. Additionally, the U.S. aviation community’s strong focus on safety, innovation, and convenience continues to drive demand for both manned and unmanned electric gliders.

Europe Electric Glider Market Insight

The Europe electric glider market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent environmental regulations and increasing emphasis on sustainable aviation. Growth is supported by rising recreational flying clubs, pilot training programs, and urban air mobility trials in countries such as Germany, France, and the Netherlands. European operators are increasingly adopting electric gliders for both commercial and leisure purposes due to low emissions, operational efficiency, and noise reduction benefits. Integration with autonomous systems and AI-assisted flight technology is further enhancing the appeal of electric gliders across residential and commercial aviation sectors.

U.K. Electric Glider Market Insight

The U.K. electric glider market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by growing interest in recreational and training aviation, as well as emerging urban air mobility projects. Concerns regarding environmental sustainability and the desire for low-emission aviation alternatives are encouraging both private operators and institutions to adopt electric gliders. The U.K.’s robust aviation infrastructure, coupled with supportive government policies and investments in clean technology, continues to stimulate market growth.

Germany Electric Glider Market Insight

The Germany electric glider market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of sustainable aviation and strong adoption of technologically advanced aircraft. Germany’s well-developed aviation infrastructure, emphasis on innovation, and commitment to eco-friendly mobility promote the adoption of electric gliders in both recreational and commercial sectors. Integration with smart flight systems and AI-assisted controls is becoming increasingly prevalent, aligning with local operators’ focus on safety, efficiency, and environmental compliance.

Asia-Pacific Electric Glider Market Insight

The Asia-Pacific electric glider market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and government initiatives supporting low-emission aviation in countries such as China, Japan, and India. The region’s growing recreational aviation community, along with emerging urban air mobility projects, is propelling demand for both manned and unmanned electric gliders. Moreover, Asia-Pacific’s manufacturing capabilities and technological advancements in battery and AI-assisted flight systems are making electric gliders more accessible and affordable.

Japan Electric Glider Market Insight

The Japan electric glider market is gaining momentum due to the country’s high-tech aviation culture, rising urbanization, and demand for eco-friendly flight solutions. Adoption is driven by an increasing number of recreational flying clubs, pilot training programs, and autonomous flight experiments. Integration with AI-assisted navigation, battery-efficient systems, and smart flight monitoring solutions is fueling market growth. Japan’s aging population also contributes to demand for user-friendly and safe electric gliders suitable for both recreational and commercial operations.

China Electric Glider Market Insight

The China electric glider market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle class, and high technological adoption. Recreational aviation, pilot training programs, and urban air mobility initiatives are increasingly adopting electric gliders as sustainable alternatives to conventional aircraft. Strong domestic manufacturing capabilities, government support for low-emission aviation, and the availability of cost-effective solutions are key factors propelling market growth in China.

Global Electric Glider Market Share

The Electric Glider industry is primarily led by well-established companies, including:

• Pipistrel (Slovenia)

• Joby Aviation (U.S.)

• Volocopter (Germany)

• Lilium (Germany)

• Bye Aerospace (U.S.)

• AeroVelo (Canada)

• E-volo (Germany)

• Pipistrel Taurus (Slovenia)

• Skydrive (Japan)

• Urban Aeronautics (Israel)

• Opener (Canada)

• Hangar Technologies (U.S.)

• Ascendance Flight Technologies (France)

• Tilt Aircraft (U.S.)

• Eviation Aircraft (Israel)

• Horizon Aircraft (Canada)

• Alaka’i Technologies (U.S.)

• Trexler Aviation (Austria)

• Joby S4 Series (U.S.)

• Volocopter 2X (Germany)

What are the Recent Developments in Global Electric Glider Market?

- In April 2024, Pipistrel, a global leader in electric aviation, launched a strategic initiative in South Africa aimed at promoting sustainable recreational and training aviation through its advanced electric glider technologies. This initiative underscores the company’s dedication to delivering high-performance, eco-friendly aircraft tailored to the unique needs of the local aviation community. By leveraging its global expertise and cutting-edge product offerings, Pipistrel is not only addressing regional aviation challenges but also reinforcing its position in the rapidly growing global Electric Glider Market.

- In March 2024, Joby Aviation introduced an upgraded version of its eVTOL glider prototype designed for urban air mobility and commercial operations. The innovative system incorporates advanced AI-assisted navigation and enhanced battery efficiency, enabling longer flight ranges and safer operation in congested urban environments. This advancement highlights Joby Aviation’s commitment to developing next-generation electric flight technologies that expand the practical applications of electric gliders.

- In March 2024, Volocopter successfully deployed its autonomous air mobility project in Bengaluru, India, aimed at enhancing urban transportation safety and efficiency. The initiative leverages state-of-the-art electric glider and eVTOL technologies to create safer, quieter, and more environmentally friendly aerial mobility solutions. This project highlights the increasing significance of electric aviation in urban infrastructure and mobility planning, contributing to smarter and greener cities.

- In February 2024, Bye Aerospace announced a strategic partnership with the European Flight Training Academy to introduce a fleet of electric gliders for pilot training programs. This collaboration is designed to improve safety, reduce operational costs, and promote sustainable aviation practices among new pilots. The initiative underscores Bye Aerospace’s commitment to innovation and operational excellence in the growing electric glider sector.

- In January 2024, Lilium unveiled its Lilium Jet eVTOL glider at the AERO Friedrichshafen Show 2024. Equipped with autonomous flight capabilities and advanced battery management systems, the Lilium Jet enables efficient and eco-friendly regional travel. This launch demonstrates the company’s focus on integrating cutting-edge technology into electric aviation solutions, offering users enhanced performance, safety, and sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.