Global Electric Kettle Market

Market Size in USD Billion

CAGR :

%

USD

4.65 Billion

USD

6.47 Billion

2024

2032

USD

4.65 Billion

USD

6.47 Billion

2024

2032

| 2025 –2032 | |

| USD 4.65 Billion | |

| USD 6.47 Billion | |

|

|

|

|

Electric Kettle Market Size

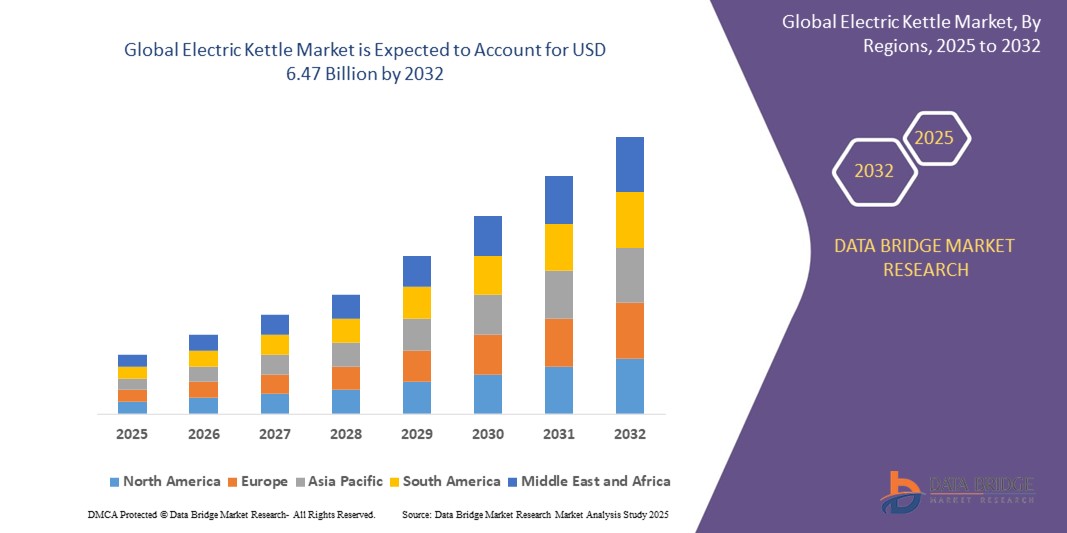

- The global electric kettle market size was valued at USD 4.65 billion in 2024 and is expected to reach USD 6.47 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely fuelled by the rising demand for energy-efficient kitchen appliances, increasing urbanization, and evolving consumer preferences for quick and convenient beverage preparation

- The increasing adoption of electric kettles in commercial establishments such as hotels, offices, and cafes, along with product innovations such as temperature control and smart connectivity, is further accelerating market expansion

Electric Kettle Market Analysis

- The electric kettle market is experiencing strong consumer traction owing to its integration of smart features and sleek design aesthetics that align with modern kitchen setups

- Growing interest in multifunctional appliances is leading manufacturers to introduce electric kettles with additional capabilities such as tea and coffee brewing

- North America dominated the electric kettle market with the largest revenue share in 2024, driven by the rising preference for quick and energy-efficient boiling solutions and increasing adoption of smart kitchen appliances

- The Asia-Pacific region is expected to witness the highest growth rate in the global electric kettle market, driven by rapid urbanization, increasing disposable incomes, and a rising preference for time-efficient kitchen appliances

- The stainless-steel segment held the largest market revenue share in 2024, attributed to its durability, heat retention efficiency, and modern design appeal. Stainless steel kettles are highly preferred by consumers for their long lifespan and resistance to stains or odors, making them ideal for repeated daily use

Report Scope and Electric Kettle Market Segmentation

|

Attributes |

Electric Kettle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electric Kettle Market Trends

“Smart Technology Integration”

- The electric kettle market is witnessing a growing trend of smart technology integration to improve convenience and customization

- Consumers increasingly prefer kettles with Wi-Fi or Bluetooth connectivity, enabling remote control through mobile applications

- Smart features such as variable temperature settings, auto shut-off, and scheduling are enhancing functionality and safety

- Cosori’s smart kettle, which connects to Alexa for voice control, exemplifies this trend by offering hands-free operation

- The rising popularity of smart homes is accelerating demand for connected kettles that support energy efficiency and user comfort

Electric Kettle Market Dynamics

Driver

“Rising Demand for Convenient and Time-Efficient Appliances”

- Increasing demand for quick-to-use kitchen appliances is driving the adoption of electric kettles, especially in urban households where time-saving solutions are prioritized

- Electric kettles offer faster boiling times than traditional methods, with added features such as auto shut-off, temperature control, and keep-warm functions enhancing user safety and convenience

- These appliances are popular among working professionals, students, and families seeking efficient kitchen routines; for instance, students in dormitories prefer electric kettles for quick meal preparation

- In developing regions such as India, rising disposable incomes and growing urbanization are making electric kettles essential small appliances in modern homes

- The growing global consumption of tea and coffee, especially in countries such as China, the U.K., and the U.S., continues to fuel demand, prompting manufacturers to launch models with varying capacities and sleek designs

Restraint/Challenge

“Limited Functionality Compared to Multifunctional Appliances”

- Limited functionality is a key restraint for electric kettles, as many consumers now prefer multifunctional appliances that offer broader utility and better space efficiency

- In compact kitchens or minimalist households, devices such as all-in-one beverage makers or induction cooktops are favored over single-purpose gadgets such as electric kettles

- Eco-conscious markets such as Germany and the Nordic countries are seeing reduced interest in electric kettles due to rising concerns over electronic waste and redundancy

- Traditional cooking habits and limited electrification in rural areas, particularly in parts of Asia and Africa, continue to hinder widespread kettle adoption

- To stay relevant, brands need to integrate features such as temperature control, tea infusers, and smart connectivity to enhance functionality and market appeal

Electric Kettle Market Scope

The market is segmented on the basis of raw material, type, capacity, application, and distribution channel.

- By Raw Material

On the basis of raw material, the electric kettle market is segmented into stainless steel, plastic, glass, and others. The stainless-steel segment held the largest market revenue share in 2024, attributed to its durability, heat retention efficiency, and modern design appeal. Stainless steel kettles are highly preferred by consumers for their long lifespan and resistance to stains or odors, making them ideal for repeated daily use.

The glass segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for transparent designs and aesthetic appeal. Glass kettles provide visual assurance of water purity and are favored in premium kitchen setups, contributing to their rising demand in urban and modern households.

- By Type

On the basis of type, the market is segmented into see through and opaque. The opaque segment captured the largest market share in 2024, driven by its extensive availability, affordability, and effective insulation. These kettles are widely adopted for their practicality and are commonly found across all retail platforms.

The see-through segment is expected to witness the fastest growth rate from 2025 to 2032, owing to growing consumer interest in elegant kitchen appliances and the demand for visual control during boiling. This trend is supported by rising disposable incomes and an inclination towards stylish home appliances.

- By Capacity

On the basis of capacity, the electric kettle market is segmented into less than 1L, 1–1.5L, and above 1.5L. The 1–1.5L segment dominated the market in 2024, due to its optimal balance between portability and volume. This capacity range is ideal for everyday use in small families or individual settings, making it a preferred choice in both residential and institutional setups.

The above 1.5L segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increased demand in offices, commercial kitchens, and larger households. These kettles offer convenience in high-consumption environments and are being increasingly adopted in co-living and co-working spaces.

- By Application

On the basis of application, the electric kettle market is segmented into residential and commercial. The residential segment accounted for the highest revenue share in 2024, propelled by the growing trend of at-home consumption of tea, coffee, and instant meals. Rising awareness of energy efficiency and convenience further supports adoption.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its rising use in hotels, cafes, restaurants, and coworking spaces. These establishments favor electric kettles for their speed, portability, and cost-effective water heating capabilities.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hypermarket/supermarket, convenience stores, online stores, and others. The hypermarket/supermarket segment led the market in 2024, due to its wide product variety, brand availability, and consumer trust in physical product evaluation before purchase.

The online stores segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing internet penetration, convenience of doorstep delivery, and competitive pricing. The rise in e-commerce platforms and online-exclusive offers continue to attract tech-savvy and price-sensitive consumers globally.

Electric Kettle Market Regional Analysis

- North America dominated the electric kettle market with the largest revenue share in 2024, driven by the rising preference for quick and energy-efficient boiling solutions and increasing adoption of smart kitchen appliances

- Consumers in the region favor electric kettles for their speed, safety features, and compatibility with modern kitchen designs, especially models with temperature control and auto shut-off functions

- Growth is further supported by busy lifestyles, higher purchasing power, and increased consumer focus on convenience and energy efficiency in daily food and beverage preparation

U.S. Electric Kettle Market Insight

The U.S. electric kettle market held the largest revenue share within North America in 2024, driven by a growing inclination toward health-conscious habits and tea consumption. The rise in demand for electric kettles with temperature control for preparing different beverages is further boosting adoption. Moreover, the increasing popularity of energy-efficient and BPA-free materials enhances product appeal.

Europe Electric Kettle Market Insight

The Europe electric kettle market is expected to witness the fastest growth rate from 2025 to 2032, supported by a deeply rooted tea culture, rising demand for sustainable products, and growing emphasis on energy conservation. Consumers across the region are also gravitating toward aesthetically pleasing and multifunctional electric kettles for modern kitchens. The region benefits from a wide availability of premium brands and innovations in user-centric features such as rapid boil and noise reduction technologies.

U.K. Electric Kettle Market Insight

The U.K. electric kettle market is expected to witness the fastest growth rate from 2025 to 2032, due to its long-standing tea-drinking tradition and the popularity of fast-boiling, smart electric kettles. Households and hospitality sectors are increasingly replacing traditional kettles with smart, temperature-controlled versions. Compact designs and stylish finishes are also influencing purchase decisions, particularly among urban dwellers and younger consumers.

Germany Electric Kettle Market Insight

The Germany electric kettle market is expected to witness the fastest growth rate from 2025 to 2032, driven by consumer interest in energy efficiency, sustainable living, and smart kitchen technologies. Features such as cordless designs, filter systems, and automatic shutoff functions are becoming standard in the market. Germany’s focus on eco-friendly appliances and preference for high-quality materials such as stainless steel and glass also shape consumer choices.

Asia-Pacific Electric Kettle Market Insight

The Asia-Pacific electric kettle market is expected to witness the fastest growth rate from 2025 to 2032, led by increasing urbanization, rising middle-class population, and changing lifestyle patterns in countries such as China, India, and Japan. Rapid adoption of electric kitchen appliances, growing awareness about energy savings, and availability of affordable product ranges from regional manufacturers are key contributors to this growth.

Japan Electric Kettle Market Insight

The Japan electric kettle market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s affinity for advanced, compact, and multi-functional kitchen appliances. Japanese consumers prioritize safety, speed, and convenience in their daily routines, boosting demand for smart kettles with adjustable temperature controls. In addition, Japan’s minimalistic kitchen designs drive demand for aesthetically sleek and space-saving electric kettle models.

China Electric Kettle Market Insight

The China electric kettle market accounted for the largest revenue share in Asia Pacific in 2024, propelled by its large consumer base, increased tea and coffee consumption, and booming e-commerce platforms. Affordable pricing, rapid urban expansion, and domestic production capabilities enable widespread access to a variety of electric kettle models. The market is also benefiting from increasing demand for appliances with digital displays, customizable settings, and durable materials.

Electric Kettle Market Share

The Electric Kettle industry is primarily led by well-established companies, including:

- Aroma Housewares (U.S.)

- Conair Hospitality (U.S.)

- Hamilton Beach Brands, Inc. (U.S.)

- Groupe SEB (India)

- Cuisinart (U.S.)

- Breville USA (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Chef's Choice by EdgeCraft (U.S.)

- Sai Enterprises (India)

- Impex Webstore.(U.K.)

- SKYLINE HOME APPLIANCES (India)

- lordsindia (India)

- BOSS INDIA (India)

- Troop Comforts Limited (India)

- TTK Prestige Ltd. (India)

- LAZER INDIA PRIVATE LIMITED(India)

Latest Developments in Global Electric Kettle Market

- In January 2023, Hamilton launched the Beach Smart Kettle, equipped with Alexa integration for seamless functionality. This innovative kettle allows users to customize temperature settings ranging from 100° to 212° Fahrenheit while accommodating 1.7 liters of water. The incorporation of smart technology enhances user convenience and represents a noteworthy advancement in the realm of electric kettles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ELECTRIC KETTLE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ELECTRIC KETTLE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL ELECTRIC KETTLE MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICE INDEX

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 GLOBAL ELECTRIC KETTLE MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION) (MILLION UNITS) (VALUE, VOLUME AND ASP FOR EACH SEGMENT WILL BE PROVIDED)

11.1 OVERVIEW

11.2 CORDED

11.3 CORDLESS

12 GLOBAL ELECTRIC KETTLE MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 STAINLESS STEEL

12.3 PLASTIC

12.4 GLASS

12.5 CERAMIC

12.6 OTHERS

13 GLOBAL ELECTRIC KETTLE MARKET, BY CAPACITY, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 LESS THAN 1 L

13.3 1 TO 1.5 L

13.4 MORE THAN 1.5 L

14 GLOBAL ELECTRIC KETTLE MARKET, BY PRICE RANGE, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 ECONOMIC

14.3 PREMIUM

15 GLOBAL ELECTRIC KETTLE MARKET, BY END-USER, 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 RESIDENTIAL

15.2.1 RESIDENTIAL, BY END-USE

15.2.1.1. INDIVIDUAL HOUSES OR PRIVATE DWELLINGS

15.2.1.2. LODGING OR ROOMING HOUSES

15.2.1.3. DORMITORIES

15.2.1.4. APARTMENTS

15.2.1.5. OTHERS

15.2.2 RESIDENTIAL, BY PRODUCT TYPE

15.2.2.1. CORDED

15.2.2.2. CORDLESS

15.3 COMMERCIAL

15.3.1 COMMERCIAL, BY END USE

15.3.1.1. HOSPITALS

15.3.1.2. AIRPORT

15.3.1.3. RAILWAY STATION

15.3.1.4. HOTELS

15.3.1.5. RESTAURANTS

15.3.1.6. SALONS & SPAS

15.3.1.7. CORPORATE OFFICE

15.3.1.8. GUEST HOUSES

15.3.1.9. SHOPPING COMPLEX

15.3.1.10. OTHERS

15.3.2 COMMERCIAL, BY PRODUCT TYPE

15.3.2.1. CORDED

15.3.2.2. CORDLESS

15.4 INSTITUTIONAL

15.4.1 INSTITUTIONAL, BY END USE

15.4.1.1. SCHOOLS

15.4.1.2. COLLEGES

15.4.1.3. UNIVERITIES

15.4.1.4. OTHERS

15.4.2 INSTITUTIONAL, BY PRODUCT TYPE

15.4.2.1. CORDED

15.4.2.2. CORDLESS

16 GLOBAL ELECTRIC KETTLE MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 OFFLINE

16.2.1 OFFLINE, BY SALES CHANNEL

16.2.1.1. SUPERMARKETS & HYPERMARKETS

16.2.1.2. SPECIALTY STORES

16.2.1.3. CONVENIENCE STORES

16.2.1.4. OTHERS

16.3 ONLINE

16.3.1 ONLINE, BY SALES CHANNEL

16.3.1.1. COMPANY-OWNED WEBSITE

16.3.1.2. THIRD PARTY WEBSITE

17 GLOBAL ELECTRIC KETTLE MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (MILLION UNITS)

17.1 GLOBAL ELECTRIC KETTLE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.2 NORTH AMERICA

17.2.1 U.S.

17.2.2 CANADA

17.2.3 MEXICO

17.3 EUROPE

17.3.1 GERMANY

17.3.2 U.K.

17.3.3 ITALY

17.3.4 FRANCE

17.3.5 SPAIN

17.3.6 RUSSIA

17.3.7 SWITZERLAND

17.3.8 TURKEY

17.3.9 BELGIUM

17.3.10 NETHERLANDS

17.3.11 DENMARK

17.3.12 SWEDEN

17.3.13 POLAND

17.3.14 REST OF EUROPE

17.4 ASIA-PACIFIC

17.4.1 JAPAN

17.4.2 CHINA

17.4.3 SOUTH KOREA

17.4.4 INDIA

17.4.5 SINGAPORE

17.4.6 THAILAND

17.4.7 INDONESIA

17.4.8 MALAYSIA

17.4.9 PHILIPPINES

17.4.10 AUSTRALIA & NEW ZEALAND

17.4.11 VIETNAM

17.4.12 THAILAND

17.4.13 REST OF ASIA-PACIFIC

17.5 SOUTH AMERICA

17.5.1 BRAZIL

17.5.2 ARGENTINA

17.5.3 REST OF SOUTH AMERICA

17.6 MIDDLE EAST AND AFRICA

17.6.1 SOUTH AFRICA

17.6.2 EGYPT

17.6.3 SAUDI ARABIA

17.6.4 UNITED ARAB EMIRATES

17.6.5 ISRAEL

17.6.6 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL ELECTRIC KETTLE MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS AND ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

18.7 EXPANSIONS

18.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

20 GLOBAL ELECTRIC KETTLE MARKET - COMPANY PROFILES

20.1 TIGER CORPORATION

20.1.1 COMPANY SNAPSHOT

20.1.2 PRODUCT PORTFOLIO

20.1.3 REVENUE ANALYSIS

20.1.4 RECENT UPDATES

20.2 BREVILLE USA

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 REVENUE ANALYSIS

20.2.4 RECENT UPDATES

20.3 KONINKLIJKE PHILIPS N.V.

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 REVENUE ANALYSIS

20.3.4 RECENT UPDATES

20.4 HAMILTON BEACH BRANDS, INC.

20.4.1 COMPANY SNAPSHOT

20.4.2 PRODUCT PORTFOLIO

20.4.3 REVENUE ANALYSIS

20.4.4 RECENT UPDATES

20.5 CUISINART

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 REVENUE ANALYSIS

20.5.4 RECENT UPDATES

20.6 MIDEA

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 REVENUE ANALYSIS

20.6.4 RECENT UPDATES

20.7 SMEG S.P.A.

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 REVENUE ANALYSIS

20.7.4 RECENT UPDATES

20.8 PANASONIC MARKETING MIDDLE EAST & AFRICA FZE

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 REVENUE ANALYSIS

20.8.4 RECENT UPDATES

20.9 TEFAL

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 REVENUE ANALYSIS

20.9.4 RECENT UPDATES

20.1 KENWOOD LIMITED

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 REVENUE ANALYSIS

20.10.4 RECENT UPDATES

20.11 KITCHENAID

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 REVENUE ANALYSIS

20.11.4 RECENT UPDATES

20.12 SECURA

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 REVENUE ANALYSIS

20.12.4 RECENT UPDATES

20.13 AROMA HOUSEWARES

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 REVENUE ANALYSIS

20.13.4 RECENT UPDATES

20.14 ELECTROLUX

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 REVENUE ANALYSIS

20.14.4 RECENT UPDATES

20.15 GROPUE SEB

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 REVENUE ANALYSIS

20.15.4 RECENT UPDATES

20.16 MORPHY RICHARDS

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 REVENUE ANALYSIS

20.16.4 RECENT UPDATES

20.17 DE’LONGHI APPLIANCES S.R.L.

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 REVENUE ANALYSIS

20.17.4 RECENT UPDATES

20.18 KENT RO SYSTEMS LTD

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 REVENUE ANALYSIS

20.18.4 RECENT UPDATES

20.19 CHEF'S CHOICE BY EDGECRAFT

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 REVENUE ANALYSIS

20.19.4 RECENT UPDATES

20.2 EMPOWER BRANDS, INC.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 REVENUE ANALYSIS

20.20.4 RECENT UPDATES

20.21 CELLO WORLD

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 REVENUE ANALYSIS

20.21.4 RECENT UPDATES

20.22 BOROSIL LIMITED

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 REVENUE ANALYSIS

20.22.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 QUESTIONNAIRE

23 CONCLUSION

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.