Global Electric Power Steering Motors Market

Market Size in USD Billion

CAGR :

%

USD

33.91 Billion

USD

55.16 Billion

2025

2033

USD

33.91 Billion

USD

55.16 Billion

2025

2033

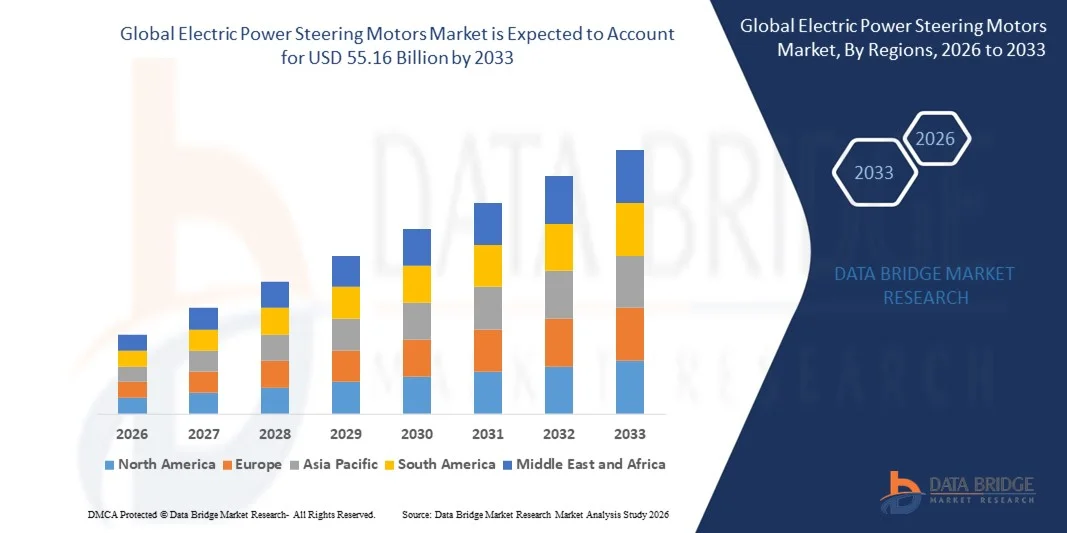

| 2026 –2033 | |

| USD 33.91 Billion | |

| USD 55.16 Billion | |

|

|

|

|

Electric Power Steering Motors Market Size

- The global electric power steering motors market size was valued at USD 33.91 billion in 2025 and is expected to reach USD 55.16 billion by 2033, at a CAGR of 6.27% during the forecast period

- The market growth is largely fuelled by the increasing adoption of electric vehicles and stringent government regulations on fuel efficiency and emissions

- Growing consumer preference for advanced driver assistance systems (ADAS) and enhanced vehicle handling is further driving demand for electric power steering motors

Electric Power Steering Motors Market Analysis

- The market is witnessing significant growth due to the rising global vehicle production and the shift from hydraulic power steering to electric power steering systems for better fuel efficiency and reduced carbon footprint

- Increasing investments by automotive OEMs in advanced steering technologies and the adoption of lightweight, energy-efficient components are boosting the demand for electric power steering motors

- North America dominated the electric power steering (EPS) motors market with the largest revenue share of 38.45% in 2025, driven by rising vehicle production, stringent fuel efficiency regulations, and increased adoption of electric and hybrid vehicles

- Asia-Pacific region is expected to witness the highest growth rate in the global electric power steering motors market, driven by urbanization, rising disposable incomes, expansion of automotive manufacturing, and government initiatives supporting electric and hybrid vehicles

- The Rack Assist Type (REPS) segment held the largest market revenue share in 2025, driven by its widespread adoption in passenger cars and light commercial vehicles due to superior steering precision, enhanced feedback, and compatibility with modern safety systems. REPS systems are preferred for their robustness, ease of integration with advanced driver assistance systems (ADAS), and contribution to improved fuel efficiency

Report Scope and Electric Power Steering Motors Market Segmentation

|

Attributes |

Electric Power Steering Motors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Electric Power Steering Motors Market Trends

Rise of Electric Power Steering Adoption in Vehicles

- The growing adoption of electric power steering (EPS) systems is transforming the automotive industry by enabling smoother and more efficient vehicle handling. EPS systems reduce driver effort, improve maneuverability, and contribute to overall fuel efficiency, driving demand across passenger cars, commercial vehicles, and light trucks

- Increasing consumer preference for vehicles with advanced safety and comfort features is accelerating the integration of EPS systems. These systems are particularly effective in urban environments and congested traffic, where precise steering and reduced fatigue enhance driving experience

- Technological advancements in EPS, such as integration with driver assistance systems and automated parking functions, are making them attractive for both new vehicle production and retrofitting in existing fleets. Manufacturers benefit from improved vehicle performance, reduced mechanical complexity, and lower maintenance costs

- For instance, in 2023, several automotive OEMs in Europe reported improved fuel efficiency and reduced steering system wear after implementing EPS across compact and mid-sized vehicles, leading to broader acceptance in commercial fleets

- While EPS systems are enhancing vehicle performance and driver convenience, their growth depends on continued innovation, cost optimization, and widespread consumer awareness. Manufacturers must focus on lightweight components, scalable designs, and integration with electric and hybrid powertrains to fully leverage market potential

Electric Power Steering Motors Market Dynamics

Driver

Growing Vehicle Production and Increasing Focus on Fuel Efficiency and Safety

- The rise in global vehicle production is boosting demand for EPS systems, as automakers seek lightweight, energy-efficient, and responsive steering solutions. EPS reduces engine load compared to hydraulic systems, improving fuel economy and meeting stricter emission standards. This trend is particularly pronounced in emerging markets where vehicle ownership is increasing rapidly, creating sustained growth opportunities for EPS manufacturers

- Automakers are increasingly aware of the performance, safety, and comfort benefits associated with EPS, such as enhanced maneuverability, integration with lane-keeping assist, and reduced steering effort. This awareness is driving widespread deployment across passenger vehicles, commercial vehicles, and electric vehicles. Furthermore, EPS contributes to reduced vehicle wear and tear, lowering long-term maintenance costs and enhancing brand loyalty

- Government regulations emphasizing fuel efficiency, emissions reduction, and vehicular safety standards are further fueling EPS adoption. Initiatives supporting electric mobility and advanced driver assistance systems create favorable conditions for EPS integration. In addition, incentives for eco-friendly vehicle technologies are encouraging OEMs to invest in high-performance, low-energy steering solutions

- For instance, in 2023, U.S. automotive regulators introduced incentives for manufacturers implementing energy-efficient steering technologies in light-duty vehicles, prompting faster adoption of EPS motors across domestic and imported vehicles. Similar regulatory frameworks in Europe and Asia are accelerating EPS integration in hybrid and fully electric vehicles

- While production growth and regulatory compliance support market expansion, continuous improvement in motor efficiency, durability, and cost-effectiveness remains essential to fully capture growth opportunities. Manufacturers are also investing in research for lightweight materials and compact designs to further enhance vehicle efficiency and steering responsiveness

Restraint/Challenge

High Component Costs and Technical Complexity in Integration

- The high cost of EPS components, including motors, sensors, and controllers, can limit adoption, especially in cost-sensitive vehicle segments and emerging markets. Upfront expenses and additional integration requirements pose challenges for small-scale manufacturers. This also impacts aftermarket adoption, where replacement parts and specialized servicing increase operational costs for fleet operators

- Many automotive service providers lack the technical expertise to maintain and repair EPS systems, leading to potential service delays and reduced system reliability. Training and infrastructure gaps in remote or underdeveloped regions further restrict effective utilization. The need for specialized diagnostic tools and software increases dependency on OEM-authorized workshops, creating additional barriers for smaller service centers

- Compatibility challenges with advanced vehicle architectures, such as electric and hybrid drivetrains, can increase engineering complexity and development time. Manufacturers must continuously optimize system design for different vehicle types and driving conditions. Ensuring seamless integration with driver assistance and autonomous driving features adds another layer of technical requirement

- For instance, in 2024, surveys across Southeast Asia revealed that over 60% of small and mid-sized workshops faced difficulties in servicing EPS-equipped vehicles due to limited specialized tools and trained technicians. This scenario highlights the critical need for regional training programs and technical support to improve system reliability and reduce downtime

- While EPS technologies continue to advance, addressing cost, technical complexity, and maintenance barriers is crucial. Industry stakeholders must focus on robust, modular designs, scalable production techniques, and comprehensive training programs to unlock long-term market potential. In addition, partnerships with local suppliers and service providers can improve availability and reduce total lifecycle costs of EPS systems

Electric Power Steering Motors Market Scope

The market is segmented on the basis of type, component, motor type, and vehicle type.

- By Type

On the basis of type, the electric power steering (EPS) motors market is segmented into Rack Assist Type (REPS), Column Assist Type (CEPS), and Pinion Assist Type (PEPS). The Rack Assist Type (REPS) segment held the largest market revenue share in 2025, driven by its widespread adoption in passenger cars and light commercial vehicles due to superior steering precision, enhanced feedback, and compatibility with modern safety systems. REPS systems are preferred for their robustness, ease of integration with advanced driver assistance systems (ADAS), and contribution to improved fuel efficiency.

The Column Assist Type (CEPS) segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its compact design, suitability for electric vehicles, and cost-effectiveness. CEPS systems are increasingly adopted in small to mid-sized vehicles, offering efficient steering control with reduced energy consumption and simplified installation in constrained cabin layouts.

- By Component

On the basis of component, the EPS motors market is segmented into Steering Wheel, Steering Column, Sensors, Steering Gear, Mechanical Rack and Pinion, Electronic Control Unit (ECU), Electric Motor, and Bearings. The Electric Motor segment held the largest market revenue share in 2025, owing to its central role in providing precise torque assistance, low energy consumption, and smooth steering experience. Advanced electric motors enhance reliability, reduce mechanical wear, and enable integration with automated driving features.

The Sensors segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for accurate torque and position detection to support safety and driver assistance functions. Sensors play a critical role in EPS systems, enabling real-time feedback, adaptive steering, and improved vehicle handling.

- By Motor Type

On the basis of motor type, the market is segmented into Brush Motor and Brushless Motor. The Brushless Motor segment held the largest market revenue share in 2025 due to its higher efficiency, longer lifespan, and low maintenance requirements. Brushless motors are favored in modern vehicles for their ability to provide consistent steering assistance, reduced energy consumption, and compatibility with electric and hybrid vehicle architectures.

The Brush Motor segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its cost-effectiveness, simplicity, and suitability for entry-level vehicles. Brush motors remain widely used in regions with cost-sensitive automotive markets and are continuously being optimized for enhanced durability and performance.

- By Vehicle Type

On the basis of vehicle type, the EPS motors market is segmented into Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. The Passenger Cars segment held the largest market revenue share in 2025, driven by the high adoption of EPS systems for improved steering comfort, fuel efficiency, and safety features. Increasing consumer preference for electric and hybrid passenger vehicles is further propelling EPS integration.

The Light Commercial Vehicle segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for commercial mobility solutions, delivery vehicles, and small transport fleets requiring precise and energy-efficient steering systems. EPS adoption in these vehicles also supports regulatory compliance for emissions and safety standards.

Electric Power Steering Motors Market Regional Analysis

- North America dominated the electric power steering (EPS) motors market with the largest revenue share of 38.45% in 2025, driven by rising vehicle production, stringent fuel efficiency regulations, and increased adoption of electric and hybrid vehicles

- Consumers and automakers in the region are increasingly prioritizing energy-efficient and responsive steering systems, as EPS motors reduce engine load compared to hydraulic systems and enhance driving comfort and safety

- This widespread adoption is further supported by strong automotive R&D infrastructure, high disposable incomes, and growing integration of advanced driver assistance systems (ADAS), establishing EPS motors as a standard solution across passenger and commercial vehicles

U.S. Electric Power Steering Motors Market Insight

The U.S. EPS motors market captured the largest revenue share in 2025 within North America, fueled by rapid electrification of vehicles and the adoption of energy-efficient steering technologies. OEMs are increasingly integrating EPS systems into passenger vehicles and light commercial vehicles to meet fuel economy targets and comply with regulatory standards. The growing focus on autonomous and semi-autonomous driving solutions, combined with demand for smoother steering and reduced mechanical complexity, is further propelling EPS adoption across U.S. automotive manufacturers.

Europe Electric Power Steering Motors Market Insight

The Europe EPS motors market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strict emission norms, safety regulations, and the rising penetration of electric and hybrid vehicles. European consumers are favoring lightweight, fuel-efficient vehicles with improved steering precision. The region is experiencing significant growth across passenger cars, light commercial vehicles, and electric vehicles, with EPS motors increasingly integrated into both new models and retrofitting projects.

U.K. Electric Power Steering Motors Market Insight

The U.K. EPS motors market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising vehicle electrification, stringent emission standards, and growing awareness of fuel efficiency. Automotive manufacturers are adopting EPS motors to enhance steering performance and reduce vehicle energy consumption. The UK’s robust automotive supply chain, along with increasing consumer demand for vehicles equipped with advanced steering technologies, is expected to sustain market growth.

Germany Electric Power Steering Motors Market Insight

The Germany EPS motors market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing production of electric vehicles, government incentives for energy-efficient technologies, and high consumer demand for advanced automotive safety features. Germany’s strong automotive engineering ecosystem and emphasis on innovation support widespread EPS adoption. Integration with ADAS and automated driving technologies is also driving EPS implementation in passenger and commercial vehicles.

Asia-Pacific Electric Power Steering Motors Market Insight

The Asia-Pacific EPS motors market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid vehicle production, rising disposable incomes, and increasing penetration of electric and hybrid vehicles in countries such as China, Japan, and India. The region’s automotive market is supported by government policies promoting energy-efficient and emission-compliant technologies. Furthermore, local manufacturing of EPS components is enhancing affordability and accessibility, enabling broader adoption across passenger, commercial, and electric vehicles.

Japan Electric Power Steering Motors Market Insight

The Japan EPS motors market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s focus on vehicle electrification, compact and efficient steering technologies, and high consumer demand for safety and comfort. Japanese automotive manufacturers are integrating EPS systems into passenger and light commercial vehicles to meet fuel economy and emission regulations. In addition, the growth of connected and automated vehicles is further driving EPS adoption in the Japanese market.

China Electric Power Steering Motors Market Insight

The China EPS motors market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s high vehicle production, expanding middle-class population, and growing adoption of electric and hybrid vehicles. China is one of the largest automotive markets globally, with increasing government support for fuel-efficient and emission-compliant technologies. The widespread manufacturing of EPS components locally, along with competitive pricing, is enabling significant market penetration across passenger cars, commercial vehicles, and electric vehicles.

Electric Power Steering Motors Market Share

The Electric Power Steering Motors industry is primarily led by well-established companies, including:

- JTEKT Corporation (Japan)

- Nexteer Automotive (U.S.)

- ZF Friedrichshafen AG (Germany)

- Robert Bosch GmbH (Germany)

- Melrose Industries PLC (U.K.)

- Tenneco Inc. (U.S.)

- NSK Ltd (Japan)

- HYUNDAI MOBIS (South Korea)

- thyssenkrupp AG (Germany)

- SHOWA CORPORATION (Japan)

- DENSO CORPORATION (Japan)

- BorgWarner Inc. (U.S.)

- ZF Steering Gear (India) Limited (India)

- Renesas Electronics Corporation (Japan)

- Infineon Technologies AG (Germany)

- Mando Corp (South Korea)

- Rane Holdings Limited (India)

- NIDEC CORPORATION (Japan)

- Mitsubishi Electric Corporation (Japan)

- Johnson Electric Holdings Limited (Hong Kong)

Latest Developments in Global Electric Power Steering Motors Market

- In March 2024, BRP Inc. completed the acquisition of Kongsberg Automotive’s Shawinigan business in Canada. The acquisition, valued at GBP 104 million ($110 million), includes a facility specializing in the manufacturing of sensors, actuators, electric power steering systems, electrical wiring, and instrument panel assemblies for sports and recreational vehicles. This strategic move enables BRP to expand its production capabilities, enhance its technology portfolio, and strengthen its position in the global recreational vehicle market. The integration of Shawinigan’s operations is expected to improve supply chain efficiency, support innovation in vehicle components, and drive market growth by offering advanced, high-quality systems to meet increasing consumer demand

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.