Global Electric Scooter Market

Market Size in USD Billion

CAGR :

%

USD

1.99 Billion

USD

3.00 Billion

2024

2032

USD

1.99 Billion

USD

3.00 Billion

2024

2032

| 2025 –2032 | |

| USD 1.99 Billion | |

| USD 3.00 Billion | |

|

|

|

|

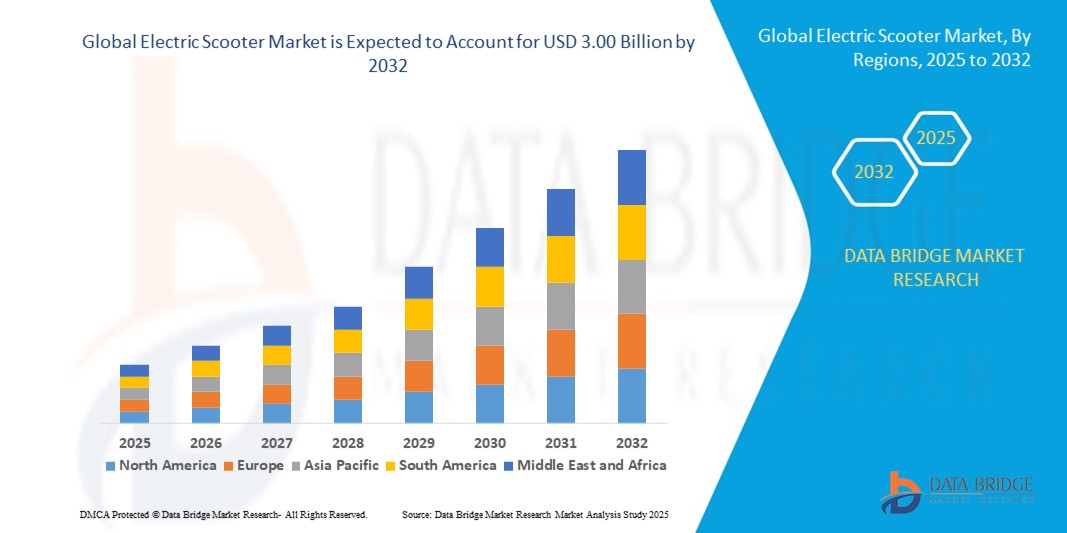

What is the Global Electric Scooter Market Size and Growth Rate?

- The global electric scooter market size was valued at USD 1.99 billion in 2024 and is expected to reach USD 3.00 billion by 2032, at a CAGR of 5.30% during the forecast period

- The most important part of any electric two-wheeler is its battery. The performance, efficiency, and price of electric two-wheelers are dependent on the battery installed. Till 2020, most electric scooters and motorcycles were offered with lead-acid batteries

- However, two-wheeler manufacturers are now focused on the development and installation of more advanced li-ion batteries in new electric scooters and motorcycles to overcome the disadvantages of lead-acid batteries. The economic growth and a rapidly growing population in India have made it imperative for the country to enhance its commuting media

What are the Major Takeaways of Electric Scooter Market?

- Battery swapping is a new technology that allows owner of electric vehicle to swap out their dying or dead batteries with fully charged one. This development could completely transform the E2W market and improve the comfort and ease of long-distance driving for motorists. Automatic and manual battery switching are the two main methods that are used in battery swapping

- Furthermore, because battery-swapping stations are far less expensive to construct than conventional gas stations, they are more accessible to communities that might not otherwise have access to fuelling choices. This may have a significant impact, especially in rural areas and underdeveloped nations where EV use is growing. In addition to this, Government is making policies and investment for development of battery snapping station. This is a major driver for the market

- Asia-Pacific dominated the electric scooter market with the largest revenue share of 41% in 2024, fueled by rising urbanization, increasing disposable incomes, and strong government support for sustainable mobility

- Europe electric scooter market is expected to grow at the fastest CAGR of 6.1% during 2025–2032, primarily driven by stringent emission regulations, rising fuel costs, and government incentives for EV adoption

- The E-Scooters/Mopeds segment dominated the market with the largest revenue share of 64.3% in 2024, primarily driven by their affordability, compact design, and suitability for short-distance urban commutes

Report Scope and Electric Scooter Market Segmentation

|

Attributes |

Electric Scooter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electric Scooter Market?

Enhanced User Experience Through AI, IoT, and Voice Integration

- A notable trend shaping the global electric scooter market is the integration of artificial intelligence (AI), Internet of Things (IoT), and voice assistants such as Google Assistant, Amazon Alexa, and Siri. This is transforming scooters into smarter, more connected mobility solutions

- For instance, NIU International has introduced scooters with IoT-enabled dashboards that connect with smartphones and allow riders to use voice commands for navigation and scooter diagnostics. Similarly, Hero Electric in India is testing AI-driven fleet management features for shared mobility operators

- AI and IoT integration enable features such as predictive maintenance alerts, intelligent battery management, and ride pattern analysis for optimized performance. Voice assistants enhance convenience by providing hands-free navigation, vehicle status updates, and theft alerts

- The seamless connectivity of scooters with broader smart ecosystems allows users to link their scooters with mobile apps and cloud platforms, offering centralized control over riding data, charging schedules, and even integration with smart city infrastructure

- Companies such as Yadea Technology Group are developing AI-based scooters that adapt to rider behavior, provide voice-enabled controls, and offer real-time route optimization

- This trend toward intelligent, connected, and user-friendly scooters is reshaping consumer expectations, driving demand across both urban commuting and shared mobility sectors

What are the Key Drivers of Electric Scooter Market?

- Rising demand for sustainable and eco-friendly mobility solutions, coupled with government incentives for electric vehicle adoption, is a major driver of the electric scooter market

- For instance, in March 2024, Okinawa Autotech (India) announced a partnership with battery-swapping infrastructure providers to accelerate adoption by reducing range anxiety and charging delays. Such initiatives are expected to drive market expansion

- Growing urbanization and rising fuel costs are prompting consumers to shift from traditional two-wheelers to electric scooters, which offer lower operating costs, reduced emissions, and advanced features such as GPS tracking and smartphone integration

- Increasing popularity of shared e-mobility services, supported by investments in charging infrastructure, is further boosting the adoption of electric scooters, particularly in densely populated urban regions

- Key factors such as government subsidies, consumer preference for cost-efficient daily commuting, and expanding availability of models with higher range and performance are propelling market growth worldwide

Which Factor is Challenging the Growth of the Electric Scooter Market?

- Battery-related concerns, including limited range, charging time, and safety risks, remain significant challenges for the electric scooter market. Dependence on lithium-ion batteries exposes scooters to overheating issues, degradation, and high replacement costs

- For instance, multiple fire incidents reported in India during 2022–2023 raised safety concerns, making some consumers hesitant to adopt electric scooters despite government subsidies

- Addressing these challenges requires advancements in solid-state batteries, thermal management systems, and fast-charging technologies. Companies such as Gogoro (Taiwan) emphasize battery-swapping stations as an alternative to overcome charging barriers

- In addition, high upfront purchase costs compared to conventional two-wheelers remain a barrier for price-sensitive markets. Although operating costs are lower, the initial investment limits adoption in developing regions

- Overcoming these hurdles through technological innovation, improved safety standards, and affordable financing options will be crucial for sustained market penetration and consumer trust in the sector

How is the Electric Scooter Market Segmented?

The market is segmented on the basis of vehicle, battery, voltage, usage, and form.

- By Vehicle

On the basis of vehicle type, the electric scooter market is segmented into E-Scooters/Mopeds and E-Motorcycles. The E-Scooters/Mopeds segment dominated the market with the largest revenue share of 64.3% in 2024, primarily driven by their affordability, compact design, and suitability for short-distance urban commutes. These vehicles are particularly popular among young commuters and delivery services due to their low operating cost and ease of maneuverability in congested city environments. Government subsidies and city-wide electrification initiatives further fuel their adoption.

The E-Motorcycles segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by increasing consumer interest in high-performance electric two-wheelers, longer range capability, and advanced battery technologies. Manufacturers are introducing premium models with better acceleration and smart connectivity features, targeting eco-conscious consumers seeking performance comparable to conventional motorcycles.

- By Battery

On the basis of battery type, the Electric Scooter market is segmented into Lead Acid and Li-ion. The Li-ion battery segment accounted for the largest market share of 72.1% in 2024, owing to its higher energy density, faster charging time, and longer lifecycle compared to lead acid batteries. Lightweight design and compatibility with modern electric scooters make Li-ion batteries the preferred choice among manufacturers and consumers. Growing R&D investments and declining battery costs are further strengthening this dominance.

Lead Acid segment is expected to witness the fastest CAGR from 2025 to 2032, due to its lower upfront cost and availability. However, stricter environmental regulations and consumer demand for longer-lasting performance are pushing a gradual transition toward Li-ion adoption. This trend indicates Li-ion’s long-term supremacy, while lead acid remains an option for entry-level models in emerging economies.

- By Voltage

On the basis of voltage, the electric scooter market is segmented into 36V, 48V, 60V, 72V, and Above 72V. The 48V segment held the largest market revenue share of 38.6% in 2024, driven by its optimal balance between performance, efficiency, and affordability. These scooters provide sufficient speed and range for everyday urban commuting, making them highly popular in both developed and developing economies

The 60V and 72V segments are expected to experience rapid growth, particularly due to rising demand for high-speed and long-range electric motorcycles. Above 72V scooters, although niche, are gaining attention in the premium performance category with advanced models entering the market. 36V scooters continue to serve entry-level users with lower speed requirements but are gradually losing ground due to limited performance. The ongoing shift toward higher-voltage models highlights consumer preference for enhanced range and efficiency in electric mobility solutions.

- By Technology Usage

On the basis of technology usage, the electric scooter market is segmented into Private and Commercial. The Private segment dominated the market with a share of 69.4% in 2024, fueled by the growing popularity of electric scooters among individual consumers for urban mobility, affordability, and eco-friendliness. Rising fuel costs and urban congestion have made private electric scooters a mainstream commuting solution, particularly among students and young professionals. Government subsidies and tax incentives for personal EV adoption further strengthen this dominance.

The Commercial segment is expected to witness the fastest CAGR from 2025 to 2032, as logistics companies, food delivery platforms, and ride-sharing services increasingly deploy electric two-wheelers to cut operational costs and meet sustainability goals. Shared e-scooter programs in cities worldwide are also boosting commercial adoption, reflecting a growing trend of businesses embracing electric mobility for last-mile connectivity.

- By Form

On the basis of form, the electric scooter market is segmented into Foldable and Unfoldable types. The Unfoldable segment captured the largest revenue share of 76.2% in 2024, primarily due to their robust build, higher performance, and better suitability for daily commuting. These scooters generally offer larger battery capacity, stronger frames, and greater stability, making them the preferred choice for long-term and frequent users.

The Foldable segment is anticipated to record the fastest growth from 2025 to 2032, supported by rising urbanization, space constraints, and the demand for portable mobility solutions. Foldable electric scooters appeal to office commuters and city residents who need lightweight, easily storable vehicles for “last-mile” travel. Their increasing adoption in shared mobility fleets and integration with public transport systems are further boosting their market penetration. This indicates that while unfoldable scooters currently dominate, foldable scooters are quickly gaining ground in urban landscapes.

Which Region Holds the Largest Share of the Electric Scooter Market?

- Asia-Pacific dominated the electric scooter market with the largest revenue share of 41% in 2024, fueled by rising urbanization, increasing disposable incomes, and strong government support for sustainable mobility

- The region benefits from the presence of leading manufacturers, rapid adoption of electric mobility solutions, and cost-effective product availability, making electric scooters highly accessible to the mass population

- In addition, the growing focus on reducing carbon emissions and the integration of IoT-enabled smart scooters further strengthen market growth across both residential and commercial mobility applications

China Electric Scooter Market Insight

The China electric scooter market captured the largest share within Asia-Pacific in 2024, driven by rapid urbanization, strong government subsidies for EV adoption, and robust domestic production. Affordable models from local players, coupled with increasing adoption of shared e-scooter platforms in urban areas, continue to propel market growth. Moreover, the nation’s push toward smart cities and sustainable transportation ensures a steady rise in demand.

India Electric Scooter Market Insight

The India electric scooter market is projected to expand significantly, supported by government initiatives such as FAME II subsidies and rising fuel prices encouraging consumers to shift toward electric mobility. Increasing investments in charging infrastructure, coupled with strong demand from Tier-1 and Tier-2 cities, are accelerating adoption. The entry of start-ups and global brands further intensifies competition in the Indian market.

Japan Electric Scooter Market Insight

The Japan electric scooter market is witnessing strong growth due to its high-tech environment, emphasis on eco-friendly solutions, and preference for compact urban mobility. Consumers are increasingly adopting connected e-scooters with IoT features, while the country’s aging population is fueling demand for convenient, easy-to-use transport options. The integration of e-scooters into smart city initiatives further contributes to market expansion.

Which Region is the Fastest Growing Region in the Electric Scooter Market?

Europe electric scooter market is expected to grow at the fastest CAGR of 6.1% during 2025–2032, primarily driven by stringent emission regulations, rising fuel costs, and government incentives for EV adoption. The region’s rapid urbanization, focus on sustainable mobility, and growing investments in charging infrastructure are fostering accelerated demand for e-scooters.

Germany Electric Scooter Market Insight

Germany electric scooter market is expanding steadily, supported by the government’s strong EV policies, rising consumer awareness of sustainability, and integration of e-scooters into public transport systems. Germany’s innovation-driven ecosystem and preference for eco-conscious solutions are propelling adoption.

U.K. Electric Scooter Market Insight

The U.K. electric scooter market is witnessing increasing adoption, fueled by regulatory approvals for e-scooter trials and the growing trend of shared mobility. Rising environmental concerns, combined with a strong retail and e-commerce infrastructure, are supporting faster consumer uptake.

France Electric Scooter Market Insight

The France electric scooter market is experiencing notable growth, driven by its emphasis on reducing vehicular emissions and the popularity of micro-mobility solutions in urban centers. Government-backed subsidies and the integration of e-scooters into last-mile connectivity strategies are further boosting demand.

Which are the Top Companies in Electric Scooter Market?

The electric scooter industry is primarily led by well-established companies, including:

- Yadea Technology Group Co., Ltd. (China)

- Jiangsu Xinri E-Vehicle Co., Ltd. (China)

- NIU International (China)

- Hero Electric (India)

- Okinawa Autotech International Private Limited (India)

- AllCell Technologies LLC (U.S.)

- BMW Motorrad International (Germany)

- BOXX Corp. (U.S.)

- Gogoro, Inc. (Taiwan)

- Green Energy Motors Corp. (U.S.)

- Greenwit Technologies Inc. (U.S.)

- Honda Motor Co. Ltd. (Japan)

- KTM AG (Austria)

- Mahindra GenZe (India)

What are the Recent Developments in Global Electric Scooter Market?

- In January 2024, Riley Scooter, a Cambridge-based company, announced plans to introduce the RS3 Electric Scooter, a fully foldable e-scooter, in the U.S. at the Consumer Electronics Show in Las Vegas. This move highlights the brand’s focus on expanding its footprint in international markets

- In December 2023, Gogoro, a Taiwanese company, launched the Gogoro CrossOver GX250, a domestically produced electric scooter in India, tailored to local riders. This initiative reflects the company’s strategy to strengthen its presence in the rapidly growing Indian electric scooter market

- In September 2023, Bird, a leading player in the electric micro-mobility industry, acquired Spin, an e-scooter and e-bike rental company, for USD 19 million. This acquisition underscores Bird’s commitment to consolidating its market position and reducing competitive pressure

- In January 2023, Yadea Group (China) unveiled the Yadea Keeness VFD at the Consumer Electronics Show in Las Vegas, featuring a 10KW high-performance motor, a top speed of 100 km/h, and 0–50 km/h acceleration in just 4 seconds. This launch reinforced Yadea’s position as a global innovator in high-performance electric scooters

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electric Scooter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electric Scooter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electric Scooter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.