Global Electric Trucks Market

Market Size in USD Billion

CAGR :

%

USD

39.01 Billion

USD

235.69 Billion

2024

2032

USD

39.01 Billion

USD

235.69 Billion

2024

2032

| 2025 –2032 | |

| USD 39.01 Billion | |

| USD 235.69 Billion | |

|

|

|

|

Electric Truck Market Size

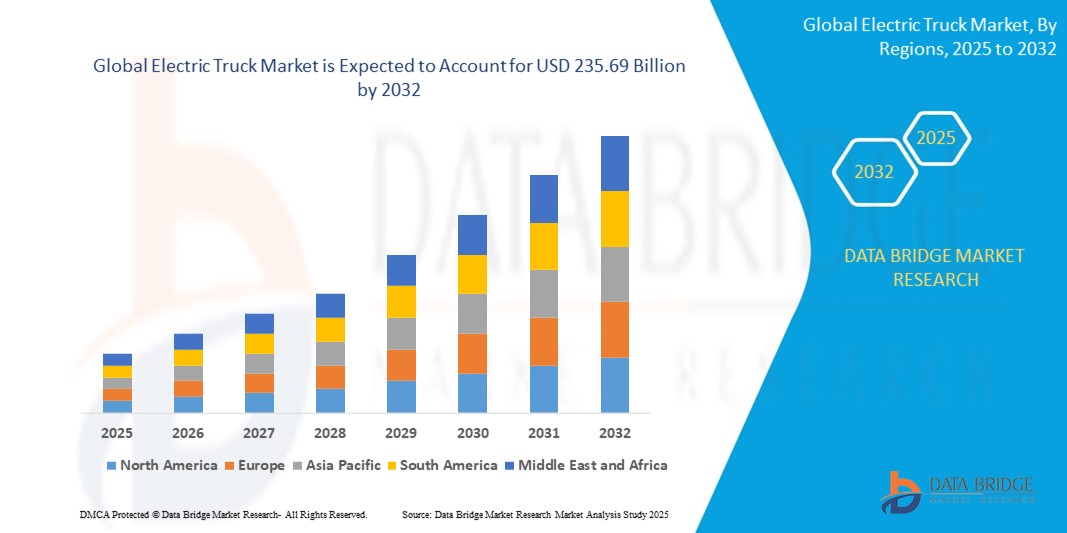

- The global electric truck market size was valued at USD 39.01 billion in 2024 and is expected to reach USD 235.69 billion by 2032, at a CAGR of 25.21% during the forecast period

- The market growth is primarily driven by increasing adoption of electric vehicles, advancements in battery technology, and supportive government policies promoting sustainable transportation

- Rising demand for eco-friendly logistics solutions and cost savings on fuel and maintenance are further accelerating the adoption of electric trucks across various industries

Electric Truck Market Analysis

- Electric trucks, powered by electric batteries or fuel cells, are becoming critical components of modern transportation systems due to their zero-emission capabilities, reduced operating costs, and integration with smart logistics platforms

- The surge in demand for electric trucks is fueled by growing environmental concerns, stricter emission regulations, and the expansion of e-commerce requiring efficient last-mile delivery solutions

- North America dominated the electric truck market with the largest revenue share of 38.1% in 2024, driven by early adoption of electric vehicle technologies, substantial government incentives, and the presence of leading manufacturers

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, increasing investments in electric vehicle infrastructure, and rising demand for sustainable transportation solutions in countries such as China and India

- The Light Electric Trucks segment dominated the largest market revenue share of 64.0% in 2024, driven by their widespread adoption in urban delivery and logistics applications

Report Scope and Electric Truck Market Segmentation

|

Attributes |

Electric Truck Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Electric Truck Market Trends

Increasing Integration of Advanced Battery Technologies and Autonomous Systems

- The global electric truck market is experiencing a significant trend toward integrating advanced battery technologies, such as lithium-iron-phosphate (LFP) and solid-state batteries, alongside autonomous driving systems

- These technologies enable improved energy efficiency, extended driving ranges, and enhanced safety features, providing deeper insights into vehicle performance and operational efficiency

- Advanced battery systems allow for faster charging and longer ranges, making electric trucks more viable for long-haul transportation and heavy-duty applications

- For instance, companies such as Volvo and Daimler are developing electric trucks with autonomous features, such as advanced driver-assistance systems (ADAS), to optimize routes and reduce driver fatigue, while Tesla’s Semi incorporates semi-autonomous capabilities for improved logistics

- This trend enhances the appeal of electric trucks for fleet operators, particularly in last-mile delivery and distribution services, by reducing operational costs and improving sustainability.

- Autonomous systems analyze real-time data on traffic, payload, and battery status, enabling predictive maintenance and optimized fleet management

Electric Truck Market Dynamics

Driver

Rising Demand for Sustainable Transportation and Stringent Emission Regulations

- The increasing global emphasis on sustainability and reducing carbon emissions is a major driver for the electric truck market, with demand growing across applications such as last-mile delivery, long-haul transportation, refuse services, field services, and distribution services

- Electric trucks offer zero tailpipe emissions, aligning with government mandates, such as the U.S. EPA’s requirement for 60% of new urban delivery trucks to be electric by 2032 and the EU’s target to cut CO2 emissions from heavy-duty vehicles by 45% by 2030

- The proliferation of charging infrastructure, supported by government incentives and private investments, is enabling broader adoption of electric trucks, particularly in North America, the dominating region

- The development of 5G and IoT technologies facilitates real-time data transmission, enhancing telematics applications for fleet monitoring, route optimization, and remote diagnostics

- Major automakers, such as BYD, AB Volvo, and Daimler, are increasingly offering electric truck models, including light, medium, and heavy-duty variants, to meet diverse end-use demands and comply with environmental regulations

Restraint/Challenge

High Initial Costs and Infrastructure Limitations

- The high upfront costs of electric trucks, including advanced battery systems and specialized hardware, remain a significant barrier to adoption, particularly for small and medium-sized enterprises in emerging markets

- Integrating electric trucks into existing fleets requires costly upgrades, such as retrofitting charging stations and adapting maintenance facilities, which can be complex and resource-intensive

- In addition, the limited availability of charging infrastructure, especially for long-haul transportation, poses a challenge, particularly in regions with underdeveloped networks

- Data security and privacy concerns related to telematics and autonomous systems, which collect sensitive vehicle and operational data, raise issues about potential breaches and compliance with varying regional regulations, such as GDPR in Europe

- These factors can deter adoption, particularly in cost-sensitive markets or regions with stringent data privacy regulations, potentially slowing market growth despite the rapid expansion in Asia-Pacific, the fastest-growing region

Electric Truck market Scope

The market is segmented on the basis of Product Type and End Use.

- By Product Type

On the basis of product type, the global electric truck market is segmented into light electric trucks, medium-sized electric trucks, and heavy electric trucks. In 2023, the light electric trucks segment held the largest market revenue share of approximately 45%, driven by their widespread use in urban deliveries and last-mile logistics due to their maneuverability, zero emissions, and lower operating costs. This segment benefits from the rapid growth of e-commerce and urban infrastructure development.

The medium-sized electric trucks segment is expected to witness the fastest growth rate, with a CAGR of around 39% from 2025 to 2032. This growth is fueled by increasing adoption in urban logistics, municipal applications, and commercial sectors requiring robust capabilities for regional distribution.

- By Propulsion Outlook

On the basis of propulsion outlook, the global electric truck market is segmented into Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs). In 2024, BEVs dominated with a market share of approximately 73%, driven by advancements in battery technology, declining costs, and supportive government policies promoting zero-emission vehicles, particularly in China and Europe.

The PHEV segment is anticipated to grow at a CAGR of 21.6% from 2025 to 2032, owing to its versatility in combining electric power for short-range urban deliveries with gasoline or diesel for longer distances, making it suitable for regions with limited charging infrastructure.

- By Vehicle Range Outlook

On the basis of vehicle range outlook, the global electric truck market is segmented into up to 300 miles, 300-600 miles, and above 600 miles. The 300-600 miles range segment held the largest market share of 41.5% in 2024, driven by its optimal balance of range, cost, and operational efficiency, making it ideal for regional and long-haul freight transportation.

The above 600 miles segment is expected to register the fastest CAGR of 16.2% from 2025 to 2032, fueled by increasing demand for long-haul trucking solutions and advancements in battery technology that reduce costs and improve charging infrastructure, addressing range anxiety for fleet operators.

- By Application Outlook

On the basis of application outlook, the global electric truck market is segmented into logistics & delivery, construction, waste management, and others. The logistics & delivery segment held the largest market share of 55.6% in 2024, driven by the rising demand for eco-friendly and cost-effective transport solutions in the logistics industry, particularly for last-mile deliveries amid the e-commerce boom.

The waste management segment is anticipated to grow at the fastest CAGR of 19.2% from 2025 to 2032, driven by the increasing adoption of electric trucks in urban areas to minimize environmental impact and comply with stringent emission regulations.

- By End Use

On the basis of end use, the global electric truck market is segmented into last mile delivery, long haul transportation, refuse services, field services, and distribution services. The last mile delivery segment dominated with a market share of approximately 40% in 2024, driven by the growing need for sustainable urban delivery solutions and the ability of electric trucks to operate quietly and efficiently in noise-sensitive and congested areas.

The long haul transportation segment is expected to witness rapid growth with a CAGR of approximately 20% from 2025 to 2032, fueled by advancements in battery technology, expanding charging infrastructure, and increasing demand for sustainable freight solutions to meet decarbonization goals.

Electric Truck Market Regional Analysis

- North America dominated the electric truck market with the largest revenue share of 38.1% in 2024, driven by early adoption of electric vehicle technologies, substantial government incentives, and the presence of leading manufacturers

- Consumers prioritize electric trucks for their low operating costs, zero emissions, and enhanced performance, particularly in regions with strong government incentives and environmental consciousness

- Growth is supported by advancements in battery technology, such as lithium-iron-phosphate and nickel-manganese-cobalt batteries, alongside rising adoption in both OEM and aftermarket segments

U.S. Electric Truck Market Insight

The U.S. smart lock market captured the largest revenue share of 81.9% in 2024 within North America, fueled by strong aftermarket demand and growing consumer awareness of environmental benefits and cost savings. The trend towards fleet electrification and supportive regulatory incentives, such as California’s Advanced Clean Trucks (ACT) mandate, further boost market expansion. Automakers’ increasing integration of electric trucks in logistics and delivery complements aftermarket sales, creating a diverse product ecosystem.

Europe Electric Truck Market Insight

The Europe electric truck market is expected to witness significant growth, supported by stringent CO2 emissions standards and a focus on sustainable transportation. Consumers seek electric trucks that offer zero emissions and operational efficiency while meeting urban and long-haul needs. The growth is prominent in both new vehicle integrations and retrofit projects, with countries such as Germany and France showing significant uptake due to environmental policies and urban logistics demands.

U.K. Electric Truck Market Insight

The U.K. market for electric trucks is expected to witness rapid growth, driven by demand for zero-emission vehicles in urban and suburban logistics. Increased interest in sustainability and rising awareness of cost savings through lower fuel and maintenance costs encourage adoption. Evolving regulations, such as the U.K.’s push for net-zero freight transport, influence consumer choices, balancing performance with compliance.

Germany Electric Truck Market Insight

Germany is expected to witness rapid growth in the electric truck market, attributed to its advanced automotive manufacturing sector and high consumer focus on sustainability and energy efficiency. German consumers prefer technologically advanced electric trucks that reduce carbon emissions and contribute to lower operational costs. The integration of these trucks in premium fleets and aftermarket options supports sustained market growth.

Asia-Pacific Electric Truck Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding automotive production and rising demand for eco-friendly transportation in countries such as China, India, and Japan. Increasing awareness of emissions reduction, cost-effectiveness, and vehicle performance is boosting demand. Government initiatives, such as China’s New Energy Vehicle (NEV) mandate and India’s FAME scheme, further encourage the use of advanced electric trucks.

Japan Electric Truck Market Insight

Japan’s electric truck market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced electric trucks that enhance operational efficiency and sustainability. The presence of major automotive manufacturers and integration of electric trucks in OEM vehicles accelerate market penetration. Rising interest in aftermarket electrification also contributes to growth.

China Electric Truck Market Insight

China holds the largest share of the Asia-Pacific electric truck market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for sustainable transportation solutions. The country’s growing middle class and focus on smart mobility support the adoption of advanced electric trucks. Strong domestic manufacturing capabilities, led by companies such as BYD and Dongfeng, and competitive pricing enhance market accessibility.

Electric Truck Market Share

The electric truck industry is primarily led by well-established companies, including:

- Tesla (U.S.)

- Rivian (U.S.)

- BYD (China)

- Daimler Truck (Germany)

- Volvo Trucks (Sweden)

- Nikola Corporation (U.S.)

- Workhorse Group (U.S.)

- Xos Trucks (U.S.)

- Scania (Sweden)

- MAN Truck & Bus (Germany)

- Dongfeng Motor (China)

- Hino Motors (Japan)

- Isuzu Motors (Japan)

- PACCAR (U.S.)

- Navistar (U.S.)

What are the Recent Developments in Global Electric Truck Market?

- In July 2025, Isuzu Motors and the Volvo Group expanded their long-term strategic alliance to jointly develop a unified platform for medium heavy-duty trucks, targeting Japan and broader Asian markets. Building on their original 2020 partnership, the new agreement spans at least 20 years and includes Volvo’s continued supply of key components, especially powertrains, along with comprehensive technical support in development and quality assurance. The collaboration aims to enhance industrial efficiency, strengthen customer support systems, and deliver sustainable, high-performance commercial vehicles tailored to regional logistics needs

- In May 2025, Swedish truck manufacturer Scania revealed plans to invest USD 2 billion in a new production plant in Rugao, China, marking its third global manufacturing site. Scheduled to begin operations in October 2025, the facility will boast an annual capacity of 50,000 vehicles. This strategic expansion aims to strengthen Scania’s presence in Asia, reduce delivery times, and tap into local next-generation technologies such as zero-emission drivetrains and smart connectivity. The Rugao plant is designed to be carbon-neutral, powered by biogas and renewable energy, aligning with Scania’s sustainability goals

- In January 2025, Aramex, a global logistics leader, launched its first commercial fleet of electric trucks in the UAE, marking a major step toward sustainable transport. Partnering with Admiral Mobility, the initiative features eight-ton Farizon electric trucks powered by 162kWh batteries, certified for operations in both the UAE and Saudi Arabia. Designed to serve the oil and gas sector, the deployment supports Aramex’s goal of achieving carbon neutrality by 2030 and net-zero emissions by 2050. This move complements broader efforts including e-bikes, electric vans, and renewable energy investments

- In June 2024, Scania introduced Erinion, a dedicated charging solutions company focused on private and semi-public EV charging. Erinion aims to install 40,000 charging points at customer sites across Europe by 2030, supporting Scania’s goal of electrifying 50% of its European sales. The company will offer depot and destination charging, tailored to fleet operations, with benefits such as predictable energy costs, enhanced uptime, and modular service models. Erinion’s brand-agnostic approach ensures compatibility across vehicle types, reinforcing Scania’s commitment to sustainable transport and e-mobility leadership

- In May 2024, BYD introduced its first-ever pickup truck, the BYD SHARK, during a global launch in Mexico. Contrary to initial reports, the SHARK is a plug-in hybrid (PHEV), not fully electric. It features a 1.5-liter turbocharged petrol engine paired with dual electric motors, delivering 435 horsepower and a combined range of over 500 miles, including 62 miles of pure electric driving. Designed for urban deliveries and light commercial use, it supports fast charging, reaching 80% in about 30 minutes, and offers a payload capacity of 835 kg and towing capacity of 2,500 kg

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electric Trucks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electric Trucks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electric Trucks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.