Global Electric Tuggers Market

Market Size in USD Million

CAGR :

%

USD

762.58 Million

USD

996.44 Million

2024

2032

USD

762.58 Million

USD

996.44 Million

2024

2032

| 2025 –2032 | |

| USD 762.58 Million | |

| USD 996.44 Million | |

|

|

|

|

Electric Tuggers Market Size

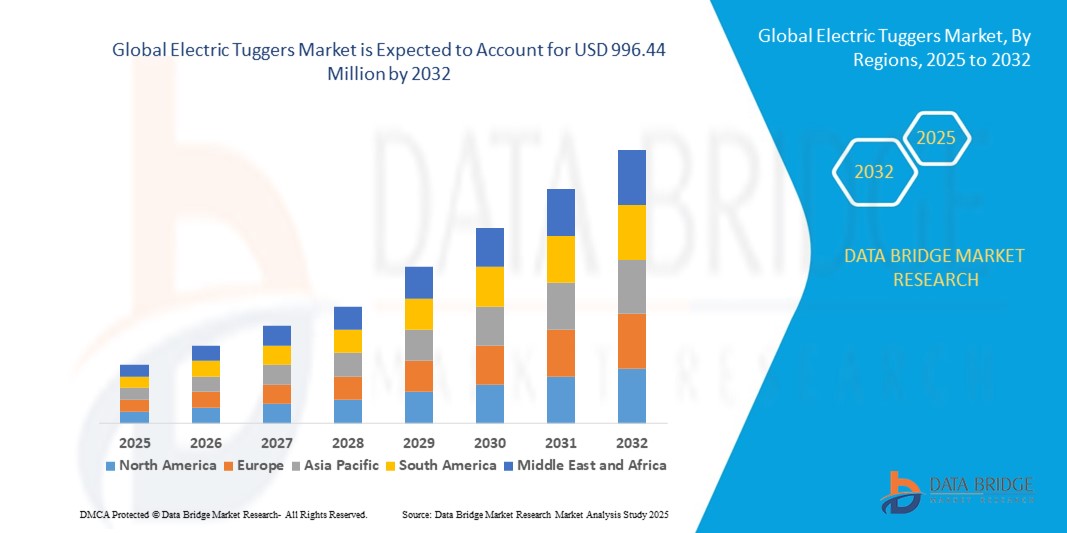

- The global electric tuggers market size was valued at USD 762.58 million in 2024 and is projected to reach USD 996.44 million by 2032, with a CAGR of 3.40% during the forecast period

- The market growth is primarily driven by the increasing demand for efficient material handling solutions across industries such as automotive, manufacturing, logistics, and healthcare, where electric tuggers play a vital role in improving operational efficiency and safety

- Moreover, the rising emphasis on automation, sustainability, and ergonomics in industrial operations is fueling the adoption of electric tuggers as a cleaner and cost-effective alternative to traditional material transport methods. These trends are expected to steadily propel the market forward in the coming years

Electric Tuggers Market Analysis

- Electric tuggers, designed for the efficient movement and handling of heavy loads in industrial and commercial environments, are becoming essential tools in logistics, manufacturing, and warehousing due to their ability to improve workplace safety, reduce manual labor, and enhance operational efficiency.

- The growing demand for electric tuggers is primarily driven by the increasing focus on automation in material handling, rising labor costs, and the need to streamline supply chain processes in various industries.

- North America dominated the global electric tuggers market with the largest revenue share of 45.34% in 2023, driven by increasing automation in warehouses, manufacturing, and logistics sectors, alongside rising labor productivity and safety requirements

- The Asia-Pacific electric tuggers market is expected to grow at the fastest CAGR of 8.8% from 2024 to 2032, propelled by rapid industrialization, urbanization, and rising labor costs in countries such as China, India, Japan, and South Korea

- The 2000 to 4000 LBS segment dominated the market with the largest revenue share of 46.7% in 2024, driven by its widespread use across aerospace and defense industries where mid-range load-bearing capacity is essential

Report Scope and Market Segmentation

|

Attributes |

Electric Tuggers Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electric Tuggers Market Trends

Automation and Ergonomics Driving Industrial Adoption

- A prominent and growing trend in the global electric tuggers market is the shift towards automation and ergonomic design in material handling, driven by the need for enhanced operational efficiency, reduced workplace injuries, and optimized labor utilization across industries such as manufacturing, logistics, automotive, and healthcare

- Manufacturers are increasingly integrating advanced technologies such as programmable controls, remote operation, and sensor-based navigation systems into electric tuggers to support semi-automated and fully automated workflows. For instance, Jungheinrich offers electric tuggers with auto-follow functionality, allowing them to trail operators hands-free in warehouse settings, improving speed and efficiency

- Furthermore, companies such as Toyota Material Handling and STILL GmbH are developing tuggers with ergonomic features such as adjustable tiller arms, standing platforms, and easy-access controls, aimed at reducing operator fatigue and enhancing user safety, especially in facilities requiring long shifts or repetitive transport tasks

- The push toward Industry 4.0 is also fostering demand for data-enabled electric tuggers that can be integrated with warehouse management systems (WMS) for real-time tracking, route optimization, and fleet performance analysis. For instance, Linde’s tugger solutions can be equipped with telematics to enable predictive maintenance and improve operational uptime

- As industries increasingly adopt lean manufacturing principles and aim to reduce downtime and material transport bottlenecks, the trend toward automated and ergonomically optimized electric tuggers is expected to accelerate

- This evolution is reshaping the expectations of material handling solutions, with electric tuggers becoming central to smart, efficient, and sustainable industrial operations across various regions and sectors

Electric Tuggers Market Dynamics

Driver

Rising Demand for Efficient, Safe, and Sustainable Material Handling Solutions

- The increasing need for efficient, ergonomic, and environmentally friendly material handling equipment across industries is a key driver fueling demand for electric tuggers. With industries such as automotive, e-commerce, healthcare, and manufacturing striving to enhance intralogistics performance, electric tuggers are gaining traction due to their ability to streamline operations, reduce manual labor, and minimize workplace injuries

- For instance, in February 2024, Toyota Material Handling introduced a new line of energy-efficient electric tuggers designed for warehouse and assembly line operations, featuring lithium-ion batteries and improved ergonomic controls. These innovations reflect growing industry focus on operational safety and sustainability

- Furthermore, rising labor costs and workforce shortages in industrial sectors are accelerating the shift toward automation and powered transport equipment. Electric tuggers, being more cost-effective and eco-friendlier compared to traditional gas-powered alternatives, align with sustainability initiatives and emission-reduction goals

- Their ability to transport heavy loads over short and medium distances, particularly in tight indoor spaces, makes electric tuggers an ideal solution for warehouse logistics, hospitals, and production plants. The integration of tuggers with automated systems and smart fleet management tools also enhances real-time visibility and productivity, further boosting their adoption globally

Restraint/Challenge

High Initial Investment and Limited Awareness in Emerging Markets

- A significant challenge facing the electric tuggers market is the high upfront investment required for procurement, installation, and training, especially for small- and medium-sized enterprises (SMEs) with limited capital expenditure flexibility. Advanced tuggers equipped with automation features or lithium-ion battery technology can be expensive compared to manual alternatives, potentially slowing adoption among cost-sensitive users

- In addition, awareness and understanding of the long-term benefits of electric tuggers such as lower operating costs, improved safety, and reduced emissions remain relatively low in emerging markets. This lack of knowledge often leads to a preference for traditional manual or combustion-powered handling equipment

- Moreover, infrastructure limitations, such as inadequate charging facilities or lack of trained personnel for maintenance and operation, further hinder the uptake of electric tuggers in developing regions. These challenges are particularly pronounced in regions where industrial automation is still at a nascent stage

- To overcome these barriers, manufacturers are focusing on cost-effective product lines, modular designs, and lease-based pricing models to improve accessibility. In addition, awareness campaigns and partnerships with local distributors and logistics providers can help educate potential customers on the value proposition of electric tuggers, thereby supporting long-term market growth

Electric Tuggers Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the market is segmented into below 2000 LBS, 2000 to 4000 LBS, and above 4000 LBS. The 2000 to 4000 LBS segment dominated the market with the largest revenue share of 46.7% in 2024, driven by its widespread use across aerospace and defense industries where mid-range load-bearing capacity is essential. These systems strike a balance between strength, weight efficiency, and cost, making them suitable for a variety of applications including aircraft structures, automotive assemblies, and industrial equipment. Their versatility and adaptability to multiple engineering designs enhance adoption across OEMs and aftermarket players.

The above 4000 LBS segment is anticipated to witness the fastest CAGR of 18.9% from 2025 to 2032, fueled by the rising demand in heavy-duty applications such as defense equipment, industrial machinery, and large-scale aerospace components. Increasing defense spending and industrial automation trends are expected to further accelerate demand for this segment.

- By Application

On the basis of application, the market is segmented into aerospace, railroad, defense, automotive, industrial, and others. The aerospace segment accounted for the largest market revenue share of 39.4% in 2024, owing to its critical reliance on lightweight yet high-strength solutions for airframes, landing gear, and structural components. Growth in global air travel, increasing aircraft production, and continuous fleet modernization programs by major airlines fuel this dominance. In addition, regulatory emphasis on safety and efficiency drives steady demand for aerospace applications.

The defense segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, driven by rising military budgets, procurement of advanced combat vehicles, and modernization of defense infrastructure. Heavy-duty load-bearing components are increasingly integrated into defense systems requiring durability under extreme conditions. Moreover, ongoing geopolitical tensions and investments in next-gen defense technologies are anticipated to accelerate the adoption of high-capacity systems in this segment.

Electric Tuggers Market Regional Analysis

- North America dominated the global electric tuggers market with the largest revenue share of 45.34% in 2023, driven by increasing automation in warehouses, manufacturing, and logistics sectors, alongside rising labor productivity and safety requirements

- Customers in the region highly value the ergonomic design, efficiency, and safety features of electric tuggers, which help reduce worker fatigue and improve material handling operations

- This widespread adoption is supported by advanced infrastructure, strict workplace safety regulations, and the presence of leading industrial equipment manufacturers, making electric tuggers a preferred choice across commercial and industrial applications

U.S. Electric Tuggers Market Insight

The U.S. electric tuggers market captured the largest revenue share of 78% in 2023 within North America, driven by rapid expansion in logistics, warehousing, and manufacturing automation. Increasing focus on workplace safety and operational efficiency is encouraging companies to replace manual tugs with electric tuggers. The growing demand for ride-on and pedestrian tuggers with advanced features such as ergonomic design, battery efficiency, and telematics integration is propelling market growth. Moreover, government regulations promoting industrial safety and labor productivity are further fueling adoption.

Europe Electric Tuggers Market Insight

The Europe electric tuggers market is projected to grow at a robust CAGR over the forecast period, driven by stringent workplace safety regulations and growing investments in automation across manufacturing and logistics sectors. Increasing urbanization and digital transformation in European industries foster the adoption of electric tuggers, particularly in Germany, France, and the U.K. The region also benefits from rising demand for eco-friendly, electric-powered material handling equipment that supports sustainability initiatives.

U.K. Electric Tuggers Market Insight

The U.K. electric tuggers market is expected to register a significant CAGR during the forecast period, fueled by the increasing trend of warehouse automation and demand for labor-saving equipment. Rising e-commerce activities and the need for streamlined supply chain operations are encouraging businesses to invest in electric tuggers. In addition, the country’s growing focus on health and safety compliance and worker ergonomics supports the adoption of advanced electric tuggers.

Germany Electric Tuggers Market Insight

Germany’s electric tuggers market is anticipated to expand steadily, backed by a strong industrial base and high awareness of automation technologies. German manufacturers emphasize sustainable and efficient material handling solutions, driving demand for electric tuggers with reduced emissions and enhanced safety features. The integration of electric tuggers with warehouse management systems and Industry 4.0 initiatives is becoming increasingly common.

Asia-Pacific Electric Tuggers Market Insight

The Asia-Pacific electric tuggers market is expected to grow at the fastest CAGR of 8.8% from 2024 to 2032, propelled by rapid industrialization, urbanization, and rising labor costs in countries such as China, India, Japan, and South Korea. Growing adoption of automated warehouses and logistics infrastructure, coupled with government incentives for industrial automation, is accelerating the market. In addition, APAC’s emergence as a manufacturing hub for electric tugger components improves affordability and accessibility, expanding its consumer base.

Japan Electric Tuggers Market Insight

Japan’s electric tuggers market is gaining traction due to the country’s advanced manufacturing sector, high labor costs, and focus on automation to improve productivity. The aging workforce is encouraging the adoption of ergonomic electric tuggers that reduce physical strain. Integration with smart factory systems and IoT-enabled fleet management solutions is driving innovation and demand.

China Electric Tuggers Market Insight

China dominated the Asia-Pacific electric tuggers market with the largest revenue share in 2023, driven by booming manufacturing and logistics sectors. The country’s expanding e-commerce industry and growing infrastructure investments fuel the need for efficient material handling equipment. Domestic manufacturers are innovating with cost-effective and technologically advanced electric tuggers, supporting widespread adoption in commercial, industrial, and warehouse settings.

Electric Tuggers Market Share

Global Electric Tuggers Market Leaders Operating in the Market Are:

- Towmaster (U.S.)

- Bulldog (U.K.)

- Panther Warehousing Solutions (U.K.)

- MasterMover (U.K.)

- TUGGER (Germany)

- Jungheinrich (Germany)

- Toyota Material Handling (Japan)

- Hyster-Yale Materials Handling (U.S.)

- Crown Equipment (U.S.)

- Raymond Corporation (U.S.)

- CESAB Material Handling (Italy)

- Mitsubishi Logisnext (Japan)

- KION Group (Germany)

- Anhui Heli Material Handling Equipment (China)

- Tailift Group (China)

Recent Developments in Global Electric Tuggers Market

- In April 2023, Toyota Material Handling Europe launched its latest line of electric tuggers designed to enhance efficiency and safety in warehouse operations. The new models feature improved battery life, ergonomic controls, and advanced telematics for real-time fleet management. This initiative reflects Toyota’s commitment to innovation and sustainability in material handling, addressing growing demand for eco-friendly and productivity-enhancing solutions worldwide

- In March 2023, Crown Equipment Corporation introduced the Crown Wave Rider, a ride-on electric tugger tailored for high-volume distribution centers. The Wave Rider offers enhanced maneuverability and operator comfort, helping reduce workplace injuries and improve operational throughput. This launch demonstrates Crown’s focus on combining cutting-edge technology with practical design to meet evolving logistics challenges

- In March 2023, Jungheinrich AG unveiled an upgraded electric tugger series integrated with Industry 4.0 capabilities, enabling seamless integration with warehouse automation systems. The initiative supports smart factory environments by providing real-time data analytics, predictive maintenance, and optimized fleet coordination. This move highlights Jungheinrich’s leadership in advancing intelligent material handling equipment

- In February 2023, Linde Material Handling partnered with a major European logistics firm to deploy a fleet of electric tuggers across multiple warehouses, aiming to enhance operational efficiency and reduce carbon emissions. The collaboration focuses on customized solutions that align with the client’s sustainability goals and workflow needs, reinforcing Linde’s role in driving greener supply chain technologies

- In January 2023, Raymond Corporation introduced the Raymond Tugger 8000 series at the Material Handling & Logistics Conference (MHLC) 2023. Featuring enhanced battery management and safety features, the Tugger 8000 is designed for versatility in various industrial environments. Raymond’s latest offering emphasizes safety, operator comfort, and energy efficiency, underscoring the company’s dedication to continuous product innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electric Tuggers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electric Tuggers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electric Tuggers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.