Global Electric Wheelchair Market

Market Size in USD Billion

CAGR :

%

USD

3.08 Billion

USD

8.38 Billion

2025

2033

USD

3.08 Billion

USD

8.38 Billion

2025

2033

| 2026 –2033 | |

| USD 3.08 Billion | |

| USD 8.38 Billion | |

|

|

|

|

What is the Global Electric Wheelchair Market Size and Growth Rate?

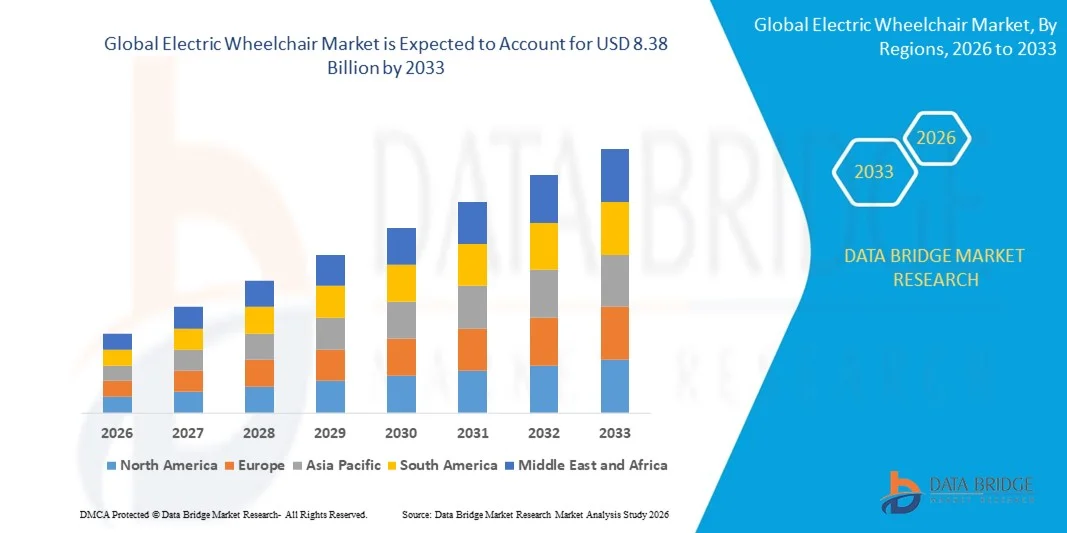

- The global electric wheelchair market size was valued at USD 3.08 billion in 2025 and is expected to reach USD 8.38 billion by 2033, at a CAGR of13.31% during the forecast period

- Major factors that are expected to boost the growth of the electric wheelchair market in the forecast period are the increasing of the geriatric population across the globe, the increasing requirement of advanced wheelchair for disabled people and the upsurge in the incidences of the cardiovascular diseases

What are the Major Takeaways of Electric Wheelchair Market?

- The increase in the disposable income of people from advanced countries, the growing need for automated wheelchairs from the sport industry and the surge in the cases of accidents are further anticipated to propel the growth of the electric wheelchair market

- On the other hand, the upsurge in the price of electric wheel chair, the unsuitable reimbursement guidelines and the absence of consciousness and infrastructure are further estimated to obstruct the growth of the electric wheelchair market

- North America dominated the electric wheelchair market with a 41.36% revenue share in 2025, driven by high adoption of advanced mobility solutions, growing elderly population, and rising healthcare infrastructure investment across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.9% from 2026 to 2033, driven by rapid expansion of healthcare infrastructure, rising elderly population, and growing disposable income across China, Japan, India, South Korea, and Southeast Asia

- The Rear Wheel Drive Chair segment dominated the market with a 41.3% share in 2025, as it remains the most widely adopted design for daily mobility due to its stability, ease of control, and suitability for indoor and outdoor use

Report Scope and Electric Wheelchair Market Segmentation

|

Attributes |

Electric Wheelchair Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electric Wheelchair Market?

Increasing Shift Toward Smart, Compact, and AI-Enabled Electric Wheelchairs

- The electric wheelchair market is witnessing strong adoption of compact, lightweight, and battery-efficient wheelchairs equipped with smart controllers, IoT-enabled monitoring, and modular designs for mobility and comfort

- Manufacturers are introducing AI-assisted navigation, obstacle detection, and customizable control systems that offer enhanced maneuverability, safety features, and compatibility with mobile applications

- Growing demand for affordable, portable, and ergonomically designed wheelchairs is driving adoption across hospitals, rehabilitation centers, elderly care facilities, and home-care environments

- For instance, companies such as Permobil, Sunrise Medical, Pride Mobility, Quantum Rehab, and GF Health Products have upgraded their models with enhanced battery life, joystick control, adjustable seating, and connectivity features

- Increasing need for autonomous mobility, patient safety, and user-friendly interfaces is accelerating the shift toward smart and digitally integrated electric wheelchairs

- As healthcare and rehabilitation services expand, electric wheelchairs will remain vital for enhancing mobility, independence, and quality of life for users

What are the Key Drivers of Electric Wheelchair Market?

- Rising demand for advanced mobility solutions, AI-enabled control, and ergonomically designed wheelchairs is driving market growth globally

- For instance, in 2025, leading companies such as Permobil, Quantum Rehab, and Pride Mobility introduced new models with longer battery life, enhanced motor control, and IoT connectivity, supporting better usability and safety

- Growing aging population, increasing prevalence of mobility impairments, neurological disorders, and post-operative rehabilitation needs is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in battery technology, lightweight materials, AI-assisted navigation, and modular designs have strengthened product performance, portability, and efficiency

- Rising adoption of smart home integration, tele-rehabilitation, and healthcare robotics is creating demand for connected and intelligent electric wheelchairs

- Supported by government healthcare programs, hospital expansion, and increasing awareness of mobility solutions, the Electric Wheelchair market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Electric Wheelchair Market?

- High costs associated with premium, AI-enabled, and customizable electric wheelchairs restrict adoption among small clinics, low-income users, and emerging markets

- For instance, during 2024–2025, fluctuations in battery and electronic component prices, coupled with supply chain constraints, increased manufacturing costs for several global vendors

- Complexity in integrating AI navigation, IoT connectivity, and modular seating systems increases the need for skilled technicians, training, and maintenance services

- Limited awareness in emerging markets regarding smart wheelchair features, usability benefits, and healthcare support programs slows adoption

- Competition from manual wheelchairs, low-cost electric scooters, and rehabilitation devices creates pricing pressure and reduces product differentiation

- To address these challenges, companies are focusing on cost-optimized designs, lightweight materials, AI-enabled safety features, and connectivity solutions to increase global adoption of electric wheelchairs

How is the Electric Wheelchair Market Segmented?

The market is segmented on the basis of type and end-user.

- By Type

On the basis of type, the electric wheelchair market is segmented into Center Wheel Drive Chair, Front Wheel Drive Chair, Standing Electric Wheelchair, Rear Wheel Drive Chair, and Others. The Rear Wheel Drive Chair segment dominated the market with a 41.3% share in 2025, as it remains the most widely adopted design for daily mobility due to its stability, ease of control, and suitability for indoor and outdoor use. Rear-wheel drive models offer enhanced maneuverability, higher speed, and compatibility with larger battery packs, making them ideal for home and clinical environments.

The Standing Electric Wheelchair segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for postural support, rehabilitation therapy, and enhanced independence for users with spinal cord injuries, neuromuscular disorders, and mobility impairments. Advancements in motorized lifting mechanisms, AI-assisted balancing, and lightweight construction are further accelerating adoption in hospitals, therapy centers, and home-care applications.

- By End-User

On the basis of end-user, the electric wheelchair market is segmented into Home Care Settings, Sports and Athletics, Hospitals, and Clinics. The Home Care Settings segment dominated the market with a 44.6% share in 2025, driven by the growing aging population, rising incidence of mobility impairments, and increasing preference for independent living solutions. Home users benefit from customizable controls, lightweight frames, and battery-efficient designs, which allow safe navigation in indoor and outdoor spaces.

The Hospitals and Clinics segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing adoption of electric wheelchairs for patient rehabilitation, mobility assistance, and post-surgery care. Rising investments in rehabilitation centers, physical therapy facilities, and eldercare hospitals, combined with AI-assisted mobility solutions and ergonomic designs, are driving the need for hospital-grade electric wheelchairs with advanced functionality and enhanced safety features.

Which Region Holds the Largest Share of the Electric Wheelchair Market?

- North America dominated the electric wheelchair market with a 41.36% revenue share in 2025, driven by high adoption of advanced mobility solutions, growing elderly population, and rising healthcare infrastructure investment across the U.S. and Canada

- Strong presence of key manufacturers such as Permobil, Sunrise Medical, Pride Mobility, Quantum Rehab, and GF Health Products enhances market penetration

- High demand for battery-efficient, AI-assisted, and ergonomically designed electric wheelchairs continues to fuel adoption across hospitals, rehabilitation centers, elderly care facilities, and home-care environments

U.S. Electric Wheelchair Market Insight

The U.S. is the largest contributor to North America, supported by extensive healthcare infrastructure, rehabilitation services, and rising awareness of mobility solutions. Increasing prevalence of age-related mobility impairments, spinal cord injuries, and neurological disorders drives demand for advanced electric wheelchairs. Strong presence of startups, design labs, and healthcare solution providers accelerates adoption of AI-assisted and connected wheelchair models.

Canada Electric Wheelchair Market Insight

Canada contributes significantly due to growing rehabilitation and elderly care facilities, government-backed healthcare initiatives, and expanding medical device adoption. Home-care mobility solutions, hospitals, and therapy centers increasingly utilize smart, ergonomic electric wheelchairs for patient independence and rehabilitation programs. Skilled workforce availability and supportive innovation policies strengthen market growth across the country.

Asia-Pacific Electric Wheelchair Market

Asia-Pacific is projected to register the fastest CAGR of 10.9% from 2026 to 2033, driven by rapid expansion of healthcare infrastructure, rising elderly population, and growing disposable income across China, Japan, India, South Korea, and Southeast Asia. Increasing demand for connected, AI-enabled, and battery-efficient wheelchairs in hospitals, clinics, and home-care facilities is a key growth driver.

China Electric Wheelchair Market Insight

China is the largest contributor in Asia-Pacific due to massive investments in medical device manufacturing, high-volume production of mobility solutions, and government support for healthcare innovation. Rising awareness of advanced rehabilitation equipment and smart home care drives demand for electric wheelchairs with AI-assisted navigation, adjustable seating, and enhanced safety features.

Japan Electric Wheelchair Market Insight

Japan shows steady growth supported by advanced healthcare systems, precision manufacturing, and focus on quality rehabilitation solutions. Increasing adoption of ergonomic and AI-enabled electric wheelchairs in hospitals, therapy centers, and home-care settings reinforces market expansion.

India Electric Wheelchair Market Insight

India is emerging as a significant growth hub due to rising geriatric population, government-supported healthcare programs, and increasing adoption of mobility aids. Hospitals, clinics, and home-care settings are progressively using smart and connected wheelchairs to enhance mobility, independence, and rehabilitation outcomes.

South Korea Electric Wheelchair Market Insight

South Korea contributes notably due to high-tech medical device manufacturing, AI-assisted mobility solutions, and growing home-care adoption. Rapid development of rehabilitation technology, healthcare robotics, and smart wheelchair designs drives the regional market forward.

Which are the Top Companies in Electric Wheelchair Market?

The electric wheelchair industry is primarily led by well-established companies, including:

- GF Health Products, Inc. (U.S.)

- Sunrise Medical (U.K.)

- Quantum Rehab (U.S.)

- Permobil (Sweden)

- Pride Mobility Products Corp. (U.S.)

- Invacare Corporation (U.S.)

- OTTOBOCK (Germany)

- LEVO AG (Germany)

- Karman Healthcare, Inc. (U.S.)

- Matsunaga (Japan)

- KARMA MEDICAL PRODUCTS CO., LTD. (Taiwan)

- Miki Kogyosho Co. Ltd. (Japan)

- NISSIN MEDICAL INDUSTRIES CO., LTD. (Japan)

- MEYRA GmbH (Germany)

- Medical Depot, Inc. (U.S.)

- Hoveround Corporation (U.S.)

- WHILL Inc. (Japan)

- Golden Technologies (U.S.)

- 21st Century Scientific Inc. (U.S.)

- Merits Health Products, Inc. (U.S.)

What are the Recent Developments in Global Electric Wheelchair Market?

- In June 2024, Ottobock UK introduced the Juvo B7, an advanced power wheelchair designed to provide all-day comfort and precise control for users with complex mobility needs, available in mid- and front-wheel drive configurations. This launch strengthens Ottobock’s position in the premium electric wheelchair segment and emphasizes its commitment to customized mobility solutions

- In April 2024, Numotion partnered with the United Spinal Association and United Airlines to develop a digital tool that helps wheelchair users identify flights that can accommodate their mobility devices, accessible via the United Airlines app and website. This initiative enhances travel convenience and accessibility for wheelchair users globally

- In October 2023, Sunrise Medical, a global pioneer in mobility solutions, announced its strategic acquisition of Ride Designs, a renowned leader in high-quality custom seating systems for wheelchair users. This acquisition expands Sunrise Medical’s custom seating portfolio, clinical expertise, and service capabilities, further strengthening its comprehensive range of manual and electric mobility products

- In October 2023, Numotion launched SpinKids, a dedicated platform under SpinLife designed specifically for children, addressing their unique mobility and equipment needs. This initiative provides a tailored shopping experience for pediatric users and their parents, reinforcing Numotion’s commitment to improving mobility solutions for children

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electric Wheelchair Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electric Wheelchair Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electric Wheelchair Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.