Global Electrical And Electronics Ceramics Market

Market Size in USD Billion

CAGR :

%

USD

13.69 Billion

USD

21.02 Billion

2024

2032

USD

13.69 Billion

USD

21.02 Billion

2024

2032

| 2025 –2032 | |

| USD 13.69 Billion | |

| USD 21.02 Billion | |

|

|

|

|

Electrical and Electronics Ceramics Market Size

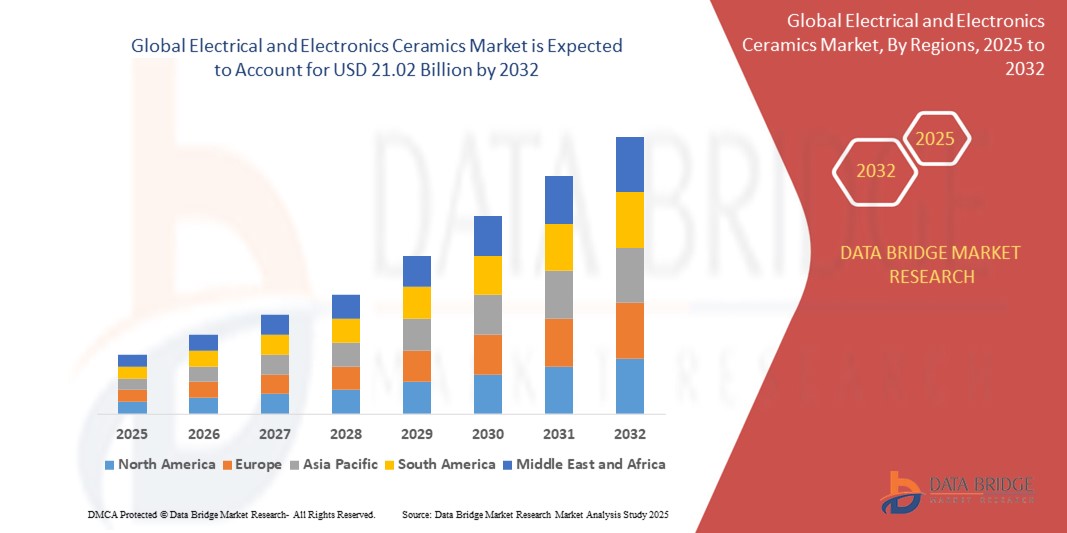

- The global electrical and electronics ceramics market size was valued at USD 13.69 billion in 2024 and is expected to reach USD 21.02 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by the increasing demand for electronic devices across various sectors, including consumer electronics, automotive, healthcare, and telecommunications

- Furthermore, the expanding renewable energy sector, particularly in solar and wind power systems, is driving the demand for advanced electrical ceramics due to their crucial applications in insulators, sensors, and power distribution systems

Electrical and Electronics Ceramics Market Analysis

- Electrical and electronics ceramics are specialized materials designed for various electronic components and devices, offering unique properties such as high thermal stability, electrical insulation, and dielectric properties

- The escalating demand for these ceramics is primarily fueled by the widespread adoption of electronic devices, the increasing integration of IoT devices across industries, and rapid advancements in semiconductor manufacturing

- Asia-Pacific dominated the electrical and electronics ceramics market share of 42% in 2024 with the largest revenue share, characterized by increasing urbanization, rising disposable incomes, and a robust manufacturing base for electronics and semiconductors in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region in the electrical and electronics ceramics market during the forecast period, driven by the presence of major electronic device manufacturers and the high adoption of advanced technologies

- The alumina ceramics segment dominated the largest market revenue share of 38.6% in 2024, primarily driven by its excellent electrical insulating properties, high thermal conductivity, and mechanical strength, making it ideal for various electronic components such as insulators, substrates, and circuit boards

Report Scope and Electrical and Electronics Ceramics Market Segmentation

|

Attributes |

Electrical and Electronics Ceramics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electrical and Electronics Ceramics Market Trends

“Miniaturization and High Performance Requirements”

- The Global Electrical and Electronics Ceramics Market is witnessing a significant trend towards miniaturization of electronic components, demanding ceramic materials with superior dielectric properties, high thermal conductivity, and excellent mechanical strength in smaller forms

- This trend is driven by the increasing demand for compact and lightweight electronic devices across various end-user industries such as mobile phones, medical devices, and automotive electronics

- Advanced ceramic materials allow for higher power densities and improved signal integrity in these miniaturized applications

- For instance, manufacturers are developing ultra-thin ceramic substrates and multilayer ceramic capacitors (MLCCs) to meet the space constraints and performance requirements of next-generation electronics

- This trend is enhancing the value proposition of electrical and electronics ceramics, making them indispensable for the development of high-performance and compact electronic systems

Electrical and Electronics Ceramics Market Dynamics

Driver

“Growing Demand in the Electronics and Semiconductor Industry”

- The increasing consumer demand for advanced electronic devices, including smartphones, tablets, laptops, and smart home appliances, is a major driver for the Global Electrical and Electronics Ceramics Market

- Ceramic materials are crucial components in semiconductors, integrated circuits, sensors, and passive electronic components due to their excellent electrical insulation, thermal stability, and mechanical properties

- The expansion of the 5G technology, IoT, and artificial intelligence (AI) is further fueling the demand for high-performance ceramic materials in these applications, offering faster data transmission, lower latency, and enhanced functionality

- Government initiatives and private investments in the development of robust electronics manufacturing ecosystems are also contributing to the widespread adoption of electrical and electronics ceramics

- Manufacturers are increasingly incorporating advanced ceramic solutions to meet stringent performance and reliability standards in the rapidly evolving electronics and semiconductor landscape

Restraint/Challenge

“Volatility in Raw Material Prices and Complex Manufacturing Processes”

- The substantial fluctuations in the prices of key raw materials such as alumina, zirconia, and titanates can significantly impact the production cost of electrical and electronics ceramics, posing a challenge for manufacturers

- The complex and energy-intensive manufacturing processes involved in producing high-quality electrical and electronics ceramics, including precise firing temperatures and controlled atmospheric conditions, can be a significant barrier to entry and expansion for many companies

- In addition, the need for specialized equipment and skilled labor for ceramic processing adds to the overall operational costs

- The stringent quality control and performance requirements for electrical and electronics applications necessitate advanced testing and validation, further increasing the cost and complexity of production

- These factors can deter potential market entrants and limit market expansion, particularly for smaller manufacturers or in regions where cost sensitivity is a significant factor

Electrical and Electronics Ceramics market Scope

The market is segmented on the basis of material type, product type, and end-user industry.

- By Material Type

On the basis of material type, the global electrical and electronics ceramics market is segmented into alumina ceramics, titanate ceramics, zirconia ceramics, silica ceramics, and others. The alumina ceramics segment dominated the largest market revenue share of 38.6% in 2024, primarily driven by its excellent electrical insulating properties, high thermal conductivity, and mechanical strength, making it ideal for various electronic components such as insulators, substrates, and circuit boards.

The zirconia ceramics segment is expected to witness robust growth from 2025 to 2032. This growth is attributed to the increasing focus on energy efficiency and sustainable power generation, as zirconia-based ceramics are utilized in applications requiring high performance and durability, particularly in demanding electronic devices and systems.

- By Product Type

On the basis of product type, the global electrical and electronics ceramics market is segmented into monolithic ceramics, ceramics matrix composites, ceramics coatings, and others. The monolithic ceramics segment hold the largest market revenue share in 2024, primarily driven by their extensive use in various electronic and electrical components due to their superior dielectric and insulating properties, and high heat resistance.

The ceramics matrix composites segment is anticipated to experience significant growth from 2025 to 2032. This growth is fueled by increasing demand for lightweight and high-performance materials in industries such as aerospace, automotive (especially EVs), and defense, where CMCs offer superior mechanical properties and temperature resistance.

- By End-User Industry

On the basis of end-user industry, the global electrical and electronics ceramics market is segmented into home appliances, power grids, medical devices, mobile phones, and others. The home appliances segment hold the largest market revenue share in 2024, driven by the widespread use of electrical and electronics ceramics for insulation, thermal management, and improved performance in various consumer electronics and smart home devices.

The medical devices segment is anticipated to witness rapid growth from 2025 to 2032. This is driven by the increasing demand for biocompatible, durable, and high-performance ceramic components in diagnostic imaging equipment, surgical instruments, and implants, where reliability and precision are crucial.

Electrical and Electronics Ceramics Market Regional Analysis

- Asia-Pacific dominated the electrical and electronics ceramics market share of 42% in 2024 with the largest revenue share, characterized by increasing urbanization, rising disposable incomes, and a robust manufacturing base for electronics and semiconductors in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region in the electrical and electronics ceramics market during the forecast period, driven by the presence of major electronic device manufacturers and the high adoption of advanced technologies

- The region's growth is further fueled by rising disposable incomes, technological advancements in consumer electronics, and significant investments in infrastructure development, including power grids and telecommunications

U.S. Electrical and Electronics Ceramics Market Insight

The U.S. electrical and electronics ceramics market fastest-growing region during the forecast period, fueled by strong demand from the semiconductor industry, medical device manufacturing, and power electronics. Growing consumer awareness of the benefits of advanced ceramic components in enhancing performance and durability further boosts market expansion. The trend towards miniaturization in electronic devices and increasing regulations promoting energy efficiency encourage the use of high-performance ceramic materials.

Europe Electrical and Electronics Ceramics Market Insight

The Europe electrical and electronics ceramics market is expected to witness significant growth, driven by a strong focus on industrial automation, renewable energy, and electric vehicles. Manufacturers seek ceramic materials that offer improved insulation, thermal management, and wear resistance. The growth is prominent in countries such as Germany and France due to their advanced manufacturing capabilities and emphasis on high-performance electronic systems. Rising environmental concerns and the push for energy-efficient solutions also contribute to market expansion.

U.K. Electrical and Electronics Ceramics Market Insight

The U.K. market for electrical and electronics ceramics is expected to witness steady growth, driven by demand from the telecommunications, medical, and defense sectors. Increased interest in high-reliability electronic components and rising awareness of the benefits of ceramic insulation encourage adoption. In addition, evolving industry standards and regulations influence material choices, balancing performance with compliance.

Germany Electrical and Electronics Ceramics Market Insight

Germany is expected to witness a strong growth rate in electrical and electronics ceramics, attributed to its advanced automotive and industrial manufacturing sectors and high consumer focus on precision engineering and energy efficiency. German industries prefer technologically advanced ceramic materials that contribute to enhanced performance and reliability in complex electronic systems. The integration of these ceramics in high-end industrial equipment and automotive electronics supports sustained market growth.

Asia-Pacific Electrical and Electronics Ceramics Market Insight

The Asia-Pacific region dominates the global electrical and electronics ceramics market with the highest revenue share of 87.8% in 2024, propelled by robust manufacturing bases in countries such as China, Japan, and South Korea. This dominance is fueled by strong demand from the consumer electronics, automotive electronics, and telecommunications sectors. Government initiatives promoting domestic manufacturing and research & development in advanced materials further bolster market expansion. The integration of electrical and electronics ceramics in smart devices and electric vehicles also contributes significantly to regional growth.

Japan Electrical and Electronics Ceramics Market Insight

Japan's electrical and electronics ceramics market is expected to witness substantial growth due to a strong consumer preference for high-quality, technologically advanced electronic components that enhance device performance and reliability. The presence of major electronics manufacturers and integration of electrical and electronics ceramics in a wide range of OEM products accelerate market penetration. Rising interest in advanced packaging and miniaturization also contributes to growth.

China Electrical and Electronics Ceramics Market Insight

The China holds the largest share of the Asia-Pacific electrical and electronics ceramics market, propelled by rapid growth in its electronics manufacturing industry, rising vehicle ownership, and increasing demand for advanced electronic solutions. The country’s growing middle class and focus on smart manufacturing support the adoption of advanced ceramic materials. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Electrical and Electronics Ceramics Market Share

The electrical and electronics ceramics industry is primarily led by well-established companies, including:

- CoorsTek Inc. (U.S.)

- CeramTec GmbH (Germany)

- KYOCERA Corporation (Japan)

- Morgan Advanced Materials (U.K.)

- Saint-Gobain (U.S.)

- 3M (U.S.)

- Paul Rauschert GmbH & Co. KG. (Germany)

- Elan Technology (U.S.)

- OC Oerlikon Management AG (Switzerland)

- Mingrui Ceramic (China)

- DuPont (U.S.)

- Honeywell International Inc. (U.S.)

- Shin-Etsu Chemical Co., Ltd. (China)

- Albemarle Corporation (U.S.)

- The American Ceramic Society (U.S.)

- Applied Ceramics (U.S.)

- MATERION CORPORATION (U.S.)

What are the Recent Developments in Global Electrical and Electronics Ceramics Market?

- In September 2024, Murata Manufacturing unveiled the world’s smallest multilayer ceramic capacitor (MLCC), measuring just 0.16mm × 0.08mm. This breakthrough represents a 75% reduction in volume compared to previous models, enabling high-density component mounting in compact electronic devices such as smartphones and wearables. The ultra-miniaturized MLCC enhances performance and efficiency, supporting the growing demand for space-saving electronic assemblies. Murata will showcase this innovation at CEATEC JAPAN 2024

- In July 2024, Cerabyte launched Ceramic Nano Memory in the U.S., introducing a recyclable ceramic-on-glass storage solution with indefinite data retention and zero energy consumption. This innovative technology enables rapid read/write operations, significantly reducing archival costs while ensuring long-term data preservation. By leveraging ceramic nanolayers, Cerabyte aims to revolutionize data storage efficiency, addressing challenges in cold storage and sustainability. The company has established offices in Silicon Valley and Boulder, Colorado, reinforcing its commitment to accessible, permanent storage solutions.

- In June 2024, CeramTec, a Germany-based ceramics manufacturer, introduced Sinalit, a silicon nitride (Si₃N₄) ceramic substrate designed to enhance power electronics applications. This innovation supports custom power module development, particularly in automotive e-mobility and vehicle electrification. Sinalit offers high flexural strength (≥700 MPa), excellent fracture toughness (≥6 MPa√m), and superior thermal conductivity (80 W/mK), making it ideal for compact, high-performance electronic systems. The substrate enables thin-layer production, ensuring efficient heat dissipation and robust environmental resistance

- In May 2024, PI Ceramic introduced Piezoceramic Composites, a new product category leveraging innovative manufacturing technology. This process embeds piezoelectric ceramics within filling polymers, combining ultrasonic conversion and actuator technology with polymer adaptability. The composites offer enhanced acoustic, mechanical, and electrical properties, supporting medical imaging, industrial metering, and non-destructive testing. Available in 2-2 and 1-3 arrangements, they feature customizable electrodes and flexible circuit board integration

- In April 2024, SCHOTT initiated pilot projects to recycle used specialty glass and glass-ceramics, reinforcing its commitment to a circular economy. These efforts aim to reduce reliance on external raw materials, particularly in the electronics ceramics sector, while supporting sustainability goals outlined in the EU Green Deal. SCHOTT is exploring ways to reintegrate recycled materials into production, focusing on cooktop panels and pharmaceutical packaging. The company seeks to overcome regulatory challenges and prove large-scale feasibility for specialty glass recycling

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electrical And Electronics Ceramics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electrical And Electronics Ceramics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electrical And Electronics Ceramics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.