Global Electrically Conductive Epoxy Adhesive Market

Market Size in USD Million

CAGR :

%

USD

829.38 Million

USD

1,435.72 Million

2024

2032

USD

829.38 Million

USD

1,435.72 Million

2024

2032

| 2025 –2032 | |

| USD 829.38 Million | |

| USD 1,435.72 Million | |

|

|

|

|

Electrically Conductive Epoxy Adhesive Market Size

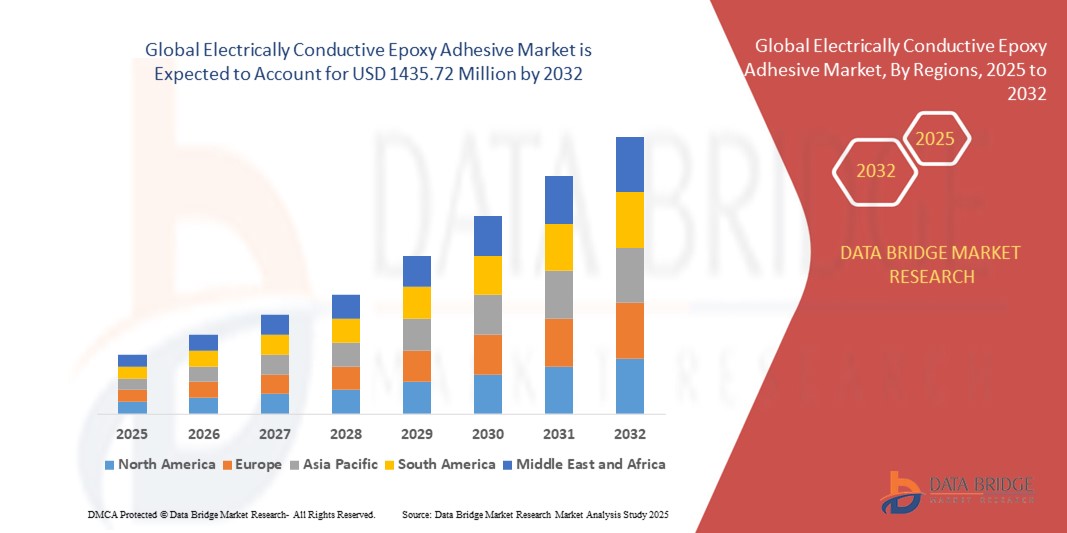

- The global electrically conductive epoxy adhesive market size was valued at USD 829.38 million in 2024 and is expected to reach USD 1435.72 million by 2032, at a CAGR of 7.10% during the forecast period

- The market growth is driven by increasing demand for lightweight, high-performance adhesives in electronics, automotive, and renewable energy sectors, along with rising adoption of advanced conductive materials for enhanced connectivity and durability

- Growing awareness of the benefits of electrically conductive adhesives, such as improved thermal management and reliability in miniaturized electronic devices, is further propelling market demand across OEM and aftermarket channels

Electrically Conductive Epoxy Adhesive Market Analysis

- The electrically conductive epoxy adhesive market is experiencing robust growth due to the rising need for reliable, high-performance bonding solutions in advanced electronics and automotive applications

- The demand from solar energy, LED lighting, and printed circuit board (PCB) manufacturing is encouraging manufacturers to innovate with high-conductivity, durable, and thermally stable adhesive solutions

- Asia-Pacific dominated the electrically conductive epoxy adhesive market with the largest revenue share of 31.2% in 2024, driven by a booming electronics industry, large-scale manufacturing, and increasing adoption of renewable energy solutions in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, fueled by rapid advancements in automotive electronics, growing investments in renewable energy, and increasing demand for high-performance adhesives in the U.S. and Canada

- The polyurethane segment dominated the largest market revenue share of 34% in 2024, driven by its superior adhesion strength, mechanical durability, and excellent electrical conductivity. Epoxy-based adhesives are widely favored in industries such as consumer electronics, automotive, and aerospace due to their ability to provide robust bonding and reliable electrical connections in high-performance applications

Report Scope and Electrically Conductive Epoxy Adhesive Market Segmentation

|

Attributes |

Electrically Conductive Epoxy Adhesive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electrically Conductive Epoxy Adhesive Market Trends

Increasing Integration of Nanotechnology and Eco-Friendly Formulations

- The global electrically conductive epoxy adhesive market is experiencing a notable trend toward the integration of nanotechnology and eco-friendly formulations

- Nanotechnology enhances the performance of conductive adhesives by improving electrical conductivity, thermal stability, and mechanical strength through the use of nano-sized fillers such as silver, carbon nanotubes, or graphene

- These advancements allow for more efficient bonding in miniaturized electronic components, critical for applications in consumer electronics, automotive, and aerospace sectors

- For instance, companies are developing nano-enhanced epoxy adhesives that provide superior conductivity for high-density printed circuit boards (PCBs) and flexible electronics, enabling compact and lightweight designs

- In addition, the shift toward eco-friendly formulations, driven by stringent environmental regulations such as the EU’s RoHS directive, is promoting the development of low-VOC and lead-free adhesives, making them more sustainable and appealing to environmentally conscious manufacturers

- These trends are enhancing the functionality and market appeal of electrically conductive epoxy adhesives, particularly in high-growth regions such as Asia-Pacific

Electrically Conductive Epoxy Adhesive Market Dynamics

Driver

Rising Demand for Miniaturized Electronics and Electric Vehicles

- The increasing demand for miniaturized electronic devices, such as smartphones, wearables, and IoT-enabled gadgets, is a key driver for the global electrically conductive epoxy adhesive market

- These adhesives provide reliable electrical connectivity and strong bonding for compact components in applications such as solar cells, automotive electronics, LED lighting, and printed circuit boards

- The rapid growth of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is further boosting demand, as electrically conductive epoxy adhesives are essential for bonding battery systems, sensors, and power electronics, ensuring lightweight and efficient designs

- Government initiatives promoting renewable energy, particularly in Asia-Pacific, are driving the use of these adhesives in solar cell production, with countries such as China and India leading in solar energy investments

- Advancements in 5G technology and IoT are enabling faster data transmission and more sophisticated applications, further increasing the adoption of electrically conductive epoxy adhesives in next-generation electronics

- Manufacturers are increasingly integrating these adhesives as standard solutions to meet consumer expectations for high-performance, compact, and sustainable products

Restraint/Challenge

High Production Costs and Regulatory Compliance Issues

- The high production costs associated with electrically conductive epoxy adhesives, including the expense of raw materials such as silver fillers and the complex manufacturing processes, pose a significant barrier to widespread adoption, particularly in cost-sensitive emerging markets

- Integrating these adhesives into existing manufacturing processes can be technically challenging and costly, requiring specialized equipment and expertise

- Data security and environmental compliance present additional challenges, as these adhesives must adhere to strict regulations such as the EU’s REACH and RoHS directives, which mandate low-VOC and hazardous substance-free formulations

- The fragmented regulatory landscape across regions, particularly regarding environmental and safety standards, complicates operations for global manufacturers and increases compliance costs

- These factors can deter adoption in regions with high cost sensitivity or stringent regulatory environments, potentially limiting market growth despite strong demand in applications such as automotive and solar cells

Electrically Conductive Epoxy Adhesive market Scope

The market is segmented on the basis of chemistry type, filler material, type, and application.

- By Chemistry Type

On the basis of chemistry type, the global electrically conductive epoxy adhesive market is segmented into silicone, polyurethane, acrylic, and other chemistries. The polyurethane segment dominated the largest market revenue share of 34% in 2024, driven by its superior adhesion strength, mechanical durability, and excellent electrical conductivity. Epoxy-based adhesives are widely favored in industries such as consumer electronics, automotive, and aerospace due to their ability to provide robust bonding and reliable electrical connections in high-performance applications. Their compatibility with a variety of substrates and resistance to thermal and mechanical stress further solidify their market dominance.

The silicone segment is expected to register the fastest growth rate from 2025 to 2032, as industries increasingly prioritize flexibility and thermal stability in harsh environments. Silicone-based electrically conductive adhesives offer elasticity, moisture resistance, and performance consistency over a wide temperature range, making them ideal for flexible electronics and high-temperature applications like LED lighting and solar cells. The rising demand for sustainable and adaptable adhesive solutions is further accelerating the adoption of silicone-based chemistries.

- By Filler Material

On the basis of filler material, the global electrically conductive epoxy adhesive market is categorized into silver fillers, copper fillers, carbon fillers, and others. The silver fillers segment accounted for the highest revenue share in 2024, attributed to their exceptional electrical conductivity and low resistivity, which ensure efficient electrical connections. Silver-filled adhesives are widely used in microelectronics, automotive sensors, and aerospace applications due to their reliability and ability to maintain performance in demanding conditions. Their high conductivity and compatibility with advanced manufacturing processes make them a preferred choice for high-performance applications.

The carbon fillers segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the increasing demand for cost-effective and eco-friendly alternatives. Carbon-based fillers, such as carbon nanotubes and carbon black, provide adequate electrical conductivity for applications like printed circuit boards and consumer electronics, while offering advantages in terms of weight reduction and sustainability. The growing focus on environmentally friendly manufacturing and the rising adoption of carbon-based materials in renewable energy applications, such as solar cells, further propel this segment's growth.

- By Type

On the basis of type, the global electrically conductive epoxy adhesive market is segmented into isotropic and anisotropic conductive adhesives. The isotropic conductive adhesives segment held the largest revenue share in 2024, owing to their ability to conduct electricity uniformly in all directions. This makes them essential for applications requiring consistent electrical connectivity, such as in automotive electronics, solar cells, and printed circuit boards. Their versatility and ease of use in high-volume manufacturing processes contribute to their widespread adoption.

The anisotropic conductive adhesives segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the increasing demand for precision in miniaturized electronics. Anisotropic adhesives conduct electricity in a specific direction, making them ideal for fine-pitch circuits in consumer electronics, such as smartphones, wearables, and LCD displays. The trend toward device miniaturization and the need for reliable, high-precision bonding in advanced electronics drive the rapid growth of this segment.

- By Application

On the basis of application, the global electrically conductive epoxy adhesive market is segmented into solar cells, automotive, LED lighting, printed circuit boards, biosciences, consumer electronics, aerospace, and others. The consumer electronics segment held the largest revenue share in 2024, driven by the exponential growth of smartphones, tablets, wearables, and other connected devices. Electrically conductive epoxy adhesives are critical for bonding components, reducing electromagnetic interference, and ensuring reliable electrical connections in compact, high-performance devices. The push for seamless integration and enhanced device durability further amplifies demand in this segment.

The solar cells segment is projected to grow at the fastest rate from 2025 to 2032, propelled by the global shift toward renewable energy and the increasing adoption of solar photovoltaic systems. Electrically conductive epoxy adhesives are used as cell interconnection materials in solar panels, offering advantages over traditional soldering by enabling lower processing temperatures and improved durability. Supportive government policies, such as investments in solar infrastructure, and the rising demand for sustainable energy solutions are key drivers of this segment's rapid growth trajectory.

Electrically Conductive Epoxy Adhesive Market Regional Analysis

- Asia-Pacific dominated the electrically conductive epoxy adhesive market with the largest revenue share of 31.2% in 2024, driven by a booming electronics industry, large-scale manufacturing, and increasing adoption of renewable energy solutions in countries such as China, Japan, and South Korea

- Consumers prioritize electrically conductive epoxy adhesives for their superior electrical conductivity, mechanical strength, and thermal stability, particularly in regions with high technological adoption and manufacturing hubs

- Growth is supported by advancements in adhesive technology, including high-performance epoxy formulations and conductive fillers such as silver and copper, alongside rising adoption in OEM and aftermarket segments for applications such as solar cells, automotive electronics, LED lighting, and printed circuit boards

Japan Electrically Conductive Epoxy Adhesive Market Insight

Japan’s electrically conductive epoxy adhesive market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced adhesives that enhance circuit reliability and thermal management. The presence of major electronics and automotive manufacturers and the integration of conductive adhesives in OEM vehicles accelerate market penetration. Rising interest in aftermarket applications for consumer electronics also contributes to growth.

China Electrically Conductive Epoxy Adhesive Market Insight

China holds the largest share of the Asia-Pacific electrically conductive epoxy adhesive market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for advanced bonding solutions in solar cells and automotive electronics. The country’s growing middle class and focus on smart mobility support the adoption of high-performance epoxy adhesives. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Electrically Conductive Epoxy Adhesive Market Insight

The U.S. electrically conductive epoxy adhesive m market is expected to witness significant growth, fueled by strong demand in automotive electronics and consumer electronics aftermarket. Growing awareness of the benefits of conductive adhesives, such as reliable electrical connections and heat dissipation, drives market expansion. The trend toward miniaturization of electronic components and increasing regulations promoting lead-free solutions further boost market growth. Automakers’ integration of conductive adhesives in electric vehicles (EVs) complements aftermarket sales, creating a diverse product ecosystem.

Europe Electrically Conductive Epoxy Adhesive Market Insight

The Europe electrically conductive epoxy adhesive market is expected to witness significant growth, supported by regulatory emphasis on sustainable and lead-free bonding solutions. Consumers seek adhesives that provide reliable electrical conductivity while maintaining mechanical strength. The growth is prominent in both OEM installations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising demand in automotive and aerospace applications and environmental concerns.

U.K. Electrically Conductive Epoxy Adhesive Market Insight

The U.K. market for electrically conductive epoxy adhesives is expected to witness rapid growth, driven by demand for advanced electronics and automotive applications in urban and suburban settings. Increased interest in high-performance adhesives for EMI shielding and circuit assembly encourages adoption. Evolving environmental regulations and a focus on sustainability influence consumer choices, balancing conductivity with compliance.

Germany Electrically Conductive Epoxy Adhesive Market Insight

Germany is expected to witness rapid growth in the electrically conductive epoxy adhesive market, attributed to its advanced automotive and electronics manufacturing sectors and high consumer focus on energy efficiency. German consumers prefer technologically advanced adhesives that enhance electrical performance and contribute to lower energy consumption in EVs and smart electronics. The integration of these adhesives in premium vehicles and aftermarket solutions supports sustained market growth.

Electrically Conductive Epoxy Adhesive Market Share

The electrically conductive epoxy adhesive industry is primarily led by well-established companies, including:

- Master Bond Inc. (U.S.)

- Panacol-Elosol GmbH (Germany)

- Aremco Products Inc. (U.S.)

- DuPont (U.S.)

- SOLVAY (Belgium)

- Dow (U.S.)

- Henkel AG & Co. KgaA (Germany)

- 3M (U.S.)

- Bostik (France)

- Sika AG (Switzerland)

- H.B. Fuller (U.S.)

- BASF SE (Germany)

- DAP Global Inc.(U.S.)

- Owens Corning (U.S.)

- The Chemours Company (U.S.)

- Paroc Group (Finland)

- Kingspan Group (Ireland)

What are the Recent Developments in Global Electrically Conductive Epoxy Adhesive Market?

- In May 2024, Azelis launched ARALDITE® GY 40100, an advanced electrically conductive epoxy resin developed by Huntsman Corporation. This innovative product incorporates a low concentration (2 wt%) of MIRALON® conductive filler, enabling high electrical conductivity while preserving mechanical properties and minimizing viscosity impact. Unsuch as traditional fillers, MIRALON® nanotubes are finely dispersed, making the resin easier to process and safer to handle—eliminating airborne nanomaterials. ARALDITE® GY 40100 is compatible with a wide range of additives and hardeners, offering enhanced formulation flexibility for adhesives used in electronics, aerospace, and industrial applications

- In June 2023, Polytec PT and Bostik joined forces to introduce a new range of thermal conductive adhesives (TCAs) tailored for electric vehicle (EV) battery designs. This partnership targets the growing e-mobility sector, offering advanced thermal management solutions essential for maintaining optimal battery performance and safety. The TCAs, including the polyurethane-based XPU TCA 202, combine high thermal conductivity with mechanical strength and flexibility. Designed for ease of processing and compliance with stringent safety standards, these adhesives support fast-charging capabilities and efficient heat dissipation—key factors in modern EV battery systems

- In May 2023, Henkel expanded its portfolio for electric vehicle (EV) battery systems with the launch of Loctite® TLB 9300 APSi, a groundbreaking injectable thermally conductive adhesive. This two-component polyurethane solution offers both structural bonding and thermal conductivity, making it ideal for bonding battery cells to modules or cooling systems. With a thermal conductivity of 3 W/mK, moderate viscosity, and self-leveling properties, it ensures efficient heat dissipation and strong adhesion across various substrates. The adhesive cures at room temperature, supports sustainability goals, and enhances safety by eliminating the need for additional energy during processing

- In January 2023, Parker Hannifin expanded its product portfolio for electric vehicle (EV) manufacturers by introducing new thermally conductive (TC) adhesives and one-component (1K) low-density gap fillers. These additions complement Parker’s existing CoolTherm™ lineup of thermal management encapsulants, adhesives, and gap fillers. Designed to meet the evolving needs of EV battery systems, the new TC adhesives offer strong adhesion, high thermal conductivity, and low dielectric constants—ideal for direct bonding of battery cells to cooling plates or chassis. The 1K gap fillers simplify manufacturing with excellent flow properties and environmental friendliness, supporting efficient and scalable EV production

- In November 2022, Henkel introduced Loctite® Ablestik ICP 2120, an electrically conductive adhesive engineered for the intricate demands of compact camera modules (CCMs) in mobile devices. This innovative material features a low modulus and a fast, low-temperature curing profile, enabling high-volume production while protecting delicate, heat-sensitive components. Its moisture-cure chemistry eliminates the need for high-temperature processing, reducing energy consumption and improving yield rates. With excellent electrical grounding performance and high thermal conductivity (7.0 W/m·K), it ensures reliable operation and effective heat dissipation in increasingly miniaturized and multifunctional camera systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electrically Conductive Epoxy Adhesive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electrically Conductive Epoxy Adhesive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electrically Conductive Epoxy Adhesive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.