Global Electro Medical Equipment Market

Market Size in USD Billion

CAGR :

%

USD

67.22 Billion

USD

117.25 Billion

2024

2032

USD

67.22 Billion

USD

117.25 Billion

2024

2032

| 2025 –2032 | |

| USD 67.22 Billion | |

| USD 117.25 Billion | |

|

|

|

|

Electro-Medical Equipment Market Size

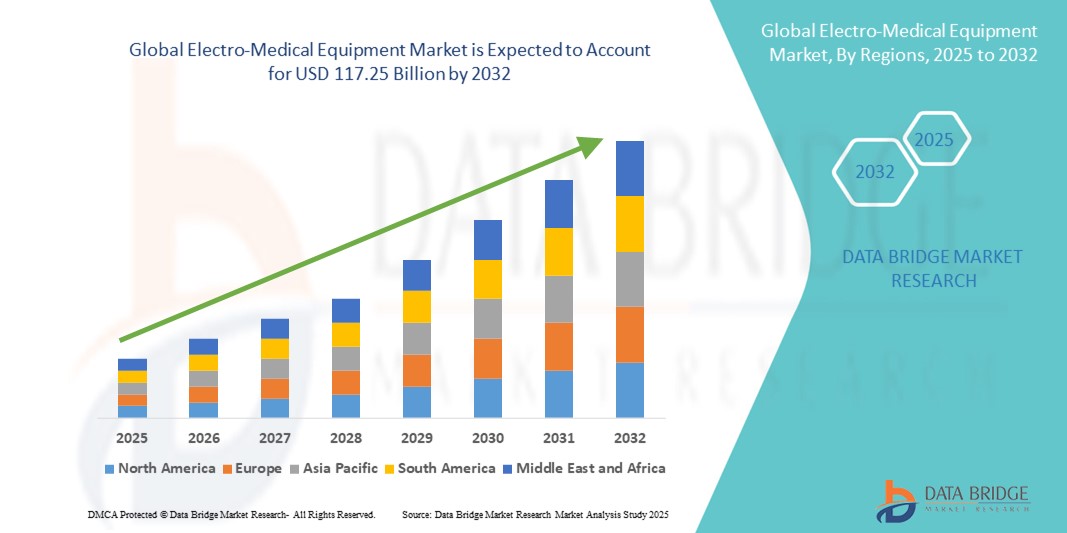

- The global electro-medical equipment market size was valued at USD 67.22 billion in 2024 and is expected to reach USD 117.25 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced therapeutic and diagnostic technologies, as well as ongoing innovations in medical devices, leading to enhanced patient care and operational efficiency in healthcare facilities.

- Furthermore, rising demand for non-invasive treatment options, improved rehabilitation therapies, and technologically advanced monitoring solutions is driving the expansion of the electro-medical equipment market. These converging factors are accelerating the uptake of modern electro-medical devices, thereby significantly boosting the industry’s growth

Electro-Medical Equipment Market Analysis

- Electro-medical devices, encompassing diagnostic imaging, patient assistive, and surgical equipment, are becoming increasingly vital in modern healthcare settings due to their ability to enhance patient care, improve procedural accuracy, and enable real-time monitoring across hospitals, clinics, and homecare environments

- The escalating demand for electro-medical equipment is primarily fueled by the growing prevalence of chronic diseases, technological advancements in medical devices, and the rising focus on patient-centric care models and remote monitoring solutions

- North America dominated the electro-medical equipment market with the largest revenue share of 41.00% in 2024, supported by a well-established healthcare infrastructure, strong government and private investments, and high adoption of advanced diagnostic and therapeutic technologies, with the U.S. leading growth through substantial deployments in hospitals, specialty clinics, and homecare settings

- Asia-Pacific is expected to be the fastest-growing region in the electro-medical equipment market during the forecast period, with a projected CAGR of 9.8%, driven by increasing healthcare expenditure, rising incidence of chronic and lifestyle diseases, rapid urbanization, and government initiatives supporting healthcare infrastructure expansion in countries such as China, India, and Japan

- The Diagnostic Imaging Devices segment dominated the electro-medical equipment market with the largest revenue share of 38.5% in 2024, driven by the increasing demand for accurate, non-invasive diagnostic solutions across hospitals, clinics, and specialty centers. Innovations in MRI, CT, ultrasound, and digital radiography have enhanced image clarity, reduced examination times, and supported early disease detection, making these devices essential in modern healthcare

Report Scope and Electro-Medical Equipment Market Segmentation

|

Attributes |

Electro-Medical Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electro-Medical Equipment Market Trends

Advancements in Device Functionality and Integration

- A significant trend in the global electro-medical equipment market is the continuous advancement in device functionality, offering improved therapeutic outcomes, patient monitoring, and clinical efficiency. These innovations are enabling healthcare providers to deliver more precise, targeted, and effective treatments

- For instance, modern neuromodulation devices now incorporate multi-channel stimulation, customizable treatment protocols, and real-time feedback systems, enhancing the efficacy and safety of therapies for chronic pain, neurological disorders, and musculoskeletal conditions

- Integration of electro-medical equipment with hospital information systems and electronic medical records is improving workflow efficiency, enabling seamless data collection, analysis, and reporting. This connectivity supports evidence-based decision-making and enhances patient management across inpatient and outpatient settings

- The trend towards portable and minimally invasive devices is expanding access to therapy in home care and outpatient environments, offering patients greater convenience and adherence to treatment plans

- Companies are increasingly focusing on designing compact, user-friendly, and versatile Electro-Medical Equipment, enabling clinicians to deliver high-quality care across diverse healthcare environments

- The growing emphasis on device interoperability, remote monitoring, and automated data collection is driving widespread adoption across hospitals, specialty clinics, and rehabilitation centers, underpinning sustained market growth in the electro-medical equipment sector

Electro-Medical Equipment Market Dynamics

Driver

Rising Demand Driven by Healthcare Needs and Technological Advancements

- The global electro-medical equipment market is witnessing robust growth, primarily driven by the rising prevalence of chronic pain, neurological disorders, musculoskeletal conditions, and other medical ailments. Increasing awareness among healthcare providers, patients, and rehabilitation specialists about the effectiveness of non-invasive and advanced therapeutic solutions is significantly contributing to market expansion. Hospitals, specialty clinics, and rehabilitation centers are increasingly adopting these devices to improve treatment outcomes and enhance patient care

- Continuous innovation in device technology, including enhanced precision, portability, ease of use, and advanced monitoring features, is enabling better patient management and operational efficiency. Manufacturers are focusing on developing devices that offer personalized therapy, real-time monitoring, and seamless integration with hospital information systems, thereby elevating the standard of care

- The rising preference for home-based care and outpatient treatments is further driving demand for compact, portable, and easy-to-use Electro-Medical Equipment. Such devices enable patients to receive effective therapy at home, enhance treatment adherence, and reduce dependency on clinical visits, creating a more patient-centric healthcare approach

- Substantial investments by healthcare facilities in modernizing medical infrastructure, coupled with supportive government initiatives promoting advanced therapeutic technologies, are providing strong impetus to market growth. In addition, the increasing availability of multi-functional devices that combine diagnostic, monitoring, and therapeutic capabilities is encouraging adoption among healthcare professionals seeking efficient, integrated solutions

- The growing focus on improving clinical outcomes, reducing treatment times, and offering patient-friendly solutions is fostering widespread deployment of Electro-Medical Equipment across both developed and emerging markets

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- Despite the growing adoption of electro-medical equipment, the high initial investment required for acquiring advanced devices remains a significant barrier, particularly for small and medium-sized healthcare facilities, clinics in emerging markets, and budget-conscious hospitals. The cost factor not only includes the purchase price but also associated expenses such as installation, calibration, regular maintenance, software updates, and consumables, which can further strain financial resources

- Many Electro-Medical Equipment devices are technologically sophisticated and require trained personnel for proper operation, monitoring, and troubleshooting. The need for specialized training programs for healthcare staff, as well as continuous skill upgrades to keep pace with evolving technology, adds to operational challenges and increases the burden on healthcare institutions

- Regulatory compliance and certification processes further complicate deployment, as manufacturers and healthcare providers must ensure that devices meet stringent international and local standards for safety, efficacy, and reliability. This often involves extensive documentation, periodic audits, and adherence to complex clinical protocols, which can slow down adoption

- In addition, some devices may face integration challenges with existing hospital information systems or electronic health record platforms, requiring additional investments in IT infrastructure and technical support. These factors collectively can limit the widespread adoption of Electro-Medical Equipment in resource-constrained settings

- To mitigate these challenges, industry players are increasingly focusing on developing cost-effective, user-friendly, and scalable devices. Solutions that combine multiple functionalities, simplify operation, reduce maintenance requirements, and offer comprehensive training programs are expected to enhance accessibility and encourage broader adoption across diverse healthcare settings

Electro-Medical Equipment Market Scope

The market is segmented on the basis of device type, application, and end user.

- By Device Type

On the basis of device type, the global electro-medical equipment market is segmented into diagnostic imaging devices, patient assistive devices, surgical devices, and others. The diagnostic imaging devices segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the increasing demand for accurate, non-invasive diagnostic solutions across hospitals, clinics, and specialty centers. Innovations in MRI, CT, ultrasound, and digital radiography have enhanced image clarity, reduced examination times, and supported early disease detection, making these devices essential in modern healthcare. Moreover, the rising prevalence of chronic diseases and the growing need for routine screenings are further propelling the adoption of advanced imaging technologies.

The surgical devices segment is anticipated to register the fastest CAGR of 16.7% from 2025 to 2032, driven by the growing demand for advanced surgical interventions and the widespread adoption of minimally invasive procedures. Innovations in robotic-assisted surgery, image-guided systems, and computer-assisted surgical tools are significantly enhancing precision, accuracy, and efficiency in complex operations. Continuous improvements, including ergonomic instrument design, seamless integration with diagnostic imaging devices, and real-time intraoperative monitoring, are enabling surgeons to reduce procedure times, minimize complications, and optimize patient recovery.

- By Application

On the basis of application, the global electro-medical equipment market is segmented into dental, ophthalmology, cardiovascular, orthopedic, and others. The cardiovascular segment held the largest revenue share of 36.2% in 2024, reflecting the critical role of electro-medical equipment in diagnosing and managing heart-related conditions. Devices such as ECG monitors, defibrillators, and pacemakers allow continuous monitoring, early intervention, and improved patient management, which is increasingly important given the rising prevalence of cardiovascular diseases worldwide.

The orthopedic segment is projected to achieve the fastest CAGR of 15.8% from 2025 to 2032, driven by the rising prevalence of musculoskeletal disorders, the growing aging population, and the increasing adoption of cutting-edge surgical and assistive technologies. Innovations such as smart orthopedic implants, robotic-assisted surgical systems, and advanced patient rehabilitation devices are transforming treatment approaches by enabling highly precise surgical interventions, accelerating recovery, and supporting personalized patient care. In addition, the integration of digital monitoring tools and wearable devices allows clinicians to track post-operative progress, optimize rehabilitation protocols, and improve long-term functional outcomes, further propelling the demand for orthopedic devices across hospitals, specialty clinics, and homecare settings worldwide.

- By End-User

On the basis of end-user, the global electro-medical equipment market is segmented into clinics, hospitals, home care settings, and others. The Hospitals segment dominated with a market share of 53.1% in 2024, reflecting the extensive adoption and reliance on electro-medical equipment across both inpatient and outpatient healthcare settings. Hospitals serve as critical centers for performing complex diagnostic procedures, conducting high-precision surgical interventions, and providing continuous patient monitoring. They integrate a wide array of device types and applications—ranging from diagnostic imaging and surgical tools to patient assistive devices—to deliver comprehensive, advanced, and multidisciplinary healthcare services. Their capacity to invest in sophisticated technologies, implement cutting-edge treatment protocols, and manage large patient volumes reinforces their position as the primary end-users driving market growth.

he Home Care Settings segment is expected to witness the fastest CAGR of 17.2% from 2025 to 2032, driven by the growing emphasis on patient-centric care and the expansion of remote healthcare solutions. The increasing use of portable diagnostic devices, wearable monitoring systems, and assistive technologies is empowering patients to manage chronic conditions effectively from the comfort of their homes, significantly reducing the need for frequent hospital visits while enhancing overall quality of life. In addition, the rapid adoption of telehealth services, home-based care programs, and digital health platforms is further propelling the demand for electro-medical equipment in residential care environments

Electro-Medical Equipment Market Regional Analysis

- North America dominated the electro-medical equipment market with the largest revenue share of 41.00% in 2024, supported by a well-established healthcare infrastructure, strong government and private investments, and high adoption of advanced diagnostic and therapeutic technologies

- The region’s market growth is particularly driven by the U.S., where extensive deployments in hospitals, specialty clinics, and homecare settings are improving access to innovative electro-medical solutions

- The presence of technologically advanced healthcare facilities, rising patient awareness, and an emphasis on improving treatment outcomes are major factors driving market expansion

U.S. Electro-Medical Equipment Market Insight

The U.S. electro-medical equipment market captured the largest revenue share within North America in 2024, fueled by the increasing prevalence of chronic and lifestyle-related diseases, a growing geriatric population, and rising adoption of advanced diagnostic and therapeutic devices. Hospitals, specialty clinics, and homecare providers are integrating electro-medical equipment to enhance patient care, improve therapeutic precision, and reduce recovery times. Substantial investments in healthcare infrastructure, coupled with continuous innovation and R&D, are further strengthening the market’s growth trajectory.

Europe Electro-Medical Equipment Market Insight

The Europe electro-medical equipment market is projected to witness steady growth throughout the forecast period, driven by well-established healthcare systems, increasing investments in medical technologies, and growing awareness of non-invasive therapeutic solutions. Countries such as Germany, France, and the U.K. are witnessing greater adoption of electro-medical devices across hospitals, rehabilitation centers, and specialty clinics, as healthcare providers focus on improving treatment efficiency, patient outcomes, and clinical workflows.

U.K. Electro-Medical Equipment Market Insight

The U.K. electro-medical equipment market is expected to grow at a significant CAGR during the forecast period, propelled by rising investments in healthcare infrastructure, increasing focus on advanced rehabilitation therapies, and a growing aging population with chronic conditions. Hospitals and specialty clinics are the primary adopters, incorporating electro-medical devices to provide precise therapeutic interventions, improve patient recovery times, and enhance overall clinical care.

Germany Electro-Medical Equipment Market Insight

The Germany electro-medical equipment market is anticipated to expand at a considerable CAGR, supported by the country’s technologically advanced healthcare infrastructure, emphasis on precision medicine, and strong focus on innovation in medical devices. The rising prevalence of neurological, musculoskeletal, and lifestyle-related disorders is encouraging hospitals and rehabilitation centers to deploy electro-medical equipment to deliver effective treatment, optimize patient outcomes, and streamline clinical procedures.

Asia-Pacific Electro-Medical Equipment Market Insight

The Asia-Pacific electro-medical equipment market is poised to grow at the fastest CAGR of 9.8% during the forecast period, driven by increasing healthcare expenditure, a rising incidence of chronic and lifestyle diseases, rapid urbanization, and government initiatives aimed at expanding healthcare infrastructure in countries such as China, India, and Japan. Adoption of electro-medical devices is accelerating in hospitals, specialty clinics, and homecare centers, supported by growing awareness about advanced therapeutic solutions and non-invasive treatments, which are helping improve patient care and clinical efficiency across the region.

Japan Electro-Medical Equipment Market Insight

The Japan electro-medical equipment market is gaining momentum due to the country’s advanced healthcare system, a high prevalence of lifestyle and age-related disorders, and a focus on early diagnosis, rehabilitation, and effective treatment delivery. Hospitals and specialty clinics are increasingly incorporating electro-medical devices to enhance treatment precision, support patient recovery, and improve overall healthcare quality, while technological advancements continue to bolster adoption rates.

China Electro-Medical Equipment Market Insight

The China electro-medical equipment market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, a growing middle class, increasing prevalence of chronic and lifestyle diseases, and strong government initiatives to expand healthcare infrastructure. Hospitals, specialty clinics, and homecare providers are actively deploying electro-medical devices to enhance diagnostic capabilities, provide advanced therapeutic interventions, and ensure improved patient management. The country’s focus on healthcare modernization and increasing investments in medical technology are key factors driving sustained market growth.

Electro-Medical Equipment Market Share

The electro-medical equipment industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Johnson & Johnson and its affiliates. (U.S.)

- Baxter (U.S.)

- BD (U.S.)

- Electro Medical, Inc. (U.S.)

- Cardinal Health (U.S.)

- HEINE Optotechnik GmbH & Co. KG (Germany)

- Smith+Nephew (UK)

- Boston Scientific Corporation (U.S.)

- B. Braun SE (Germany)

- Zimmer Biomet (U.S.)

- Abbott (U.S.)

- Stryker (U.S.)

Latest Developments in Global Electro-Medical Equipment Market

- In August 2024, Seer Medical, an Australian med-tech start-up specializing in at-home epilepsy monitoring, entered administration despite receiving USD 30 million in funding from Victoria's venture capital fund. The company faced severe cash flow issues and a court dispute, leading to its financial collapse. This event underscores the challenges faced by med-tech startups in achieving financial sustainability

- In April 2024, Philips announced a finalized agreement with the U.S. government concerning its sleep apnea machines, following a significant recall initiated in 2021 due to potential health risks associated with foam degradation. The settlement included a USD 1.075 billion compensation package for affected consumers and a USD 25 million fund for medical monitoring. In addition, a federal court issued a consent decree mandating Philips to restrict production and sales of certain devices until specific remediation measures were implemented at its U.S. facilities

- In May 2025, Siemens Healthineers' innovative photon-counting CT scanner, the Naeotom Alpha, faced potential business disruptions due to proposed global tariffs by the U.S. government. The scanner, developed in Germany's "Medical Valley," offers superior imaging clarity and reduced radiation exposure. However, the proposed 50% tariffs on EU goods threatened to inflate costs and delay procurement, potentially impacting access to this advanced medical technology

- In January 2025, Medtronic announced plans to spin off its diabetes business into a separate publicly traded company within 18 months. This strategic move aims to allow Medtronic to concentrate on its more profitable cardiovascular, neuroscience, and surgical device segments. The new diabetes-focused entity, headquartered in Northridge, California, will employ approximately 8,000 individuals and is expected to drive innovation and growth in the diabetes care sector

- In June 2025, the European Union implemented a policy barring Chinese companies from participating in most public tenders for medical devices valued over five million euros. This decision, part of the EU's International Procurement Instrument, was based on findings that Chinese markets deny fair access to European firms. The move has significant implications for global trade dynamics in the medical device industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.