Global Electronic Article Surveillance Labels Eas Market

Market Size in USD Billion

CAGR :

%

USD

1.17 Billion

USD

1.78 Billion

2024

2032

USD

1.17 Billion

USD

1.78 Billion

2024

2032

| 2025 –2032 | |

| USD 1.17 Billion | |

| USD 1.78 Billion | |

|

|

|

|

Electronic Article Surveillance Labels (EAS) Market Analysis

The electronic article surveillance labels market focuses on anti-theft solutions integrated into retail and supply chain sectors to safeguard merchandise. These labels, leveraging technologies such as radio frequency, acousto-magnetic, and electromagnetic systems, act as essential tools in minimizing shrinkage and improving inventory accuracy. Market growth is driven by expanding retail sectors, rising concerns over theft, and advancements in label designs offering seamless integration with packaging. Recent developments include the introduction of more discreet, eco-friendly labels and the adoption of digital tracking capabilities. Major players are investing in R&D to enhance detection accuracy and compatibility across diverse retail environments. The market sees significant demand from supermarkets, apparel stores, and drugstores, driven by a surge in organized retail and e-commerce. With the adoption of smart security solutions, electronic article surveillance labels are poised to remain indispensable in securing products while ensuring operational efficiency in retail ecosystems.

Electronic Article Surveillance Labels (EAS) Market Size

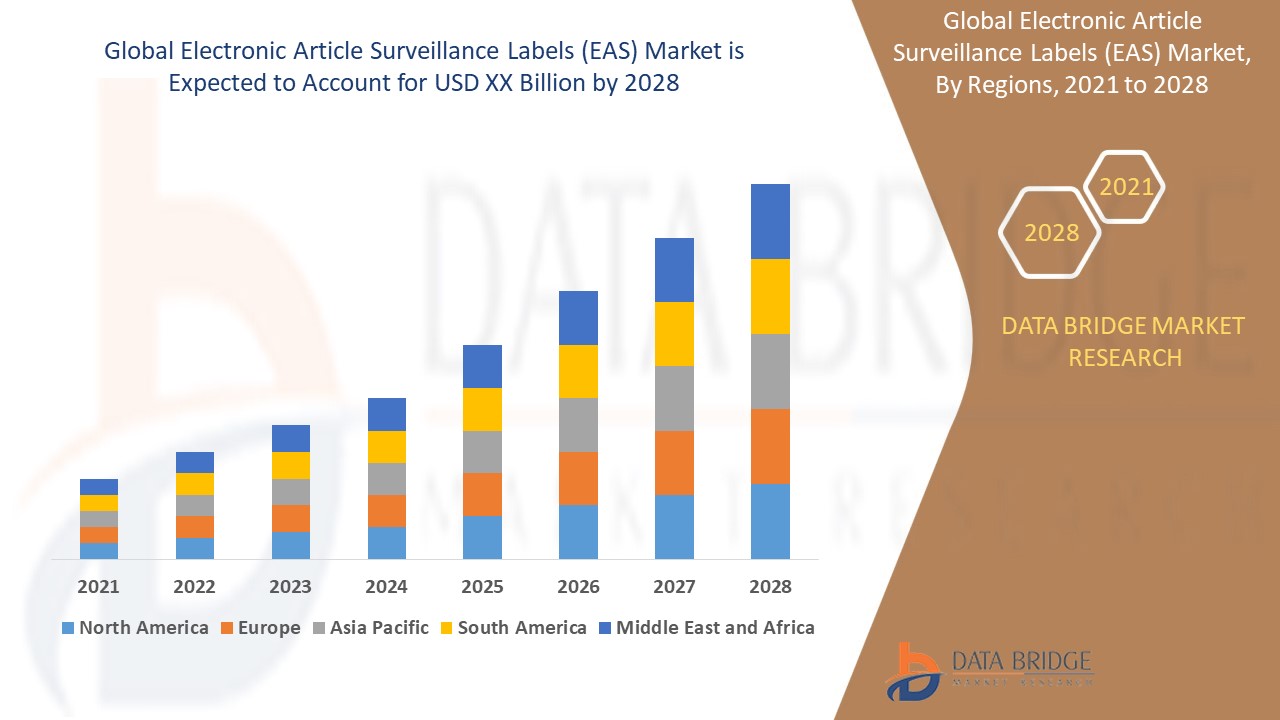

The electronic article surveillance labels (EAS) market size was valued at USD 1.17 billion in 2024 and is projected to reach USD 1.78 billion by 2032, with a CAGR of 5.4% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Electronic Article Surveillance Labels (EAS) Market Trends

“Development of Eco-Friendly and Reusable Labels”

The electronic article surveillance labels market is evolving as a critical component of retail security, helping businesses combat theft and streamline inventory management. These labels, powered by acousto-magnetic and radio frequency technologies, have become essential in reducing shrinkage across retail sectors. Innovation in this space includes the development of eco-friendly and reusable labels, aligning with sustainability goals while enhancing cost efficiency. A prominent trend is the integration of smart technologies, such as IoT-enabled labels, which offer real-time tracking and data analytics for improved operational insights. With growing demand from apparel, grocery, and pharmacy sectors, the market continues to expand, driven by advancements in security solutions and the rising emphasis on efficient retail management systems.

Report Scope and Electronic Article Surveillance Labels (EAS) Market Segmentation

|

Attributes |

Electronic Article Surveillance Labels (EAS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Checkpoint Systems, Inc. (U.S.), Johnson Controls (Ireland), Agon Systems Ltd. (U.K.), ALL-Tag Corporation (U.S.), AMERSEC (Czech Republic), Tag (U.K.), KETEC PRECISION TOOLING CO., LTD. (Taiwan), BTCB, Incorporated (U.S.), Softdel (India), Dongguan Lifangmei Electronic Technology Co., Ltd. (China), TAKACHIHO KOHEKI CO., LTD. (Japan), Shopguard (Hungary), Dexilon Automation (India), Feltron Security Systems LLC (UAE), Sentry Custom Security (Canada), Nedap N.V. (Netherlands), GATEWAY SECURITY SWEDEN AB (Sweden), Hangzhou Century Co., Ltd. (China), Tyco Security Products (U.S.), Vintage Securities Limited (Australia), Safegear (Denmark), Endeavor Business Media, LLC. (U.S.), The F.E. Moran Group (U.S.), Industrial Security Solutions (U.S.), SPIE AGIS Fire & Security Ltd. (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electronic Article Surveillance Labels (EAS) Market Definition

Electronic article surveillance labels (EAS labels) are security tags or labels used to prevent theft and unauthorized removal of items from retail stores or other establishments. These labels are typically integrated with technologies such as acousto-magnetic, radio frequency, or electromagnetic systems. EAS labels are activated and deactivated at checkout points, triggering alarms if items with active labels are moved through security gates. They are widely used in industries such as retail, libraries, and supply chains to enhance loss prevention, improve inventory management, and ensure product security.

Electronic Article Surveillance Labels (EAS) Market Dynamics

Drivers

- Rising Retail Theft and Shrinkage

The increasing incidents of theft and inventory shrinkage in the retail sector have become a significant challenge for businesses worldwide, leading to substantial financial losses each year. As retail theft continues to rise, there is an urgent need for more effective security solutions to safeguard merchandise. Electronic article surveillance (EAS) labels have emerged as a robust tool to combat this issue. These labels, integrated with advanced security technologies such as RFID and acousto-magnetic systems, provide an effective deterrent against theft. The growing concern over shrinkage is, therefore, driving demand for EAS labels, positioning them as a critical market driver in the retail industry.

- Focus on Inventory Management

As retailers increasingly focus on improving inventory management and minimizing losses, electronic article surveillance (EAS) labels have become a crucial tool in ensuring operational efficiency. These labels prevent theft and enhance stock accuracy by providing real-time tracking of products. With EAS labels, retailers can gain better visibility into their inventory, reducing discrepancies and the risk of stockouts or overstocking. The ability to integrate EAS labels with other technologies such as RFID and IoT further streamlines operations, allowing for smoother logistics and supply chain management. This growing need for efficient inventory control and loss prevention is a significant driver of the EAS market's growth.

Opportunities

- Integration with IoT and Smart Technology

The integration of electronic article surveillance (EAS) labels with Internet of Things (IoT) technology is creating significant opportunities in the retail sector. By embedding IoT sensors into EAS labels, retailers can access real-time tracking and data analytics, enhancing inventory management processes. This technology allows for seamless communication between the labels and central systems, providing constant updates on product location, movement, and stock levels. With this integration, retailers can improve loss prevention, quickly identify discrepancies, and optimize stock replenishment. The ability to leverage IoT for smarter, more efficient operations presents a key market opportunity for the EAS label industry, meeting the growing demand for enhanced operational control and security.

- Customization and Advanced Features

The increasing demand for more customized and feature-rich electronic article surveillance (EAS) labels is driving innovation in the market. Retailers are seeking labels that provide theft protection and offer enhanced security features, such as tamper detection or integration with RFID technology. These advanced features enable greater accuracy in tracking inventory and improve the overall security of merchandise. Customizable EAS labels that can be tailored to different retail environments provide an opportunity for manufacturers to differentiate themselves in the market. As retailers focus on improving operational efficiency and security, this demand for innovative EAS labels presents a lucrative growth opportunity.

Restraints/Challenges

- Label Removal and Tampering

One of the key challenges in the electronic article surveillance (EAS) market is the issue of tampering or improper removal of EAS labels, which can compromise the effectiveness of security systems. In some cases, thieves or customers may attempt to disable or remove labels, rendering them ineffective in preventing theft. In addition, improper removal can lead to product damage or malfunctions in the security system, further impacting store operations. This tampering issue presents a significant market challenge, as it reduces the overall security efficiency of EAS systems and increases the need for more robust and tamper-resistant label designs.

- High Initial Cost

The high cost of implementing electronic article surveillance (EAS) systems represents a significant restraint for the market, particularly for smaller retailers or businesses with limited budgets. The expenses associated with purchasing EAS labels, tags, and the necessary infrastructure—such as antennas, detection systems, and installation—can be prohibitive for businesses with tight financial constraints. In addition, ongoing maintenance and upgrades to keep systems efficient add to the overall cost. This financial burden may discourage smaller enterprises from adopting EAS solutions, limiting their ability to enhance security and reduce shrinkage, and ultimately slowing the growth of the EAS market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Electronic Article Surveillance Labels (EAS) Market Scope

The market is segmented on the basis of component, technology, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Tags

- Antennas

- Detachers

Technology

- Video Wall

- Acousto-Magnetic

- Electro Magnetic

- Radio Frequency

- Microwave

End User

- Apparel and Fashion Accessories Stores

- Supermarket and Mass Merchandise Stores

- Drug and Health Product Stores

- Others

Electronic Article Surveillance Labels (EAS) Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, component, technology, and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

North America dominates the electronic article surveillance (EAS) labels market due to growing concerns over security in retail environments. The need to effectively manage and control customer movement within stores has become a crucial aspect for security authorities in the region. This focus on enhanced store security is expected to drive the growth of the EAS market in North America throughout the forecast period.

Asia-Pacific region is expected to experience substantial growth in the electronic article surveillance (EAS) labels market, driven by the expanding number of retail outlets. Factors such as strong economic development, rising consumerism, increased disposable incomes, and changing lifestyles are fueling this growth. In addition, the rise of supermarkets and mass-merchandise stores is expected to further boost the demand for EAS solutions in the region during the forecast period.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Electronic Article Surveillance Labels (EAS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Electronic Article Surveillance Labels (EAS) Market Leaders Operating in the Market Are:

- Checkpoint Systems, Inc. (U.S.)

- Johnson Controls (Ireland)

- Agon Systems Ltd. (U.K.)

- ALL-Tag Corporation (U.S.)

- AMERSEC (Czech Republic)

- Tag (U.K.)

- KETEC PRECISION TOOLING CO.,LTD (Taiwan)

- BTCB, Incorporated (U.S.)

- Softdel (India)

- Dongguan Lifangmei Electronic Technology Co.,Ltd (China)

- TAKACHIHO KOHEKI CO., LTD. (Japan)

- Shopguard (Hungary)

- Dexilon Automation (India)

- Feltron Security Systems LLC (UAE)

- Sentry Custom Security (Canada)

- Nedap N.V. (Netherlands)

- GATEWAY SECURITY SWEDEN AB (Sweden)

- Hangzhou Century Co., Ltd. (China)

- Tyco Security Products (U.S.)

- Vintage Securities Limited (Australia)

- Safegear (Denmark)

- Endeavor Business Media, LLC. (U.S.)

- The F.E. Moran Group (U.S.)

- Industrial Security Solutions (U.S.)

- SPIE AGIS Fire & Security Ltd. (France)

Latest Developments in Electronic Article Surveillance Labels (EAS) Market

- In June 2023, Controltek launched an innovative online RFID resource center, offering a major step forward in asset tracking, inventory management, and electronic article surveillance (EAS) solutions. This virtual platform acts as a comprehensive hub, providing businesses with essential information, insights, and educational resources on RFID technology. By enhancing awareness and knowledge, it supports businesses in optimizing their security and operational strategies through advanced RFID applications

- In April 2023, Checkpoint Systems, a global leader in RFID and RF technology solutions, acquired Alert Systems, a Denmark-based company renowned for its expertise in the Internet of Things (IoT), particularly in metal and magnet detection for the retail sector. This strategic acquisition is designed to strengthen Checkpoint Systems' portfolio of loss-prevention solutions, expanding its capabilities in advanced security technologies. The move further underscores Checkpoint's commitment to enhancing its product offerings and delivering innovative security solutions to the retail industry

- In July 2021, ADT Commercial announced its entry into the electronic article surveillance (EAS) market through a strategic partnership with WG Security Products Inc. and a team of experts from various vertical markets. This collaboration allows ADT to install and service WG Security Products' comprehensive EAS solutions across the United States. These solutions include advanced detection systems, specialty tags, hard tags, disposable labels, deactivation devices, and detachers, expanding ADT’s portfolio of security offerings in the retail sector

- In September 2020, Avery Dennison announced the release of the AD-362r6-P inlay, which integrates high-performance RAIN RFID (UHF) tag features with item-level tracking and digital ID capabilities. Designed for a wide range of retail apparel products and applications, this inlay also includes secondary loss prevention features commonly found in EAS tags. This combination of tracking and security features makes the AD-362r6-P inlay ideal for enhancing operational efficiency and loss prevention across various retail clothing products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Article Surveillance Labels Eas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Article Surveillance Labels Eas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Article Surveillance Labels Eas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.