Global Electronic Chemicals And Materials Market

Market Size in USD Billion

CAGR :

%

USD

67.02 Billion

USD

107.22 Billion

2025

2033

USD

67.02 Billion

USD

107.22 Billion

2025

2033

| 2026 –2033 | |

| USD 67.02 Billion | |

| USD 107.22 Billion | |

|

|

|

|

Electronic Chemicals and Materials Market Size

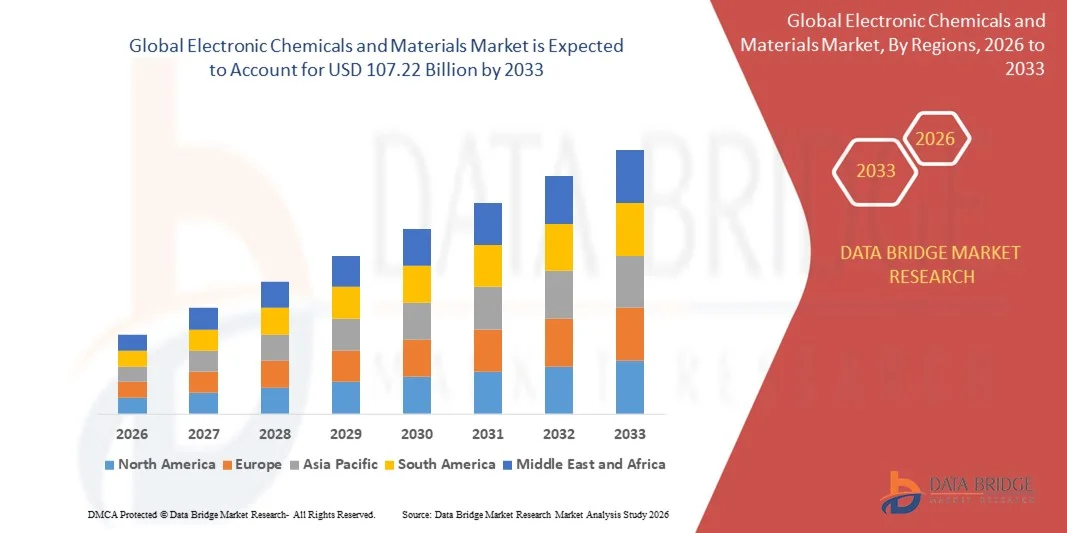

- The global electronic chemicals and materials market size was valued at USD 67.02 billion in 2025 and is expected to reach USD 107.22 billion by 2033, at a CAGR of 6.05% during the forecast period

- The market growth is largely fueled by the increasing demand for semiconductors, advanced electronics, and high-performance devices, which require specialized electronic chemicals and materials for fabrication, coating, and packaging processes

- Furthermore, rapid technological advancements in semiconductor manufacturing, rising adoption of miniaturized and high-density electronic components, and growing investments in electronics production are accelerating the uptake of electronic chemicals and materials, thereby significantly boosting the industry's growth

Electronic Chemicals and Materials Market Analysis

- Electronic chemicals and materials, including specialty gases, CMP slurries, photoresist chemicals, and conductive polymers, are essential for high-precision semiconductor fabrication, advanced packaging, and other electronics manufacturing applications due to their role in ensuring performance, reliability, and yield

- The escalating demand for these materials is primarily fueled by the growth of the semiconductor and electronics industries, increasing production of consumer and industrial electronics, and the rising need for high-purity, high-performance chemical solutions in next-generation devices

- Asia-Pacific dominated the electronic chemicals and materials market with a share of 69.6% in 2025, due to rapid expansion of semiconductor manufacturing, rising demand for advanced materials in consumer electronics, and a strong presence of chemical production hubs

- North America is expected to be the fastest growing region in the electronic chemicals and materials market during the forecast period due to robust demand for high-purity chemicals in semiconductors, electronics, and advanced materials

- Silicon wafers segment dominated the market with a market share of 44% in 2025, due to their role as the primary substrate for semiconductor fabrication and rising demand for high-performance integrated circuits across consumer electronics, automotive, and data center applications. The segment benefits from superior purity, uniformity, and compatibility with advanced lithography processes. Expansion of semiconductor fabrication facilities and increasing miniaturization of electronic components further support its market leadership

Report Scope and Electronic Chemicals and Materials Market Segmentation

|

Attributes |

Electronic Chemicals and Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electronic Chemicals and Materials Market Trends

Rising Adoption of High-Purity and Specialty Electronic Chemicals

- A significant trend in the electronic chemicals and materials market is the increasing adoption of high-purity and specialty chemicals across semiconductor fabrication, advanced packaging, and electronic device manufacturing, driven by the rising need for precision, reliability, and enhanced performance in next-generation electronics. This trend is elevating electronic chemicals as foundational elements for advanced semiconductor and electronics applications across automotive, consumer electronics, and industrial sectors

- For instance, JSR Corporation and FUJIFILM produce specialty photoresist and color filter materials that are widely used in semiconductor lithography and sensor manufacturing. Such materials ensure higher yields, improved device performance, and compatibility with miniaturized and complex designs

- The demand for CMP slurries, conductive polymers, and low-k dielectrics is growing rapidly as these chemicals enable wafer planarization, improved electrical performance, and efficient signal transmission. This is positioning specialty electronic chemicals as critical enablers for advanced semiconductor nodes and high-density packaging technologies

- The semiconductor industry is integrating advanced electronic chemicals into wafer processing, die bonding, and thin-film deposition applications where precision and consistency are paramount. This trend is accelerating innovation in next-generation semiconductor devices and high-performance integrated circuits

- Industries manufacturing consumer and industrial electronics are increasingly adopting high-purity gases, wet chemicals, and PCB laminates to support automated assembly lines, surface treatment processes, and high-speed device operations. This is shaping a stronger preference for chemicals that deliver both performance reliability and process efficiency

- The market is witnessing robust growth in high-performance electronics manufacturing where specialty chemicals contribute to device miniaturization, enhanced thermal management, and reduced defect rates. This rising incorporation of electronic chemicals is reinforcing the overall transition toward smarter, faster, and more reliable semiconductor and electronics systems

Electronic Chemicals and Materials Market Dynamics

Driver

Growing Demand from Semiconductor and Advanced Electronics Manufacturing

- The growing production of semiconductors, memory chips, and advanced electronics is driving demand for high-purity chemicals, specialty materials, and electronic-grade gases that enable precise fabrication and high-yield manufacturing. These materials ensure device performance, reliability, and longevity, which are critical across diverse applications

- For instance, companies such as Air Liquide and Cabot Corporation supply high-purity gases and CMP slurries that support wafer planarization, deposition, and etching processes. These chemicals are essential for maintaining production efficiency and meeting stringent semiconductor quality standards

- Rising adoption of advanced packaging technologies, miniaturized chips, and high-density electronic components is further fueling the need for specialty chemicals that support complex processes while reducing defects and improving throughput

- Increasing investments in semiconductor fabs and electronics manufacturing plants across Asia-Pacific, North America, and Europe are bolstering market demand. This expansion ensures steady consumption of high-performance electronic chemicals to meet global production needs

- The focus on integrating electronics into consumer devices, automotive systems, and industrial equipment continues to strengthen this driver. Manufacturers are increasingly relying on specialty materials to enhance device capabilities, reduce power consumption, and improve overall system reliability

Restraint/Challenge

Stringent Environmental and Regulatory Compliance Requirements

- The electronic chemicals and materials market faces challenges due to strict environmental regulations and compliance standards that govern the handling, storage, and disposal of hazardous chemicals. These requirements increase operational complexity and add to overall production costs

- For instance, companies such as Shin-Etsu Chemical and Linde must implement extensive safety protocols, emission control systems, and waste management processes to meet global chemical regulations. These measures extend production timelines and elevate compliance expenses

- The use of specialty gases, wet chemicals, and photoresist formulations involves adherence to safety and environmental standards, which can limit flexibility in scaling operations or introducing new chemical formulations

- Manufacturers face challenges in balancing high-purity production requirements with eco-friendly practices, as stringent regulations may restrict the use of certain raw materials or processes. This can impact product availability and innovation speed

- The market continues to encounter constraints related to maintaining regulatory compliance while ensuring cost-effective and high-quality chemical production. These challenges collectively place pressure on manufacturers to optimize processes, invest in sustainable solutions, and maintain competitiveness in the global electronic chemicals market

Electronic Chemicals and Materials Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the electronic chemicals and materials market is segmented into specialty gases, CMP slurries, conductive polymers, photoresist chemicals, low-k dielectrics, wet chemicals, silicon wafers, and PCB laminates. The silicon wafers segment dominated the market with the largest market revenue share of 44% in 2025, driven by their role as the primary substrate for semiconductor fabrication and rising demand for high-performance integrated circuits across consumer electronics, automotive, and data center applications. The segment benefits from superior purity, uniformity, and compatibility with advanced lithography processes. Expansion of semiconductor fabrication facilities and increasing miniaturization of electronic components further support its market leadership.

The CMP slurries segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in semiconductor and memory chip manufacturing for wafer planarization. CMP slurries enhance the surface uniformity of wafers, which is essential for high-performance integrated circuits and advanced packaging technologies. For instance, companies such as Cabot Microelectronics are innovating with tailored slurry formulations to improve wafer polishing efficiency and reduce defects. Increasing adoption in advanced nodes, along with the expansion of semiconductor fabrication capacities globally, supports the rapid growth of CMP slurries. Their technological advancements, cost-effectiveness, and ability to improve device yield contribute to their growing prominence in the market.

- By Application

On the basis of application, the electronic chemicals and materials market is segmented into semiconductors and others. The semiconductors segment dominated the market with the largest market revenue share in 2025, driven by the expanding global semiconductor industry and rising demand for consumer electronics, automotive electronics, and data center solutions. Semiconductor applications require highly specialized chemicals and materials to ensure precise fabrication, superior performance, and reliability of integrated circuits. The growth in semiconductor fabrication facilities and the continual innovation in chip designs reinforce the dominance of this segment. Strong investment in advanced technology nodes and collaborations between chemical suppliers and semiconductor manufacturers further support market leadership in this application segment.

The others segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing utilization of electronic chemicals and materials in emerging applications such as printed electronics, flexible displays, and advanced packaging solutions. For instance, conductive polymers are seeing rapid adoption in wearable electronics and flexible sensors due to their lightweight, adaptable, and conductive properties. Expanding research in next-generation electronics, combined with the rising adoption of miniaturized and multifunctional devices, propels the growth of this segment. Its ability to address evolving technological requirements and support innovative applications underlines its accelerating market trajectory.

Electronic Chemicals and Materials Market Regional Analysis

- Asia-Pacific dominated the electronic chemicals and materials market with the largest revenue share of 69.6% in 2025, driven by rapid expansion of semiconductor manufacturing, rising demand for advanced materials in consumer electronics, and a strong presence of chemical production hubs

- The region’s cost-effective manufacturing landscape, growing investments in specialty electronic chemicals, and increasing exports of high-purity materials are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of electronic chemicals in both semiconductor and advanced electronics sectors

China Electronic Chemicals and Materials Market Insight

China held the largest share in the Asia-Pacific electronic chemicals and materials market in 2025, owing to its position as a global leader in semiconductor fabrication and electronic component production. The country's strong industrial base, favorable government policies supporting high-tech chemical production, and extensive export capabilities for semiconductor-grade materials are major growth drivers. Demand is also bolstered by ongoing investments in specialty chemicals and high-purity materials for both domestic and international markets.

India Electronic Chemicals and Materials Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding semiconductor fabrication facilities, rising electronics manufacturing, and increasing investments in specialty chemical infrastructure. Initiatives supporting domestic production of high-purity electronic materials are strengthening the market. In addition, rising exports of electronic components and growing R&D capabilities in advanced materials are contributing to robust market expansion.

Europe Electronic Chemicals and Materials Market Insight

The Europe electronic chemicals and materials market is expanding steadily, supported by stringent quality standards, high demand for semiconductor-grade chemicals, and growing investments in sustainable specialty chemical production. The region emphasizes environmental compliance, precision manufacturing, and advanced material formulations, particularly for electronics and semiconductors. Increasing adoption of high-performance chemicals for custom applications further enhances market growth.

Germany Electronic Chemicals and Materials Market Insight

Germany’s electronic chemicals and materials market is driven by its leadership in precision semiconductor manufacturing, strong chemical industry heritage, and export-oriented production model. The country benefits from well-established R&D networks and partnerships between academic institutions and chemical manufacturers, fostering innovation in specialty electronic materials. Demand is particularly strong for high-purity chemicals used in semiconductors, polymers, and advanced electronics.

U.K. Electronic Chemicals and Materials Market Insight

The U.K. market is supported by a mature electronics and semiconductor sector, growing efforts to localize high-value chemical production, and increased demand for specialty materials. Focus on R&D, academic-industry collaborations, and investments in lab-scale synthesis and production of niche electronic chemicals allow the U.K. to maintain a significant presence in the high-value materials segment.

North America Electronic Chemicals and Materials Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand for high-purity chemicals in semiconductors, electronics, and advanced materials. Strong investment in semiconductor fabs, material science advancements, and rising reshoring of chemical manufacturing are boosting market expansion. Increasing collaboration between electronics manufacturers and specialty chemical companies further supports growth.

U.S. Electronic Chemicals and Materials Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive semiconductor and electronics industry, strong R&D infrastructure, and significant investment in specialty chemical production. The country’s focus on innovation, regulatory compliance, and sustainability encourages the use of high-purity electronic chemicals in semiconductor fabrication and advanced electronics. Presence of key industry players and a mature distribution network further solidify the U.S.'s leading position in the region.

Electronic Chemicals and Materials Market Share

The electronic chemicals and materials industry is primarily led by well-established companies, including:

- Air Liquide (France)

- Honeywell International Inc. (U.S.)

- Eastman Chemical Company (U.S.)

- Transene Company, Inc. (U.S.)

- Heraeus Holding (Germany)

- Air Products Inc. (U.S.)

- BASF SE (Germany)

- Linde plc (U.K.)

- Solvay (Belgium)

- Dow (U.S.)

- Cabot Corporation (U.S.)

- Hitachi, Ltd. (Japan)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- SONGWON (South Korea)

- Albemarle Corporation (U.S.)

- Ashland (U.S.)

- Merck KGaA (Germany)

Latest Developments in Global Electronic Chemicals and Materials Market

- In August 2024, JSR Corporation acquired all shares of Yamanaka Hutech Corporation, making YHC a wholly owned subsidiary. This strategic acquisition strengthens JSR's position in the semiconductor materials market by expanding its product portfolio in film-forming technologies. The move enhances JSR’s ability to provide integrated solutions, improves supply chain efficiency, and reinforces its competitive edge in meeting growing global demand for advanced semiconductor materials. The acquisition is expected to boost market share and foster innovation in high-performance electronic materials

- In May 2024, Air Liquide inaugurated a new diborane production facility at its advanced materials center in Sejong, South Korea. The facility, leveraging advanced analytical and digital technologies, aims to supply high-purity diborane critical for semiconductor manufacturing. This expansion reinforces Air Liquide's role in supporting Korea’s semiconductor ecosystem and strengthens its position in the global electronic chemicals market. By localizing advanced material production, the company can better serve rising regional demand while enhancing operational efficiency and reliability

- In April 2023, Resonac Corporation announced plans to increase production of its "Dicing Die Bonding Film" at the Goi Plant in Kamisu City, Japan, by 60%. This expansion addresses the growing demand for two-in-one adhesive solutions used in semiconductor packaging. By scaling up production, Resonac is positioning itself to capture greater market share in the semiconductor materials segment, improve supply responsiveness, and support the rising adoption of advanced packaging technologies. The enhanced capacity is set to operationalize by 2026, reinforcing the company’s market leadership

- In January 2023, Linde acquired nexAir, LLC, an independent packaged gas distributor in the U.S., acquiring the remaining 77.2% of shares it did not previously own. This strategic move expands Linde’s presence in the Southeast U.S. and strengthens its market position in industrial and electronic gases. By integrating nexAir’s existing operations and client base, Linde can enhance distribution efficiency, increase market penetration, and capture additional revenue streams in the high-demand packaged gas sector. The acquisition also supports long-term growth in the North American specialty gas market

- In December 2022, FUJIFILM Corporation announced the construction of a new semiconductor materials manufacturing facility in South Korea to produce color filter materials for image sensors. The facility, designed with cutting-edge manufacturing and evaluation capabilities, aims to meet increasing demand for high-quality, high-performance semiconductor materials. This expansion reinforces FUJIFILM’s market position in the semiconductor materials industry, strengthens its supply chain in Asia, and positions the company to capture growth opportunities driven by rising adoption of image sensors in consumer electronics and advanced imaging applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Chemicals And Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Chemicals And Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Chemicals And Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.