Global Electronic Contract Manufacturing And Design Services Market

Market Size in USD Billion

CAGR :

%

USD

598.31 Billion

USD

1,236.62 Billion

2024

2032

USD

598.31 Billion

USD

1,236.62 Billion

2024

2032

| 2025 –2032 | |

| USD 598.31 Billion | |

| USD 1,236.62 Billion | |

|

|

|

|

Electronic Contract Manufacturing and Design Service Market Size

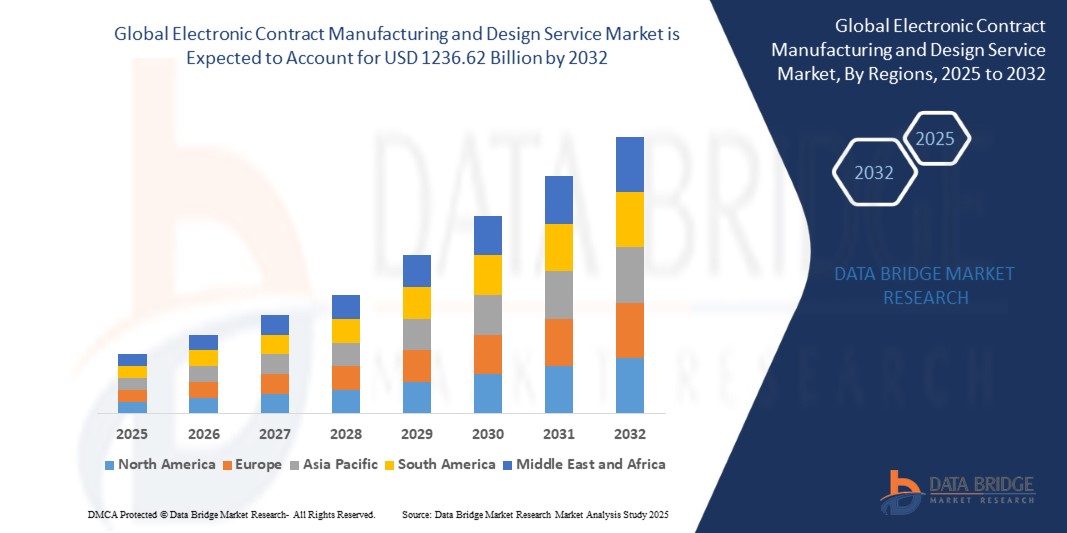

- The global Electronic Contract Manufacturing and Design Service market size was valued at USD 598.31 Billion in 2024 and is expected to reach USD 1236.62 Billion by 2032, at a CAGR of9.5% during the forecast period

- The development in consumer purchasing power and increase in the need for consumer electronics are also anticipated to flourish the growth of the electronic contract manufacturing and design service market. Furthermore, the rise in the functionalities, such as engineering, component assembly, sub-assembly manufacturing, design of printed circuit boards and serviceable testing offered by contract manufacturers are also likely to positively impact the growth of the market.

Electronic Contract Manufacturing and Design Service Market Analysis

- The Electronic Contract Manufacturing and Design Service Market is experiencing significant growth due to increasing demand for electric vehicles (EVs), advancements in battery technologies, and supportive government regulations focused on clean energy and carbon emission reduction.

- Key performance metrics used to evaluate battery performance in EVs, such as Cold Cranking Amperes (CCA), Amp-Hours (AH), power (watts), and Reserve Capacity (RC), are contributing to the need for specialized electronic design and manufacturing services. These factors, along with innovations in hybrid and electric automotive models from Original Equipment Manufacturers (OEMs), are accelerating market expansion.

- North America dominates the market with the largest revenue share of 46.01% in 2025, driven by the strong presence of lead-acid battery manufacturers, growing EV demand, and increasing government initiatives aimed at promoting eco-friendly technologies.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period. Factors include high demand for automotive applications in countries such as China and India, increased sales of passenger and commercial vehicles, and government incentives promoting EV adoption through subsidies.

- The Electronic Design and Engineering segment is expected to account for the largest market share of 25.9%, supported by rising EV production, technological advancements, and regulatory support. The segment benefits from the growing preference for lithium-ion batteries due to their superior energy density, longer lifespan, and fast charging capabilities.

Report Scope and Electronic Contract Manufacturing and Design Service Market Segmentation

|

Attributes |

Electronic Contract Manufacturing and Design Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electronic Contract Manufacturing and Design Service Market Trends

“Powering the Future of Mobility”

- One of the most significant trends in the Electronic Contract Manufacturing and Design Service market is the growing demand for advanced battery technologies, such as solid-state and lithium-sulfur. These next-generation batteries require sophisticated electronics, boosting the need for outsourced design, testing, and assembly services to support enhanced range, safety, and performance in electric vehicles (EVs).

- The integration of vehicle-to-grid (V2G) capabilities is expanding the scope of power electronics and control systems, creating demand for specialized contract design and manufacturing services. This trend is increasing opportunities for ECMDS providers in grid-interfacing modules and intelligent energy management systems.

- A rising focus on battery sustainability and recycling is encouraging OEMs to collaborate with ECMDS providers to develop recyclable and modular electronic systems. This supports compliance with global environmental regulations and helps streamline reverse logistics and battery disassembly operations.

- The emergence of modular battery platforms is enabling automakers to reduce costs and accelerate vehicle development. This scalability increases demand for standardized yet customizable electronic components, strengthening the role of contract manufacturers in providing flexible, platform-ready electronics across EV models.

Electronic Contract Manufacturing and Design Service Market Dynamics

Driver

““Surge in Electric Vehicle Production and Government Support”

- The rapid increase in global EV and hybrid vehicle production is a key growth driver for the ECMDS market. Automakers are outsourcing more electronic component design and assembly to meet rising demand while maintaining agility and reducing in-house complexity.

- Government-led support through emission reduction mandates, tax credits, and subsidies is encouraging OEMs to expand their EV lineups. This is creating more opportunities for contract manufacturing companies to deliver high-performance and regulatory-compliant electronic systems.

- Falling battery prices, driven by improved production processes and scale, are making EVs more accessible. This trend is resulting in greater investment in power electronics and control systems, directly benefitting electronic contract manufacturers.

Restraint/Challenge

“Raw Material Supply Constraints and Regulatory Hurdles”

- The ECMDS market is vulnerable to supply chain disruptions and cost volatility of critical materials such as lithium, cobalt, and nickel. These issues impact production timelines and costs for contract manufacturers involved in battery electronics and related assemblies.

- Varying regulatory frameworks across regions impose strict standards on battery safety, lifecycle performance, and environmental impact. This complexity raises operational and compliance costs for contract manufacturers and may slow new product launches.

- Inadequate EV infrastructure in developing markets limits EV adoption and consequently reduces the scale of demand for electronic components in those regions. This geographical imbalance can affect market penetration and planning strategies for ECMDS providers.

Electronic Contract Manufacturing and Design Service Market Scope

The market is segmented on the basis service type and end user.

- By Service Type

On the basis of service type, the Electronic Contract Manufacturing and Design Service market is segmented into electronic design and engineering, electronics assembly, electronic manufacturing, others. The electronic design and engineering segment dominates the largest market revenue share of 42.1% in 2025,. The Electronic Design and Engineering segment is driven by increasing demand for advanced, customized electronics in sectors like automotive and healthcare. Growth in EVs, IoT devices, and embedded systems fuels the need for high-performance circuit design, rapid prototyping, and specialized development services.

The electronics assembly segment is anticipated to witness the fastest growth rate of 18.7% from 2025 to 2032, Electronics Assembly is witnessing strong growth due to rising product complexity and miniaturization across consumer and industrial applications. Outsourcing assembly to contract manufacturers ensures scalability, cost efficiency, and quality control, especially for components used in battery management systems, sensors, and connected devices.

- By End User

On the basis of end user the Electronic Contract Manufacturing and Design Service market is segmented into Healthcare, Automotive, Industrial, Aerospace and Defense, IT and Telecom, Power and Energy, Consumer Electronics, Others. The healthcare held the largest market revenue share in 2025. The healthcare segment is propelled by growing demand for wearable devices, diagnostic equipment, and remote patient monitoring systems. Strict regulatory requirements and the need for precision and reliability make electronic contract manufacturing essential for producing medical-grade components and high-reliability circuit assemblies.

The automotive segment is expected to witness the fastest CAGR from 2025 to 2032, In the automotive segment, rapid electrification and the shift toward autonomous and connected vehicles are key growth drivers. OEMs increasingly rely on contract manufacturers to supply electronic control units, battery systems, and power electronics, enabling faster innovation and production scalability in EV platforms.

Electronic Contract Manufacturing and Design Service Market Regional Analysis

- North America dominates the Electronic Contract Manufacturing and Design Service market with the largest revenue share of 45.01% in 2024, North America leads the ECMDS market due to strong demand for electric vehicles, advanced healthcare electronics, and defense-grade components. The presence of leading OEMs and high R&D investment supports regional growth. Emphasis on localized production and digital manufacturing further accelerates market expansion across automotive and medical sectors.

U.S. Electronic Contract Manufacturing and Design Service Market Insight

The U.S. Electronic Contract Manufacturing and Design Service market captured the largest revenue share of 71.2% within North America in 2025, The U.S. market is driven by technological innovation, increasing EV production, and a growing medtech industry. Government incentives for reshoring electronics manufacturing and clean energy initiatives push OEMs to rely on contract design and assembly partners. High-tech applications in aerospace, automotive, and diagnostics fuel ongoing ECMDS demand.

Europe Electronic Contract Manufacturing and Design Service Market Insight

The Europe Electronic Contract Manufacturing and Design Service market is projected to expand at a substantial CAGR throughout the forecast period, Europe’s ECMDS market growth is supported by strict emissions regulations, rising EV adoption, and the medical device industry's expansion. Contract manufacturers play a vital role in helping European OEMs meet green targets and accelerate digital healthcare solutions. Strong demand comes from Germany, France, and Nordic countries focused on innovation.

Germany Electronic Contract Manufacturing and Design Service Market Insight

The Germany Electronic Contract Manufacturing and Design Service market is anticipated to grow at a noteworthy CAGR during the forecast period, Germany’s market is driven by its leadership in automotive engineering and industrial automation. As manufacturers shift toward electric and autonomous vehicles, demand for sophisticated electronic design and assembly rises. ECMDS firms benefit from collaborations with automotive giants and investments in energy-efficient power electronics and smart mobility infrastructure.

France Electronic Contract Manufacturing and Design Service Market Insight

The France Electronic Contract Manufacturing and Design Service market is expected to expand at a considerable CAGR during the forecast period, France is emerging as a key ECMDS hub, propelled by government support for e-mobility and medical technology innovation. French companies increasingly outsource electronic design to improve product efficiency and regulatory compliance. Growth is supported by local manufacturing incentives and demand for advanced electronics in EVs, aerospace, and diagnostics.

Asia-Pacific Intelligence Systems Market Insight

The Asia-Pacific Electronic Contract Manufacturing and Design Service market is poised to grow at the fastest CAGR of over 25.1% in 2025, Asia-Pacific is the fastest-growing ECMDS market, led by booming consumer electronics, EV, and medical device industries. Favorable government policies, low-cost skilled labor, and regional supply chain integration drive market expansion. Contract manufacturers in this region support high-volume, high-speed production with advanced design and prototyping capabilities.

Japan Electronic Contract Manufacturing and Design Service Market Insight

Japan’s ECMDS market is driven by precision engineering, robotics, and automotive electronics. With a focus on miniaturization and high-reliability components, Japanese firms collaborate with contract manufacturers for advanced design and high-tech assembly. Demand from healthcare, electric mobility, and smart devices supports consistent growth and technological advancement.

China Electronic Contract Manufacturing and Design Service Market Insight

The China Electronic Contract Manufacturing and Design Service market accounted for the largest market revenue share in Asia Pacific in 2025, China dominates ECMDS growth in Asia-Pacific due to massive EV production, battery manufacturing capacity, and strong consumer electronics demand. Supportive government policies and low manufacturing costs make it a global hub for contract electronics. Companies invest in automation and quality control to meet international standards and export demand.

Electronic Contract Manufacturing and Design Service Market Share

The Electronic Contract Manufacturing and Design Service industry is primarily led by well-established companies, including:

- FLEX LTD

- Asteelflash Group

- Celestica Inc.

- Kimball Electronics Inc.

- Venture Corporation Limited

- Benchmark Electronics

- ACTIA Group

- Zollner Elektronik

- Keytronic

- Jabil Inc.

- SGS Tekniks

- RAYMING TECHNOLOGY

- NEOTech Inc.

- EXCELICA / Electronic Contract Manufacturer

- QUANTRONIC CORPORATION

- Saline Lectronics, Inc.

- Matric Group, Inc.

- Orbweaver Inc.

- Sanmina Corporation

- A&D Precision Inc.

- Sparqtron Corporation

Latest Developments in Global Electronic Contract Manufacturing and Design Service Market

- In May 2025, Foxconn's EV subsidiary, Foxtron, signed a landmark agreement with Mitsubishi Motors to produce electric vehicles (EVs) for the Australian and New Zealand markets. Production is set to commence in Taiwan by the second half of 2026.

- On March 4, 2025, Jabil announced plans to open a new factory in Gujarat, India. This expansion aims to support the nation's developing photonics capabilities and strengthen Jabil's manufacturing footprint in the region.

- In early 2025, Wistron began operations at its new $24.5 million manufacturing plant in Ha Nam Province, Vietnam. The facility is expected to produce a wide range of electronics, including LCD panels and notebooks, enhancing Wistron's production capacity in the region.

- On February 5, 2025, Jabil acquired Pharmaceutics International, Inc. (Pii), a contract development and manufacturing organization (CDMO). This strategic move expands Jabil's capabilities in drug development, clinical trials, and commercial manufacturing, marking its entry into the healthcare sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.