Global Electronic Design Automation Software Market

Market Size in USD Billion

CAGR :

%

USD

12.12 Billion

USD

25.90 Billion

2024

2032

USD

12.12 Billion

USD

25.90 Billion

2024

2032

| 2025 –2032 | |

| USD 12.12 Billion | |

| USD 25.90 Billion | |

|

|

|

|

Electronic Design Automation Software Market Analysis

The electronic design automation (EDA) software market has experienced substantial growth driven by continuous technological advancements and increasing demand for complex semiconductor designs. The growing need for smaller, faster, and more efficient electronic devices has created a surge in demand for EDA tools. These tools facilitate the design, simulation, verification, and testing of integrated circuits (ICs), PCBs, and other electronic systems, significantly improving the efficiency of the design process. Moreover, the integration of AI and machine learning in EDA tools has accelerated the design and simulation process, offering more accurate predictions and reducing time-to-market for new electronic products. The adoption of EDA software in various sectors such as automotive, telecommunications, and consumer electronics is further contributing to market expansion, particularly as these industries demand increasingly complex and high-performance electronic components.

Electronic Design Automation Software Market Size

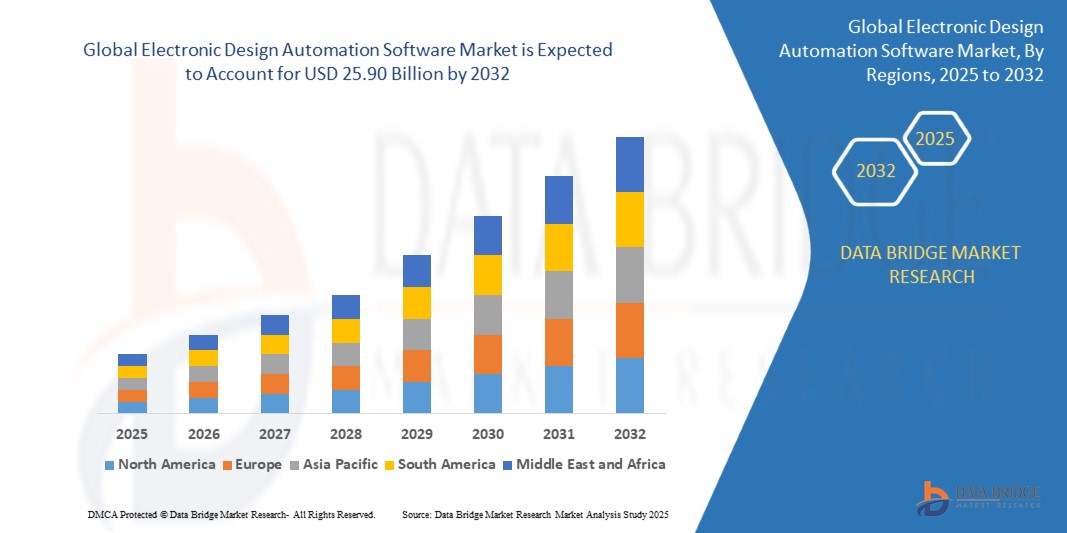

The global electronic design automation software market size was valued at USD 12.12 billion in 2024 and is projected to reach USD 25.90 billion by 2032, with a CAGR of 9.30% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Electronic Design Automation Software Market Trends

“AI-Powered EDA Tools"

One of the most significant trends driving growth in the EDA software market is the incorporation of artificial intelligence (AI) to optimize the design and testing phases. AI-based tools can automatically identify design flaws, optimize layouts, and predict performance issues before hardware is manufactured. Companies such as Cadence Design Systems and Synopsys are investing heavily in AI to enhance their software offerings, improving design efficiency and accuracy. This trend is expected to push the adoption of EDA tools across various sectors, including automotive, consumer electronics, and telecommunications, as the demand for more complex and faster electronic systems increases.

Report Scope and Electronic Design Automation Software Market Segmentation

|

Attributes |

Digital Out-of-Home Advertising Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America |

|

Key Market Players |

Cadence Design Systems (U.S.), Synopsys Inc. (U.S.), Mentor Graphics (Siemens) (U.S.), Keysight Technologies (U.S.), Altium (U.S.), ANSYS (U.S.), Xilinx (U.S.), Texas Instruments (U.S.), Infineon Technologies (Germany), NVIDIA Corporation (U.S.), Microchip Technology (U.S.), ARM Holdings (U.K.), TSMC (Taiwan Semiconductor Manufacturing Company) (Taiwan), Qualcomm Incorporated (U.S.), Analog Devices (U.S.), Aptiv (Ireland), Lattice Semiconductor (U.S.), Keysight Technologies (U.S.), National Instruments (U.S.), and Marvell Technology (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Electronic Design Automation Software Market Definition

Electronic Design Automation (EDA) software is a suite of tools used by engineers and designers to create, simulate, verify, and optimize electronic systems, including integrated circuits (ICs) and printed circuit boards (PCBs). These tools enable the design process of complex electronic systems, offering capabilities such as circuit design, system architecture development, simulation, verification, testing, and layout. EDA software is essential for automating repetitive tasks, improving design accuracy, and reducing the time required for product development in industries such as semiconductors, telecommunications, automotive, aerospace, and consumer electronics. It supports both on-premises and cloud-based deployments, with licensing options such as perpetual and subscription models.

Electronic Design Automation Software Market Dynamics

Drivers

- Increasing Complexity of Electronic Devices:

The growing complexity of electronic devices and systems is a major driver for the Electronic Design Automation (EDA) software market. As the demand for advanced devices such as smartphones, autonomous vehicles, and IoT (Internet of Things) devices rises, designers face increasingly intricate challenges in terms of power management, heat dissipation, and signal integrity. EDA tools help streamline the design process, enabling engineers to manage this complexity by automating tasks such as layout optimization, circuit simulation, and testing. For instance, tools like Cadence Allegro provide capabilities for PCB (Printed Circuit Board) design, while Synopsys' Design Compiler is used for optimizing ASIC (Application-Specific Integrated Circuit) designs. These tools are essential in shortening design cycles, reducing errors, and ensuring that products meet performance standards. As the devices evolve, so does the need for advanced EDA solutions that can handle such complexity efficiently.

- Miniaturization and Need for Precision:

The trend toward miniaturization in electronic devices is another significant driver for the EDA software market. As components continue to shrink in size, especially in the semiconductor and microelectronics industries, the precision required in designing these devices has become more critical. EDA tools are crucial for ensuring that the design meets strict performance requirements at smaller scales. Software solutions, such as Mentor Graphics' Calibre, are used to verify design integrity at the nanometer scale, optimizing layouts and preventing errors that could lead to product failure. This precision is essential for creating advanced integrated circuits (ICs) with billions of transistors packed into tiny spaces. As demand grows for smaller, more powerful devices across various industries, including telecommunications, healthcare, and consumer electronics, the need for precise design and simulation tools becomes even more pressing, fueling further growth in the EDA software market.

Opportunities

- Growth in AI and Machine Learning Integration:

One of the key opportunities for the Electronic Design Automation (EDA) software market is the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies. AI and ML can significantly enhance the design process by automating complex tasks such as circuit optimization, defect detection, and performance prediction. For example, EDA tools can leverage machine learning algorithms to identify design flaws or inefficiencies that would be difficult for human engineers to detect manually. Companies like Synopsys and Cadence are already incorporating AI-driven features in their tools to improve design accuracy and reduce time-to-market. This integration can not only enhance the capabilities of EDA software but also make the design process more efficient, creating new opportunities for companies that adopt these advanced technologies. As AI and ML continue to advance, the potential for EDA tools to drive innovation in design automation will continue to expand.

- Expansion in Automotive and IoT Industries:

Another significant opportunity for the EDA software market lies in the rapid growth of the automotive and Internet of Things (IoT) industries. As the automotive sector moves toward electric vehicles (EVs), autonomous driving systems, and advanced driver-assistance systems (ADAS), the demand for sophisticated electronic designs will increase, driving the need for EDA tools. Similarly, the IoT industry, with its vast network of connected devices, requires robust and efficient design solutions to handle the massive amount of data, power management, and interconnectivity involved in these systems. EDA tools are vital in optimizing designs for these complex applications. Companies like Mentor Graphics (now part of Siemens) and Cadence are increasingly focusing on the automotive and IoT markets with tailored solutions. As these sectors continue to grow, they will present a wealth of opportunities for EDA software providers to innovate and meet the evolving design needs of next-generation electronic systems.

Restraints/Challenges

- High Cost of EDA Software:

One of the primary challenges facing the Electronic Design Automation (EDA) software market is the high cost associated with these tools. EDA solutions, especially those designed for complex semiconductor and systems-level designs, can be prohibitively expensive for smaller companies or startups. The licensing fees, maintenance costs, and hardware requirements for running advanced EDA tools can be substantial, limiting access to only large corporations with significant R&D budgets. This financial barrier restricts the growth potential of smaller players and may lead to slower innovation across the industry. For example, leading EDA software providers such as Cadence and Synopsys offer enterprise-level solutions that are priced in the range of hundreds of thousands to millions of dollars annually. While some vendors are introducing more affordable, cloud-based solutions to mitigate this issue, the cost remains a significant restraint, particularly for small businesses and emerging markets.

- Complex Learning Curve and Expertise Requirement:

Another challenge in the EDA software market is the steep learning curve and the high level of expertise required to effectively use these tools. EDA software is highly specialized, often requiring users to have advanced knowledge in areas like electrical engineering, computer science, and design theory. The complexity of the software and the sophistication of the tasks it handles, such as circuit simulation, layout design, and signal integrity analysis, necessitate significant training and experience. This expertise gap can slow down the adoption of EDA tools, particularly in regions with fewer highly skilled professionals or in smaller companies with limited resources for training. Additionally, engineers must stay updated with constant advancements in software capabilities and design methodologies. As a result, the challenge of acquiring and retaining skilled personnel remains a significant barrier to the widespread adoption of EDA tools.

details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Electronic Design Automation Software Market Scope

The market is segmented on the basis of product, end user, application, deployment, licensing model, and size of organization. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- IC (Integrated Circuit) Design

- PCB (Printed Circuit Board) Design

- Systems Design

- Others

End User

- Semiconductors

- Automotive

- Telecommunications

- Consumer Electronics

- Aerospace and Defense

- Others

Application

- Design

- Simulation

- Verification

- Testing

Deployment

- On-Premises

- Cloud

Licensing Model

- Perpetual License

- Subscription License

Size of Organization

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Electronic Design Automation Software Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, end user, application, deployment, licensing model, and size of organization as referenced above.

The countries covered in the market report are U.S., Canada and Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina and rest of South America.

North America is expected to dominate the EDA software market due to factors such as the presence of a strong technology ecosystem, substantial R&D investments, and the increasing demand for semiconductors in industries such as telecommunications and automotive. Additionally, the region benefits from a highly skilled workforce, advancements in AI and machine learning technologies, and strong government support for innovation and technological development. The growing trend of automation in various sectors, along with the rapid adoption of advanced electronics in industries such as aerospace and defense, also contributes to the dominance of North America in the EDA software market.

Asia-Pacific is projected to exhibit the highest growth rate during the forecast period, driven by the rise of electronics manufacturing in countries such as China, Japan, and South Korea. The growing demand for consumer electronics and the rapid expansion of the automotive sector in the region are major factors contributing to the growth of the EDA software market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Electronic Design Automation Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Electronic Design Automation Software Market Leaders Operating in the Market Are:

- Cadence Design Systems (U.S.)

- Synopsys Inc. (U.S.)

- Mentor Graphics (Siemens) (U.S.)

- Keysight Technologies (U.S.)

- Altium (U.S.)

- ANSYS (U.S.)

- Xilinx (U.S.)

- Texas Instruments (U.S.)

- Infineon Technologies (Germany)

- NVIDIA Corporation (U.S.)

- Microchip Technology (U.S.)

- ARM Holdings (U.K.)

- TSMC (Taiwan Semiconductor Manufacturing Company) (Taiwan)

- Qualcomm Incorporated (U.S.)

- Analog Devices (U.S.)

- Aptiv (Ireland)

- Lattice Semiconductor (U.S.)

- Keysight Technologies (U.S.)

- National Instruments (U.S.)

- Marvell Technology (U.S.)

Latest Developments in Electronic Design Automation Software Market

- In March 2024, HCLTech launched an Electronic Design Automation (EDA) solution in partnership with NetApp. The solution enables semiconductor enterprises to accelerate EDA workloads in the hybrid cloud, improving scalability, flexibility, and overall product quality. It helps streamline the design process from concept to manufacturing, optimizing IT environments and managing workloads efficiently

- In January 2024, Synopsys announced the acquisition of Ansys for $35 billion, creating a leader in silicon-to-systems design solutions. This merger combines Synopsys' EDA expertise with Ansys' simulation and analysis capabilities, enhancing AI, compute performance, and efficiency for diverse industries while expanding Synopsys' market reach and growth potential

- In November 2023, Siemens Digital Industries Software acquired Insight EDA, enhancing its Calibre integrated circuit reliability verification offerings. The acquisition enables design engineers to incorporate design-specific reliability checks and analysis into IC design flows, strengthening Siemens’ leadership in circuit reliability with advanced EDA automation tools

- In February 2023, Keysight Technologies acquired Cliosoft, expanding its EDA software portfolio with advanced design data and IP management tools. This acquisition enhances Keysight's automation capabilities, integrating design-test workflows and improving productivity in semiconductor and electronics systems development

- In November 2024, Keysight Technologies introduced its EDA 2025 software suite, integrating AI and machine learning to streamline RF circuit design and chiplet interconnects. The software accelerates development for 5G/6G and data center applications, enhancing productivity and design efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.