Global Electronic Display Market

Market Size in USD Billion

CAGR :

%

USD

169.22 Billion

USD

224.04 Billion

2025

2033

USD

169.22 Billion

USD

224.04 Billion

2025

2033

| 2026 –2033 | |

| USD 169.22 Billion | |

| USD 224.04 Billion | |

|

|

|

|

Electronic Display Market Size

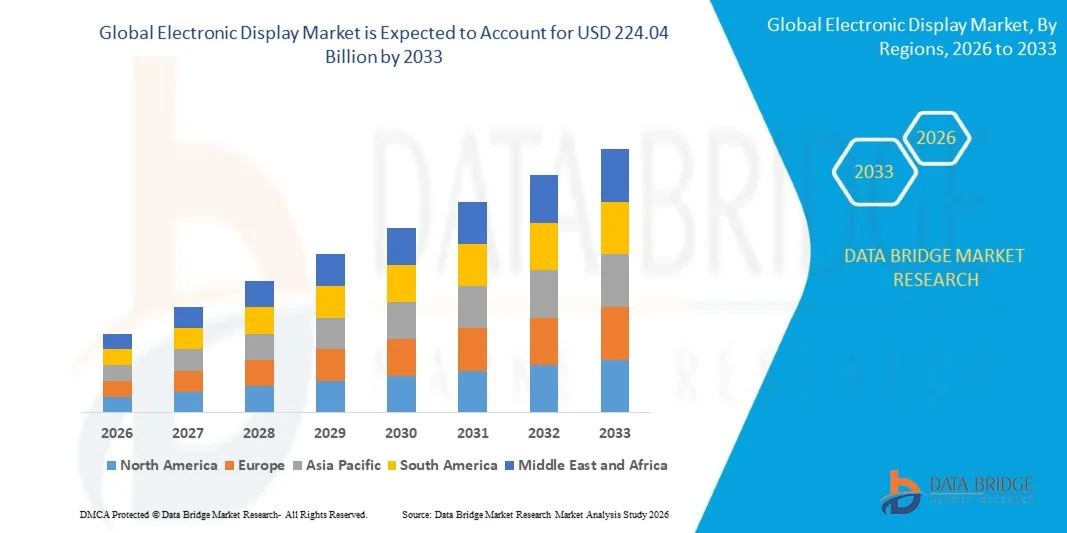

- The global electronic display market size was valued at USD 169.22 billion in 2025 and is expected to reach USD 224.04 billion by 2033, at a CAGR of 3.57% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-resolution displays in consumer electronics, growing adoption of OLED and AMOLED technologies, and rising use of electronic displays in automotive and healthcare applications

- The expansion of smart devices and digital signage solutions is further driving market growth

Electronic Display Market Analysis

- The market is witnessing technological innovations such as flexible, transparent, and foldable displays, which are opening new application opportunities

- Rising consumer preference for energy-efficient and high-performance displays is influencing product development strategies

- Asia-Pacific dominated the electronic display market with the largest revenue share of 41.70% in 2025, driven by rapid urbanization, rising disposable incomes, and technological advancements in China, Japan, India, and South Korea

- North America region is expected to witness the highest growth rate in the global electronic display market, driven by rising adoption of smart devices, connected homes, high-end TVs, and AR/VR applications requiring cutting-edge display solutions

- The OLED segment held the largest market revenue share in 2025, driven by its superior color accuracy, high contrast ratios, and energy efficiency. OLED displays are widely used in premium smartphones, TVs, and automotive dashboards, making them a preferred choice for applications demanding high-quality visuals and sleek form factors. Increasing R&D investments to improve durability, brightness, and cost efficiency are further supporting OLED adoption across consumer and professional applications. Manufacturers are also exploring hybrid OLED solutions to meet diverse industrial and healthcare requirements

Report Scope and Electronic Display Market Segmentation

|

Attributes |

Electronic Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Electronic Display Market Trends

“Rising Demand for High-Resolution and Energy-Efficient Displays”

• The growing adoption of high-resolution displays in consumer electronics, automotive dashboards, and smart appliances is significantly shaping the electronic display market, as consumers increasingly prefer devices with superior image quality, brightness, and color accuracy. OLED, AMOLED, and Mini-LED technologies are gaining traction due to their energy efficiency, thin form factor, and improved contrast ratios. This trend is driving manufacturers to innovate with new display panels that cater to evolving consumer expectations and premium product positioning

• Increasing integration of electronic displays in automotive, healthcare, and industrial applications has accelerated market growth. Advanced infotainment systems, medical imaging devices, and industrial monitoring solutions are adopting high-performance displays to enhance usability, reliability, and user experience. The rising focus on smart and connected devices further encourages collaborations between component suppliers and OEMs to optimize performance and functionality

• Energy efficiency and sustainability trends are influencing product development and purchasing decisions, with manufacturers emphasizing low-power consumption displays and eco-friendly production processes. Such initiatives help brands differentiate their products in competitive markets and appeal to environmentally conscious consumers, while also promoting adoption of certifications for energy efficiency and environmental standards

• For instance, in 2024, Samsung in South Korea and LG Display in South Korea launched next-generation OLED and MicroLED panels for TVs, monitors, and automotive applications. These panels were introduced in response to consumer demand for high-resolution, energy-efficient displays and were distributed across retail, B2B, and online channels. Marketing campaigns highlighted improved image quality, durability, and eco-conscious manufacturing

• While demand for electronic displays is growing, sustained market expansion depends on technological innovation, cost-effective production, and maintaining performance benchmarks across display types. Manufacturers are focusing on improving scalability, reducing production defects, and developing flexible, foldable, and transparent display solutions to capture emerging application opportunities

Electronic Display Market Dynamics

Driver

“Growing Adoption of High-Resolution and Energy-Efficient Displays”

• Rising consumer preference for devices with superior image quality, high brightness, and energy efficiency is a major driver for the electronic display market. Manufacturers are increasingly replacing older display technologies with OLED, AMOLED, and Mini-LED alternatives to meet consumer expectations and regulatory energy-efficiency standards

• Expanding applications in consumer electronics, automotive dashboards, healthcare imaging, and industrial monitoring are further influencing market growth. Electronic displays help improve user experience, operational efficiency, and product differentiation, enabling manufacturers to cater to high-value segments and premium offerings

• Display manufacturers are actively promoting next-generation technologies through product innovation, collaborations, and strategic marketing campaigns. These efforts are supported by rising demand for smart, connected, and eco-friendly devices, encouraging partnerships between component suppliers, OEMs, and system integrators to enhance performance and reliability

• For instance, in 2023, Samsung in South Korea and BOE Technology in China reported increased adoption of OLED and AMOLED displays across TVs, smartphones, and automotive infotainment systems. This expansion followed higher consumer demand for premium, energy-efficient, and high-performance displays, driving repeat purchases and product differentiation. Both companies also emphasized sustainability and advanced manufacturing processes in marketing campaigns to strengthen brand reputation

• Although rising consumer demand and technological trends support market growth, wider adoption depends on cost optimization, supply chain efficiency, and production scalability. Investment in advanced fabrication techniques, sustainable material sourcing, and defect reduction will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

“High Manufacturing Costs and Technological Complexity”

• The relatively higher cost of next-generation displays such as OLED, MicroLED, and AMOLED compared to conventional LCDs remains a key challenge, limiting adoption among price-sensitive consumer segments. High material costs, complex fabrication processes, and yield management contribute to elevated pricing and longer production cycles

• Technological complexity and integration challenges also restrict widespread adoption, particularly in emerging markets where demand for premium displays is still developing. Limited awareness of advanced display benefits and functional differences can slow uptake in cost-sensitive regions

• Supply chain constraints and component shortages impact market growth, as high-performance displays require specialized raw materials and adherence to stringent quality standards. Logistical complexities and production lead times increase operational costs, requiring manufacturers to invest in efficient supply chain management and quality control

• For instance, in 2024, manufacturers in India and Southeast Asia reported slower adoption of OLED and MicroLED displays in smartphones and automotive dashboards due to higher costs and technical integration challenges. Limited local manufacturing capacity and dependence on imported components affected availability and pricing, influencing product placement and retail visibility

• Overcoming these challenges will require cost-efficient production methods, expanded local manufacturing, and technology transfer initiatives. Collaboration with suppliers, OEMs, and research institutions can help unlock long-term growth potential. Developing cost-competitive, high-performance, and energy-efficient display solutions will be essential for broader adoption across global markets

Electronic Display Market Scope

The market is segmented on the basis of technology, display type, end use, and screen size.

• By Technology

On the basis of technology, the electronic display market is segmented into LCD, LED, OLED, MicroLED, and E-Paper. The OLED segment held the largest market revenue share in 2025, driven by its superior color accuracy, high contrast ratios, and energy efficiency. OLED displays are widely used in premium smartphones, TVs, and automotive dashboards, making them a preferred choice for applications demanding high-quality visuals and sleek form factors. Increasing R&D investments to improve durability, brightness, and cost efficiency are further supporting OLED adoption across consumer and professional applications. Manufacturers are also exploring hybrid OLED solutions to meet diverse industrial and healthcare requirements.

The MicroLED segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its high brightness, low power consumption, and long lifespan. MicroLED technology is increasingly adopted in large-format displays, signage, and next-generation consumer electronics, offering scalable solutions with superior visual performance compared to conventional LED and LCD panels. Innovations in manufacturing and mass production are gradually reducing costs, making MicroLED more accessible for mainstream applications

• By Display Type

On the basis of display type, the market is segmented into flat panel displays, flexible displays, transparency displays, 3D displays, and holographic displays. Flat panel displays held the largest share in 2025 due to widespread usage in TVs, monitors, and laptops, supported by mature manufacturing processes and cost efficiency. Growing demand for ultra-thin, high-definition panels in consumer electronics and enterprise solutions continues to drive flat panel adoption.

Flexible displays is expected to witness the fastest growth rate from 2026 to 2033, driven by innovations in foldable smartphones, wearable devices, and automotive interiors. Their lightweight, bendable form factor allows OEMs to introduce new designs and interactive applications. Increasing interest in foldable tablets and rollable signage is also contributing to market expansion

• By End Use

On the basis of end use, the market is segmented into consumer electronics, advertising signage, automotive displays, healthcare displays, and industrial displays. Consumer electronics held the largest revenue share in 2025, fueled by increasing demand for high-resolution TVs, smartphones, tablets, and smart appliances. Rising adoption of smart homes and connected devices is further encouraging display innovations tailored for user experience and energy efficiency.

Automotive displays are expected to witness the fastest growth from 2026 to 2033, driven by rising adoption of advanced infotainment systems, digital dashboards, and electric vehicle platforms that require high-performance, energy-efficient displays. Integration of AR-based heads-up displays, navigation screens, and digital instrument clusters is creating additional opportunities for display manufacturers.

• By Screen Size

On the basis of screen size, the market is segmented into small screens, medium screens, large screens, and giant screens. Medium screens accounted for the largest share in 2025, owing to their extensive use in smartphones, laptops, and tablets. Increasing consumer preference for high-resolution displays in portable devices is supporting continuous demand for medium-sized screens.

Giant screens is expected to witness the fastest growth rate from 2026 to 2033, propelled by demand for large-format digital signage, stadium displays, and commercial installations requiring ultra-high resolution and enhanced visual impact. Growth in advertising, events, and public display applications is also encouraging manufacturers to invest in modular and scalable large-screen solutions.

Electronic Display Market Regional Analysis

- Asia-Pacific dominated the electronic display market with the largest revenue share of 41.70% in 2025, driven by rapid urbanization, rising disposable incomes, and technological advancements in China, Japan, India, and South Korea

- Growing consumer demand for high-resolution TVs, smartphones, and automotive displays, supported by government initiatives promoting digitalization and smart manufacturing, is fueling market expansion

- APAC is also emerging as a hub for display panel production, making innovative displays more affordable and widely available

Japan Electronic Display Market Insight

The Japan electronic display market is expected to witness strong growth from 2026 to 2033 due to the country’s technology-driven culture, high smartphone penetration, and growing smart home adoption. Japanese consumers prioritize high-resolution, energy-efficient, and interactive displays. Integration with connected devices such as AR/VR systems, automotive infotainment, and healthcare monitoring solutions is further driving demand.

China Electronic Display Market Insight

The China electronic display market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid urbanization, expanding middle class, and technological adoption. High demand for smartphones, large-screen TVs, and commercial signage is propelling market growth. Government support for smart cities, combined with the presence of major domestic manufacturers, is enhancing accessibility and affordability of advanced display technologies across residential, commercial, and industrial segments.

North America Electronic Display Market Insight

North America electronic display market is expected to witness the fastest growth rate from 2026 to 2033, driven by high demand for advanced consumer electronics, automotive infotainment systems, and smart device. Consumers in the region highly value high-resolution, energy-efficient displays and innovative technologies such as OLED and MicroLED, which offer superior visual quality and thin, lightweight form factors. This widespread adoption is further supported by high disposable incomes, a tech-savvy population, and the growing preference for smart homes and connected devices, establishing electronic displays as a key component across residential, commercial, and industrial applications

U.S. Electronic Display Market Insight

The U.S. electronic display market is expected to witness the fastest growth rate from 2026 to 2033, fueled by strong adoption of smartphones, tablets, and high-definition TVs. Consumers are increasingly prioritizing energy efficiency, screen quality, and interactive features. The growing trend of smart homes, coupled with demand for advanced automotive displays and AR/VR applications, further propels market growth. Moreover, continuous R&D investments by display manufacturers to improve OLED and MicroLED performance are significantly contributing to the expansion of the market.

Europe Electronic Display Market Insight

The Europe electronic display market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising demand for OLED and flexible displays across consumer electronics, automotive, and commercial signage. Stringent energy-efficiency regulations and increasing urbanization are fostering adoption of high-performance displays. European consumers also prefer eco-friendly, low-power consumption displays, with growth seen in both new constructions and technology upgrades.

U.K. Electronic Display Market Insight

The U.K. electronic display market is expected to witness rapid growth from 2026 to 2033, fueled by increasing adoption of smart devices, interactive signage, and energy-efficient displays. Rising consumer awareness about high-resolution and environmentally sustainable products is encouraging manufacturers to introduce innovative display solutions. The U.K.’s strong retail and e-commerce infrastructure further supports distribution and market expansion.

Germany Electronic Display Market Insight

The Germany electronic display market is expected to witness significant growth from 2026 to 2033, driven by technological advancements, innovation in OLED and MicroLED panels, and growing adoption in automotive and industrial applications. The country’s well-developed infrastructure, focus on sustainability, and preference for premium, high-performance displays encourage manufacturers to introduce advanced solutions integrated with smart systems.

Electronic Display Market Share

The Electronic Display industry is primarily led by well-established companies, including:

- ActiveLight Inc. (U.S.)

- AUO Corporation (Taiwan)

- CASIO COMPUTER CO., LTD. (Japan)

- LG Electronics (South Korea)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- Sony Group Corporation (Japan)

- Zenith Electronics, LLC (U.S.)

- Samsung (South Korea)

- SHARP CORPORATION (Japan)

- Innolux Corporation (Taiwan)

Latest Developments in Global Electronic Display Market

- In June 2024, AUO, in collaboration with Acer, launched the world’s first display manufactured entirely using 100% green energy for the Aspire Vero 16 carbon-neutral laptop. The display leverages solar power and green energy wheeling, enhancing energy efficiency and supporting circular economy practices. This development promotes sustainability, meets the rising demand for carbon reduction among global brands, and positions AUO as a leader in eco-friendly display solutions, positively impacting the green technology segment of the market

- In May 2023, LG introduced a new Micro LED display designed for virtual production studios. The display delivers high brightness, precise color accuracy, and seamless integration, enabling immersive film and television production without traditional green screens. This innovation enhances visual quality, streamlines workflows for creators, and strengthens LG’s presence in the advanced display market, driving adoption of Micro LED technology across entertainment and professional sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Display Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Display Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Display Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.