Global Electronic Drug Delivery Systems Market

Market Size in USD Billion

CAGR :

%

USD

19.14 Billion

USD

37.85 Billion

2024

2032

USD

19.14 Billion

USD

37.85 Billion

2024

2032

| 2025 –2032 | |

| USD 19.14 Billion | |

| USD 37.85 Billion | |

|

|

|

|

Electronic Drug Delivery Systems Market Size

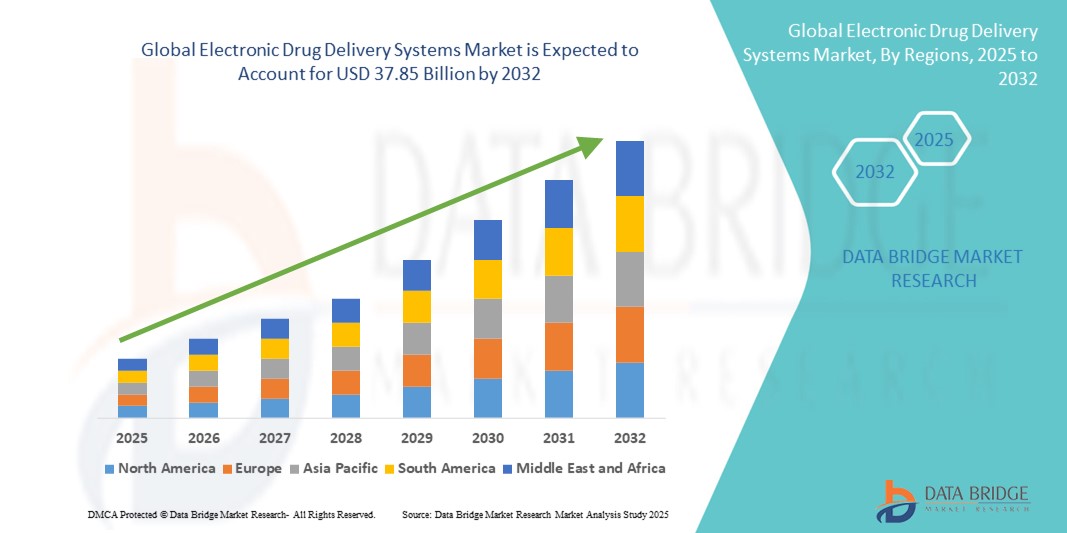

- The global electronic drug delivery systems market size was valued at USD 19.14 billion in 2024 and is expected to reach USD 37.85 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced drug delivery technologies and continuous technological progress in electronic healthcare devices, leading to enhanced efficiency and accuracy in medication administration across hospitals, clinics, and home-care settings

- Furthermore, rising patient demand for convenient, precise, and patient-centric drug delivery solutions is establishing electronic drug delivery systems as the preferred method for therapeutic administration. These converging factors are accelerating the adoption of electronic drug delivery systems solutions, thereby significantly boosting the growth of the global market

Electronic Drug Delivery Systems Market Analysis

- Electronic Drug Delivery Systems, offering precise and automated drug administration for patients, are increasingly vital components of modern healthcare due to their enhanced convenience, real-time monitoring capabilities, and integration with connected health technologies

- The escalating demand for electronic drug delivery systems is primarily fueled by the widespread adoption of smart healthcare solutions, growing patient focus on personalized therapy, and a rising preference for home-based or remote drug delivery

- North America dominated the electronic drug delivery systems market with the largest revenue share of 40.58% in 2024, characterized by early technology adoption, high healthcare expenditure, and a strong presence of key industry players. The U.S. experienced substantial growth in electronic drug delivery systems installations across hospitals, specialty clinics, and home-care settings, driven by innovations from both established companies and emerging startups focusing on connected and AI-enabled drug delivery solutions

- Asia-Pacific is expected to be the fastest-growing region in the electronic drug delivery systems market during the forecast period due to increasing urbanization, rising disposable incomes, and the expanding healthcare infrastructure in countries such as China, Japan, and India. The growing demand for advanced drug delivery solutions in hospitals, home care, and remote patient monitoring programs is driving this regional growth

- The battery-powered systems segment dominated with a electronic drug delivery systems market share of 62.3% in 2024, due to its reliability, portability, and consistent performance in hospitals, clinics, and home care. These systems ensure uninterrupted medication delivery, even in regions with irregular power supply

Report Scope and Electronic Drug Delivery Systems Market Segmentation

|

Attributes |

Electronic Drug Delivery Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electronic Drug Delivery Systems Market Trends

Rising Adoption Driven by Technological Advancements and Patient-Centric Solutions

- A significant trend in the global electronic drug delivery systems market is the increasing adoption of advanced, patient-friendly delivery technologies that enhance drug administration efficiency and compliance. These systems are designed to provide precise dosing, reduce errors, and improve therapeutic outcomes across chronic and acute treatments

- For instance, wearable insulin pumps and connected auto-injectors allow patients to manage their medication regimens with greater accuracy and minimal discomfort, offering real-time monitoring and dosage adjustments as prescribed by healthcare professionals. Similarly, implantable infusion pumps provide continuous, targeted drug delivery for conditions requiring long-term therapy

- Integration of connectivity and monitoring features within electronic drug delivery platforms enables seamless tracking of patient adherence, dosing schedules, and therapy outcomes, supporting clinicians in making informed treatment decisions. Advanced analytics capabilities also allow healthcare providers to optimize therapy plans and identify potential issues before they escalate

- The growing emphasis on personalized medicine and the rising prevalence of chronic diseases such as diabetes, cancer, and autoimmune disorders are driving the demand for innovative drug delivery solutions that enhance convenience, safety, and patient engagement

- Companies such as Medtronic, Insulet Corporation, and Ypsomed are developing sophisticated electronic drug delivery systems with features such as precision dosing, real-time monitoring, and integration with mobile health platforms, addressing evolving patient and healthcare provider needs

- The global market for electronic drug delivery systems is experiencing rapid growth, fueled by technological innovations, increasing patient awareness, and healthcare initiatives aimed at improving adherence, reducing side effects, and enhancing overall treatment effectiveness

Electronic Drug Delivery Systems Market Dynamics

Driver

Growing Need Due to Rising Demand for Efficient and Patient-Centric Drug Delivery

- The increasing prevalence of chronic diseases, coupled with the growing emphasis on patient adherence and precision medicine, is a significant driver for the heightened demand for advanced electronic drug delivery systems.

- For instance, in March 2024, Insulet Corporation launched the next-generation Omnipod DASH Insulin Management System, which offers improved connectivity, intuitive user interfaces, and real-time monitoring features. Such initiatives by key companies are expected to drive the Electronic Drug Delivery Systems market growth during the forecast perio

- Healthcare providers are increasingly adopting electronic drug delivery systems to ensure precise dosing, reduce medication errors, and enhance therapeutic outcomes, providing a significant improvement over conventional drug administration method

- Furthermore, the integration of connected platforms and smart monitoring features in drug delivery systems enables seamless tracking of patient adherence, dosage schedules, and treatment outcomes, supporting clinicians in optimizing therapy and improving patient engagement

- The convenience of user-friendly interfaces, automated dosing schedules, and compatibility with mobile applications are key factors propelling the adoption of electronic drug delivery systems in both hospital and homecare settings. The trend toward personalized therapy and rising awareness of innovative drug delivery solutions further contributes to market growth

Restraint/Challenge

Challenges Related to High Costs, Integration, and Adoption Barriers

- The relatively high cost of advanced electronic drug delivery systems compared to conventional drug administration methods poses a significant barrier, particularly for smaller clinics, emerging healthcare providers, and patients in cost-sensitive regions. These high upfront investments can delay adoption despite the long-term benefits of improved therapy adherence and reduced medication errors

- Integration with existing healthcare infrastructure remains a challenge, as many electronic drug delivery systems require compatibility with hospital IT platforms, electronic health records (EHRs), and monitoring tools. Healthcare providers need assurance that new systems will function seamlessly with legacy setups without disrupting workflows

- Complexity in device operation or lack of sufficient training for clinicians and patients can slow adoption. Proper education and support programs are critical to ensure correct usage, maximize therapeutic outcomes, and prevent errors

- Concerns around device maintenance, software updates, and long-term reliability may also influence purchasing decisions, especially for institutions managing multiple devices across different care settings

- Manufacturers are addressing these issues by developing cost-effective, user-friendly systems with broad interoperability, robust support networks, and simplified training programs. Ensuring affordability, ease of integration, and strong post-sales support will be essential for sustained growth and wider adoption of electronic drug delivery systems globally

Electronic Drug Delivery Systems Market Scope

The market is segmented on the basis of type, component, connectivity, system type, application, and end-user.

- By Type

On the basis of type, the global electronic drug delivery systems market is segmented into electronic infusion pumps, electronic injection pens, electronic auto-injectors, electronic inhalers, electronic capsules, and others. The electronic infusion pumps segment dominated with a revenue share of 35.7% in 2024, owing to its essential role in hospitals, home healthcare, and ambulatory care for the controlled and continuous administration of medications. These pumps are widely used in critical care, oncology, and chronic disease management due to their accuracy, programmable dosing schedules, and integration with electronic health records. The segment benefits from rising demand for patient safety, reduced medication errors, and improved therapeutic outcomes. Innovations such as wireless connectivity, alarms for dosage deviations, and compatibility with advanced monitoring platforms further reinforce its dominance. Hospitals and specialty clinics extensively rely on these systems to deliver precise therapy to patients with complex medical conditions. Additionally, the increasing adoption of infusion pumps in emerging markets due to expanding healthcare infrastructure is boosting revenue generation.

The electronic injection pens segment is expected to witness the fastest CAGR of 9.1% from 2025 to 2032, fueled by the growing prevalence of diabetes and the rising trend of self-administration in home-care settings. These pens offer improved accuracy, convenience, and patient adherence, especially for insulin delivery and other injectable therapies. Integration with mobile applications allows patients to track doses, receive reminders, and maintain digital records for better disease management. Their compact design, portability, and ease of use make them highly suitable for outpatient care and home settings. Rising awareness about personalized medicine and patient-centric care is driving adoption globally. The increasing production of smart injection pens with connected features is further propelling market growth in both developed and emerging economies.

- By Component

On the basis of component, the market is segmented into sensors, wireless communicator and antennas, micro pumps and flow regulators, drug reservoir, microcontroller, and others. The sensors segment dominated with a revenue share of 31.5% in 2024, reflecting the critical need for real-time monitoring of parameters like flow rate, pressure, and dosage accuracy. Sensors are integral for maintaining patient safety and ensuring consistent therapeutic delivery across hospital and home-care environments. They provide actionable feedback to caregivers and healthcare professionals, reducing the risk of medication errors. Continuous technological improvements, such as enhanced sensitivity, miniaturization, and integration with IoT-enabled devices, further enhance their adoption. Hospitals and clinics prefer sensor-enabled systems for high-risk therapies and long-term treatments. Moreover, the incorporation of advanced alert systems ensures timely interventions and improved compliance.

The wireless communicator and antennas segment is projected to register the fastest CAGR of 10.3% from 2025 to 2032, driven by the increasing prevalence of IoT-enabled drug delivery systems. These components enable real-time remote monitoring, seamless data transfer, and automated notifications for patients and healthcare providers. They facilitate integration with mobile applications, cloud-based platforms, and hospital management systems. The rising trend of telemedicine and home-based therapies is further accelerating adoption. Improved wireless standards, low-latency transmission, and enhanced security features are making these systems highly reliable. The growth is particularly pronounced in outpatient clinics and home healthcare services that require constant monitoring.

- By Connectivity

On the basis of connectivity, the market is segmented into bluetooth low energy (BLE), Wi-Fi, ethernet, NB-IoT, and others. The Bluetooth Low Energy (BLE) segment dominated with a market share of 28.7% in 2024, owing to its low energy consumption, seamless smartphone integration, and compatibility with wearable devices. BLE-enabled drug delivery systems allow patients and healthcare providers to monitor medication schedules, receive alerts, and maintain adherence data efficiently. Hospitals leverage BLE systems to connect multiple devices without complex infrastructure changes. The segment’s growth is supported by increasing smartphone penetration and mobile health initiatives. BLE also enables interoperability with other medical devices and platforms, enhancing its importance in modern healthcare. Integration with mobile apps helps patients manage chronic conditions at home, reducing hospital visits.

The NB-IoT segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by its ability to provide reliable long-range connectivity for home-based and remote drug delivery systems. NB-IoT supports massive device connectivity, making it suitable for monitoring large patient populations in telehealth programs. Its low power requirements ensure long-term operation without frequent maintenance. The technology enables secure data transmission to cloud platforms, facilitating remote interventions and digital record-keeping. Adoption is further accelerated by growing government initiatives promoting digital health. Healthcare providers in rural and underserved areas increasingly rely on NB-IoT-enabled devices to ensure patient adherence and continuous monitoring.

- By System Type

On the basis of system type, the market is segmented into battery-powered systems and rechargeable systems. The battery-powered systems segment dominated with a market share of 62.3% in 2024, due to its reliability, portability, and consistent performance in hospitals, clinics, and home care. These systems ensure uninterrupted medication delivery, even in regions with irregular power supply. They are particularly preferred for critical care, oncology, and chronic disease therapies. Healthcare providers rely on battery-powered systems to maintain continuous treatment, reduce operational downtime, and enhance patient safety. Their simple maintenance and ready-to-use design further reinforce adoption. In addition, the ability to integrate with monitoring platforms and safety alarms makes them indispensable in high-acuity settings.

The rechargeable systems segment is projected to register the fastest CAGR of 8.9% from 2025 to 2032, driven by the growing adoption of eco-friendly and sustainable healthcare solutions. Rechargeable systems offer long-term cost benefits, lower environmental impact, and ease of portability. Patients benefit from reduced dependency on disposable batteries and improved usability for home-based therapy. Integration with smart devices and mobile apps allows better tracking of usage and charging status. Rising awareness about sustainability and hospital initiatives to reduce electronic waste are supporting adoption. These systems are increasingly used in outpatient centers and home healthcare setups due to convenience and operational efficiency.

- By Application

On the basis of application, the market is segmented into diabetes, asthma and chronic obstructive pulmonary disease (COPD), multiple sclerosis, growth hormone therapy, immunodeficiency disease, cardiovascular disease, thalassemia, and others. The diabetes segment accounted for the largest revenue share of 34.8% in 2024, driven by the growing prevalence of diabetes globally and the increasing adoption of insulin delivery devices. Electronic drug delivery systems for diabetes offer precision, self-administration, and digital dose tracking. Patients benefit from enhanced convenience, adherence, and improved glycemic control. Hospitals and home healthcare providers are increasingly integrating these devices with mobile apps and telemedicine platforms. Continuous technological innovations in connected pens and pumps further enhance patient engagement. The segment’s dominance is strengthened by chronic disease management programs and government initiatives promoting self-care.

The multiple sclerosis segment is expected to register the fastest CAGR of 9.7% from 2025 to 2032, fueled by the rising use of automated injectable systems for immunomodulatory therapies. These systems improve patient adherence, reduce injection errors, and allow safe home administration. Integration with remote monitoring platforms enables healthcare providers to track therapy progress and intervene promptly. The convenience of self-administration empowers patients to maintain treatment schedules without frequent hospital visits. Growing awareness about patient-centric care and the expansion of home healthcare programs are key drivers. Advanced features like dose tracking, reminders, and digital reporting are accelerating adoption.

- By End-User

On the basis of end-user, the market is segmented into home healthcare, hospitals, clinics, ambulatory centers, and others. The hospitals segment dominated with a market share of 49.2% in 2024, reflecting extensive adoption in critical care, chronic disease management, and surgical applications. Hospitals integrate these systems with electronic medical records, monitoring platforms, and patient management tools to enhance treatment accuracy, reduce errors, and improve patient outcomes. Their capacity to invest in high-quality devices, maintain operational protocols, and manage high patient volumes reinforces dominance. Hospitals also leverage advanced features such as alarms, real-time data tracking, and connectivity with telehealth platforms. The segment’s growth is further bolstered by the rising prevalence of chronic diseases and increasing surgical procedures worldwide.

The home healthcare segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032, driven by the rising emphasis on patient-centric care, remote monitoring, and convenience for chronic disease management. These systems empower patients to self-administer medications accurately while maintaining digital adherence records. Integration with mobile apps and cloud platforms ensures continuous monitoring by healthcare professionals. The segment’s growth is accelerated by government initiatives promoting home healthcare and telemedicine. Patients benefit from reduced hospital visits, improved adherence, and better disease management outcomes. Technological innovations such as lightweight, portable, and connected systems are enhancing adoption in home-care settings.

Electronic Drug Delivery Systems Market Regional Analysis

- North America dominated the electronic drug delivery systems market with the largest revenue share of 40.58% in 2024, characterized by early technology adoption

- High healthcare expenditure, and a strong presence of leading industry players

- The region’s advanced healthcare infrastructure, strong regulatory framework, and patient-centric initiatives have further accelerated the adoption of these systems, enabling more precise dosing, improved patient adherence, and seamless integration with digital health platforms

U.S. Electronic Drug Delivery Systems Market Insight

The U.S. electronic drug delivery systems market captured the largest revenue share of 67% within North America in 2024, fueled by the rapid adoption of technologically sophisticated drug delivery solutions across clinical and home-care environments. The increasing emphasis on personalized therapy, remote patient monitoring, and adherence support, combined with innovations in connected devices and digital health integration, are driving significant market expansion. Hospitals and specialty clinics are increasingly incorporating these systems to enhance treatment efficacy, minimize dosing errors, and optimize workflow efficiency.

Europe Electronic Drug Delivery Systems Market Insight

The electronic drug delivery systems market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising healthcare expenditure, growing prevalence of chronic and lifestyle-related diseases, and the demand for precise, patient-friendly drug delivery solutions. Countries such as Germany, the U.K., and France are witnessing widespread adoption of these systems across hospitals, specialty clinics, and home-care programs. Efforts to improve patient compliance, reduce medication errors, and integrate digital health platforms, alongside strong regulatory support, are further strengthening market growth across the region.

U.K. Electronic Drug Delivery Systems Market Insight

The U.K. Electronic Drug Delivery Systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing deployment in hospitals, home-care services, and specialty clinics. Rising awareness of chronic disease management, technological advancements in drug delivery devices, and the government’s push toward integrated digital healthcare solutions are key factors supporting market expansion. Enhanced patient adherence, accuracy in dosing, and streamlined healthcare workflows are encouraging healthcare providers to adopt advanced delivery systems.

Germany Electronic Drug Delivery Systems Market Insight

The Germany electronic drug delivery systems market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s robust healthcare infrastructure, strong focus on patient-centric care, and adoption of innovative drug delivery technologies in hospital and outpatient settings. Increasing awareness of chronic disease management, precision dosing, and integration with digital healthcare platforms is further accelerating market growth. Germany’s emphasis on high-quality care and technological innovation provides a favorable environment for the adoption of advanced drug delivery systems.

Asia-Pacific Electronic Drug Delivery Systems Market Insight

The Asia-Pacific electronic drug delivery systems market is expected to be the fastest-growing region during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing demand for technologically advanced drug delivery solutions in hospitals, home-care, and remote patient monitoring programs. Countries such as China, Japan, and India are witnessing significant adoption, supported by government initiatives promoting digital health, telemedicine, and patient-centric care. The growing middle class, awareness about chronic disease management, and improving affordability of devices are further catalyzing market growth.

Japan Electronic Drug Delivery Systems Market Insight

The Japan electronic drug delivery systems market is gaining momentum due to the country’s well-established healthcare system, high technological adoption, and strong focus on patient convenience and treatment adherence. Increasing demand for home-care solutions, connected drug delivery systems, and precision dosing in hospitals and specialty clinics is driving robust growth. Japan’s aging population is also fostering demand for user-friendly and reliable drug delivery systems that ensure safety and improved quality of care.

China Electronic Drug Delivery Systems Market Insight

The China electronic drug delivery systems market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, expanding middle-class population, and rising healthcare infrastructure. High adoption of digital health platforms, remote patient monitoring programs, and connected drug delivery systems in hospitals, specialty clinics, and home-care settings is driving market expansion. Additionally, the availability of cost-effective local devices and government initiatives promoting smart healthcare solutions are further propelling the growth of the Electronic Drug Delivery Systems market in China.

Electronic Drug Delivery Systems Market Share

The electronic drug delivery systems industry is primarily led by well-established companies, including:

- AstraZeneca (U.K.)

- Amgen Inc. (U.S.)

- Ypsomed AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- Bayer AG (Germany)

- Nemera (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Teva Pharmaceutical Industries Ltd. (U.S.)

- AptarGroup, Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- ViCentra B.V. (Netherlands)

- Medtronic (Ireland)

- United Therapeutics Corporation (U.S.)

- Companion Medical (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- Debiotech S.A. (Switzerland)

- Canè S.p.A (Italy)

- Insulet Corporation (U.S.)

- BD (U.S.)

- B. Braun SE (Germany)

Latest Developments in Global Electronic Drug Delivery Systems Market

- In January 2025, Portal Instruments, a leader in innovative drug delivery technology, announced the launch of its new PRIME Nexus system. This cutting-edge reusable electronic injector is designed to enhance the administration of injectable medications while helping partners meet their sustainability goals. The PRIME Nexus aims to provide a more comfortable and efficient experience for patients requiring regular injections

- In May 2025, a comprehensive article was published discussing the key trends and technologies shaping drug delivery amid a surge of innovation. The article delved into advancements in advanced delivery systems and sustainability, offering an outlook for the future of the sector. This publication highlights the ongoing evolution in drug delivery technologies and their impact on patient care

- In July 2025, LENZ Therapeutics announced the submission of a New Drug Application (NDA) for LNZ100 to the Center for Drug Evaluation (CDE) of the National Medical Products Administration (NMPA) in China. LNZ100 is being developed for the treatment of presbyopia, a condition associated with aging that affects the ability to focus on close objects. This submission marks a significant step in expanding treatment options for age-related vision impairments

- In August 2025, Sever Pharma Solutions expanded its partnership with Silo Pharma on a novel ketamine-based implant for chronic pain and fibromyalgia. This collaboration focuses on developing a controlled-release system for delivering ketamine, aiming to provide sustained pain relief for patients suffering from these conditions. The partnership underscores the growing interest in implantable drug delivery systems for chronic pain management

- In October 2023, Amazon launched a drone delivery service for certain common medicines in College Station, Texas, promising deliveries within 60 minutes. This initiative is part of Amazon's efforts to revolutionize healthcare delivery, aiming to enhance convenience and help patients begin treatments promptly. The service is part of Amazon's Prime Air, which started in June 2022, initially offering 30-minute drone deliveries for various products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.