Global Electronic Grade Hydrochloric Acid Market

Market Size in USD Million

CAGR :

%

USD

199.40 Million

USD

363.64 Million

2024

2032

USD

199.40 Million

USD

363.64 Million

2024

2032

| 2025 –2032 | |

| USD 199.40 Million | |

| USD 363.64 Million | |

|

|

|

|

Electronic Grade Hydrochloric Acid Market Size

-

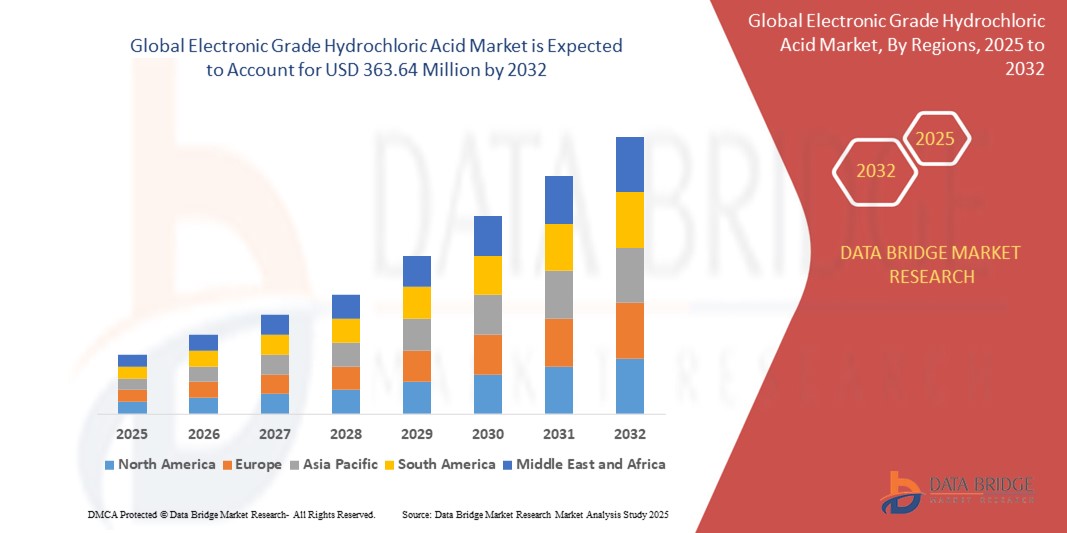

The global Electronic Grade Hydrochloric Acid market size was valued at USD 199.40 million in 2024 and is expected to reach USD 363.64 million by 2032, at a CAGR of 7.80% during the forecast period

-

This growth is driven by increasing demand for electronic equipment

Electronic Grade Hydrochloric Acid Market Analysis

-

Electronic Grade Hydrochloric Acid plays a critical role in semiconductor manufacturing, used for cleaning and etching wafers in the production of integrated circuits. Its purity is essential for maintaining high-quality standards in the electronics industry, ensuring the efficiency of production processes and enhancing device performance

- Market growth is driven by the increasing demand for electronic devices, advancements in technology, and the expansion of semiconductor industries globally. As the demand for more advanced and efficient electronic products rises, the need for high-purity electronic grade hydrochloric acid to meet the growing requirements in manufacturing processes becomes critical

- Asia-Pacific is expected to dominate the global electronic grade hydrochloric acid market, driven by the presence of key semiconductor manufacturing hubs such as China, South Korea, Japan, and Taiwan. The region benefits from a well-established electronics manufacturing ecosystem, contributing to its leading position in the global market

- North America is projected to register the highest growth rate in the electronic grade hydrochloric acid market, fueled by the increasing demand for electronics, advancements in semiconductor technology, and rising investments in research and development for next-generation devices

- The Integrated Circuits segment is expected to dominate the electronic grade hydrochloric acid market, due to extensive use of electronic-grade hydrochloric acid in semiconductor manufacturing processes, which are integral to integrated circuit production

Report Scope and Electronic Grade Hydrochloric Acid Market Segmentation

|

Attributes |

Electronic Grade Hydrochloric Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Electronic Grade Hydrochloric Acid Market Trends

“Technological Advancements Driving Purity Enhancements”

- The demand for ultra-pure electronic grade hydrochloric acid is increasing as the semiconductor industry continues to advance, with a focus on achieving higher device performance and miniaturization

- Manufacturers are developing new purification techniques, such as distillation and filtration, to achieve superior purity levels, catering to the stringent requirements of semiconductor fabrication

- These innovations are contributing to the development of high-performance acids used in etching and cleaning processes, ensuring greater efficiency in the production of microelectronics

- For instance, in January 2024, KMG Electronic Chemicals announced the launch of a new ultra-pure Electronic Grade Hydrochloric Acid product line designed specifically for the semiconductor sector, featuring enhanced purification capabilities

- This trend is expected to drive further advancements in electronic grade hydrochloric acid production, supporting the ongoing growth of the global semiconductor industry

Electronic Grade Hydrochloric Acid Market Dynamics

Driver

“Rising Demand for Advanced Semiconductor Manufacturing”

- The rapid growth of the semiconductor industry is a key driver for the demand for electronic grade hydrochloric acid, as the material is critical in wafer cleaning, etching, and other manufacturing processes

- As consumer demand for electronic devices such as smartphones, computers, and electric vehicles increases, so does the need for high-quality semiconductors, further driving the demand for electronic grade hydrochloric acid

- The transition to next-generation technologies, such as 5G, AI, and IoT, is expected to further fuel the need for advanced semiconductor manufacturing

- For instance, in March 2024, Taiwan Semiconductor Manufacturing Company (TSMC) announced plans to expand its production facilities, requiring large quantities of high-purity Electronic Grade Hydrochloric Acid to meet increased manufacturing demands

- This driver highlights the essential role that electronic grade hydrochloric acid plays in the growth of the global semiconductor market

Opportunity

“Growing Adoption of 5G Technology Boosting Demand for High-Purity Electronic Grade Hydrochloric Acid”

- The global roll-out of 5G networks is opening up new opportunities for the electronic grade hydrochloric acid market, as high-purity acid is needed in the manufacturing of advanced 5G-enabled semiconductors

- As 5G technology advances, semiconductor manufacturers are faced with the need for even more precision and efficiency in their production processes, increasing demand for ultra-pure electronic grade hydrochloric acid

- The growing investments in 5G infrastructure worldwide are creating opportunities for the expansion of the electronic grade hydrochloric acid market in this segment

- For instance, in July 2023, Qualcomm announced new developments in 5G chipsets, which required the use of high-purity Electronic Grade Hydrochloric Acid for manufacturing processes to support the scaling of 5G technology

- The adoption of 5G is set to significantly influence the demand for high-quality electronic materials, creating new growth opportunities for electronic grade hydrochloric acid producers

Restraint/Challenge

“Supply Chain Disruptions and Raw Material Availability”

- The availability of high-quality raw materials for the production of electronic grade hydrochloric acid is becoming a challenge due to supply chain disruptions, particularly in regions with geopolitical instability or economic uncertainty

- These disruptions are impacting the manufacturing timelines and the cost structure of electronic grade hydrochloric acid, as companies struggle to secure reliable sources of the raw materials required for production

- Fluctuations in the price of raw materials, such as chlorine, are also affecting the overall market dynamics

- For instance, in November 2023, a major Electronic Grade Hydrochloric Acid producer faced delays in production due to chlorine supply disruptions in Europe, impacting the availability of high-purity acid

- This challenge underscores the need for companies to diversify their supply chains and ensure access to raw materials to mitigate risks associated with global supply chain disruptions

Electronic Grade Hydrochloric Acid Market Scope

The market is segmented on the basis of type, application, end-use industry, packaging type, and distribution channels.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End-Use Industry |

|

|

By Packaging Type |

|

|

By Distribution Channel |

|

In 2025, the integrated circuits is projected to dominate the market with a largest share in function segment

The integrated circuits segment is expected to dominate the electronic grade hydrochloric acid market in 2025 due to extensive use of electronic-grade hydrochloric acid in semiconductor manufacturing processes, which are integral to integrated circuit production.

Electronic Grade Hydrochloric Acid Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Electronic Grade Hydrochloric Acid Market”

- Asia-Pacific dominates the global electronic grade hydrochloric acid market, primarily driven by the growing electronics and semiconductor manufacturing industry, strong presence of fabrication plants, and rising demand for high-purity chemicals in countries such as China, South Korea, and Taiwan

- In China and Taiwan, rapid expansion in semiconductor fabrication and printed circuit board (PCB) manufacturing has significantly increased consumption of electronic-grade hydrochloric acid for etching and cleaning processes

- The region also benefits from favorable government policies, expanding export potential, and lower production costs, reinforcing its leadership in the global market

“North America is projected to register the Highest CAGR in the Electronic Grade Hydrochloric Acid Market”

- North America is projected to witness the highest compound annual growth rate (CAGR) in the electronic grade hydrochloric acid market due to the increasing adoption of advanced microelectronics, growth in integrated circuit manufacturing, and significant R&D investments by major players in the U.S.

- Leading U.S.-based technology firms are expanding their domestic manufacturing capabilities, creating a strong demand for ultra-pure chemicals such as electronic-grade hydrochloric acid in semiconductor processing

- In addition, government incentives for reshoring semiconductor production, such as the CHIPS Act, further support this growth trajectory

Electronic Grade Hydrochloric Acid Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF (Germany)

- Occidental Petroleum Corporation (U.S.)

- TOAGOSEI CO., LTD. (Japan)

- Detrex Corporation (U.S.)

- Akzo Nobel N.V. (Netherlands)

- PCC Group (Germany)

- Vynova Group (Belgium)

- Dongyue Group Ltd (China)

- Tianjin Jinmao Group (China)

- Jiangsu Suhua Group Co., Ltd. (China)

- ADAMA (Israel)

- Suzhou Crystal Clear Chemical Co., Ltd. (China)

- Chongqing Chuandong Chemical (Group) Co., Ltd. (China)

- Solvay (Belgium)

- Honeywell International Inc. (U.S.)

- Morita Chemical Industries Co., Ltd. (Japan)

- Stella Chemifa Corporation (Japan)

- Zhejiang Sanmei Chemical Incorporated Company (China)

- Zhejiang Kaisn Fluorochemical Co., Ltd. (China)

- FORMOSA DAIKIN ADVANCED CHEMICALS CO., LTD. (Taiwan)

- Derivados del Fluor (Spain)

- Xinxiang Yellow River Chemical Industry Co., Ltd. (China)

- Fujian Shaowu Yongjing Chemical Co., Ltd. (China)

Latest Developments in Global Electronic Grade Hydrochloric Acid Market

- In January 2024, Tanfac Industries announced an investment of USD 12.03 million to double the capacity of its hydrofluoric acid plant from 14,750 MTPA to 29,500 MTPA. This strategic expansion is expected to strengthen the company’s position in the domestic and export markets for fluorine-based chemicals

- In March 2023, NFASL, a wholly-owned subsidiary of Navin Fluorine International Limited, selected Buss ChemTech’s Hydrogen Fluoride Production Technology for its upcoming manufacturing facility in Gujarat, India. This technology adoption marks a key step toward enhancing production efficiency and environmental compliance

- In January 2022, Sunlit Chemical committed US$100 million toward establishing a new facility dedicated to producing high-purity hydrofluoric acid and other industrial chemicals for the semiconductor industry. This investment aims to meet the rising demand for ultra-pure materials critical to advanced chip manufacturing

- In November 2021, TSMC introduced the world’s first hydrofluoric acid waste regeneration system, generating annual benefits of USD 12.55 million. This innovative solution reflects TSMC’s commitment to sustainable semiconductor production through circular economy practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Grade Hydrochloric Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Grade Hydrochloric Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Grade Hydrochloric Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.