Global Electronic Logging Device Market

Market Size in USD Billion

CAGR :

%

USD

14.38 Billion

USD

20.92 Billion

2024

2032

USD

14.38 Billion

USD

20.92 Billion

2024

2032

| 2025 –2032 | |

| USD 14.38 Billion | |

| USD 20.92 Billion | |

|

|

|

|

Electronic Logging Device Market Size

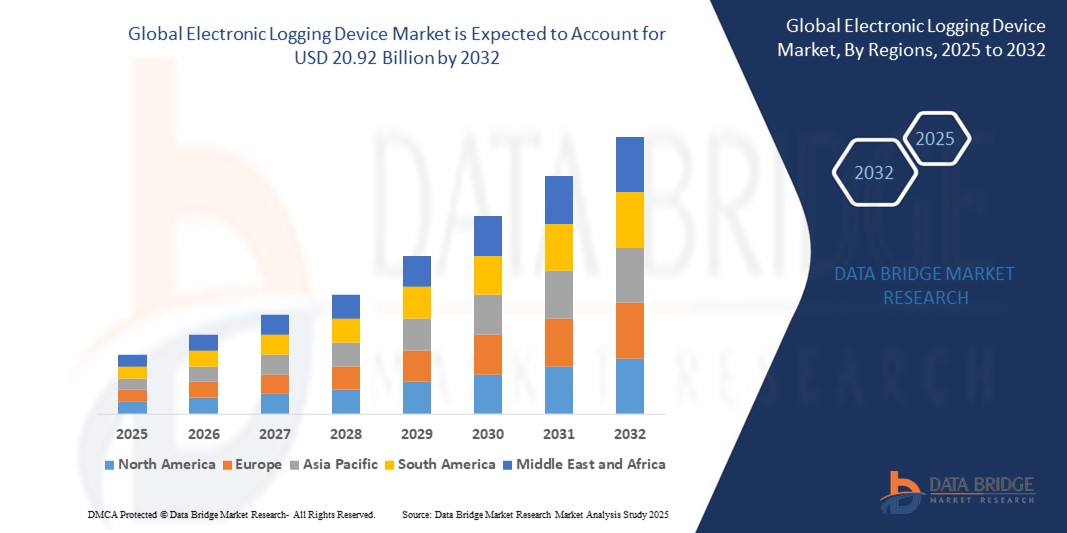

- The Global Electronic Logging Device Market size was valued at USD 14.38 billion in 2024 and is expected to reach USD 20.92 billion by 2032, at a CAGR of 4.8% during the forecast period

- The market growth is largely fueled by the shift of OEMs from not only manufacturing but also providing in-built electronic logging device for commercial vehicles

- Furthermore, the continuous and forthcoming organic and inorganic growth plans created by the market players will further boost the growth of the electronic logging device market in the region during the forecast period. North America is projected to observe significant amount of growth in the electronic logging device market because of the occurrences of large manufacturing and oil and gas companies.

Electronic Logging Device Market Analysis

- Electronic logging device is an electronic hardware which is attached to the commercial motor vehicle engine to record driving hours. The driving hours of the commercial drivers are controlled by a set of rules called as the hours of service. They contribute to form a safer work environment for the drivers of commercial motor vehicles to track, manage and share data precisely the on driving and also off-duty time.

- Europe dominates the Electronic Logging Device market with the largest revenue share of 47.56% in 2025, characterized by shift of OEMs from not only manufacturing but also providing in-built electronic logging device for commercial vehicles

- North America is expected to be the fastest growing region in the Electronic Logging Device market during the forecast period due to growth in the electronic logging device market because of the occurrences of large manufacturing and oil and gas companies

- Display segment is expected to dominate the Electronic Logging Device market with a market share of 54.32% in 2025, driven by its increasing demand for user-friendly interfaces and real-time data visibility.

Report Scope and Electronic Logging Device Market Segmentation

|

Attributes |

Electronic Logging Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electronic Logging Device Market Trends

“Expanding Regulatory Requirements Driving ELD Adoption”

- Around the world, governments are putting stronger regulations in place to improve road safety by limiting how many hours commercial drivers can be on the road without rest. These regulations aim to reduce accidents caused by driver fatigue. Because manual logging of driving hours can be inaccurate or falsified, Electronic Logging Devices (ELDs) have become mandatory in many countries to ensure honest, automatic recording of driver hours.

- As more regions adopt these rules, especially in North America, Europe, and parts of Asia, the demand for ELDs is growing rapidly. Fleet operators want devices that are easy to install, user-friendly, and compliant with the latest laws. This trend not only pushes existing companies to innovate but also opens doors for new players who can offer affordable and reliable solutions.

- Additionally, companies are investing in training and support services around ELDs, making this market even more lucrative. The expanding scope of regulation combined with technological improvements in ELDs means this market will keep growing steadily for years.

- For Instance, In December 2024, KeepTruckin (a leading fleet management technology company) launched an upgraded ELD device specifically designed to meet the latest Hours of Service (HOS) regulations introduced by the Federal Motor Carrier Safety Administration (FMCSA) in the United States. This new device features enhanced automatic logging capabilities and a more intuitive user interface to help fleet operators comply effortlessly with stricter safety rules. The launch came shortly after several U.S. states updated their regulations, reinforcing the critical role of ELDs in ensuring driver compliance and road safety. KeepTruckin’s move highlights how regulatory changes are driving innovation and increased adoption of ELD technology across the industry.

Electronic Logging Device Market Dynamics

Driver

“Increasing Government Regulations on Driver Hours and Safety”

- One of the biggest reasons driving the growth of the Electronic Logging Device market is the introduction of stricter government regulations around the world. Authorities are enforcing limits on how many hours commercial drivers can operate vehicles to reduce accidents caused by fatigue.

- Manual record-keeping has proven unreliable and prone to manipulation, so ELDs have become mandatory in many regions to automatically track driving hours. This ensures drivers follow the rules, and companies avoid hefty fines and legal issues. Because of these regulations, trucking companies are rapidly adopting ELDs to stay compliant and maintain safety standards.

- As more countries adopt similar laws, the market demand will continue to increase. The pressure to improve road safety combined with the need for accurate records is a strong driver pushing fleets toward modern ELD solutions. This also encourages manufacturers to develop better, easier-to-use devices that can meet regulatory standards.

- For Instance, In January 2025, Omnitracs introduced a new ELD solution designed to meet updated federal driver hours regulations in the United States. The device includes features that simplify compliance reporting and automatically alert drivers about their remaining legal driving time. This launch came after stricter government rules took effect, demonstrating how regulation directly fuels ELD adoption and innovation.

Restraint/Challenge

“High Initial Costs and Installation Challenges”

- One major challenge slowing down the adoption of Electronic Logging Devices is the high upfront cost for purchasing and installing these systems. Many small and mid-sized trucking companies operate on tight budgets and may find it difficult to invest in new technology, especially if they need to outfit large fleets.

- Additionally, installation can be complex, requiring professional support to ensure the devices work properly with a variety of vehicle models and electrical systems. This can lead to extra costs and downtime, discouraging some fleet operators from switching to ELDs quickly.

- Furthermore, training drivers and staff to use these new systems can take time and resources. Some companies also worry about technical glitches or device malfunctions that could disrupt operations or lead to penalties if data isn’t recorded correctly. These factors combined create a barrier, particularly for smaller fleets, limiting faster growth of the market.

- For Instance, In September 2024, FleetOps reported slower-than-expected adoption of their premium ELD device among small trucking companies, citing installation complexity and cost as major hurdles. Many customers requested more affordable packages and simpler installation guides to help overcome these barriers.

Electronic Logging Device Market Scope

The market is segmented on the basis component, form factor, new and aftermarket service and vehicle type.

- By Component

Based on the component, the electronic logging device market is segmented into display, telematics unit, other. Display segment is expected to dominate the Electronic Logging Device market with a market share of 54.32% in 2025, driven by its increasing demand for user-friendly interfaces and real-time data visibility.

The telematics unit segment is anticipated to witness the fastest growth rate of 17.8% from 2025 to 2032, fueled by increasing demand for real-time vehicle tracking and advanced data analytics. Enhanced connectivity enables fleet operators to optimize routes, improve safety, and reduce operational costs. Growing adoption of IoT and smart transportation solutions further accelerates this segment’s expansion.

- By Form Factor

Based on the form factor, the electronic logging device market is segmented into embedded, integrated. The embedded held the largest market revenue share in 2025 of, driven seamless integration with vehicles and reliable performance. This makes it popular among fleet operators looking for built-in solutions.

The integrated segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its increasing demand for all-in-one systems that combine tracking, diagnostics, and compliance features. These solutions help fleets operate more efficiently.

- By New and Aftermarket Service

Based on the new and aftermarket service, the electronic logging device market is segmented into entry level services, intermediate services, and high-end services. The entry level services held the largest market revenue share in 2025, driven by their affordability and simplicity, making them ideal for small and medium-sized fleets starting to adopt digital tools.

The intermediate services segment held a significant market share in 2025, favored for its providing a balanced combination of essential features and cost-effectiveness, appealing to expanding fleets.

- By Vehicle Type

Based on the vehicle type, the electronic logging device market is segmented into light commercial vehicle, truck, bus. The light commercial vehicle segment accounted for the largest market revenue share in 2024, driven by the increased use in urban delivery and last-mile logistics, where flexibility and efficiency are crucial.

The truck segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for heavy-duty fleet management and stricter safety regulations pushing adoption of advanced ELD solutions.

Electronic Logging Device Market Regional Analysis

- Europe dominates the Electronic Logging Device market with the largest revenue share of 47.56% in 2025, characterized by shift of OEMs from not only manufacturing but also providing in-built electronic logging device for commercial vehicles

- The continuous and forthcoming organic and inorganic growth plans created by the market players will further boost the growth of the electronic logging device market in the region during the forecast period.

U.K. Electronic Logging Device Market Insight

The U.K. market is growing steadily as the government pushes for stricter driver safety and working hour regulations. Increasing demand comes from logistics and transportation companies aiming to improve compliance and reduce accidents. Advanced ELDs integrated with fleet management systems are gaining popularity. Small and medium fleets are adopting affordable solutions, driving market expansion. The focus on digitalization and smart transport supports continued growth.

Germany Electronic Logging Device Market Insight

Germany leads Europe in adopting ELDs, driven by strong regulations on driver hours and road safety. The country’s large automotive and logistics sectors demand high-quality, reliable devices. Integration with advanced telematics and fleet management platforms is a key trend. Growing investments in smart transportation infrastructure also boost market potential. Fleet operators benefit from improved efficiency and regulatory compliance.

North America Electronic Logging Device Market Insight

North America dominates the global ELD market due to strict regulations, especially in the U.S. mandating ELD use for commercial trucks. The market is driven by large trucking fleets adopting technology to ensure compliance and enhance operational efficiency. Advances in telematics and connected vehicle solutions are accelerating adoption. Canada is also increasing ELD use as it aligns with U.S. regulations. The region is a hotspot for innovation in fleet management.

U.S. Electronic Logging Device Market Insight

The U.S. market is the largest globally, propelled by FMCSA’s mandatory ELD rule since 2017. Trucking companies are investing heavily in ELDs to avoid penalties and improve driver safety. The market features a wide variety of solutions, from entry-level to integrated systems. Continuous technology upgrades and government enforcement drive sustained growth. The rise of e-commerce is also increasing demand for reliable fleet tracking.

Asia-Pacific Electronic Logging Device Market Insight

The Asia-Pacific ELD market is expanding rapidly as countries like China and India introduce stricter transport safety rules. Growing logistics and e-commerce sectors fuel demand for compliance and fleet optimization solutions. Many fleets still rely on manual logging, so digital transformation offers a big growth opportunity. Local companies are developing cost-effective devices suited for regional needs. Infrastructure improvements and government initiatives support market development.

India Electronic Logging Device Market Insight

India’s ELD market is in the early growth phase but expanding quickly due to new regulations on driver working hours. Rising road safety concerns and government efforts to digitize transport operations push demand. The market sees increasing adoption among large logistics players and fleet operators. Cost-effective and easy-to-install devices are especially popular. Awareness campaigns and government incentives help accelerate market penetration.

China Electronic Logging Device Market Insight

China’s ELD market is growing fast as the government enforces stricter transport safety standards. Large-scale logistics and commercial vehicle fleets adopt ELDs to improve compliance and reduce accidents. Integration with telematics and smart fleet management solutions is a key trend. The market benefits from strong government support and technology innovation. Rising e-commerce and urban delivery demand further boost market growth.

Electronic Logging Device Market Share

The Electronic Logging Device industry is primarily led by well-established companies, including:

- Pedigree Technologies,

- KeepTruckin, Inc.,

- EROAD,

- FleetUp,

- Intrepid Control Systems Inc,

- Gorilla Safety Fleet Management.,

- Omnitracs,

- Trimble Inc.,

- Verizon,

- Drivewyze,

- LINXUP,

- InTouch GPS, LLC,

- Geotab Inc.,

- Fleet Complete.,

- Blue Ink Technology,

- Wheels, Inc.,

- Donlen,

- ORBCOMM,

- Garmin Ltd.,

- CarrierWeb,

- Transflo a Pegasus TransTech Company.,

- Stoneridge, Inc.,

- Teletrac Navman US Ltd,

- TomTom International BV.,

- WorkWave, LLC,

- Merchants Fleet,

- LeasePlan,

- Vector Informatik GmbH,

- MICHELIN,

- Racelogic,

- HEM Data Corporation,

- Danlaw Technologies India Limited.,

- Influx Technology

Latest Developments in Global Electronic Logging Device Market

-

In February 2025, KeepTruckin launched a new AI-based driver safety coaching feature. This tool uses real-time driving data to provide personalized feedback, helping reduce accidents and improve compliance. It reflects the company’s focus on leveraging AI to enhance fleet safety and efficiency.

- In March 2025, EROAD introduced an updated ELD device featuring enhanced GPS accuracy and extended battery life. These improvements help commercial fleets better track vehicles and reduce downtime. The new product meets evolving regulatory requirements, driving greater market adoption.

- In January 2025, Trimble partnered with Qualcomm to launch ultra-precise positioning tech for heavy vehicles. This joint solution offers centimeter-level accuracy, improving navigation and safety for automated trucks. The technology is expected to be deployed commercially by 2028.

- In March 2025, FleetUp rolled out an upgraded ELD system that offers seamless integration with popular third-party fleet management software. This enables fleets to unify data streams for better operational visibility. The product aims to increase efficiency and reduce manual work for fleet operators.

- In February 2025, Drivewyze expanded its Smart Roadways service with new virtual in-cab alerts in several U.S. states. These alerts provide drivers with real-time road and traffic info, enhancing safety and operational efficiency. The feature integrates with popular ELDs to deliver timely updates.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.