Global Electronic Safety System Market

Market Size in USD Billion

CAGR :

%

USD

8.20 Billion

USD

19.59 Billion

2024

2032

USD

8.20 Billion

USD

19.59 Billion

2024

2032

| 2025 –2032 | |

| USD 8.20 Billion | |

| USD 19.59 Billion | |

|

|

|

|

Electronic Safety System Market Size

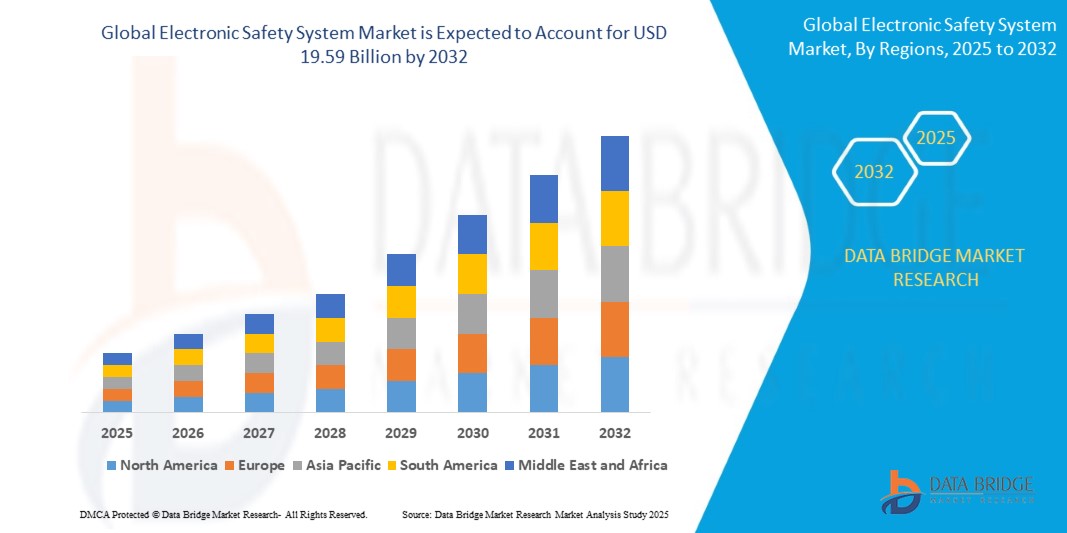

- The global Electronic Safety System market size was valued at USD 8.20 billion in 2024 and is expected to reach USD 19.59 billion by 2032, at a CAGR of 11.50% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, which is leading to increased digitalization in both residential and commercial settings.

- Furthermore, rising consumer demand for secure, user-friendly, and integrated safety solutions for homes and businesses is establishing Electronic Safety Systems as the modern access control system of choice.

Electronic Safety System Market Analysis

- Electronic Safety Systems, which provide electronic or digital access control for doors, gates, and entry points, are becoming essential components of modern residential, commercial, and industrial security systems. Their appeal stems from enhanced user convenience, remote management, biometric integration, and seamless compatibility with smart ecosystems like IoT, voice assistants, and cloud platforms.

- The growing demand is strongly driven by increased smart home penetration, rising security concerns, and the shift toward contactless, keyless entry mechanisms that improve both accessibility and safety for users.

- North America leads the global Electronic Safety System market, accounting for 40.01% of the total revenue share in 2024, owing to early smart technology adoption, high disposable incomes, and an active ecosystem of innovation in home automation and security. In the U.S., the market is expanding rapidly with the growing popularity of AI-powered, cloud-connected Electronic Safety Systems in multi-family residential units, offices, and retail stores.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period (2025–2032), supported by rapid urbanization, rising middle-class incomes, and increased digitization of security infrastructure in countries like China, India, Japan, and South Korea. Local governments and private developers are also investing heavily in smart city projects that integrate advanced safety systems.

- The Hardware segment dominates the Electronic Safety System market with a market share of 43.2% in 2024, primarily due to the robustness, reliability, and compatibility of physical access devices like electronic locks, keypads, biometric scanners, and RFID-based access units. Hardware continues to be a cornerstone of security installations due to its ease of retrofit and user trust in tangible devices.

Report Scope and Electronic Safety System Market Segmentation

|

Attributes |

Electronic Safety System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electronic Safety System Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A key trend shaping the global Electronic Safety System market is the increasing integration of artificial intelligence (AI) and voice assistant technologies (Amazon Alexa, Google Assistant, Apple HomeKit), enabling users to manage access control with greater convenience, personalization, and automation.

- In January 2024, August Home expanded the capabilities of its Wi-Fi Smart Lock to include deeper integration with Alexa, Siri, and Google Assistant, allowing voice-activated commands for locking/unlocking and real-time activity alerts via mobile apps.

- Similarly, Level Lock+, launched in partnership with Apple in late 2023, is compatible with Apple HomeKit and Siri, and supports Home Key functionality, enabling users to unlock doors using iPhones or Apple Watches with a simple tap.

- AI-enhanced Electronic Safety Systems like the Ultraloq U-Bolt Pro WiFi use adaptive learning algorithms to improve fingerprint recognition accuracy and generate behavior-based alerts. These features are increasingly important in both residential and multi-tenant commercial setups.

- The trend is also influencing new product development, such as WELOCK's AI-powered smart locks, launched in December 2023, which support automatic unlocking based on proximity and offer built-in voice assistant compatibility.

- Overall, voice control, predictive automation, and smart home ecosystem integration are becoming baseline expectations for modern Electronic Safety Systems, reshaping consumer behavior and competitive differentiation in the market

Electronic Safety System Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- The global increase in crime rates and a growing awareness of digital home security solutions are fueling demand for Electronic Safety Systems, especially as smart homes become more common.

- In April 2024, Onity, Inc. (a subsidiary of Honeywell International, Inc.) unveiled enhancements to its Passport IoT-based access control system, introducing new smart sensors to bolster self-storage and residential security applications.

- As smart home devices become more accessible, Electronic Safety Systems offering remote access, real-time monitoring, activity history, and customizable user access are becoming a core part of security infrastructure in both new and retrofitted buildings.

- Brands like Yale, Schlage, and Wyze have released new models (e.g., Yale Assure Lock 2 in 2023) that support smartphone-based access, temporary access codes, and geofencing features—all designed to make Electronic Safety Systems more flexible and user-centric.

- The convenience of keyless entry, along with integration into platforms like SmartThings, Apple Home, and Google Home, has further accelerated consumer preference toward electronic locks, especially in urban households and rental properties.

- DIY trends and increasing consumer confidence in managing home tech are expanding the market even in mid-income regions, reducing reliance on professional installations

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Cybersecurity vulnerabilities in IoT and smart devices pose a critical barrier to widespread Electronic Safety System adoption. Consumers are increasingly concerned about potential data breaches and unauthorized access.

- For example, a 2023 study by Consumer Reports highlighted several vulnerabilities in popular smart locks, including default password issues and weak encryption, prompting discussions around the need for standardized IoT security protocols.

- In response, companies like August Home and Level Home are marketing their use of AES-128 encryption, two-factor authentication, and secure cloud-based architecture to reassure users of data protection.

- Another significant challenge is the cost barrier. Advanced Electronic Safety Systems with biometric readers, built-in cameras, or remote integration features can be priced above $250–$400, which may discourage adoption in price-sensitive markets.

- Though lower-cost alternatives (e.g., Wyze Lock Bolt, priced under $100) are entering the market, they often compromise on premium features, leading to varied adoption levels based on income and regional tech literacy.

- To counter this, brands are exploring modular upgrade paths, subscription-based access to premium features, and educational outreach to improve cybersecurity understanding among users.

Electronic Safety System Market Scope

The market is segmented on the basis of component, system type, application, and end-user.

- By Component

The hardware segment held the largest market share in 2024, driven by the widespread deployment of smart locks, sensors, cameras, and access devices essential to Electronic Safety Systems. The growing adoption of Wi-Fi and Bluetooth-enabled door locks, as seen in products like August Wi-Fi Smart Lock and Ultraloq U-Bolt Pro, reflects the hardware segment’s dominance.

The software segment is witnessing rising demand, driven by the need for cloud-based access control platforms, mobile apps, and analytics dashboards. In January 2024, EagleView Technologies launched its cloud-based geospatial analytics platform with advanced monitoring capabilities, enabling smarter safety management across commercial applications.

The services segment is anticipated to grow steadily, propelled by the increasing need for installation, integration, consulting, and maintenance services. In July 2023, Woolpert’s acquisition of AAM Group strengthened its global footprint in safety services and integration for infrastructure and urban security deployments.

- By System Type

The access control segment led the market in 2024, as demand for keyless entry, remote authorization, and multi-user access soared across residential and commercial buildings. Companies like Level Home and WELOCK are launching new products with voice assistant compatibility and biometric options, enhancing appeal.

The surveillance systems segment is growing rapidly due to the integration of video analytics and real-time threat detection. Maxar Technologies’ agreement with Esri in September 2023 enhanced surveillance capabilities by integrating high-resolution satellite imagery with GIS tools, benefiting large-scale commercial and government users.

The fire protection systems segment is evolving with the inclusion of smart detectors and emergency alerts, though adoption is more prominent in industrial and institutional settings.

The emergency shutdown systems segment is particularly relevant in high-risk industries such as oil & gas and manufacturing, where safety automation is essential.

The others category includes biometric verification systems and automated visitor management, which are increasingly being adopted in corporate and educational settings.

- By Application

Worker safety emerged as a critical application, particularly in industrial and high-risk sectors such as oil & gas and manufacturing. Onity’s 2024 innovation in IoT-based locking systems for self-storage facilities reflects increasing emphasis on employee and personnel safety through advanced sensor integration.

Asset protection dominated the application segment in 2024, driven by the need to secure physical assets across both residential and commercial properties. Smart Electronic Safety Systems offering real-time alerts, tamper notifications, and remote locking capabilities are critical in this space.

Environmental monitoring is gaining traction, especially in government and infrastructure projects. For example, Bluesky International’s 2023 contract with the UK Environment Agency involved deploying aerial LiDAR to support climate resilience and flood monitoring, signaling growing convergence between Electronic Safety Systems and environmental analytics.

Others includes visitor tracking, automated delivery access, and smart notifications, increasingly common in smart buildings and multi-unit residences.

- By End-User

The residential segment held the largest market revenue share in 2024, propelled by growing adoption of smart homes and consumer demand for enhanced security. Smart locks, app-based control, and integration with voice assistants are now considered standard features in new residential projects.

The commercial and industrial sectors, including manufacturing and healthcare, are rapidly adopting Electronic Safety Systems for compliance, centralized control, and employee safety. In 2024, companies such as Allegion launched advanced access control systems tailored to corporate offices and healthcare facilities.

The oil & gas sector is increasingly relying on emergency shutdown systems, perimeter monitoring, and access management to meet stringent safety regulations.

The transportation sector is adopting Electronic Safety Systems for asset protection, crew safety, and logistics terminal access control, particularly in urban centers.

The government sector leverages Electronic Safety Systems for public building security, critical infrastructure protection, and emergency response systems, highlighted by increased deployments across smart city initiatives.

Others includes education, utilities, and data centers, where electronic access control and biometric verification are becoming critical for infrastructure safety.

Electronic Safety System Market Regional Analysis

- North America dominates the global Electronic Safety System market, accounting for the largest revenue share of 40.01% in 2024, driven by widespread adoption of smart home automation, increasing security consciousness, and rapid penetration of connected devices.

- High consumer preference for smart locks integrated with voice assistants (Alexa, Google Assistant, Apple HomeKit) and DIY installation solutions enhances market momentum.

- The region benefits from leading players like August, Level, Yale, and Schlage, actively launching new AI-integrated security solutions.

U.S. Electronic Safety System Market Insight

The U.S. held an 81% share of the North American market in 2024, propelled by the rise of keyless entry, mobile-controlled access, and growing awareness of smart security. In April 2024, Level Home Inc. launched a new generation of invisible smart locks compatible with Apple HomeKit and Ring Alarm, demonstrating increasing demand for aesthetically discreet yet advanced systems. Additionally, the popularity of subscription-free security solutions and integration with cloud storage further boosts consumer adoption.

Europe Electronic Safety System Market Insight

Europe is projected to grow at a substantial CAGR during the forecast period, driven by strict regulatory frameworks, increased urbanization, and eco-conscious security systems. Governments and urban developers are incorporating Electronic Safety Systems into smart city and sustainability projects.

U.K. Electronic Safety System Market Insight

The U.K. market is expanding steadily, fueled by growing burglary concerns and the widespread adoption of home automation solutions. The emergence of digital-first housing solutions in cities like London and Manchester is pushing the demand for keyless and app-controlled entry systems. In 2023, Yale UK released its Linus Smart Lock, enhancing its smart home portfolio and driving residential adoption.

Germany Electronic Safety System Market Insight

Germany shows a considerable CAGR, backed by its strong infrastructure, focus on energy efficiency, and preference for privacy-centric technologies. The 2024 deployment of sustainability-aligned Electronic Safety Systems in smart commercial buildings highlights the country’s shift toward green buildings with secure access systems. Demand is also supported by industrial and manufacturing safety protocols requiring smart surveillance and emergency access features.

Asia-Pacific Electronic Safety System Market Insight

The Asia-Pacific Electronic Safety System market is forecast to grow at the fastest CAGR of 24% from 2025 to 2032, attributed to rapid urbanization, expanding smart city initiatives, and massive smartphone penetration. Governments in India, Singapore, and South Korea are actively investing in residential surveillance and digital door lock programs to bolster smart city security.

Japan Electronic Safety System Market Insight

Japan’s market is rapidly advancing due to a tech-savvy population and the growth of smart buildings. In 2024, Panasonic and Mitsubishi Electric invested in integrated IoT platforms for Electronic Safety Systems, targeting senior care homes with biometric and voice-based unlocking solutions. The country’s aging demographic continues to drive interest in accessible, secure, and intuitive locking systems.

China Electronic Safety System Market Insight

China held the largest share of the Asia-Pacific market in 2024, due to urban expansion, a growing middle class, and widespread smartphone use. Domestic brands such as Loock, Xiaomi, and Aqara lead innovations in affordable smart locks with facial recognition and AI-based threat alerts. In March 2024, Aqara launched its U200 Smart Lock, featuring fingerprint recognition, mobile unlock, and voice assistant integration, specifically designed for China’s rising smart rental market. National initiatives under Smart City China 2030 further accelerate market penetration, especially in Tier 1 and Tier 2 cities.

Electronic Safety System Market Share

The Electronic Safety System industry is primarily led by well-established companies, including:

- Bosch Security Systems, Inc. (Germany)

- Honeywell International Inc. (U.S.)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Johnson Controls (Ireland)

- General Electric Co. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Axis Communications AB (Sweden)

- Emerson Electric Co. (U.S.)

Latest Developments in Global Electronic Safety System Market

- In April 2023, ASSA ABLOY Group launched a strategic initiative in South Africa to strengthen residential and commercial property security using its advanced Electronic Safety System technologies. This initiative is part of the company’s broader global push to address localized security challenges and demonstrates ASSA ABLOY’s commitment to innovation and expansion in emerging markets. It aligns with rising demand for smart access control systems in developing regions.

- In March 2023, HavenLock Inc., a U.S.-based, veteran-led company, released the Power G version of its Haven Lockdown System, targeting schools and commercial settings. This development underscores the rising importance of emergency lockdown systems in public and educational institutions and the company’s dedication to delivering robust, scalable safety infrastructure tailored to crisis scenarios.

- In March 2023, Honeywell International Inc. successfully executed the Bengaluru Safe City Project in India, deploying state-of-the-art Electronic Safety Systems and surveillance infrastructure. This smart city initiative showcases Honeywell’s expertise in urban safety and marks a significant step in integrating IoT-driven security solutions to enhance city-wide monitoring and response capabilities.

- In February 2023, SentriLock, LLC, a key player in electronic lockbox technology, announced a partnership with the Chesapeake Bay and Rivers Association of REALTORS (CBRAR) to launch a smart lockbox marketplace for real estate professionals. This collaboration reflects the growing trend of digitizing real estate access control and highlights demand for secure, app-based lock systems that streamline property transactions and increase operational efficiency.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Safety System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Safety System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Safety System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.