Global Electronic Security Market

Market Size in USD Billion

CAGR :

%

USD

63.28 Billion

USD

121.09 Billion

2024

2032

USD

63.28 Billion

USD

121.09 Billion

2024

2032

| 2025 –2032 | |

| USD 63.28 Billion | |

| USD 121.09 Billion | |

|

|

|

|

Electronic Security Market Size

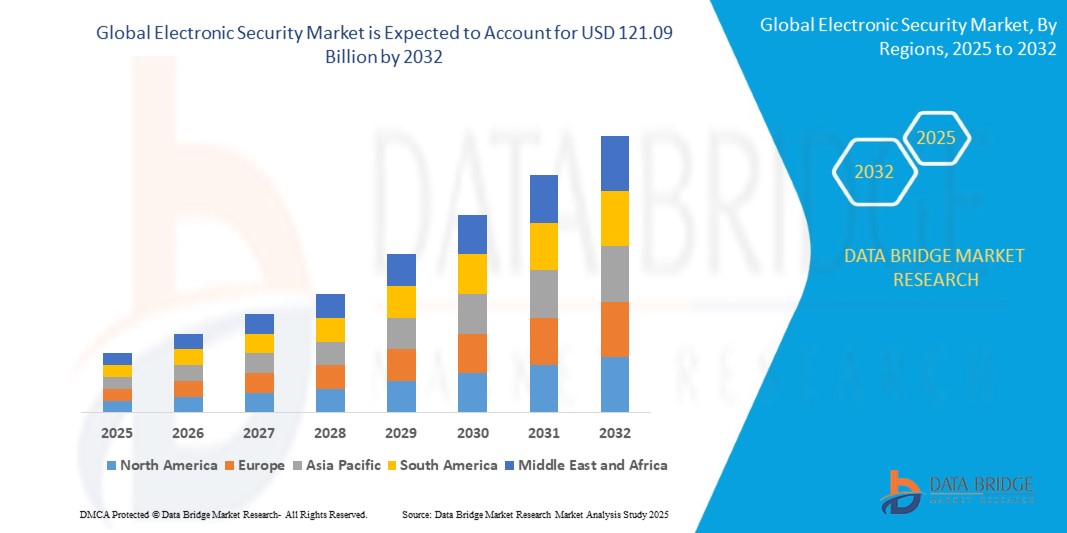

- The global electronic security market size was valued at USD 63.28 billion in 2024 and is expected to reach USD 121.09 billion by 2032, at a CAGR of 8.45% during the forecast period

- The market growth is primarily driven by the increasing adoption of advanced security technologies, rising concerns over safety and security, and the growing integration of IoT and AI in security systems across residential, commercial, and industrial settings

- In addition, the rising demand for sophisticated, scalable, and integrated security solutions to combat evolving threats is positioning electronic security systems as essential tools for modern safety management, significantly boosting industry growth

Electronic Security Market Analysis

- Electronic security systems, encompassing surveillance, alarming, and access control solutions, are critical for ensuring safety and security across various sectors, offering advanced monitoring, real-time alerts, and seamless integration with smart technologies

- The growing demand for electronic security is fueled by increasing urbanization, rising crime rates, and a growing preference for automated and remotely accessible security solutions

- North America dominated the electronic security market with the largest revenue share of 42.5% in 2024, driven by early adoption of advanced security technologies, high investment in infrastructure, and the presence of leading market players

- Asia-Pacific is expected to be the fastest-growing region in the electronic security market during the forecast period due to rapid urbanization, increasing infrastructure development, and rising disposable incomes

- The Surveillance Security System segment dominated the largest market share of 36.7% in 2024, driven by the increasing need for comprehensive security solutions across commercial, residential, and governmental establishments

Report Scope and Electronic Security Market Segmentation

|

Attributes |

Electronic Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Electronic Security Market Trends

“Increasing Integration of AI and Machine Learning”

- The global electronic security market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Machine Learning (ML) into security systems

- These technologies enable advanced data processing and analytics, providing deeper insights into security events, threat detection, and system performance

- AI-powered security solutions allow for proactive threat identification, such as detecting suspicious activities or predicting potential security breaches before they occur

- For instance, companies are developing AI-driven platforms that use facial recognition, behavioral analytics, and automated alerts to enhance surveillance and access control systems

- This trend is increasing the appeal of electronic security systems for both commercial and residential users, offering smarter and more efficient security solutions

- ML algorithms can analyze patterns in security data, such as unauthorized access attempts, unusual crowd behavior, or equipment malfunctions, improving response times and accuracy

Electronic Security Market Dynamics

Driver

“Rising Demand for Smart Security and IoT Integration”

- Increasing consumer and business demand for smart security solutions, such as real-time surveillance, remote monitoring, and integrated access control, is a major driver for the global electronic security market

- Electronic security systems enhance safety by providing features such as real-time alerts, automated intrusion detection, and remote access management

- Government mandates, particularly in regions such as Europe with regulations requiring advanced security in public spaces, are accelerating the adoption of electronic security systems

- The proliferation of IoT and advancements in 5G technology are enabling faster data transmission and lower latency, supporting sophisticated security applications such as cloud-based monitoring and real-time analytics

- Manufacturers are increasingly offering integrated security systems as standard features in commercial, industrial, and residential applications to meet rising expectations and enhance asset protection

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- The high initial investment required for hardware, software, and integration of electronic security systems can be a significant barrier, particularly in cost-sensitive regions such as emerging markets

- Retrofitting existing infrastructure with advanced security systems, such as surveillance cameras or biometric access controls, can be complex and expensive

- Data security and privacy concerns are a major challenge, as electronic security systems collect and transmit sensitive data, raising risks of breaches, misuse, or non-compliance with data protection regulations such as GDPR

- The fragmented regulatory landscape across countries regarding data collection, storage, and usage complicates operations for global manufacturers and service providers

- These factors may deter adoption in regions with high cost sensitivity or strong data privacy awareness, limiting market growth in certain areas

Electronic Security market Scope

The market is segmented on the basis of product type and end-user vertical.

- By Product Type

On the basis of product type, the electronic security market is segmented into Surveillance Security System, Alarming System, Access and Control System, and Other. The Surveillance Security System segment dominated the largest market share of 36.7% in 2024, driven by the increasing need for comprehensive security solutions across commercial, residential, and governmental establishments.

The Alarming System segment is anticipated to experience robust growth from 2025 to 2032, with a projected CAGR of 10%. The increasing demand for intrusion detection and fire alarms, particularly in high-risk environments such as industrial and banking sectors, is driving growth. Integration with monitoring centers and mobile applications enhances their effectiveness for rapid response.

- By End-user Vertical

On the basis of end-user vertical, the electronic security market is segmented into Government, Transportation, Industrial, Banking, Hotels, Retail stores, and other. The Government segment dominated the market with a revenue share of approximately 35% in 2024, driven by substantial investments in advanced security measures for public infrastructure, border control, and law enforcement. The deployment of surveillance systems, access controls, and cybersecurity solutions is critical to counter evolving threats and ensure public safety.

The Banking segment is expected to experience robust growth from 2025 to 2032, fueled by the rising need to protect financial assets and customer data. Investments in cybersecurity, surveillance, and access control systems are increasing due to the growing sophistication of cyber threats targeting financial institutions.

Electronic Security Market Regional Analysis

- North America dominated the electronic security market with the largest revenue share of 42.5% in 2024, driven by early adoption of advanced security technologies, high investment in infrastructure, and the presence of leading market players

- Consumers prioritize electronic security systems for enhancing safety, protecting assets, and ensuring compliance with regulatory standards, particularly in regions with high crime rates and urban development

- Growth is supported by advancements in security technology, including AI-powered surveillance, cloud-based systems, and biometric access controls, alongside rising adoption in both government and commercial sectors

U.S. Electronic Security Market Insight

The U.S. electronic security market captured the largest revenue share of 84.3% in 2024 within North America, fueled by strong demand for video surveillance and access control systems in both public and private sectors. The trend toward smart city initiatives and increasing awareness of cybersecurity threats further boost market expansion. The integration of advanced security solutions in government, banking, and retail applications complements the robust aftermarket demand.

Europe Electronic Security Market Insight

The Europe electronic security market is expected to witness significant growth, supported by stringent regulatory frameworks such as GDPR and a focus on public safety. Consumers seek systems that enhance security while ensuring data privacy and compliance. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising smart city projects and urban security needs.

U.K. Electronic Security Market Insight

The U.K. market for electronic security is expected to witness rapid growth, driven by demand for advanced surveillance and access control systems in urban and suburban settings. Increased interest in AI-driven security solutions and rising awareness of cybersecurity benefits encourage adoption. Evolving regulations balancing security needs with privacy concerns influence consumer choices, promoting compliant systems.

Germany Electronic Security Market Insight

Germany is expected to witness rapid growth in the electronic security market, attributed to its advanced technological infrastructure and high consumer focus on security and efficiency. German consumers prefer technologically advanced systems, such as AI-powered surveillance and biometric access controls, that enhance safety and reduce operational risks. The integration of these systems in industrial and government applications supports sustained market growth.

Asia-Pacific Electronic Security Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid urbanization, expanding infrastructure, and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of security threats, including crime and cyberattacks, boosts demand for surveillance, alarming, and access control systems. Government initiatives promoting smart cities and public safety further encourage the adoption of advanced electronic security solutions.

Japan Electronic Security Market Insight

Japan’s electronic security market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced security systems that enhance safety and operational efficiency. The presence of major technology manufacturers and the integration of security systems in government and commercial applications accelerate market penetration. Rising interest in aftermarket solutions also contributes to growth.

China Electronic Security Market Insight

China holds the largest share of the Asia-Pacific electronic security market, propelled by rapid urbanization, rising infrastructure development, and increasing demand for surveillance and access control solutions. The country’s growing middle class and focus on smart city initiatives support the adoption of advanced security systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Electronic Security Market Share

The electronic security industry is primarily led by well-established companies, including:

- Bosch Security Systems (Germany)

- Honeywell International Inc. (U.S.)

- Hikvision (China)

- Dahua Technology (China)

- Axis Communications (Sweden)

- Johnson Controls (Ireland)

- ADT Inc. (U.S.)

- Securitas AB (Sweden)

- ASSA ABLOY (Sweden)

- FLIR Systems (U.S.)

- Hanwha Techwin (South Korea)

- Tyco Security Products (U.S.)

- Allegion (Ireland)

- Avigilon Corporation (Canada)

- Panasonic Corporation (Japan)

- Siemens AG (Germany)

- Verkada (U.S.)

What are the Recent Developments in Global Electronic Security Market?

- In July 2025, Johnson Controls launched its enhanced Connected Sprinkler service, introducing a smarter, cloud-enabled approach to fire safety for commercial and industrial buildings. This solution integrates with existing sprinkler systems and uses real-time data—including pressure, temperature, and water presence—to enable predictive maintenance and reduce emergency repairs. Facility managers receive instant alerts for adverse conditions such as freezing pipes or pressure imbalances, allowing for proactive responses and minimizing downtime. The service reflects Johnson Controls’ commitment to intelligent building technologies, helping customers improve safety, reduce costs, and extend system lifespan

- In March 2025, the Assa Abloy Group published its Annual Report for 2024, showcasing a strong commitment to innovation and growth. Over the year, the company launched more than 550 new products and solutions and registered over 250 new patents, reinforcing its leadership in access solutions and electronic security. These achievements reflect Assa Abloy’s strategic focus on continuous product development, sustainability, and technological advancement across its global portfolio. The report also highlights milestones in carbon emission reductions and operational efficiency, positioning the company for long-term value creation and industry leadership

- In July 2024, Dahua Technology introduced the DSS OneBox Lightweight Workstation, a compact, plug-and-play solution designed for fast and secure deployment of video surveillance and security systems. Tailored for small and medium-sized businesses, the workstation integrates server and client functions, eliminating the need for additional hardware. Powered by an Intel Core i7 processor with 32GB RAM, it supports multi-channel 1080P decoding, 4K output, and remote access via the DSS Mobile app. The launch underscores Dahua’s commitment to delivering efficient, intelligent, and scalable security platforms that meet evolving market demands for simplified yet powerful solutions

- In May 2024, Dahua Technology partnered with Team Gullit, a leading Dutch EAFC esports academy, to supply high-performance gaming monitors to players and staff. While not part of Dahua’s traditional security portfolio, this collaboration highlights the company’s broader technological capabilities and strategic expansion into consumer electronics. The partnership aims to enhance the competitive gaming experience through premium hardware, while also fostering community engagement via exclusive content and interactive events. It reflects Dahua’s effort to diversify its brand presence and explore cross-industry innovation beyond surveillance and security

- In October 2023, Assa Abloy Group acquired Securitech Group Inc., a New York-based manufacturer of high-security mechanical and electronic door hardware. This strategic acquisition strengthens Assa Abloy’s position in the high-security segment of the electronic security market, expanding its product portfolio and market presence across North America. Securitech’s innovative locking solutions complement Assa Abloy’s core offerings, particularly in sectors such as education, government, critical infrastructure, and behavioral health. The move aligns with Assa Abloy’s strategy to grow in mature markets through targeted acquisitions that enhance its access solutions portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Security Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Security Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Security Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.