Global Electronic Support Market

Market Size in USD Billion

CAGR :

%

USD

20.28 Billion

USD

29.28 Billion

2024

2032

USD

20.28 Billion

USD

29.28 Billion

2024

2032

| 2025 –2032 | |

| USD 20.28 Billion | |

| USD 29.28 Billion | |

|

|

|

|

Electronic Support Market Size

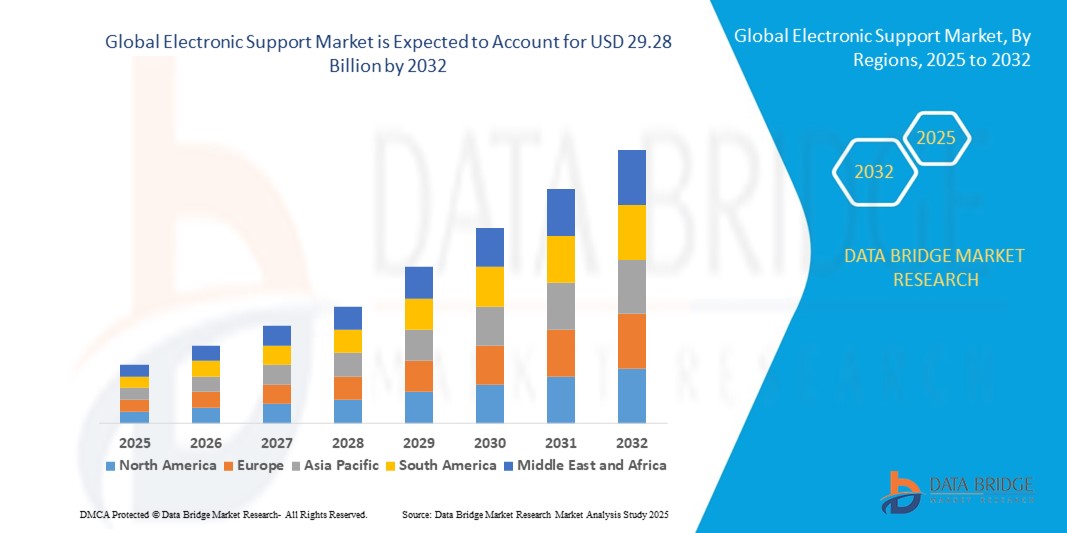

- The global electronic support market size was valued at USD 20.28 billion in 2024 and is expected to reach USD 29.28 billion by 2032, at a CAGR of 4.7% during the forecast period

- The market growth is largely fueled by increasing defense modernization programs and rising investments in electronic warfare, signal intelligence, and spectrum monitoring systems. Military and homeland security organizations are prioritizing advanced electronic support solutions to enhance situational awareness, threat detection, and operational efficiency across multiple domains

- Furthermore, the growing need for integrated electronic support systems that combine EW, COMINT, and ELINT capabilities is driving adoption across air, land, and naval platforms. These converging factors are accelerating the deployment of advanced electronic support solutions, thereby significantly boosting the market’s growth and technological advancement

Electronic Support Market Analysis

- Electronic support systems are advanced solutions used to detect, intercept, analyze, and respond to electromagnetic signals in defense and security operations. They include EW support measures (ESM), radar warning receivers (RWR), direction-finding systems, and signal analyzers, which collectively enhance threat awareness and operational readiness

- The escalating demand for electronic support solutions is primarily fueled by rising defense budgets, growing regional security concerns, and the increasing adoption of modernized military platforms requiring real-time intelligence, precise threat identification, and automated electronic warfare capabilities

- North America dominated the electronic support market with a share of over 30% in 2024, due to increasing defense budgets, modernization of military systems, and heightened investments in homeland security

- Asia-Pacific is expected to be the fastest growing region in the electronic support market during the forecast period due to increasing defense budgets, modernization of military capabilities, and growing security concerns in countries such as China, India, and Japan

- Defense and military segment dominated the market with a market share of 41.7% in 2024, due to extensive deployment in naval, air, and ground operations for electronic surveillance, threat analysis, and tactical communications support. Military organizations prioritize these solutions for their ability to enhance battlefield situational awareness, support countermeasure deployment, and integrate with multi-domain electronic warfare strategies. The continuous modernization of defense systems and increasing defense budgets globally further reinforce the demand for electronic support solutions in this segment

Report Scope and Electronic Support Market Segmentation

|

Attributes |

Electronic Support Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Electronic Support Market Trends

Growing Demand for Advanced Signal Intelligence

- The electronic support market is expanding rapidly as governments and defense organizations prioritize advanced signal intelligence solutions. Rising geopolitical tensions and asymmetric threats highlight the importance of monitoring, identifying, and analyzing adversary communication systems effectively

- For instance, BAE Systems has enhanced its electronic warfare portfolio with advanced signal intelligence capabilities. These systems are being deployed to detect, process, and counter emerging electronic threats, reinforcing the company’s standing in defense technology markets

- The growing sophistication of radar and communication systems is strengthening reliance on electronic support technologies. Advanced receivers and sensors are increasingly necessary to detect stealth signals and maintain superiority in complex defense environments

- In addition, integration of artificial intelligence and machine learning in electronic support solutions is transforming threat detection. AI-based systems reduce response times and improve operational decision-making in high-intensity, multi-domain defense scenarios

- Commercial spillovers are also influencing innovation. As 5G and advanced wireless networks become widespread, electronic support solutions are adapting detection systems to distinguish adversarial signals hidden within civilian communication environments

- The demand for multi-platform interoperability is rising. Modern electronic support solutions are being integrated across land, air, sea, and space platforms, ensuring situational awareness and seamless command-and-control capabilities across multiple defense operations globally

Electronic Support Market Dynamics

Driver

Increased Proliferation of Electronic Devices and Networks

- The global proliferation of electronic devices and interconnected networks is driving stronger demand. Defense agencies require advanced monitoring tools to track potential adversary communications within increasingly congested electromagnetic environments worldwide

- For instance, Lockheed Martin has expanded its advanced support systems to address large-scale electronic environments. These innovations allow operators to track multi-frequency signals, improving intelligence gathering capabilities in both conventional and irregular warfare domains

- The continued expansion of wireless spectrum use highlights the importance of situational awareness. Military organizations are increasing investment into systems capable of differentiating between civilian and adversarial signals in highly complex electromagnetic spaces

- In addition, the rise of unmanned aerial systems and drones is reinforcing the importance of electronic support. Monitoring their communication and control systems is critical to prevent unauthorized intrusions and neutralize hostile reconnaissance activity

- Growing integration of satellite communication networks adds to spectrum traffic. Defense agencies are investing in electronic support solutions that maintain resilience while exploiting vulnerabilities within these multi-frequency, high-bandwidth communication networks

Restraint/Challenge

High Development and Deployment Costs

- Electronic support systems face significant barriers due to their high development and deployment costs. Creating complex signal intelligence platforms requires expensive testing, specialized hardware, and extensive integration, limiting adoption by resource-constrained governments and defense budgets

- For instance, Northrop Grumman has highlighted the heavy R&D and integration costs associated with advanced electronic support systems. These expenses place financial pressure on defense departments already facing competing modernization priorities globally

- Maintenance and lifecycle costs further intensify the burden. Specialized technicians, continuous upgrades, and calibration requirements drive operational expenses, making long-term ownership of electronic support solutions financially challenging for several developing nations

- In addition, the cost of interoperability testing raises obstacles. Ensuring systems function across multi-platform networks requires additional capital outlays, increasing total deployment costs and slowing adoption within multinational alliances and joint defense programs

- Reducing costs remains a key industry challenge. Without cost-effective modular architectures and scalable manufacturing approaches, adoption of advanced electronic support systems will remain concentrated among wealthier defense stakeholders with high military budgets

Electronic Support Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the electronic support market is segmented into Electronic Warfare (EW) Support Measures (ESM) Systems, Communication Intelligence (COMINT) Systems, Electronic Intelligence (ELINT) Systems, Radar Warning Receivers (RWR), Signal Analyzers, and Direction Finding (DF) Systems. The EW Support Measures (ESM) Systems segment dominated the largest market revenue share in 2024, driven by their critical role in detecting, intercepting, and analyzing electromagnetic signals to provide situational awareness in complex operational environments. These systems are widely preferred by defense organizations for their capability to identify potential threats, support threat countermeasures, and integrate seamlessly with broader electronic warfare platforms. The robust performance, real-time signal processing, and proven reliability of ESM systems make them the backbone of modern electronic support operations, driving sustained demand globally.

The Direction Finding (DF) Systems segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing emphasis on precise signal localization and monitoring across defense, homeland security, and intelligence sectors. DF systems provide accurate positioning of signal sources, enhancing threat detection, navigation, and communication interception capabilities. The growth is further supported by technological advancements enabling miniaturization, portability, and integration with automated monitoring platforms. In addition, rising adoption in border security and critical infrastructure monitoring contributes to the accelerated uptake of DF systems across global markets.

- By Application

On the basis of application, the electronic support market is segmented into Defense and Military, Homeland Security and Border Protection, Law Enforcement and Intelligence Agencies, and Spectrum Monitoring and Management. The Defense and Military segment dominated the largest market revenue share of 41.7% in 2024, driven by extensive deployment in naval, air, and ground operations for electronic surveillance, threat analysis, and tactical communications support. Military organizations prioritize these solutions for their ability to enhance battlefield situational awareness, support countermeasure deployment, and integrate with multi-domain electronic warfare strategies. The continuous modernization of defense systems and increasing defense budgets globally further reinforce the demand for electronic support solutions in this segment.

The Homeland Security and Border Protection segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing initiatives to strengthen border surveillance, prevent illegal activities, and monitor electromagnetic spectrum usage. Electronic support solutions in this segment help detect unauthorized communications, support rapid response operations, and provide actionable intelligence for security forces. Advancements in portable monitoring devices, remote sensing, and AI-assisted signal analysis are accelerating adoption, while government investments in national security infrastructure are driving significant growth potential.

Electronic Support Market Regional Analysis

- North America dominated the electronic support market with the largest revenue share of over 30% in 2024, driven by increasing defense budgets, modernization of military systems, and heightened investments in homeland security

- Governments and defense agencies in the region are prioritizing electronic surveillance, threat detection, and signal intelligence capabilities, fueling demand for advanced ES solutions

- The widespread adoption is further supported by technological expertise, strong R&D infrastructure, and high defense expenditure, establishing electronic support systems as a critical component across military and security operations

U.S. Electronic Support Market Insight

The U.S. electronic support market captured the largest revenue share in 2024 within North America, fueled by rapid modernization of defense and intelligence platforms. The growing need for real-time situational awareness, electronic warfare capabilities, and spectrum monitoring is driving adoption across military and homeland security applications. Increasing investments in signal intelligence, coupled with technological innovations in EW, COMINT, and ELINT systems, are further accelerating market growth. Moreover, integration with AI-assisted monitoring and automated threat analysis systems is significantly contributing to the expansion of electronic support solutions in the U.S.

Europe Electronic Support Market Insight

The Europe electronic support market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing defense modernization programs and the demand for advanced electronic intelligence capabilities. Rising cross-border security concerns and the need for enhanced situational awareness in military operations are promoting adoption. European governments are investing in EW and signal intelligence technologies, while advancements in spectrum monitoring and electronic surveillance systems are supporting market growth across defense, homeland security, and law enforcement applications.

U.K. Electronic Support Market Insight

The U.K. electronic support market is anticipated to grow at a noteworthy CAGR, driven by government initiatives focused on defense modernization and electronic warfare capabilities. Increasing focus on homeland security, border protection, and intelligence operations is encouraging adoption of advanced ES solutions. The U.K.’s robust defense infrastructure, technological expertise, and strong procurement framework for military and security applications are expected to further stimulate market growth.

Germany Electronic Support Market Insight

The Germany electronic support market is expected to expand at a considerable CAGR, fueled by rising awareness of electronic surveillance, technological advancements in radar and signal intelligence systems, and increased defense spending. Germany’s focus on innovation and precision engineering is driving the adoption of advanced EW, COMINT, and DF systems. The integration of electronic support solutions with national security initiatives and military modernization programs is also contributing to the market’s steady growth.

Asia-Pacific Electronic Support Market Insight

The Asia-Pacific electronic support market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing defense budgets, modernization of military capabilities, and growing security concerns in countries such as China, India, and Japan. Government initiatives aimed at strengthening border security and enhancing electronic intelligence capabilities are accelerating adoption. Furthermore, the region’s focus on indigenization of defense technologies and the presence of emerging domestic ES solution providers are expanding accessibility to advanced systems across military and homeland security applications.

Japan Electronic Support Market Insight

The Japan electronic support market is gaining momentum due to the country’s focus on high-tech defense capabilities, advanced signal intelligence, and spectrum monitoring. The growing need for automated threat detection and enhanced situational awareness is driving adoption in military and security operations. Integration with modern EW platforms and the increasing number of smart surveillance systems in defense infrastructure are fueling market growth, while technological advancements and government support further strengthen market expansion.

China Electronic Support Market Insight

The China electronic support market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid military modernization, rising defense expenditure, and the expansion of homeland security initiatives. China’s focus on domestic development of EW, ELINT, and DF systems, coupled with government-backed research in advanced surveillance and signal intelligence technologies, is boosting market growth. In addition, strategic deployment of ES solutions across military bases, border security operations, and intelligence networks is contributing to the country’s dominance in the region.

Electronic Support Market Share

The electronic support industry is primarily led by well-established companies, including:

- Lockheed Martin (U.S.)

- L3Harris Technologies (U.S.)

- Thales Group (France)

- Leonardo S.p.A. (Italy)

- Hensoldt AG (Germany)

- Rohde & Schwarz GmbH & Co. KG (Germany)

- NSPO (Russia)

- KRET (Russia)

- China Electronics Technology Group Corporation (CETC) (China)

- Aviation Industry Corporation of China (AVIC) (China)

- Raytheon Technologies (U.S.)

- General Dynamics (U.S.)

- Saab Group (Sweden)

- Elbit Systems (Israel)

- Bharat Electronics Limited (BEL) (India)

Latest Developments in Global Electronic Support Market

- In August 2025, Northrop Grumman secured a $99.1 million contract from the U.S. Navy to provide support for the Department of Defense’s Combined Joint All-Domain Command and Control (CJADC2) vision. This program emphasizes integrated electronic warfare and command-and-control systems, enabling multi-domain operations and interoperability across military branches. The contract highlights the strategic importance of sophisticated electronic support systems in modern warfare and is expected to propel demand for solutions that combine EW, COMINT, and ELINT functionalities in one comprehensive platform

- In December 2024, Northrop Grumman was awarded a $422 million contract to support the installation and integration of the AN/SLQ-32(V)7 electronic warfare Block 3 system. This program focuses on improving the U.S. Navy’s surface electronic warfare capabilities through technical and engineering support for the functional Block 3 subsystem. The initiative enhances detection and countermeasure efficiency, providing comprehensive electronic support for naval operations. It is expected to drive market growth by encouraging the adoption of advanced EW support measures (ESM) systems across naval platforms and allied defense programs

- In December 2024, the U.S. Army introduced a dismounted spectrum warfare system that provides mobile electronic attack and electronic support capabilities. This system allows soldiers to pair non-kinetic electronic warfare options with existing kinetic weapons, offering flexibility and enhanced operational intelligence in dynamic battlefield environments. The deployment of this system demonstrates growing investment in portable, adaptable electronic support technologies, fostering increased demand for compact, multi-functional ES systems that can be used across defense, homeland security, and intelligence applications

- In December 2023, the U.S. Navy awarded Raytheon Technologies an $80 million contract to prototype the Advanced Electronic Warfare (ADVEW) system for the F/A-18 E/F Super Hornet. This prototype is intended to replace the existing AN/ALQ-214 integrated defensive electronic countermeasure and AN/ALR-67(V)3 radar warning receiver systems. The development significantly enhances the Navy’s electronic warfare capabilities by integrating advanced detection, interception, and countermeasure functionalities into one platform. By providing improved situational awareness, threat detection, and survivability, the ADVEW system strengthens operational efficiency and readiness, directly supporting the growth and adoption of advanced electronic support solutions across defense platforms

- In August 2023, the U.K. Ministry of Defence (MOD) awarded BAE Systems a contract to enhance front-line connectivity for military personnel. The project links small reconnaissance drones, combat vehicles, fighter jets, aircraft carriers, and command centers to provide seamless communication and real-time intelligence sharing. This initiative reflects the increasing demand for integrated electronic support solutions that can facilitate coordinated operations and rapid threat response. The development is expected to drive market growth by accelerating the adoption of advanced communication intelligence (COMINT) systems and supporting a broader electronic support ecosystem within defense and homeland security operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electronic Support Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electronic Support Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electronic Support Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.