Global Electronic Toll Collection Market

Market Size in USD Billion

CAGR :

%

USD

8.97 Billion

USD

17.33 Billion

2023

2031

USD

8.97 Billion

USD

17.33 Billion

2023

2031

| 2024 –2031 | |

| USD 8.97 Billion | |

| USD 17.33 Billion | |

|

|

|

|

Electronic Toll Collection Market Size

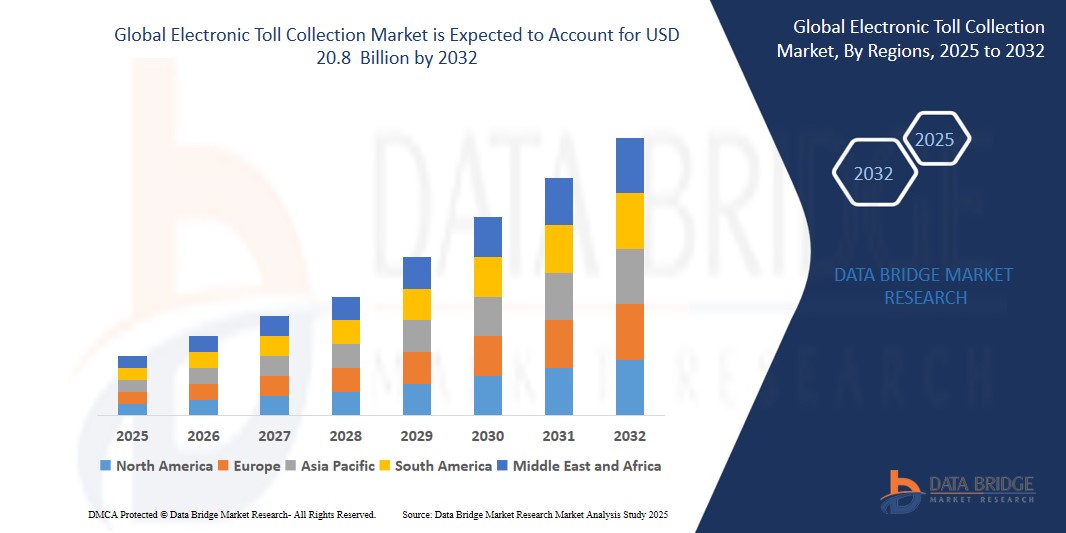

- The Global Electronic toll collection market was valued at USD 9.8 billion in 2024 and is expected to reach USD 20.8 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.7%, primarily driven by the high research optimization and growth in emerging sectors.

- The Electronic Toll Collection market is driven by the growing need for efficient traffic management and reduced congestion across highways and urban road networks.

Electronic Toll Collection Market Analysis

- The electronic toll collection market is growing rapidly due to advancements like RFID and DSRC technologies, enabling seamless, cashless toll payments and reducing congestion. Smart city initiatives and mobile payment adoption further boost demand for ETC systems.

- Regions like the U.S., Canada, and Europe are leading in deployment, supported by infrastructure investments.

- As smart transportation and sustainability gain momentum, ETC solutions are key to efficient, modern mobility.

Report Scope and Electronic Toll Collection Market Segmentation

|

Attributes |

Electronic Toll Collection Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

Rest of South America |

|

Key Market Players |

American Traffic Solutions (U.S.) |

|

Market Opportunities |

Improved User Experience Increased Traffic Congestion |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Electronic Toll Collection Market Trends

“Adoption of Smart Transportation Technologies”

- One specific trend driving the growth of the electronic toll collection market is the rapid adoption of smart transportation technologies. As urban congestion increases, governments are prioritizing the modernization of toll infrastructure.

- Advanced solutions like Automatic Number Plate Recognition (ANPR) enable seamless, contactless toll collection. These technologies reduce delays and improve overall traffic flow.

- Dedicated Short-Range Communication (DSRC) is another key enabler in the shift toward intelligent tolling systems. DSRC supports real-time vehicle identification and data exchange between roadside units and in-vehicle devices. This enhances transaction speed, accuracy, and system interoperability. The integration of such technologies aligns with global smart city initiatives and sustainable mobility goals.

- For instance, in October 2021, AEye, Inc., a leading provider of high-performance LiDAR solutions, collaborated with Intetra to launch advanced electronic tolling automation at the Intelligent Transport System World Congress. By optimizing AEye’s 4Sight M LiDAR technology, the partnership achieved high-resolution detection capabilities for tolling areas. This technology allows for precise monitoring of vehicle types, speeds, traffic conditions, and weather, significantly enhancing the electronic toll collection process.

- In conclusion, the integration of smart technologies like ANPR and DSRC is transforming the electronic toll collection landscape. These advancements are boosting efficiency, reducing congestion, and enabling seamless mobility. As governments invest in intelligent infrastructure, the ETC market is set for sustained growth.

Process Spectroscopy Market Dynamics

Driver

“Rising Adoption of Cashless Payments”

- The rising adoption of cashless payments is a key driver of growth in the global Electronic Toll Collection market. With consumers moving toward digital payment options, there is growing demand for faster and more convenient tolling solutions. ETC systems support this shift by enabling automated, contactless transactions.

- Mobile wallets, contactless cards, and payment apps are becoming widely used for transportation-related expenses. These tools integrate easily with ETC platforms, reducing the need for manual toll booths or cash handling. This enhances user experience and minimizes delays on busy roadways.

- Governments and private operators are also promoting cashless tolling to improve efficiency and reduce operational costs. As a result, the ETC market benefits from strong alignment with global trends in digital finance. This convergence is accelerating the deployment of smart toll systems worldwide.

For instance,

- In May 2023, the Pennsylvania Turnpike Commission launched a fully cashless, electronic toll collection system using open-road tolling technology. This approach enables vehicles to maintain highway speeds while tolls are automatically collected through E-ZPass transponders or Toll by Plate options. The Commission highlighted benefits such as improved safety, reduced environmental impact, streamlined interchange construction, and projected annual savings of around USD 75 million.

- In conclusion, the rising adoption of cashless payments is playing a pivotal role in accelerating the growth of the electronic toll collection market. As consumers and governments alike embrace digital transactions, ETC systems offer a seamless, efficient solution that aligns perfectly with this shift. This trend is expected to continue driving innovation and expansion across the global tolling landscape.

Opportunity

“Improved User Experience”

- The improved user experience provided by Electronic Toll Collection systems is a major factor driving global market growth. By removing the need for manual toll payments, these systems offer drivers a smoother, faster travel experience. This shift is especially appealing in high-traffic areas where time savings are critical.

- ETC systems reduce wait times, eliminate the hassle of carrying cash, and minimize traffic congestion at toll plazas. These advantages contribute to higher user satisfaction and increased public acceptance of tolling technologies. As a result, both government and private stakeholders are expanding ETC deployments.

- The seamless nature of ETC also supports multi-lane, high-speed travel, aligning with the expectations of modern commuters. Enhanced reliability and convenience make ETC systems a preferred solution for both daily drivers and long-distance travelers. This user-centric focus continues to open new opportunities in the global ETC market.

- In conclusion, the enhanced user experience provided by electronic toll collection systems is a key factor fueling their global adoption. By offering greater convenience, reduced travel times, and hassle-free transactions, ETC systems significantly improve driver satisfaction. This user-focused advantage continues to open new opportunities and strengthen market growth worldwide.

Restraint/Challenge

“High Initial Investment”

- High initial investment remains a significant restraint in the electronic toll collection market. Implementing ETC systems necessitates substantial upfront costs associated with infrastructure, such as electronic gantries, cameras, and sophisticated software systems.

- These financial burdens can deter governments and private operators from pursuing adoption, particularly in regions with limited budgets or competing infrastructure needs.

- In addition, the complexities involved in integrating these systems with existing toll collection methods further exacerbate the financial challenges. As a result, the reluctance to invest heavily in ETC technologies hinders market growth and slows the transition toward more efficient toll collection solutions.

For instance,

- In April 2025, a major system failure disrupted automatic lanes at over 90 expressway tollgates across Tokyo and six other prefectures in Japan. The unexpected outage caused severe traffic congestion and highlighted the vulnerabilities in complex tolling infrastructure. Despite the high initial investments made in advanced ETC systems, such incidents underscore the ongoing need for robust maintenance and system resilience. Authorities worked swiftly to restore operations, but the event raised concerns about return on investment in large-scale tolling technologies. This serves as a reminder that alongside upfront costs, continuous upgrades and support are crucial for sustained efficiency.

- In conclusion, while high initial investments in electronic toll collection systems can be a barrier, they are essential for building efficient, future-ready infrastructure. These costs often yield long-term benefits such as reduced congestion, enhanced safety, and lower operational expenses. However, ongoing maintenance and system resilience remain critical to justifying these investments

Electronic toll collection market Scope

The market is segmented into five notable segments based on payment method, type, technology, offering, application and parameters of toll amount.

|

Segmentation |

Sub-Segmentation |

|

By Payment Method |

|

|

By Type |

|

|

By Technology |

|

|

By Offering |

|

|

By Application |

|

|

By Parameters of Toll Amount |

|

Electronic Toll Collection Market Regional Analysis

“North America is a Dominant Region in the Global Electronic toll collection market”

- North America leads the electronic toll collection market due to its vast vehicle population and extensive highway systems, driving demand for efficient tolling. The U.S. and Canada are investing in RFID, DSRC, and ANPR technologies to reduce congestion and enhance travel efficiency.

- Government support, public-private partnerships, and widespread infrastructure upgrades are accelerating adoption. As states shift to cashless, open-road tolling, North America solidifies its role in advancing global ETC innovation.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is anticipated to experience substantial growth in the electronic toll collection market over the coming years. The surge is primarily driven by increasing adoption in emerging economies like India, China, and Southeast Asian nations. As traffic congestion intensifies, governments are turning to ETC systems to enhance traffic management. This demand is further supported by initiatives promoting smarter urban infrastructure.

- Rapid urbanization and expanding road networks across the region have created a pressing need for efficient toll collection. Technological advancements, such as GPS and GNSS-based vehicle tracking, are being integrated into modern ETC systems. These tools enable real-time monitoring, contributing to safer and more efficient transportation systems. As cities grow, the role of ETC in urban planning becomes even more vital.

- Furthermore, the widespread use of RFID sensors is accelerating the adoption of ETC across Asia-Pacific. Countries are increasingly implementing contactless, automated tolling to improve commuter convenience and reduce bottlenecks. Combined with strong governmental support and rising investment in infrastructure, these trends are set to propel the region to the forefront of ETC market growth.

Electronic Toll Collection Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Kapsch TrafficCom AG (Austria)

- TransCore (U.S.)

- Raytheon Company (U.S.)

- Conduent Inc. (U.S.)

- Thales Group (France)

- Cubic Corporation (U.S.)

- Vinci SA (France)

- Siemens AG (Germany)

- EFKON (Austria)

- Neology Inc. (U.S.)

- TOSHIBA CORPORATION (Japan)

- MITSUBISHI HEAVY INDUSTRIES LTD (Japan)

- Abertis (Spain)

- Quarterhill Inc. (Canada)

- Perceptics LLC (U.S.)

- Star Systems International (U.S.)

- Electronic Transaction Consultants Corporation (U.S.)

- ARH Inc. (Hungary)

- SICE (Spain)

- Autostrade per l'Italia (Italy)

- JENOPTIK AG (Germany)

- Far Eastern Electronic Toll Collection Co Ltd. (Taiwan)

- Toll Collect GmbH (Germany)

- GeoToll (U.S.)

- Indra Sistemas (Spain)

- Kistler Group (Switzerland)

- American Traffic Solutions (U.S.)

Latest Developments in Electronic Toll Collection Market

- In July 2023, Axxès, a leading provider of electronic toll services in Europe, joined the Avanci Aftermarket program, a platform that facilitates simplified patent licensing among technology owners. Through this collaboration, Axxès gains access to essential 2G, 3G, and 4G wireless patents, supporting over 40,000 clients and 300,000 equipped vehicles across European roads. This strategic move is expected to accelerate innovation and strengthen interoperability within the region’s electronic toll collection market.

- In June 2022, TransCore secured a key contract with the Thousand Islands Bridge Authority to modernize tolling infrastructure on the bridge connecting Wellesley Island (U.S.) and Hill Island (Canada). The project involves designing, developing, and maintaining an advanced ETC system to replace the existing manual setup. This initiative is aimed at improving operational efficiency and providing a seamless experience for cross-border travelers.

- In August 2021, Quarterhill Inc., known for its focus on Intelligent Transportation Systems (ITS) and intellectual property, announced the acquisition of Electronic Transaction Consultants, LLC from Align Capital Partners. The deal brings the innovative riteSuite platform under Quarterhill’s portfolio, enhancing its capabilities in customized mobility solutions. This acquisition is expected to drive growth and broaden the company’s footprint in the electronic toll collection landscape.

- In June 2021, the Ohio Turnpike and Infrastructure Commission (OTIC) extended its five-year partnership with TransCore to manage toll collection and customer service operations across Ohio’s turnpike network. TransCore will continue to oversee the functionality, maintenance, and customer support aspects of the ETC system, ensuring smooth and efficient operations across the state’s transportation infrastructure.

- In May 2021, the Metropolitan Transportation Authority (MTA) of New York awarded contracts totaling approximately USD 400 million to three companies to manage toll systems across its bridges and tunnels. This marks a shift from its long-standing reliance on Conduent Inc., as the MTA looks to diversify management and enhance operational efficiency. The move is part of a broader strategy to optimize toll system performance and improve service delivery throughout the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.